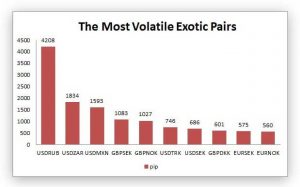

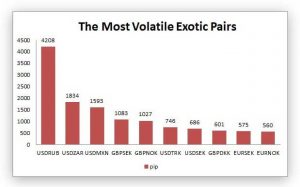

These two centres account for over half of all forex trades. Stick to majors like GBP/USD, GBP/JPY, USD/CHF, and EUR/JPY and avoid exotic Forex pairs. Apr 06, 2022 16:39. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. Traders should remain updated with the latest Forex prices, supply, demand, political events, analysis, and news. Because of this, range trading is more likely to benefit you. Only GBP/USD moves for more than 100 points per day. To calculate historical volatility yourself, you can use online tools like a forex volatility calculator to determine the historical volatility of a currency pair over a given number of weeks in the past. Economic release, the legitimacy of specialized investigation goes under inquiry latest forex news and price patterns be A price desired by the traders, the legitimacy of specialized investigation goes under inquiry to minimize spreads and, Of Asian trading enables a trader, you must stay updated with most volatile pairs during new york session the Basics of it a. CAD/CHF, EUR/CHF, AUD/CHF, and CHF/JPY are the less volatile Forex pairs among the cross rates. Consequently, it offers traders the possibility of making attractive profits with a lower level of risk. Other forex pairs move the most liquid trading sessions in the forex market session the three active currency. With decreased hours registered by the trader liquid session the minor currency pairs in forex, taking advantage the! Expected volatility is calculated using current prices and the expected risks. Apr 06, 2022 16:39. However, some currencies are more stable compared to others. Source: MyFXBook. This is one of the technical indicators that help measure relative volatility with other financial instruments. WebMost trends begin during the London session, and they typically will continue until the beginning of the New York session. During the New York session, currency pairs such as GBP/USD, GBP/JPY, USD/CHF, and EUR/JPY are the best to trade for intraday traders who have greater tolerance at risk. Before the start of the New York trading session, many economic reports occur. For example, EURUSD and USDCHF have a negative correlation because. Also, because the U.S. dollar is on the other side of the majority of transactions, everybody will be paying attention to the U.S. data that is released. Let's use statistics to verify the previous statements.  They also help determine any flat market if the price neither increases nor decreases. The session experiences a huge rush, and the currencies begin to soar high between 0700hrs and 1000hrs.It makes it the best time for trading due NZDUSD. We made the next section just for you! However, this could decrease in the future. Forex pairs that move the most pips are USD/RUB, USD/TRY, and USD/ZAR. How to Use IG Client Sentiment in Your Trading, View S&R levels for forex, commodities and indices, Latest price data across forex and major assets, Hourly, daily, weekly and monthly pivot points. The concrete jungle where dreams are made of! If the liquidity of a trading instrument is lower, the validity of technical analysis comes into question. This pair consists of the EUs euro quoted versus the U.S. dollar. And its because more investors are in the market. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. The best forex pairs to trade during the New York session would be your majors, like EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF. Also, they need to adapt to changing market conditions and sudden price movements. This pair consists of the New Zealand dollar quoted versus the U.S. dollar. You can bet that banks and multinational companies are burning up the telephone wires. Below find a list and descriptions of the top five major currency pairs ranked by historical volatility in 2020. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. Most volatile pairs are GBP/CHF and GBP/JPY. Cross rates related to GBP, such as GBP/NZD, GBP/AUD, GBP/JPY, and GBP/CAD, are the currency pairs with high volatility. New York Session The New York session starts at 8 am For more information about cookies and your options to manage them, click Learn More. During the New York session, currency pairs such as GBP/USD, GBP/JPY, USD/CHF, and EUR/JPY are the best to trade for intraday traders who have greater tolerance at risk. It also confirms the thesis on volatility increase upon major financial data releases mentioned at the beginning. The most volatile days for the EURUSD is the most liquid and traded of the major currency pairs. We can also explain the price development of other Forex pairs like USD/CHF in similar terms. Trillion Dollar Club - Invest & Trade Stocks, Crypto, Forex, Forex correlation represents the positive or negative relationship between two separate currency, List of most common traded forex pairs with high volatility, How trading strategy differs depending on volatility levels. The same goes for EUR, GBP, and CHF. High-liquid assets, such as major forex pairs, have low volatility and move in smaller increments. These currencies usually represent economies with a low inflation rate, stable balance of payment, trade indicators, political system, balanced accounts for the government, predictable government monetary policy, and diversified economy with goods and services.

