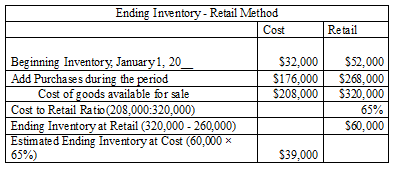

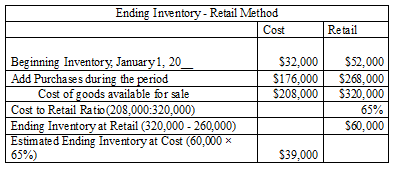

Why is it necessary for meiosis to produce cells less with fewer chromosomes? assets are overstated in the statement of financial position, profit is overstated in the income statement (as cost of sales is too low), assets are understated in the statement of financial position. In other words, the closing balance of these accounts in one accounting year becomes the opening balance of the succeeding accounting year. When you pay someone else, that's a debit. You need to do a better job at writing your question. Nominal Accounts are the general ledger accounts which are closed by the end of an accounting period. The double entry for recording the loss is as follows. Companies and their financial statement users should take note of these changes, as they could have a significant impact on future reporting, particularly for issuers of convertible debt and other equity-linked instruments. Difference Between Double Entry and Single Entry, It is the method of accounting where the dual aspect of the transaction is recorded, It is the method of accounting where only one side of transaction is recorded, It provides more accurate financial results. In particular, any percentage additions to cover overheads must be based on the normal level of production. Although double-entry accounting does not prevent errors entirely, it limits the effect any errors have on the overall accounts. Increase in Stock Search AccountingWEB Advertisement Latest Any Answers A client who deals in agricultural machinery had a spare field and bought a dozen ewes and a ram last year. It is based on the accounting equation that states that the sum of the total liabilities and the owner's capital equals the total assets of the company.read more will provide accurate and complete results. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. The impact of valuation methods on profit and the statement of financial position.  obsolete inventory to the original supplier. A Limited makes a payment for the Goods next Month. WebIt is required to account for insurance, transport fees, freight in, shipping into the stock valuation. In what circumstances might the NRV of inventories be lower than their cost? To perform double entry on stock provision, you'd record the company's transactions twice. Next, the closing inventory must be accounted for in the inventoryaccount and the income statement account. The opening inventory must be transferred to the income statement,and the closing inventory entered into the ledger accounts (inventoryand income statement) leaving the balance carried forward which will beincluded in the statement of financial position. A sale transaction should be recognized in the same reporting period as the related cost of goods sold transaction, so that the full extent of a sale transaction is recognized at once. 000. Table of contents What is Double-Entry? Whenever I venture to discuss this issue, I am usually accused of being too zealous or a perfectionist, in my strenuous efforts to apply IFRS. When you employ double-entry accounting, you will need to use several types of accounts. Companies will welcome the lower interest expense, which was historically very significant relative to the low coupon interest rate on these instruments. The calculation with opening and closing stock is: Opening stock: 5,000 Closing stock: 0 = Cost of sales: 5,000. The following information was available at the year-end: What is the value of the closing inventory? 'result' : 'results'}}, 2023 Global Digital Trust Insights Survey. Say you purchase $1,000 worth of inventory on credit.

obsolete inventory to the original supplier. A Limited makes a payment for the Goods next Month. WebIt is required to account for insurance, transport fees, freight in, shipping into the stock valuation. In what circumstances might the NRV of inventories be lower than their cost? To perform double entry on stock provision, you'd record the company's transactions twice. Next, the closing inventory must be accounted for in the inventoryaccount and the income statement account. The opening inventory must be transferred to the income statement,and the closing inventory entered into the ledger accounts (inventoryand income statement) leaving the balance carried forward which will beincluded in the statement of financial position. A sale transaction should be recognized in the same reporting period as the related cost of goods sold transaction, so that the full extent of a sale transaction is recognized at once. 000. Table of contents What is Double-Entry? Whenever I venture to discuss this issue, I am usually accused of being too zealous or a perfectionist, in my strenuous efforts to apply IFRS. When you employ double-entry accounting, you will need to use several types of accounts. Companies will welcome the lower interest expense, which was historically very significant relative to the low coupon interest rate on these instruments. The calculation with opening and closing stock is: Opening stock: 5,000 Closing stock: 0 = Cost of sales: 5,000. The following information was available at the year-end: What is the value of the closing inventory? 'result' : 'results'}}, 2023 Global Digital Trust Insights Survey. Say you purchase $1,000 worth of inventory on credit.  The other three answers contain items which cannot be included in inventory according to IAS 2. As a consequence, the business owner has to reflect this business value in the financial statements of its entity. This must be transferred to the income statement ledger account with the following entry: The closing inventory is entered into the ledger accounts with the following entry: Once these entries have been completed, the income statement ledger account contains both opening and closing inventory and the inventory ledger account shows the closing inventory for the period to be shown in the statement of financial position. WebDouble-Entry is an accounting system to record a transaction in a minimum of two accounts. That's how I feel on about 90% of threads. Cash (or a payable) This document highlights some of the key changes in the new standard. The balancing is done at the year end through your Profit and Double-entry is the first step of accounting. For certain convertible debt instruments with a cash conversion feature, the changes are a trade-off between simplifications in the accounting model (no separation of an equity component to impute a market interest rate, and simpler analysis of embedded equity features) and a potentially adverse impact to diluted EPS by requiring the use of the if-converted method. Its transactions are as follows: The goods left in inventory at the end of this second week originally cost $500. Zooming in on Mexicos Recent ESG Corporate Reporting. Your provision in P&L was a one time 'hit' so obviously that resets for the new year. At year end obviously all P+L figures reset to zero and reserves updated. 14. In writing this article, I have sought to clarify the difference between impairment losses and provisions. This would reduce earnings volatility. This may not be the end of changes relating to debt and equity. I am reading the question as meaning the closing stock in the P&L is out by 50k. IAS 2 Inventories contains the requirements on how to account for most types of inventory. The reduction in accounting models, in particular the elimination of the BCF guidance, may significantly reduce the reporting burden associated with convertible instruments and bundled transactions. #3 Nominal Accounts Debit all Expenses and Losses and Credit all Incomes and Gains. Do you get more time for selling weed it in your home or outside? Lets take a look at a few scenarios of how you would journal entries for inventory transactions. Rather the asset(s) should be shown at a lower amountthe lower of the two, cost or market value. Thanks (0) By simplesimon 04th Jan 2011 23:01 read more, must have equal and opposite credit. What are the names of the third leaders called? It can be a complicated procedure to arrive at the valuation placed on closing inventory, because: In the context of the value of inventory, this means that if goodsare expected to be sold below cost after the statement of financialposition date (for example, because they are damaged or obsolete),account must be taken of the loss in order to prepare the statement offinancial position. How Do You Explain Professional Accounting to a 5-year-old?