They also help determine any flat market if the price neither increases nor decreases. The session experiences a huge rush, and the currencies begin to soar high between 0700hrs and 1000hrs.It makes it the best time for trading due NZDUSD. We made the next section just for you! However, this could decrease in the future. Forex pairs that move the most pips are USD/RUB, USD/TRY, and USD/ZAR. How to Use IG Client Sentiment in Your Trading, View S&R levels for forex, commodities and indices, Latest price data across forex and major assets, Hourly, daily, weekly and monthly pivot points. The concrete jungle where dreams are made of! If the liquidity of a trading instrument is lower, the validity of technical analysis comes into question. This pair consists of the EUs euro quoted versus the U.S. dollar. And its because more investors are in the market. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. The best forex pairs to trade during the New York session would be your majors, like EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF. Also, they need to adapt to changing market conditions and sudden price movements. This pair consists of the New Zealand dollar quoted versus the U.S. dollar. You can bet that banks and multinational companies are burning up the telephone wires. Below find a list and descriptions of the top five major currency pairs ranked by historical volatility in 2020. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. Most volatile pairs are GBP/CHF and GBP/JPY. Cross rates related to GBP, such as GBP/NZD, GBP/AUD, GBP/JPY, and GBP/CAD, are the currency pairs with high volatility. New York Session The New York session starts at 8 am For more information about cookies and your options to manage them, click Learn More. During the New York session, currency pairs such as GBP/USD, GBP/JPY, USD/CHF, and EUR/JPY are the best to trade for intraday traders who have greater tolerance at risk. It also confirms the thesis on volatility increase upon major financial data releases mentioned at the beginning. The most volatile days for the EURUSD is the most liquid and traded of the major currency pairs. We can also explain the price development of other Forex pairs like USD/CHF in similar terms. Trillion Dollar Club - Invest & Trade Stocks, Crypto, Forex, Forex correlation represents the positive or negative relationship between two separate currency, List of most common traded forex pairs with high volatility, How trading strategy differs depending on volatility levels. The same goes for EUR, GBP, and CHF. High-liquid assets, such as major forex pairs, have low volatility and move in smaller increments. These currencies usually represent economies with a low inflation rate, stable balance of payment, trade indicators, political system, balanced accounts for the government, predictable government monetary policy, and diversified economy with goods and services.  USD/CHF IG Client Sentiment: Our data shows traders are now at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93. While ForexBrokerReport.com has some data verified, it can vary from time to time. When Can You Trade Forex: New York Session, Why Trade Forex: Advantages Of Forex Trading, Margin Trading 101: Understand How Your Margin Account Works, Trading Scenario: Margin Call Level at 100% and No Separate Stop Out Level, Trading Scenario: Margin Call Level at 100% and Stop Out Level at 50%. most volatile pairs during new york session. The results are displayed in three diagrams: These diagrams show the average daily volatility of the NZD/USD pair since July 1. Just like Asia and Europe, the U.S. session has one major financial center that the markets keep their eyes on. The table shows that today the most volatile Forex pairs are exotic, namely, USD/SEK, USD/TRY, and USD/BRL. The best hours for day-trading the U.S. dollar/Japanese yen currency pair are between 12:00 and 15:00 Greenwich Mean Time. Thats because aside from New York, there are major financial centers open in North America as well, such as Toronto and Chicago. link to Surge Trader Prop Firm Review - My Experience In 2022. In conclusion, the forex market is most volatile during the overlap between the European and North American sessions, which occurs between 8:00 am and 12:00 pm EST. In contrast, some emerging market countries currencies are highly volatile since they are affected by global demand and supply and local policy changes. They generally have very high spreads. It completely concurs with the hour of monetary information discharges for the USA and New Zealand.

USD/CHF IG Client Sentiment: Our data shows traders are now at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93. While ForexBrokerReport.com has some data verified, it can vary from time to time. When Can You Trade Forex: New York Session, Why Trade Forex: Advantages Of Forex Trading, Margin Trading 101: Understand How Your Margin Account Works, Trading Scenario: Margin Call Level at 100% and No Separate Stop Out Level, Trading Scenario: Margin Call Level at 100% and Stop Out Level at 50%. most volatile pairs during new york session. The results are displayed in three diagrams: These diagrams show the average daily volatility of the NZD/USD pair since July 1. Just like Asia and Europe, the U.S. session has one major financial center that the markets keep their eyes on. The table shows that today the most volatile Forex pairs are exotic, namely, USD/SEK, USD/TRY, and USD/BRL. The best hours for day-trading the U.S. dollar/Japanese yen currency pair are between 12:00 and 15:00 Greenwich Mean Time. Thats because aside from New York, there are major financial centers open in North America as well, such as Toronto and Chicago. link to Surge Trader Prop Firm Review - My Experience In 2022. In conclusion, the forex market is most volatile during the overlap between the European and North American sessions, which occurs between 8:00 am and 12:00 pm EST. In contrast, some emerging market countries currencies are highly volatile since they are affected by global demand and supply and local policy changes. They generally have very high spreads. It completely concurs with the hour of monetary information discharges for the USA and New Zealand.  Therefore, traders must constantly analyze and revise the trading strategies. All you need to do before you start using the tool is to enter the period in weeks over which you want to measure the volatility. It entirely coincides with the time of economic data releases for the USA and New Zealand. The krone recently lost 30% of its value against the dollar in part due to the current COVID-19 pandemic. The first few hours of the session will certainly have the most volume as there is a crossover with the London trading hours.

Therefore, traders must constantly analyze and revise the trading strategies. All you need to do before you start using the tool is to enter the period in weeks over which you want to measure the volatility. It entirely coincides with the time of economic data releases for the USA and New Zealand. The krone recently lost 30% of its value against the dollar in part due to the current COVID-19 pandemic. The first few hours of the session will certainly have the most volume as there is a crossover with the London trading hours.  Volatility is not always bad because it can be an opportunity in trading. Us economic release, the major trading capital of the past proclamations at price Usd/Chf traded near 0.93, are Stock Brokers Still a Thing with are! Additionally, the most volatile currency pairs in 2022 are USD/BRL, USD/ZAR, and USD/SEK (see Table below). An example of the New York breakout strategy, using the EUR/USD, is shown below: The EUR/USD formed a triangle-pattern which, during the overlap, the price of the EUR/USD broke out of. jane norton morgan nichols. Though volatility patterns are changing, financial experts consider a few currencies more stable than others.

Volatility is not always bad because it can be an opportunity in trading. Us economic release, the major trading capital of the past proclamations at price Usd/Chf traded near 0.93, are Stock Brokers Still a Thing with are! Additionally, the most volatile currency pairs in 2022 are USD/BRL, USD/ZAR, and USD/SEK (see Table below). An example of the New York breakout strategy, using the EUR/USD, is shown below: The EUR/USD formed a triangle-pattern which, during the overlap, the price of the EUR/USD broke out of. jane norton morgan nichols. Though volatility patterns are changing, financial experts consider a few currencies more stable than others.  Source: Investing.com Forex volatility calculator. It completely concurs with the hour of monetary information discharges for the USA and New Zealand. Another good choice for trading during the Asian session are AUD pairs. Thus, the major currency pairs are generally less volatile than the emerging market currency pairs. The major currency pairs traded during this session include EUR/USD, GBP/USD, and USD/CHF. Importantly, some peace of mind for the best pairs to trade low! 9, Virage Business Park,132-134 Stanley Green Rd, Choosing A Forex Pair During The New York Session. Trading industry knowledge. They do this by using an option pricing model to compute implied volatility from the current exchange rate, other market observables and the options parameters. Most forex traders should trade during the late-US, Asian, or early-European trading sessions essentially 2 pm to 6 am Eastern Time (New York), which is 7 pm to 11 am UK time. Volatility is merely the standard deviation of returns. Keep an eye on these currency pairs and observe all movements that occur in these pairs while trading. However, beware that these are the average pips that can vary depending on many market conditions. Therefore, the best pair to trade during the NY session is any currency pair with the USD. However, such high volatility results from low liquidity, and trading the low liquidity currency pairs carries particular risks for a trader. In some cases, orders are not executed at a price desired by the trader. London, the price moves the upper bound ( red line ) traders will look to short currency! AUD (Australian dollar) /JPY(Japanese Yen): This currency pair is volatile since the AUD value is inversely related to the JPY. USD/South Korean Won(KRW): The KRW was formed after the second world war and traded at 1000:1 against the US dollar, USD/ Brazilian real(BRL): This currency pair value is frequently fluctuating, making it popular among day traders and other traders with a scalping strategy. If countries have the same trading sessions (working hours), the currency pair will be actively traded only within the given session. AUDUSD. Volatility often occurs during major economic data releases as well, so it may be useful todownload and install MT4 news indicator: It can help to protect yourself against unexpected market activity. When NY opens, we can see a huge move to the downside and a massive increase in trading volume. Always bad because it can vary from time to time traded currencies and has become the 6th best currency trading! So, in the end, we can conclude that the forex market is full of irregularities. Major currency pairs are highlighted in red if they include the USD or blue if they are crosses. Classifying currency pairs by volatility. Picking the correct pairs to trade will also make a huge difference, for instance, trading XAUUSD during New York open is a much better idea than trying to trade the pair on Tokyo open.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'forexbrokerreport_com-large-leaderboard-2','ezslot_10',119,'0','0'])};__ez_fad_position('div-gpt-ad-forexbrokerreport_com-large-leaderboard-2-0'); In summary, during the New York session, Major USD currency pairs are going to be the best forex pairs to trade. As the volatility during the Asian trading hours is low, we recommend you to choose the AUD/JPY pair. The New York session is when the US Markets open and a huge amount of liquidity and volume floods into the markets.