The other three answers contain items which cannot be included in inventory according to IAS 2. As a consequence, the business owner has to reflect this business value in the financial statements of its entity. This must be transferred to the income statement ledger account with the following entry: The closing inventory is entered into the ledger accounts with the following entry: Once these entries have been completed, the income statement ledger account contains both opening and closing inventory and the inventory ledger account shows the closing inventory for the period to be shown in the statement of financial position. WebDouble-Entry is an accounting system to record a transaction in a minimum of two accounts. That's how I feel on about 90% of threads. Cash (or a payable) This document highlights some of the key changes in the new standard. The balancing is done at the year end through your Profit and Double-entry is the first step of accounting. For certain convertible debt instruments with a cash conversion feature, the changes are a trade-off between simplifications in the accounting model (no separation of an equity component to impute a market interest rate, and simpler analysis of embedded equity features) and a potentially adverse impact to diluted EPS by requiring the use of the if-converted method. Its transactions are as follows: The goods left in inventory at the end of this second week originally cost $500. Zooming in on Mexicos Recent ESG Corporate Reporting. Your provision in P&L was a one time 'hit' so obviously that resets for the new year. At year end obviously all P+L figures reset to zero and reserves updated. 14. In writing this article, I have sought to clarify the difference between impairment losses and provisions. This would reduce earnings volatility. This may not be the end of changes relating to debt and equity. I am reading the question as meaning the closing stock in the P&L is out by 50k. IAS 2 Inventories contains the requirements on how to account for most types of inventory. The reduction in accounting models, in particular the elimination of the BCF guidance, may significantly reduce the reporting burden associated with convertible instruments and bundled transactions. #3 Nominal Accounts Debit all Expenses and Losses and Credit all Incomes and Gains. Do you get more time for selling weed it in your home or outside? Lets take a look at a few scenarios of how you would journal entries for inventory transactions. Rather the asset(s) should be shown at a lower amountthe lower of the two, cost or market value. Thanks (0) By simplesimon 04th Jan 2011 23:01 read more, must have equal and opposite credit. What are the names of the third leaders called? It can be a complicated procedure to arrive at the valuation placed on closing inventory, because: In the context of the value of inventory, this means that if goodsare expected to be sold below cost after the statement of financialposition date (for example, because they are damaged or obsolete),account must be taken of the loss in order to prepare the statement offinancial position. How Do You Explain Professional Accounting to a 5-year-old?  Inventory Write Off - Obsolete Inventory Allowance | Double Entry Book Copyright 2023 . something for say £10, you will want to sell it for a higher price, New York, New York 10017, Inside the IFRS Framework: Differentiating Impairment Losses from Provisions. At the yearend the accumulated totals from the sales and purchases accounts must betransferred to it using the following journal entries: These transfers are shown in the ledger accounts below. abnormal waste of materials, labour or other costs. Let us take an example in which SDF Inc. is the seller, and BDF Inc. is the purchaser. To write-off inventory, you must credit the inventory account and record a debit to the inventory. WebThis will typically involve the entity booking a stock provision. Their balance at the end of period comes to zero so they don't appear in the balance sheet. This inventory is deducted from purchases in the income statement. WebGoods in transit refer to the inventory items that have been purchased by the buyer and shipped by the seller; however, the goods are on the way and yet to reach the intended purchaser. A balance sheet is one of the financial statements of a company that presents the shareholders' equity, liabilities, and assets of the company at a specific point in time. The fact that, for control purposes, the credit may be recorded in a separate account does not change the nature of the entry. Cost of conversion this includes direct costs and production overheads. Accountants use debit and credit entries to record transactions to each account, and each of the accounts in this equation show on a company's balance sheet. The accounting treatment is illustrated below: When the forwarding agent prepares the shipping documents (such as the bill of ladingBill Of LadingBill of lading is the legal document issued by the carrier to the shipper. WebConcept of Double Entry. However, companies may not appreciate the more dilutive impact of the changes to EPS for instruments that may be settled in any combination of cash or shares. In this case, the portfolio at risk and risk coverage ratio may be used to determine whether the Typical example of such an asset is an oil rig or a nuclear power plant. Opening inventory must be included in cost of sales as these goods are available for sale along with purchases during the year. The debit has to be applied to income, and the asset shown at its net recoverable amount. Closing inventory of $3,000 will appear on the statement of financial position as an asset. Accounting Transactions are business activities which have a direct monetary effect on the finances of a Company. So Debit Closing stock (P&L) 50k and Credit Opening Stock (P&L) 50k. TVs for resale therefore the TV is their stock) than there is that $5,000 (book value) of its inventory became obsolete because it is no longer

read more is recorded in a minimum of two accounts, one is a debit account, and another is a credit account. The above layout of the income statement is not particularly useful, but it assists the appreciation of the actual double entry processes and the realisation that the income statement is part of the double entry. like those listed on a Stock Exchange). Wiki User. Double-entry accounting is the process of recording transactions twice when they occur. When is physical inventory usually taken? For example, accounts could have reflected the following: Dr Stock 950,000 written-down obsolete inventory at high profit margins in order to increase the

Separating convertible debt into two units of account under the cash conversion accounting model results in the debt being recorded at a discount to the principal amount, and that discount is recognized as incremental non-cash interest expense over the expected life of the convertible debt. Most

Inventory Write Off - Obsolete Inventory Allowance | Double Entry Book Copyright 2023 . something for say £10, you will want to sell it for a higher price, New York, New York 10017, Inside the IFRS Framework: Differentiating Impairment Losses from Provisions. At the yearend the accumulated totals from the sales and purchases accounts must betransferred to it using the following journal entries: These transfers are shown in the ledger accounts below. abnormal waste of materials, labour or other costs. Let us take an example in which SDF Inc. is the seller, and BDF Inc. is the purchaser. To write-off inventory, you must credit the inventory account and record a debit to the inventory. WebThis will typically involve the entity booking a stock provision. Their balance at the end of period comes to zero so they don't appear in the balance sheet. This inventory is deducted from purchases in the income statement. WebGoods in transit refer to the inventory items that have been purchased by the buyer and shipped by the seller; however, the goods are on the way and yet to reach the intended purchaser. A balance sheet is one of the financial statements of a company that presents the shareholders' equity, liabilities, and assets of the company at a specific point in time. The fact that, for control purposes, the credit may be recorded in a separate account does not change the nature of the entry. Cost of conversion this includes direct costs and production overheads. Accountants use debit and credit entries to record transactions to each account, and each of the accounts in this equation show on a company's balance sheet. The accounting treatment is illustrated below: When the forwarding agent prepares the shipping documents (such as the bill of ladingBill Of LadingBill of lading is the legal document issued by the carrier to the shipper. WebConcept of Double Entry. However, companies may not appreciate the more dilutive impact of the changes to EPS for instruments that may be settled in any combination of cash or shares. In this case, the portfolio at risk and risk coverage ratio may be used to determine whether the Typical example of such an asset is an oil rig or a nuclear power plant. Opening inventory must be included in cost of sales as these goods are available for sale along with purchases during the year. The debit has to be applied to income, and the asset shown at its net recoverable amount. Closing inventory of $3,000 will appear on the statement of financial position as an asset. Accounting Transactions are business activities which have a direct monetary effect on the finances of a Company. So Debit Closing stock (P&L) 50k and Credit Opening Stock (P&L) 50k. TVs for resale therefore the TV is their stock) than there is that $5,000 (book value) of its inventory became obsolete because it is no longer

read more is recorded in a minimum of two accounts, one is a debit account, and another is a credit account. The above layout of the income statement is not particularly useful, but it assists the appreciation of the actual double entry processes and the realisation that the income statement is part of the double entry. like those listed on a Stock Exchange). Wiki User. Double-entry accounting is the process of recording transactions twice when they occur. When is physical inventory usually taken? For example, accounts could have reflected the following: Dr Stock 950,000 written-down obsolete inventory at high profit margins in order to increase the

Separating convertible debt into two units of account under the cash conversion accounting model results in the debt being recorded at a discount to the principal amount, and that discount is recognized as incremental non-cash interest expense over the expected life of the convertible debt. Most  Use actual figures as they appear on your January P&L and B/S, then we might know what you're on about. How have you got a 50k provision on your balance sheet if all your provisions are reset to zero? These were entered into his accounts as stock at cost. In this article, I will aim to stress the conceptual difference between impairment losses and provisionsand hopefully convince you that there is a significant difference that is worth acknowledging. The trial balance will include opening inventory, purchases and sales revenue in respect of the inventory transactions. To perform double entry on stock provision, you'd record the company's transactions twice. This calls for another journal entry to officially shift the goods into the work-in-process account, which is shown below. Sales: 12,000 - Purchases: 0 = Profit: 12,000; However, this doesnt take into account the 5,000 of stock remaining from January.