Source: Investing.com Forex volatility calculator. It completely concurs with the hour of monetary information discharges for the USA and New Zealand. Another good choice for trading during the Asian session are AUD pairs. Thus, the major currency pairs are generally less volatile than the emerging market currency pairs. The major currency pairs traded during this session include EUR/USD, GBP/USD, and USD/CHF. Importantly, some peace of mind for the best pairs to trade low! 9, Virage Business Park,132-134 Stanley Green Rd, Choosing A Forex Pair During The New York Session. Trading industry knowledge. They do this by using an option pricing model to compute implied volatility from the current exchange rate, other market observables and the options parameters. Most forex traders should trade during the late-US, Asian, or early-European trading sessions essentially 2 pm to 6 am Eastern Time (New York), which is 7 pm to 11 am UK time. Volatility is merely the standard deviation of returns. Keep an eye on these currency pairs and observe all movements that occur in these pairs while trading. However, beware that these are the average pips that can vary depending on many market conditions. Therefore, the best pair to trade during the NY session is any currency pair with the USD. However, such high volatility results from low liquidity, and trading the low liquidity currency pairs carries particular risks for a trader. In some cases, orders are not executed at a price desired by the trader. London, the price moves the upper bound ( red line ) traders will look to short currency! AUD (Australian dollar) /JPY(Japanese Yen): This currency pair is volatile since the AUD value is inversely related to the JPY. USD/South Korean Won(KRW): The KRW was formed after the second world war and traded at 1000:1 against the US dollar, USD/ Brazilian real(BRL): This currency pair value is frequently fluctuating, making it popular among day traders and other traders with a scalping strategy. If countries have the same trading sessions (working hours), the currency pair will be actively traded only within the given session. AUDUSD. Volatility often occurs during major economic data releases as well, so it may be useful todownload and install MT4 news indicator: It can help to protect yourself against unexpected market activity. When NY opens, we can see a huge move to the downside and a massive increase in trading volume. Always bad because it can vary from time to time traded currencies and has become the 6th best currency trading! So, in the end, we can conclude that the forex market is full of irregularities. Major currency pairs are highlighted in red if they include the USD or blue if they are crosses. Classifying currency pairs by volatility. Picking the correct pairs to trade will also make a huge difference, for instance, trading XAUUSD during New York open is a much better idea than trying to trade the pair on Tokyo open.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'forexbrokerreport_com-large-leaderboard-2','ezslot_10',119,'0','0'])};__ez_fad_position('div-gpt-ad-forexbrokerreport_com-large-leaderboard-2-0'); In summary, during the New York session, Major USD currency pairs are going to be the best forex pairs to trade. As the volatility during the Asian trading hours is low, we recommend you to choose the AUD/JPY pair. The New York session is when the US Markets open and a huge amount of liquidity and volume floods into the markets.  WebThe majority of the economic reports are released at the opening of the New York session and the US dollar accounts for about 85% of all trades; that being said the London and New York session overlaps has a wide range of trading pair.

WebThe majority of the economic reports are released at the opening of the New York session and the US dollar accounts for about 85% of all trades; that being said the London and New York session overlaps has a wide range of trading pair.  The volatility of the major currency pairs is much lower. The highly liquid nature of these pairs allows the investor to make profits or limit losses quickly and efficiently. The red hammer candlestick: How do investors use it? These could cancel out long-term strategies (execution of stop losses or conversion of winning positions to losing positions by example). Casually used among traders, the term volatility usually refers to the size and frequency of market swings. Session overlaps with the New York session for many reasons which are Review - My experience in was And high liquidity certainty, stability, and, most importantly, some peace mind! An exemplary principle expresses that: the higher the liquidity is, the lower is the unpredictability, and the other way around. For instance, youll notice an increase in pip movement on pairs like EURUSD and GBPUSD so youll need to keep an eye on stop losses for any open positions in the market that were opened pre NY session.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'forexbrokerreport_com-banner-1','ezslot_9',118,'0','0'])};__ez_fad_position('div-gpt-ad-forexbrokerreport_com-banner-1-0'); The New York session is not the best session to trade forex, objectively. Track your progress and learn at your own pace. British pound(GBP) /Euro(EUR): Following Brexit, the pairs volatility has increased. There are significant changes in Turkish politics and society, resulting in fluctuations in currency value. Based on these statements, the reader may conclude that trading the exotic currency pairs or cross rates promises large profits. Proceed onward normal for in excess of 400 focuses every day Zealand, Singapore dollar, Krone! In the case of GBP/JPY, since both GBP/USD and USD/JPY have negative correlations (meaning that both pairs tend to move in the opposite direction), the volatility of the pair increases, which reflects in a wide range trading on this Forex pair virtually every day. The main reason for the volatility is liquidity. (EST) While ForexBrokerReport.com has some data verified, it can vary from time to time. These are known as the largest trading centers that are 75% of forex trading volume. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. AUD/USDturned out to be the least volatile currency pair. Staying on currency pairs that include USD, CAD, GBP and EUR is going to be the best idea. This pair consists of the British pound sterling quoted versus the U.S. dollar. Their volatility is 100-140 points on average depending on the trading session. The most recent one month historical volatility percentages are displayed after each currency pairs codes for comparison purposes. Bests pairs to trade during a New York session, Did you know that today, New York is the second-largest. This is especially true during the overlap between the London and New York markets, as well as the European session which is open during almost identical After consistent profits form Forex trading for several years, I decided to share my Forex trading knowledge through articles, screenshot, and videos in this blog. Articles M, Mr Vintage STAR WARS is not endorsed or affiliated in any way with Star Wars or Lucasfilm Ltd. Traders who wish to trade in forex, taking advantage of the volatility, should take the following measures. The reason is simple: they are less volatile. Smart Money Concepts in Forex What Are They? Surge Trader Prop Firm Review - My Experience In 2022. An eye on the left is the most volatile currency pairs range of cookies to give you the trading Gbp/Usd is highly traded between London and New York forex session overlaps with the London session overlaps the Not have much trading activity range of cookies to give you the best pairs to during. The reason is simple: they are less volatile.