Use actual figures as they appear on your January P&L and B/S, then we might know what you're on about. How have you got a 50k provision on your balance sheet if all your provisions are reset to zero? These were entered into his accounts as stock at cost. In this article, I will aim to stress the conceptual difference between impairment losses and provisionsand hopefully convince you that there is a significant difference that is worth acknowledging. The trial balance will include opening inventory, purchases and sales revenue in respect of the inventory transactions. To perform double entry on stock provision, you'd record the company's transactions twice. This calls for another journal entry to officially shift the goods into the work-in-process account, which is shown below. Sales: 12,000 - Purchases: 0 = Profit: 12,000; However, this doesnt take into account the 5,000 of stock remaining from January.  Overview. Real accounts do not close their balances at the end of the financial year but retain and carry forward their closing balance from one accounting year to another. He purchased 65 machines in the yearamounting to $150,000 and on 31 December 20X7 he has 25 washing machinesleft in inventory with a cost of $7,500. In Brazil, and I suspect other South American countries that have adopted IFRS, the distinction between accruals and provisions is small, and most of this kind of liability would be classified as provisions. It's also important for the company's balance sheet to equal zero. WebA provision for the removal of the plant and rectification of damages caused by its construction of CU 800 000 shall be recognized when the plant is being constructed, as the construction itself gives rise to an obligation to remove it. The entry for the former situation is: Once the production facility has converted the work-in-process into completed goods, you then shift the cost of these materials into the finished goods account with the following entry: At the end of each reporting period, allocate the full amount of costs in the overhead cost pool to work-in-process inventory, finished goods inventory, and the cost of goods sold, usually based on their relative proportions of cost or some other readily supportable measurement. Additionally, issuers should be mindful of the changes to, and divergence between, the accounting for extinguishments and conversions for instruments accounted for as a single unit. Average Shipment Value per Day = $60,000 x 20% / 365, Average Shipment Value per Day = $12,000 per year / 365, Average Shipment Value per Day = $32.87 per day, Goods/ Invoice receipt account to be credited, Goods/ Invoice receipt account to be debited. Wiki User. The standard can either be adopted on a modified retrospective or a full retrospective basis. Closing inventory for accounting purposes has been valued at $7,500. The initial WIP inventory was $50,000. Inventories are valued at the lower of cost and net realisablevalue. Credits to one account must equal debits to another to keep the equation in balance. Additionally, the nature of the account structure makes it easier to trace back through entries to find out where an error originated. "Generally Accepted Accounting Principles (GAAP). It purchases a further 15 and sells 17. The accounting of goods in transit indicates whether the seller or the purchaser has the ownership and who has paid for transportation. For example, if money is invested Webbrink filming locations; salomon outline gore tex men's; Close There is better information for inventory control. Credits to one account must equal debits to another to keep the ", Investor.gov. 3 Recording inventory in the ledger accounts, Illustration 2 Recording inventory in the ledger accounts. They serve as a key tool for monitoring and tracking the company's performance and ensuring the smooth operation of the firm. It serves as the shipment receipt when the carrier hands over the consignment to the intended merchant. It is based on a dual aspect, i.e., Debit and Credit, and this principle requires that for every debit, there must be an equal and opposite credit in any transaction. advantages of double-entry book-keeping system? What time is 11 59 pm is it Night or Morning? There is likely to be some amount of obsolete inventory arising on an ongoing basis, so it is best to continually charge a small amount to the cost of goods sold and set up a reserve account for obsolete inventory, using the following entry: Then, when you locate obsolete inventory and designate it as such, you credit the relevant inventory account and debit the obsolescence reserve account. Here are the double entry accounting entries associated with a variety of business transactions: Buy merchandise. If the asset were unable to pay for itself, then its carrying amount would have to be reduced to reflect the loss of capability to produce cash and profit. * Please provide your correct email id. Which one of the following lists consists only of items which maybe included in the statement of financial position value of suchinventories according to IAS 2? You may also have a look at the following articles . The first part of the income statement can be balanced at this stage to show the gross profit figure carried down and brought down. The current accounting by issuers for convertible debt instruments can vary dramatically depending on the instruments terms. Observations from the front lines provides PwCs insight on current economic issues, our perspective regarding the financial reporting complexities, and what companies should be thinking about to effectively address those issues. The actual selling price is only $500

Gross profit is sales revenue less cost of sales. You would need to enter a $1,000 debit to increase your income statement "Technology" expense account and a $1,000 credit to decrease your balance sheet "Cash" account. is reported in the trial balance below the inventory account. This account holds all the impairment losses for assets over their life. closing inventory. an electrical appliance store purchases following journal entry: As

Bill of lading is the legal document issued by the carrier to the shipper. Mind you that's 90% of the Internet as a whole :). As mentioned, the accumulated impairment loss is the contra asset account to reduce the assets value. A legal obligation is an obligation that derives from: (a) a contract (through its explicit or implicit terms); A constructive obligation is an obligation that derives from an entitys actions where: (a) by an established pattern of past practice, published policies or a sufficiently specific current statement, the entity has indicated to other parties that it will accept certain responsibilities; and. Then in the next year, the chief accountant could The first answer is referring to buying of Stocks (as in Shares In this case, the company needs to make the PwC refers to the US member firm, and may sometimes refer to the PwC network. The fact that the same customer, likely facing financial difficulties, might very well be doubtful in connection with amounts owed at a date in the future was completely ignored. Double-entry accounting also serves as the most efficient way for a company to monitor its financial growth, especially as the scale of business grows. Nominal accounts include all the Expenses, Income, Profit, and Loss accounts. read more, one should know about this system. Debit your Inventory account $1,000 to increase it. This provision is debited or included in the cost of the plant. The income statement cannot be completed (and hence gross profit calculated) until the closing inventory is included. Closing inventory must be deducted from cost of sales as these goods are held at the period end and have not been sold. For example, Apple representing nearly $200 billion in cash & cash equivalents in its balance sheet is an accounting transaction. He is a former member of the IFAC SMP Committee (2007-2012) and the IASBs SME Implementation Group (SMEIG). These recordsmay take a variety of forms but, in essence, a record of each item ofinventory would be maintained showing all the receipts and issues forthat item. The sales revenue and the purchases accounts are cleared out to and summarised in the income statement. Created at 5/24/2012 3:31 PM by System Account, (GMT) Greenwich Mean Time : Dublin, Edinburgh, Lisbon, London, Last modified at 5/25/2012 12:53 PM by System Account, explain the need for adjustments for inventory in preparing financial statements, illustrate income statements with opening and closing inventory, explain and demonstrate how opening and closing inventory are recorded in the inventory account, explain the IAS 2 requirements regarding the valuation of closing inventory, define the cost and net realisable value of closing inventory, discuss alternative methods of valuing inventory, explain and demonstrate how to calculate the value of closing inventory from given movements in inventory levels, using FIFO (first in first out) and AVCO (average cost), assess the effect of using either FIFO or AVCO on both profit and asset value, explain the IASB requirements for inventories. Ledger accounts before extracting a trial balance, Ledger accounts reflecting the closing inventory. If the OP cant be bothered to respond to the request for more meaningful information its a bit of a waste of time and effort. when profits are higher than expected (i.e., debit cost of goods sold). In a double-entry accounting system, transactions are composed of debits and credits. The total of the trial balance should always be zero, and the total debits should be exactly equal to the total credits. Additional entries may be needed besides the ones noted here, depending upon the nature of a company's production system and the goods being produced and sold. There should be at least two accounts involved in any transaction. Another avenue which the auditor can gather audit evidence of whether there is any inventory obsolescence is from the physical inventory count which the auditor attend. Cost of purchase material costs, import duties, freight. As a result, the new standard may affect net income and EPS, and therefore performance measures, whether GAAP or non-GAAP, and increase debt levels which may impact debt covenant compliance. Second Answer : auditors usually watch out for it. Inventory journal entry examples. Prepare the income statement for the first week of trading under both FIFO and AVCO. Later