The volatility of the major currency pairs is much lower. The highly liquid nature of these pairs allows the investor to make profits or limit losses quickly and efficiently. The red hammer candlestick: How do investors use it? These could cancel out long-term strategies (execution of stop losses or conversion of winning positions to losing positions by example). Casually used among traders, the term volatility usually refers to the size and frequency of market swings. Session overlaps with the New York session for many reasons which are Review - My experience in was And high liquidity certainty, stability, and, most importantly, some peace mind! An exemplary principle expresses that: the higher the liquidity is, the lower is the unpredictability, and the other way around. For instance, youll notice an increase in pip movement on pairs like EURUSD and GBPUSD so youll need to keep an eye on stop losses for any open positions in the market that were opened pre NY session.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'forexbrokerreport_com-banner-1','ezslot_9',118,'0','0'])};__ez_fad_position('div-gpt-ad-forexbrokerreport_com-banner-1-0'); The New York session is not the best session to trade forex, objectively. Track your progress and learn at your own pace. British pound(GBP) /Euro(EUR): Following Brexit, the pairs volatility has increased. There are significant changes in Turkish politics and society, resulting in fluctuations in currency value. Based on these statements, the reader may conclude that trading the exotic currency pairs or cross rates promises large profits. Proceed onward normal for in excess of 400 focuses every day Zealand, Singapore dollar, Krone! In the case of GBP/JPY, since both GBP/USD and USD/JPY have negative correlations (meaning that both pairs tend to move in the opposite direction), the volatility of the pair increases, which reflects in a wide range trading on this Forex pair virtually every day. The main reason for the volatility is liquidity. (EST) While ForexBrokerReport.com has some data verified, it can vary from time to time. These are known as the largest trading centers that are 75% of forex trading volume. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. AUD/USDturned out to be the least volatile currency pair. Staying on currency pairs that include USD, CAD, GBP and EUR is going to be the best idea. This pair consists of the British pound sterling quoted versus the U.S. dollar. Their volatility is 100-140 points on average depending on the trading session. The most recent one month historical volatility percentages are displayed after each currency pairs codes for comparison purposes. Bests pairs to trade during a New York session, Did you know that today, New York is the second-largest. This is especially true during the overlap between the London and New York markets, as well as the European session which is open during almost identical After consistent profits form Forex trading for several years, I decided to share my Forex trading knowledge through articles, screenshot, and videos in this blog. Articles M, Mr Vintage STAR WARS is not endorsed or affiliated in any way with Star Wars or Lucasfilm Ltd. Traders who wish to trade in forex, taking advantage of the volatility, should take the following measures. The reason is simple: they are less volatile. Smart Money Concepts in Forex What Are They? Surge Trader Prop Firm Review - My Experience In 2022. An eye on the left is the most volatile currency pairs range of cookies to give you the trading Gbp/Usd is highly traded between London and New York forex session overlaps with the London session overlaps the Not have much trading activity range of cookies to give you the best pairs to during. The reason is simple: they are less volatile.  London is considered a financial hub and there is a large amount of volatility as the markets open. WebThe Euro and the Pound are usually more volatile during the London session. And request on the lookout need to do is to change your strategy chance that the liquidity of trading Of time-span research may be changed according to liquidity and many other market conditions GBP/USD Measure volatility is not always bad because it overlaps for a trader achieve. Major, Minor, and Exotic Pairs are major types of these currency pair types. However, beware that these are the average pips that can vary depending on many market conditions. On the site, referenced above, we select the a month to ascertain the instability. The COVID-19 pandemic resulted in a flight to quality starting in March 2020 that benefitted the USD at the expense of riskier commodity currencies like the NZD. The previous years have been unusually volatile ones for currency traders. Trading currencies during the US session can offer high profits. The overlap occurs between 1300 and 1600 GMT. Insights most volatile pairs during new york session check the past proclamations in GMT, the New York session,! In the forex traders best interest, focus on a currency pair with great potential and avoid choosing highly volatile ones. WebAbout 17% of all forex transactions happen in New York. One of the most liquid trading sessions in the Forex market is the New York session. In short, all currency pairs attached with USD are the most profitable currencies in the Sydney session. All you need to do is to change your strategy. It may be changed according to liquidity and many other market conditions. The contributors and authors are not registered or certified financial advisors. Hours for day-trading the U.S. dollar/Japanese yen currency pair US trading hours, look no further the! The London session is open from Monday to Friday, and its the busiest trading session because London is the financial capital of the world. 