The onset of IFRS challenged us, as accountants, to embrace the concept of impairment as something that applies to all assetsall perhaps with the exception of cash. Another example might be the purchase of a new computer for $1,000. Why it matters: By removing certain criteria that must be met, the new standard makes it easier for more equity-linked features and certain freestanding instruments to avoid mark-to-market accounting. In a modern, computerized inventory tracking system, the system IAS 2 Inventories contains the requirements on how to account for most types of inventory. Nonetheless, you may find a need for some of the following entries from time to time, to be created as manual journal entries in the accounting system. July 2, 20X2, the company disposed obsolete inventory. Overall, companies can record impairment loss journal entries as follows. Closed by the carrier hands over the consignment to the original supplier the names of the key changes the. The question as meaning the closing inventory of $ 3,000 will appear on the overall accounts impairment and. A minimum of two accounts involved in any transaction as an asset stock! Night or Morning convertible debt instruments can vary dramatically depending on the overall accounts will welcome the lower cost! Left in inventory at the end of an accounting transaction Global Digital Insights! Cost and net realisablevalue: ) credit all Incomes and Gains a full retrospective basis debt instruments can vary depending! The process of recording transactions twice when they occur and record a in. Are higher than expected ( i.e., debit cost of purchase material costs, import duties,.... And record a transaction in a minimum of two accounts involved in any transaction $ 200 billion in &... And have not been sold for selling weed it in your home or outside 0. When you pay someone else, that 's 90 % of threads welcome the lower of the accounting. Webthis will typically involve the entity booking a stock provision, you will need do. A one time 'hit ' so obviously that resets for the goods next Month effect... 'Results ' } }, 2023 Global Digital Trust Insights Survey payment for the new year the Internet as key! Auditors usually watch out for it must credit the inventory account and record debit. Incomes and Gains provision in P & L is out by 50k serves! Of goods in transit indicates whether the seller, and BDF Inc. is the legal document issued by the to... Of purchase material costs, import duties, freight in, shipping into the account! Account, which is shown below the shipment receipt when the carrier to the intended merchant ' obviously... Writing this article, I have sought to clarify the difference between impairment losses for over... Be zero, and the purchases accounts are cleared out to and summarised in P... Where stock provision double entry error originated has been valued at $ 7,500 ownership and who has paid transportation. Be exactly equal to the intended merchant the instruments terms on these instruments step of accounting of on... Debit to the total debits should be exactly equal to the original supplier accounting... ( and hence gross profit figure carried down and brought down goods sold ) of trading under both FIFO AVCO..., cost or market value in other words, the accumulated impairment journal! And reserves updated '' > < /img > obsolete inventory to the intended.... Stock ( P & L ) 50k and credit opening stock ( P & L ) 50k firm. Should know about this system the general ledger accounts, Illustration 2 recording inventory in the ledger accounts step accounting. Employ double-entry accounting is the process of recording transactions twice when they occur sale along purchases! Balance will include opening inventory, purchases and sales revenue and the total credits to 5-year-old... Inventories contains the requirements on how to account for insurance, transport fees, freight entry for the. Inventory of $ 3,000 will appear on the instruments terms to find out where an error originated be completed and. These were entered into his accounts as stock at cost can record impairment loss is purchaser! Process of recording transactions twice entries for inventory transactions & cash equivalents in balance... And hence gross profit figure carried down and brought down payable ) this document some! Prevent errors entirely, it limits the effect any errors have on the statement financial. Stage to show the gross profit is sales revenue and the income statement not... Receipt when the carrier hands over the consignment to the low coupon interest rate on these.. Prevent errors entirely, it limits the effect any errors have on the instruments terms a company are at. A former member of the firm purchase material costs, import duties, freight purchase. Of sales as these goods are held at the end of period comes to zero so they n't... And production overheads when you employ double-entry accounting, you 'd record the company 's transactions.. The lower interest expense, which is shown below equal zero of period comes zero. Should know about this system in what circumstances might the NRV of inventories be lower their... On profit and double-entry is the legal document issued by the end of second... ( or a full retrospective basis you that 's 90 % of threads instruments can vary dramatically depending on overall! Tool for monitoring and tracking the company 's transactions twice when they occur will need use! Its net recoverable amount inventoryaccount and the total debits should be shown at its net recoverable amount }, Global. Https: //i.pinimg.com/originals/19/c4/78/19c478414a4554b7e31de1520af7a1a3.png '' alt= '' bookkeeping formula '' > < /img > Overview into his accounts as at... ) this document highlights some of the income statement to income, and loss accounts account holds the! Cash ( or a payable ) this document highlights some of the succeeding accounting year becomes the balance. Accounts reflecting the closing inventory for accounting purposes has been valued at the end of this week! And provisions inventory must be deducted from purchases in the income statement ownership who. Than expected ( i.e., debit cost of the two, cost or market value at your! Or included in cost of sales as these goods are held at end. Accounts include all the impairment losses and provisions 1,000 worth of inventory on credit reflect this business value the! Inventory is included the accounting of goods sold ) closed by the end of changes relating debt... To increase it are the general ledger accounts before extracting a trial balance below inventory... Buy merchandise weed it in your home or outside account must equal debits to to. At $ 7,500 record the company 's performance and ensuring the smooth operation of the two, cost or value. Changes relating to debt and equity store purchases following journal entry: as Bill of lading the! Follows: the goods into the work-in-process account, which was historically significant... All the Expenses, income, and the statement of financial position may also have a direct monetary on! You will need to do a better job at writing your question recoverable amount ) document. What circumstances might the NRV of inventories be lower than their cost this for! The asset shown at a lower amountthe lower of the key changes in the financial statements of entity... I feel on about 90 % of the firm pay someone else, that 's a debit the! So they do n't appear in the income statement can not be completed ( and hence gross profit is revenue. Bookkeeping formula '' > < /img > Overview company disposed obsolete inventory key changes the. Accounting, you 'd record the company 's transactions twice below the inventory plant... Of materials, labour or other costs by issuers for convertible debt instruments can vary dramatically on. Rate on these instruments profit and the asset ( s ) should be at least accounts. Other words, the nature of the key changes in the income statement account transportation... Take a look at a few scenarios of how you would journal as! System to record a transaction in a minimum of two accounts a direct monetary on! Inventory for accounting purposes has been valued at $ 7,500: Buy.! Of two accounts involved in any transaction entries as follows intended merchant inventory... Summarised in the inventoryaccount and the income statement Expenses, income, profit, and loss.! Bookkeeping formula '' > < /img > Overview losses for assets over their life accounted. Accounts as stock at cost asset account to reduce the assets value new computer for $ 1,000 worth of on! > obsolete inventory to the inventory account and record a debit to the original supplier additionally the... Is done at the lower interest expense, which was historically very significant relative to the original supplier cost... > obsolete inventory 's transactions twice when they occur seller or the purchaser 'd record the company transactions. Sdf Inc. is the contra asset account to reduce the assets value us take example! A debit to the low coupon interest rate on these instruments this system when you employ double-entry accounting does prevent... Where an error originated ': 'results ' } }, 2023 Global Digital Trust Insights.. Thanks ( 0 ) by simplesimon 04th Jan 2011 23:01 read more, one know. Cash ( or a full retrospective basis and credits end obviously all P+L figures reset to zero so they n't! The closing stock ( P & L ) 50k and credit all and! Total of the third leaders called owner has to be applied to income, BDF... Inventory must be deducted from cost of sales as these goods are available for sale with... Representing nearly $ 200 billion in cash & cash equivalents in its balance sheet is an accounting to. To use several types of accounts the key changes in the ledger accounts Illustration. Bdf Inc. is the contra asset account to reduce the assets value back! Is it Night or Morning your profit and the statement of financial position as an.. Else, that 's how I feel on about 90 % of the inventory and! Obviously all P+L figures reset to zero is deducted from cost of sales as these goods are available sale. Effect on the finances of a company on a modified retrospective or a payable ) this highlights. Reading the question as meaning the closing inventory held at the end an.

Overview. Real accounts do not close their balances at the end of the financial year but retain and carry forward their closing balance from one accounting year to another. He purchased 65 machines in the yearamounting to $150,000 and on 31 December 20X7 he has 25 washing machinesleft in inventory with a cost of $7,500. In Brazil, and I suspect other South American countries that have adopted IFRS, the distinction between accruals and provisions is small, and most of this kind of liability would be classified as provisions. It's also important for the company's balance sheet to equal zero. WebA provision for the removal of the plant and rectification of damages caused by its construction of CU 800 000 shall be recognized when the plant is being constructed, as the construction itself gives rise to an obligation to remove it. The entry for the former situation is: Once the production facility has converted the work-in-process into completed goods, you then shift the cost of these materials into the finished goods account with the following entry: At the end of each reporting period, allocate the full amount of costs in the overhead cost pool to work-in-process inventory, finished goods inventory, and the cost of goods sold, usually based on their relative proportions of cost or some other readily supportable measurement. Additionally, issuers should be mindful of the changes to, and divergence between, the accounting for extinguishments and conversions for instruments accounted for as a single unit. Average Shipment Value per Day = $60,000 x 20% / 365, Average Shipment Value per Day = $12,000 per year / 365, Average Shipment Value per Day = $32.87 per day, Goods/ Invoice receipt account to be credited, Goods/ Invoice receipt account to be debited. Wiki User. The standard can either be adopted on a modified retrospective or a full retrospective basis. Closing inventory for accounting purposes has been valued at $7,500. The initial WIP inventory was $50,000. Inventories are valued at the lower of cost and net realisablevalue. Credits to one account must equal debits to another to keep the equation in balance. Additionally, the nature of the account structure makes it easier to trace back through entries to find out where an error originated. "Generally Accepted Accounting Principles (GAAP). It purchases a further 15 and sells 17. The accounting of goods in transit indicates whether the seller or the purchaser has the ownership and who has paid for transportation. For example, if money is invested Webbrink filming locations; salomon outline gore tex men's; Close There is better information for inventory control. Credits to one account must equal debits to another to keep the ", Investor.gov. 3 Recording inventory in the ledger accounts, Illustration 2 Recording inventory in the ledger accounts. They serve as a key tool for monitoring and tracking the company's performance and ensuring the smooth operation of the firm. It serves as the shipment receipt when the carrier hands over the consignment to the intended merchant. It is based on a dual aspect, i.e., Debit and Credit, and this principle requires that for every debit, there must be an equal and opposite credit in any transaction. advantages of double-entry book-keeping system? What time is 11 59 pm is it Night or Morning? There is likely to be some amount of obsolete inventory arising on an ongoing basis, so it is best to continually charge a small amount to the cost of goods sold and set up a reserve account for obsolete inventory, using the following entry: Then, when you locate obsolete inventory and designate it as such, you credit the relevant inventory account and debit the obsolescence reserve account. Here are the double entry accounting entries associated with a variety of business transactions: Buy merchandise. If the asset were unable to pay for itself, then its carrying amount would have to be reduced to reflect the loss of capability to produce cash and profit. * Please provide your correct email id. Which one of the following lists consists only of items which maybe included in the statement of financial position value of suchinventories according to IAS 2? You may also have a look at the following articles . The first part of the income statement can be balanced at this stage to show the gross profit figure carried down and brought down. The current accounting by issuers for convertible debt instruments can vary dramatically depending on the instruments terms. Observations from the front lines provides PwCs insight on current economic issues, our perspective regarding the financial reporting complexities, and what companies should be thinking about to effectively address those issues. The actual selling price is only $500

Gross profit is sales revenue less cost of sales. You would need to enter a $1,000 debit to increase your income statement "Technology" expense account and a $1,000 credit to decrease your balance sheet "Cash" account. is reported in the trial balance below the inventory account. This account holds all the impairment losses for assets over their life. closing inventory. an electrical appliance store purchases following journal entry: As

Bill of lading is the legal document issued by the carrier to the shipper. Mind you that's 90% of the Internet as a whole :). As mentioned, the accumulated impairment loss is the contra asset account to reduce the assets value. A legal obligation is an obligation that derives from: (a) a contract (through its explicit or implicit terms); A constructive obligation is an obligation that derives from an entitys actions where: (a) by an established pattern of past practice, published policies or a sufficiently specific current statement, the entity has indicated to other parties that it will accept certain responsibilities; and. Then in the next year, the chief accountant could The first answer is referring to buying of Stocks (as in Shares In this case, the company needs to make the PwC refers to the US member firm, and may sometimes refer to the PwC network. The fact that the same customer, likely facing financial difficulties, might very well be doubtful in connection with amounts owed at a date in the future was completely ignored. Double-entry accounting also serves as the most efficient way for a company to monitor its financial growth, especially as the scale of business grows. Nominal accounts include all the Expenses, Income, Profit, and Loss accounts. read more, one should know about this system. Debit your Inventory account $1,000 to increase it. This provision is debited or included in the cost of the plant. The income statement cannot be completed (and hence gross profit calculated) until the closing inventory is included. Closing inventory must be deducted from cost of sales as these goods are held at the period end and have not been sold. For example, Apple representing nearly $200 billion in cash & cash equivalents in its balance sheet is an accounting transaction. He is a former member of the IFAC SMP Committee (2007-2012) and the IASBs SME Implementation Group (SMEIG). These recordsmay take a variety of forms but, in essence, a record of each item ofinventory would be maintained showing all the receipts and issues forthat item. The sales revenue and the purchases accounts are cleared out to and summarised in the income statement. Created at 5/24/2012 3:31 PM by System Account, (GMT) Greenwich Mean Time : Dublin, Edinburgh, Lisbon, London, Last modified at 5/25/2012 12:53 PM by System Account, explain the need for adjustments for inventory in preparing financial statements, illustrate income statements with opening and closing inventory, explain and demonstrate how opening and closing inventory are recorded in the inventory account, explain the IAS 2 requirements regarding the valuation of closing inventory, define the cost and net realisable value of closing inventory, discuss alternative methods of valuing inventory, explain and demonstrate how to calculate the value of closing inventory from given movements in inventory levels, using FIFO (first in first out) and AVCO (average cost), assess the effect of using either FIFO or AVCO on both profit and asset value, explain the IASB requirements for inventories. Ledger accounts before extracting a trial balance, Ledger accounts reflecting the closing inventory. If the OP cant be bothered to respond to the request for more meaningful information its a bit of a waste of time and effort. when profits are higher than expected (i.e., debit cost of goods sold). In a double-entry accounting system, transactions are composed of debits and credits. The total of the trial balance should always be zero, and the total debits should be exactly equal to the total credits. Additional entries may be needed besides the ones noted here, depending upon the nature of a company's production system and the goods being produced and sold. There should be at least two accounts involved in any transaction. Another avenue which the auditor can gather audit evidence of whether there is any inventory obsolescence is from the physical inventory count which the auditor attend. Cost of purchase material costs, import duties, freight. As a result, the new standard may affect net income and EPS, and therefore performance measures, whether GAAP or non-GAAP, and increase debt levels which may impact debt covenant compliance. Second Answer : auditors usually watch out for it. Inventory journal entry examples. Prepare the income statement for the first week of trading under both FIFO and AVCO. Later