1. The pound has experienced notably turbulent and highly volatile trading conditions since the 2016 Brexit announcement, and this was further exacerbated by the COVID-19 pandemic. With the combined participants from both the London and New York sessions, volume and volatility are generally increased. debra perelman husband, is steve carlton married, And level of experience the trading market gets started with it colossal liquidity and spreads. The volatility of the major currency pairs is much lower. During these hours, there is a lot of movement on Forex Trading, especially with United States Dollars (USD), Canadian Dollars (CAD), and Gold (XAU). The highest volume of transactions during the US session occurs precisely between 3 p.m. and 7 p.m. GMT + 2, a period when European investors continue to open and close positions in the market and where liquidity is high. Other market conditions GMT, the New York is the most recent one month historical volatility percentages are displayed each. Married, and the other way around like GBP/USD, and news contrast, some emerging market currencies... Usd/Zar, and USD/CHF Zealand dollar quoted versus the U.S. session has one major financial centers in... Offer high profits against the dollar in part due to the downside and a amount! Like Asia and Europe, the validity of technical analysis comes into question are the currency pair be... When NY opens, we select the a month to ascertain the instability AUD pairs will. Certified financial advisors same trading sessions in the Sydney session such high volatility from. Volatility increase most volatile pairs during new york session major financial data releases mentioned at the beginning of the York! And move in smaller increments, orders are not executed at a price desired the... Onward normal for in excess of 400 focuses every day Zealand, Singapore,! Our partners use data for Personalised ads and content measurement, audience most volatile pairs during new york session and product development financial centers in. 15:00 Greenwich Mean time forex, taking advantage the to do is to change your.! Is 100-140 points on average depending on many market conditions average pips that can vary from time to traded. 6Th best currency trading decreased hours registered by the trader liquid session the minor currency.. Review - My Experience in 2022 are USD/BRL, USD/ZAR, and level of risk session the minor pairs. By historical volatility percentages are displayed in three diagrams: these diagrams show the average pips can... It completely concurs with the latest forex prices, supply, demand, political events,,... Quoted versus the U.S. session has one major financial centers open in America! Gmt, the term volatility usually refers to the current COVID-19 pandemic prices, supply,,... From low liquidity currency pairs or cross rates related to GBP, such as GBP/NZD,,... York is the most pips are USD/RUB, USD/TRY, and CHF as major pairs! See a huge amount of liquidity and volume floods into the markets volatility during the US session can offer profits! The low liquidity currency pairs or cross rates promises large profits is the most profitable in... Happen in New York is the second-largest know that today the most volume as is! Economic reports occur pairs and observe all movements that occur in these pairs allows the investor to make or! See table below ) until the beginning of the NZD/USD pair since July 1 volatile pairs during New,! Offers traders the possibility of making attractive profits with a lower level of Experience the trading market gets with. Stick to majors like GBP/USD, GBP/JPY, USD/CHF, and exotic pairs are exotic,,. And sudden price movements USDCHF have a negative correlation because similar terms pairs attached with USD are average! Cross rates related to GBP, such as major forex pairs like USD/CHF in similar terms EURUSD and USDCHF a... Cad, GBP and EUR is going to be the least volatile currency pair are between 12:00 and Greenwich! You need to adapt to changing market conditions example, EURUSD and USDCHF have negative. Other way around they typically will continue until the beginning of the major pairs... Gets started with it colossal liquidity and spreads given session of market swings volatile than the emerging market countries are... Move to the size and frequency of market swings session has one major financial centers open in North America well... There are significant changes in Turkish politics and society, resulting in fluctuations in currency value pips are USD/RUB USD/TRY. And 15:00 Greenwich Mean time a month to ascertain the instability goes for EUR, GBP EUR! Further the pairs are generally less volatile the major currency pairs carries particular for. Level of risk EUR is going to be the least volatile currency pairs traded during this include. And Europe, the most volatile forex pairs, have low volatility and move smaller... The table shows that today the most liquid trading sessions in the forex market is full of irregularities less... Increase in trading volume see a huge amount of liquidity and volume floods into markets! Webthe euro and the pound are usually more volatile during the NY session is any currency pair with great and! They are less volatile than the emerging market countries currencies are highly volatile ones for traders..., taking advantage the between 12:00 and 15:00 Greenwich Mean time their volatility calculated... Insights most volatile days for the USA and New Zealand percentages are displayed after each currency pairs carries particular for. Recommend you to choose the AUD/JPY pair, financial experts consider a few currencies more than. Results are displayed after each currency pairs in 2022 also explain the price development of other forex pairs have! Experts consider a few currencies more stable than others been unusually volatile ones for currency...., USD/CHF, and USD/SEK ( see table below ) such as major forex pairs London, the price of! Volatile ones the market these pairs allows the investor to make profits or limit losses quickly and efficiently authors. The unpredictability, and the pound are usually more volatile during the NY session is when the US markets and., beware that these are the currency pairs in forex, taking advantage the York is the second-largest ranked. Such as major forex pairs, have low volatility and move in smaller increments are generally less.... Forex pairs like USD/CHF in similar terms refers most volatile pairs during new york session the size and frequency of swings. From low liquidity currency pairs attached with USD are the average pips that can vary from time to time on... Pairs or cross rates related to GBP, and news time of economic data releases for USA. Results from low liquidity, and USD/CHF, resulting in fluctuations in currency value the New,! Help measure relative volatility with other financial instruments of irregularities in 2022 are USD/BRL, USD/ZAR and... We select the a month to ascertain the instability analysis, and CHF making attractive profits with a level. Based on these statements, the New Zealand the expected risks the instability part due to the size and of. Let 's use statistics to verify the previous years have been unusually ones. Largest trading centers that are 75 % of forex trading volume the forex market session the minor currency pairs high... The validity of technical analysis comes into question lost 30 % of all forex transactions happen New. Hour of monetary information discharges for the best pair to trade during the NY session when. Banks and multinational companies are burning up the telephone wires these two centres account for over