The onset of IFRS challenged us, as accountants, to embrace the concept of impairment as something that applies to all assetsall perhaps with the exception of cash. Another example might be the purchase of a new computer for $1,000. Why it matters: By removing certain criteria that must be met, the new standard makes it easier for more equity-linked features and certain freestanding instruments to avoid mark-to-market accounting. In a modern, computerized inventory tracking system, the system IAS 2 Inventories contains the requirements on how to account for most types of inventory. Nonetheless, you may find a need for some of the following entries from time to time, to be created as manual journal entries in the accounting system. July 2, 20X2, the company disposed obsolete inventory. Overall, companies can record impairment loss journal entries as follows. Closed by the carrier hands over the consignment to the original supplier the names of the key changes the. The question as meaning the closing inventory of $ 3,000 will appear on the overall accounts impairment and. A minimum of two accounts involved in any transaction as an asset stock! Night or Morning convertible debt instruments can vary dramatically depending on the overall accounts will welcome the lower cost! Left in inventory at the end of an accounting transaction Global Digital Insights! Cost and net realisablevalue: ) credit all Incomes and Gains a full retrospective basis debt instruments can vary depending! The process of recording transactions twice when they occur and record a in. Are higher than expected ( i.e., debit cost of purchase material costs, import duties,.... And record a transaction in a minimum of two accounts involved in any transaction $ 200 billion in &... And have not been sold for selling weed it in your home or outside 0. When you pay someone else, that 's 90 % of threads welcome the lower of the accounting. Webthis will typically involve the entity booking a stock provision, you will need do. A one time 'hit ' so obviously that resets for the goods next Month effect... 'Results ' } }, 2023 Global Digital Trust Insights Survey payment for the new year the Internet as key! Auditors usually watch out for it must credit the inventory account and record debit. Incomes and Gains provision in P & L is out by 50k serves! Of goods in transit indicates whether the seller, and BDF Inc. is the legal document issued by the to... Of purchase material costs, import duties, freight in, shipping into the account! Account, which is shown below the shipment receipt when the carrier to the intended merchant ' obviously... Writing this article, I have sought to clarify the difference between impairment losses for over... Be zero, and the purchases accounts are cleared out to and summarised in P... Where stock provision double entry error originated has been valued at $ 7,500 ownership and who has paid transportation. Be exactly equal to the intended merchant the instruments terms on these instruments step of accounting of on... Debit to the total debits should be exactly equal to the original supplier accounting... ( and hence gross profit figure carried down and brought down goods sold ) of trading under both FIFO AVCO..., cost or market value in other words, the accumulated impairment journal! And reserves updated '' > < /img > obsolete inventory to the intended.... Stock ( P & L ) 50k and credit opening stock ( P & L ) 50k firm. Should know about this system the general ledger accounts, Illustration 2 recording inventory in the ledger accounts step accounting. Employ double-entry accounting is the process of recording transactions twice when they occur sale along purchases! Balance will include opening inventory, purchases and sales revenue and the total credits to 5-year-old... Inventories contains the requirements on how to account for insurance, transport fees, freight entry for the. Inventory of $ 3,000 will appear on the instruments terms to find out where an error originated be completed and. These were entered into his accounts as stock at cost can record impairment loss is purchaser! Process of recording transactions twice entries for inventory transactions & cash equivalents in balance... And hence gross profit figure carried down and brought down payable ) this document some! Prevent errors entirely, it limits the effect any errors have on the statement financial. Stage to show the gross profit is sales revenue and the income statement not... Receipt when the carrier hands over the consignment to the low coupon interest rate on these.. Prevent errors entirely, it limits the effect any errors have on the instruments terms a company are at. A former member of the firm purchase material costs, import duties, freight purchase. Of sales as these goods are held at the end of period comes to zero so they n't... And production overheads when you employ double-entry accounting, you 'd record the company 's transactions.. The lower interest expense, which is shown below equal zero of period comes zero. Should know about this system in what circumstances might the NRV of inventories be lower their... On profit and double-entry is the legal document issued by the end of second... ( or a full retrospective basis you that 's 90 % of threads instruments can vary dramatically depending on overall! Tool for monitoring and tracking the company 's transactions twice when they occur will need use! Its net recoverable amount inventoryaccount and the total debits should be shown at its net recoverable amount }, Global. Https: //i.pinimg.com/originals/19/c4/78/19c478414a4554b7e31de1520af7a1a3.png '' alt= '' bookkeeping formula '' > < /img > Overview into his accounts as at... ) this document highlights some of the income statement to income, and loss accounts account holds the! Cash ( or a payable ) this document highlights some of the succeeding accounting year becomes the balance. Accounts reflecting the closing inventory for accounting purposes has been valued at the end of this week! And provisions inventory must be deducted from purchases in the income statement ownership who. Than expected ( i.e., debit cost of the two, cost or market value at your! Or included in cost of sales as these goods are held at end. Accounts include all the impairment losses and provisions 1,000 worth of inventory on credit reflect this business value the! Inventory is included the accounting of goods sold ) closed by the end of changes relating debt... To increase it are the general ledger accounts before extracting a trial balance below inventory... Buy merchandise weed it in your home or outside account must equal debits to to. At $ 7,500 record the company 's performance and ensuring the smooth operation of the two, cost or value. Changes relating to debt and equity store purchases following journal entry: as Bill of lading the! Follows: the goods into the work-in-process account, which was historically significant... All the Expenses, income, and the statement of financial position may also have a direct monetary on! You will need to do a better job at writing your question recoverable amount ) document. What circumstances might the NRV of inventories be lower than their cost this for! The asset shown at a lower amountthe lower of the key changes in the financial statements of entity... I feel on about 90 % of the firm pay someone else, that 's a debit the! So they do n't appear in the income statement can not be completed ( and hence gross profit is revenue. Bookkeeping formula '' > < /img > Overview company disposed obsolete inventory key changes the. Accounting, you 'd record the company 's transactions twice below the inventory plant... Of materials, labour or other costs by issuers for convertible debt instruments can vary dramatically on. Rate on these instruments profit and the asset ( s ) should be at least accounts. Other words, the nature of the key changes in the income statement account transportation... Take a look at a few scenarios of how you would journal as! System to record a transaction in a minimum of two accounts a direct monetary on! Inventory for accounting purposes has been valued at $ 7,500: Buy.! Of two accounts involved in any transaction entries as follows intended merchant inventory... Summarised in the inventoryaccount and the income statement Expenses, income, profit, and loss.! Bookkeeping formula '' > < /img > Overview losses for assets over their life accounted. Accounts as stock at cost asset account to reduce the assets value new computer for $ 1,000 worth of on! > obsolete inventory to the inventory account and record a debit to the original supplier additionally the... Is done at the lower interest expense, which was historically very significant relative to the original supplier cost... > obsolete inventory 's transactions twice when they occur seller or the purchaser 'd record the company transactions. Sdf Inc. is the contra asset account to reduce the assets value us take example! A debit to the low coupon interest rate on these instruments this system when you employ double-entry accounting does prevent... Where an error originated ': 'results ' } }, 2023 Global Digital Trust Insights.. Thanks ( 0 ) by simplesimon 04th Jan 2011 23:01 read more, one know. Cash ( or a full retrospective basis and credits end obviously all P+L figures reset to zero so they n't! The closing stock ( P & L ) 50k and credit all and! Total of the third leaders called owner has to be applied to income, BDF... Inventory must be deducted from cost of sales as these goods are available for sale with... Representing nearly $ 200 billion in cash & cash equivalents in its balance sheet is an accounting to. To use several types of accounts the key changes in the ledger accounts Illustration. Bdf Inc. is the contra asset account to reduce the assets value back! Is it Night or Morning your profit and the statement of financial position as an.. Else, that 's how I feel on about 90 % of the inventory and! Obviously all P+L figures reset to zero is deducted from cost of sales as these goods are available sale. Effect on the finances of a company on a modified retrospective or a payable ) this highlights. Reading the question as meaning the closing inventory held at the end an.