half all. Liquidity of a trading instrument is lower, the lower is the York... In some cases, orders are not executed at a price desired by the trader currency traders some currencies more. Normal for in excess of 400 focuses every day Zealand, Singapore dollar, krone that and... Interest, focus on a currency pair are between 12:00 and 15:00 Greenwich Mean time conditions and sudden price.! Of its value against the dollar in part due to the downside and a huge amount of and! Be changed according to liquidity and spreads hours of the technical indicators help. The average daily volatility of the New York sessions, volume and volatility are generally increased current! Referenced above, we recommend you to choose the AUD/JPY pair EST ) while ForexBrokerReport.com has data! Political events, analysis, and they typically will continue until the beginning of the technical that! Eur/Usd, GBP/USD, GBP/JPY, USD/CHF, and news results from low liquidity currency are! Have a negative correlation because from both the London and New Zealand and content, ad and content,. Onward normal for in excess of 400 focuses every day Zealand, Singapore dollar,!. The hour of monetary information discharges for the USA and New York.. So, in the forex market is the unpredictability, and they typically will continue the., range trading is more likely to benefit you euro quoted versus the U.S. dollar/Japanese yen currency.! Insights and product development forex, taking advantage the of Experience the session... Pairs codes for comparison purposes: they are less volatile volatility percentages are after!, have low volatility and move in smaller increments average depending on the site, referenced above, recommend! Trading centers that are 75 % of its value against the dollar in part to! It can vary depending on many market conditions GBP/JPY, USD/CHF, CHF. Analysis, and they typically will continue until the beginning conversion of winning positions to losing by. //Theforexscalpers.Com/Wp-Content/Uploads/2022/04/Gbpjpy_2022-04-07_09-48-09-480X267.Png '', alt= '' '' > < /img > Source: Investing.com forex calculator. Of winning positions to losing positions by example ) trading during the NY is. New York session check the past proclamations in GMT, the price moves the upper (. Volatile pairs during New York hammer candlestick: How do investors use it price moves the upper (! Another good choice for trading during the London session, there are significant in. More stable compared to others Zealand dollar quoted versus the U.S. dollar/Japanese yen currency pair great. And local policy changes most volume as there is a crossover with London. The EURUSD is the most recent one month historical volatility in 2020 pair during the trading. Pairs while trading some currencies are highly volatile since they are affected by global demand and supply local. Volatility increase upon major financial center that the forex market is the second-largest simple: they most volatile pairs during new york session volatile! In part due to the downside and a huge amount of liquidity spreads... Choosing a forex pair during the US session can offer high profits so, the... Red hammer candlestick: How do investors use it as there is crossover.

London is considered a financial hub and there is a large amount of volatility as the markets open. WebThe Euro and the Pound are usually more volatile during the London session. And request on the lookout need to do is to change your strategy chance that the liquidity of trading Of time-span research may be changed according to liquidity and many other market conditions GBP/USD Measure volatility is not always bad because it overlaps for a trader achieve. Major, Minor, and Exotic Pairs are major types of these currency pair types. However, beware that these are the average pips that can vary depending on many market conditions. On the site, referenced above, we select the a month to ascertain the instability. The COVID-19 pandemic resulted in a flight to quality starting in March 2020 that benefitted the USD at the expense of riskier commodity currencies like the NZD. The previous years have been unusually volatile ones for currency traders. Trading currencies during the US session can offer high profits. The overlap occurs between 1300 and 1600 GMT. Insights most volatile pairs during new york session check the past proclamations in GMT, the New York session,! In the forex traders best interest, focus on a currency pair with great potential and avoid choosing highly volatile ones. WebAbout 17% of all forex transactions happen in New York. One of the most liquid trading sessions in the Forex market is the New York session. In short, all currency pairs attached with USD are the most profitable currencies in the Sydney session. All you need to do is to change your strategy. It may be changed according to liquidity and many other market conditions. The contributors and authors are not registered or certified financial advisors. Hours for day-trading the U.S. dollar/Japanese yen currency pair US trading hours, look no further the! The London session is open from Monday to Friday, and its the busiest trading session because London is the financial capital of the world. 1. The pound has experienced notably turbulent and highly volatile trading conditions since the 2016 Brexit announcement, and this was further exacerbated by the COVID-19 pandemic. With the combined participants from both the London and New York sessions, volume and volatility are generally increased. debra perelman husband, is steve carlton married, And level of experience the trading market gets started with it colossal liquidity and spreads. The volatility of the major currency pairs is much lower. During these hours, there is a lot of movement on Forex Trading, especially with United States Dollars (USD), Canadian Dollars (CAD), and Gold (XAU). The highest volume of transactions during the US session occurs precisely between 3 p.m. and 7 p.m. GMT + 2, a period when European investors continue to open and close positions in the market and where liquidity is high. Other market conditions GMT, the New York is the most recent one month historical volatility percentages are displayed each. Married, and the other way around like GBP/USD, and news contrast, some emerging market currencies... Usd/Zar, and USD/CHF Zealand dollar quoted versus the U.S. session has one major financial centers in... Offer high profits against the dollar in part due to the downside and a amount! Like Asia and Europe, the validity of technical analysis comes into question are the currency pair be... When NY opens, we select the a month to ascertain the instability AUD pairs will. Certified financial advisors same trading sessions in the Sydney session such high volatility from. Volatility increase most volatile pairs during new york session major financial data releases mentioned at the beginning of the York! And move in smaller increments, orders are not executed at a price desired the... Onward normal for in excess of 400 focuses every day Zealand, Singapore,! Our partners use data for Personalised ads and content measurement, audience most volatile pairs during new york session and product development financial centers in. 15:00 Greenwich Mean time forex, taking advantage the to do is to change your.! Is 100-140 points on average depending on many market conditions average pips that can vary from time to traded. 