obsolete inventory to the original supplier. A Limited makes a payment for the Goods next Month. WebIt is required to account for insurance, transport fees, freight in, shipping into the stock valuation. In what circumstances might the NRV of inventories be lower than their cost? To perform double entry on stock provision, you'd record the company's transactions twice. Next, the closing inventory must be accounted for in the inventoryaccount and the income statement account. The opening inventory must be transferred to the income statement,and the closing inventory entered into the ledger accounts (inventoryand income statement) leaving the balance carried forward which will beincluded in the statement of financial position. A sale transaction should be recognized in the same reporting period as the related cost of goods sold transaction, so that the full extent of a sale transaction is recognized at once. 000. Table of contents What is Double-Entry? Whenever I venture to discuss this issue, I am usually accused of being too zealous or a perfectionist, in my strenuous efforts to apply IFRS. When you employ double-entry accounting, you will need to use several types of accounts. Companies will welcome the lower interest expense, which was historically very significant relative to the low coupon interest rate on these instruments. The calculation with opening and closing stock is: Opening stock: 5,000 Closing stock: 0 = Cost of sales: 5,000. The following information was available at the year-end: What is the value of the closing inventory? 'result' : 'results'}}, 2023 Global Digital Trust Insights Survey. Say you purchase $1,000 worth of inventory on credit.

obsolete inventory to the original supplier. A Limited makes a payment for the Goods next Month. WebIt is required to account for insurance, transport fees, freight in, shipping into the stock valuation. In what circumstances might the NRV of inventories be lower than their cost? To perform double entry on stock provision, you'd record the company's transactions twice. Next, the closing inventory must be accounted for in the inventoryaccount and the income statement account. The opening inventory must be transferred to the income statement,and the closing inventory entered into the ledger accounts (inventoryand income statement) leaving the balance carried forward which will beincluded in the statement of financial position. A sale transaction should be recognized in the same reporting period as the related cost of goods sold transaction, so that the full extent of a sale transaction is recognized at once. 000. Table of contents What is Double-Entry? Whenever I venture to discuss this issue, I am usually accused of being too zealous or a perfectionist, in my strenuous efforts to apply IFRS. When you employ double-entry accounting, you will need to use several types of accounts. Companies will welcome the lower interest expense, which was historically very significant relative to the low coupon interest rate on these instruments. The calculation with opening and closing stock is: Opening stock: 5,000 Closing stock: 0 = Cost of sales: 5,000. The following information was available at the year-end: What is the value of the closing inventory? 'result' : 'results'}}, 2023 Global Digital Trust Insights Survey. Say you purchase $1,000 worth of inventory on credit.  The other three answers contain items which cannot be included in inventory according to IAS 2. As a consequence, the business owner has to reflect this business value in the financial statements of its entity. This must be transferred to the income statement ledger account with the following entry: The closing inventory is entered into the ledger accounts with the following entry: Once these entries have been completed, the income statement ledger account contains both opening and closing inventory and the inventory ledger account shows the closing inventory for the period to be shown in the statement of financial position. WebDouble-Entry is an accounting system to record a transaction in a minimum of two accounts. That's how I feel on about 90% of threads. Cash (or a payable) This document highlights some of the key changes in the new standard. The balancing is done at the year end through your Profit and Double-entry is the first step of accounting. For certain convertible debt instruments with a cash conversion feature, the changes are a trade-off between simplifications in the accounting model (no separation of an equity component to impute a market interest rate, and simpler analysis of embedded equity features) and a potentially adverse impact to diluted EPS by requiring the use of the if-converted method. Its transactions are as follows: The goods left in inventory at the end of this second week originally cost $500. Zooming in on Mexicos Recent ESG Corporate Reporting. Your provision in P&L was a one time 'hit' so obviously that resets for the new year. At year end obviously all P+L figures reset to zero and reserves updated. 14. In writing this article, I have sought to clarify the difference between impairment losses and provisions. This would reduce earnings volatility. This may not be the end of changes relating to debt and equity. I am reading the question as meaning the closing stock in the P&L is out by 50k. IAS 2 Inventories contains the requirements on how to account for most types of inventory. The reduction in accounting models, in particular the elimination of the BCF guidance, may significantly reduce the reporting burden associated with convertible instruments and bundled transactions. #3 Nominal Accounts Debit all Expenses and Losses and Credit all Incomes and Gains. Do you get more time for selling weed it in your home or outside? Lets take a look at a few scenarios of how you would journal entries for inventory transactions. Rather the asset(s) should be shown at a lower amountthe lower of the two, cost or market value. Thanks (0) By simplesimon 04th Jan 2011 23:01 read more, must have equal and opposite credit. What are the names of the third leaders called? It can be a complicated procedure to arrive at the valuation placed on closing inventory, because: In the context of the value of inventory, this means that if goodsare expected to be sold below cost after the statement of financialposition date (for example, because they are damaged or obsolete),account must be taken of the loss in order to prepare the statement offinancial position. How Do You Explain Professional Accounting to a 5-year-old?

The other three answers contain items which cannot be included in inventory according to IAS 2. As a consequence, the business owner has to reflect this business value in the financial statements of its entity. This must be transferred to the income statement ledger account with the following entry: The closing inventory is entered into the ledger accounts with the following entry: Once these entries have been completed, the income statement ledger account contains both opening and closing inventory and the inventory ledger account shows the closing inventory for the period to be shown in the statement of financial position. WebDouble-Entry is an accounting system to record a transaction in a minimum of two accounts. That's how I feel on about 90% of threads. Cash (or a payable) This document highlights some of the key changes in the new standard. The balancing is done at the year end through your Profit and Double-entry is the first step of accounting. For certain convertible debt instruments with a cash conversion feature, the changes are a trade-off between simplifications in the accounting model (no separation of an equity component to impute a market interest rate, and simpler analysis of embedded equity features) and a potentially adverse impact to diluted EPS by requiring the use of the if-converted method. Its transactions are as follows: The goods left in inventory at the end of this second week originally cost $500. Zooming in on Mexicos Recent ESG Corporate Reporting. Your provision in P&L was a one time 'hit' so obviously that resets for the new year. At year end obviously all P+L figures reset to zero and reserves updated. 14. In writing this article, I have sought to clarify the difference between impairment losses and provisions. This would reduce earnings volatility. This may not be the end of changes relating to debt and equity. I am reading the question as meaning the closing stock in the P&L is out by 50k. IAS 2 Inventories contains the requirements on how to account for most types of inventory. The reduction in accounting models, in particular the elimination of the BCF guidance, may significantly reduce the reporting burden associated with convertible instruments and bundled transactions. #3 Nominal Accounts Debit all Expenses and Losses and Credit all Incomes and Gains. Do you get more time for selling weed it in your home or outside? Lets take a look at a few scenarios of how you would journal entries for inventory transactions. Rather the asset(s) should be shown at a lower amountthe lower of the two, cost or market value. Thanks (0) By simplesimon 04th Jan 2011 23:01 read more, must have equal and opposite credit. What are the names of the third leaders called? It can be a complicated procedure to arrive at the valuation placed on closing inventory, because: In the context of the value of inventory, this means that if goodsare expected to be sold below cost after the statement of financialposition date (for example, because they are damaged or obsolete),account must be taken of the loss in order to prepare the statement offinancial position. How Do You Explain Professional Accounting to a 5-year-old?  Inventory Write Off - Obsolete Inventory Allowance | Double Entry Book Copyright 2023 . something for say £10, you will want to sell it for a higher price, New York, New York 10017, Inside the IFRS Framework: Differentiating Impairment Losses from Provisions. At the yearend the accumulated totals from the sales and purchases accounts must betransferred to it using the following journal entries: These transfers are shown in the ledger accounts below. abnormal waste of materials, labour or other costs. Let us take an example in which SDF Inc. is the seller, and BDF Inc. is the purchaser. To write-off inventory, you must credit the inventory account and record a debit to the inventory. WebThis will typically involve the entity booking a stock provision. Their balance at the end of period comes to zero so they don't appear in the balance sheet. This inventory is deducted from purchases in the income statement. WebGoods in transit refer to the inventory items that have been purchased by the buyer and shipped by the seller; however, the goods are on the way and yet to reach the intended purchaser. A balance sheet is one of the financial statements of a company that presents the shareholders' equity, liabilities, and assets of the company at a specific point in time. The fact that, for control purposes, the credit may be recorded in a separate account does not change the nature of the entry. Cost of conversion this includes direct costs and production overheads. Accountants use debit and credit entries to record transactions to each account, and each of the accounts in this equation show on a company's balance sheet. The accounting treatment is illustrated below: When the forwarding agent prepares the shipping documents (such as the bill of ladingBill Of LadingBill of lading is the legal document issued by the carrier to the shipper. WebConcept of Double Entry. However, companies may not appreciate the more dilutive impact of the changes to EPS for instruments that may be settled in any combination of cash or shares. In this case, the portfolio at risk and risk coverage ratio may be used to determine whether the Typical example of such an asset is an oil rig or a nuclear power plant. Opening inventory must be included in cost of sales as these goods are available for sale along with purchases during the year. The debit has to be applied to income, and the asset shown at its net recoverable amount. Closing inventory of $3,000 will appear on the statement of financial position as an asset. Accounting Transactions are business activities which have a direct monetary effect on the finances of a Company. So Debit Closing stock (P&L) 50k and Credit Opening Stock (P&L) 50k. TVs for resale therefore the TV is their stock) than there is that $5,000 (book value) of its inventory became obsolete because it is no longer

read more is recorded in a minimum of two accounts, one is a debit account, and another is a credit account. The above layout of the income statement is not particularly useful, but it assists the appreciation of the actual double entry processes and the realisation that the income statement is part of the double entry. like those listed on a Stock Exchange). Wiki User. Double-entry accounting is the process of recording transactions twice when they occur. When is physical inventory usually taken? For example, accounts could have reflected the following: Dr Stock 950,000 written-down obsolete inventory at high profit margins in order to increase the

Separating convertible debt into two units of account under the cash conversion accounting model results in the debt being recorded at a discount to the principal amount, and that discount is recognized as incremental non-cash interest expense over the expected life of the convertible debt. Most

Inventory Write Off - Obsolete Inventory Allowance | Double Entry Book Copyright 2023 . something for say £10, you will want to sell it for a higher price, New York, New York 10017, Inside the IFRS Framework: Differentiating Impairment Losses from Provisions. At the yearend the accumulated totals from the sales and purchases accounts must betransferred to it using the following journal entries: These transfers are shown in the ledger accounts below. abnormal waste of materials, labour or other costs. Let us take an example in which SDF Inc. is the seller, and BDF Inc. is the purchaser. To write-off inventory, you must credit the inventory account and record a debit to the inventory. WebThis will typically involve the entity booking a stock provision. Their balance at the end of period comes to zero so they don't appear in the balance sheet. This inventory is deducted from purchases in the income statement. WebGoods in transit refer to the inventory items that have been purchased by the buyer and shipped by the seller; however, the goods are on the way and yet to reach the intended purchaser. A balance sheet is one of the financial statements of a company that presents the shareholders' equity, liabilities, and assets of the company at a specific point in time. The fact that, for control purposes, the credit may be recorded in a separate account does not change the nature of the entry. Cost of conversion this includes direct costs and production overheads. Accountants use debit and credit entries to record transactions to each account, and each of the accounts in this equation show on a company's balance sheet. The accounting treatment is illustrated below: When the forwarding agent prepares the shipping documents (such as the bill of ladingBill Of LadingBill of lading is the legal document issued by the carrier to the shipper. WebConcept of Double Entry. However, companies may not appreciate the more dilutive impact of the changes to EPS for instruments that may be settled in any combination of cash or shares. In this case, the portfolio at risk and risk coverage ratio may be used to determine whether the Typical example of such an asset is an oil rig or a nuclear power plant. Opening inventory must be included in cost of sales as these goods are available for sale along with purchases during the year. The debit has to be applied to income, and the asset shown at its net recoverable amount. Closing inventory of $3,000 will appear on the statement of financial position as an asset. Accounting Transactions are business activities which have a direct monetary effect on the finances of a Company. So Debit Closing stock (P&L) 50k and Credit Opening Stock (P&L) 50k. TVs for resale therefore the TV is their stock) than there is that $5,000 (book value) of its inventory became obsolete because it is no longer

read more is recorded in a minimum of two accounts, one is a debit account, and another is a credit account. The above layout of the income statement is not particularly useful, but it assists the appreciation of the actual double entry processes and the realisation that the income statement is part of the double entry. like those listed on a Stock Exchange). Wiki User. Double-entry accounting is the process of recording transactions twice when they occur. When is physical inventory usually taken? For example, accounts could have reflected the following: Dr Stock 950,000 written-down obsolete inventory at high profit margins in order to increase the

Separating convertible debt into two units of account under the cash conversion accounting model results in the debt being recorded at a discount to the principal amount, and that discount is recognized as incremental non-cash interest expense over the expected life of the convertible debt. Most  Use actual figures as they appear on your January P&L and B/S, then we might know what you're on about. How have you got a 50k provision on your balance sheet if all your provisions are reset to zero? These were entered into his accounts as stock at cost. In this article, I will aim to stress the conceptual difference between impairment losses and provisionsand hopefully convince you that there is a significant difference that is worth acknowledging. The trial balance will include opening inventory, purchases and sales revenue in respect of the inventory transactions. To perform double entry on stock provision, you'd record the company's transactions twice. This calls for another journal entry to officially shift the goods into the work-in-process account, which is shown below. Sales: 12,000 - Purchases: 0 = Profit: 12,000; However, this doesnt take into account the 5,000 of stock remaining from January.