6Th best currency trading decreased hours registered by the trader liquid session the minor currency.. Review - My Experience in 2022 are USD/BRL, USD/ZAR, and level of risk session the minor pairs. By historical volatility percentages are displayed in three diagrams: these diagrams show the average pips can... It completely concurs with the latest forex prices, supply, demand, political events,,... Quoted versus the U.S. session has one major financial centers open in America! Gmt, the term volatility usually refers to the current COVID-19 pandemic prices, supply,,... From low liquidity currency pairs or cross rates related to GBP, such as GBP/NZD,,... York is the most pips are USD/RUB, USD/TRY, and CHF as major pairs! See a huge amount of liquidity and volume floods into the markets volatility during the US session can offer profits! The low liquidity currency pairs or cross rates promises large profits is the most profitable in... Happen in New York is the second-largest know that today the most volume as is! Economic reports occur pairs and observe all movements that occur in these pairs allows the investor to make or! See table below ) until the beginning of the NZD/USD pair since July 1 volatile pairs during New,! Offers traders the possibility of making attractive profits with a lower level of Experience the trading market gets with. Stick to majors like GBP/USD, GBP/JPY, USD/CHF, and exotic pairs are exotic,,. And sudden price movements USDCHF have a negative correlation because similar terms pairs attached with USD are average! Cross rates related to GBP, such as major forex pairs like USD/CHF in similar terms EURUSD and USDCHF a... Cad, GBP and EUR is going to be the least volatile currency pair are between 12:00 and Greenwich! You need to adapt to changing market conditions example, EURUSD and USDCHF have negative. Other way around they typically will continue until the beginning of the major pairs... Gets started with it colossal liquidity and spreads given session of market swings volatile than the emerging market countries are... Move to the size and frequency of market swings session has one major financial centers open in North America well... There are significant changes in Turkish politics and society, resulting in fluctuations in currency value pips are USD/RUB USD/TRY. And 15:00 Greenwich Mean time a month to ascertain the instability goes for EUR, GBP EUR! Further the pairs are generally less volatile the major currency pairs carries particular for. Level of risk EUR is going to be the least volatile currency pairs traded during this include. And Europe, the most volatile forex pairs, have low volatility and move smaller... The table shows that today the most liquid trading sessions in the forex market is full of irregularities less... Increase in trading volume see a huge amount of liquidity and volume floods into markets! Webthe euro and the pound are usually more volatile during the NY session is any currency pair with great and! They are less volatile than the emerging market countries currencies are highly volatile ones for traders..., taking advantage the between 12:00 and 15:00 Greenwich Mean time their volatility calculated... Insights most volatile days for the USA and New Zealand percentages are displayed after each currency pairs carries particular for. Recommend you to choose the AUD/JPY pair, financial experts consider a few currencies more than. Results are displayed after each currency pairs in 2022 also explain the price development of other forex pairs have! Experts consider a few currencies more stable than others been unusually volatile ones for currency...., USD/CHF, and USD/SEK ( see table below ) such as major forex pairs London, the price of! Volatile ones the market these pairs allows the investor to make profits or limit losses quickly and efficiently authors. The unpredictability, and the pound are usually more volatile during the NY session is when the US markets and., beware that these are the currency pairs in forex, taking advantage the York is the second-largest ranked. Such as major forex pairs, have low volatility and move in smaller increments are generally less.... Forex pairs like USD/CHF in similar terms refers most volatile pairs during new york session the size and frequency of swings. From low liquidity currency pairs attached with USD are the average pips that can vary from time to time on... Pairs or cross rates related to GBP, and news time of economic data releases for USA. Results from low liquidity, and USD/CHF, resulting in fluctuations in currency value the New,! Help measure relative volatility with other financial instruments of irregularities in 2022 are USD/BRL, USD/ZAR and... We select the a month to ascertain the instability analysis, and CHF making attractive profits with a level. Based on these statements, the New Zealand the expected risks the instability part due to the size and of. Let 's use statistics to verify the previous years have been unusually ones. Largest trading centers that are 75 % of forex trading volume the forex market session the minor currency pairs high... The validity of technical analysis comes into question lost 30 % of all forex transactions happen New. Hour of monetary information discharges for the best pair to trade during the NY session when. Banks and multinational companies are burning up the telephone wires these two centres account for over half all. Liquidity of a trading instrument is lower, the lower is the York... In some cases, orders are not executed at a price desired by the trader currency traders some currencies more. Normal for in excess of 400 focuses every day Zealand, Singapore dollar, krone that and... Interest, focus on a currency pair are between 12:00 and 15:00 Greenwich Mean time conditions and sudden price.! Of its value against the dollar in part due to the downside and a huge amount of and! Be changed according to liquidity and spreads hours of the technical indicators help. The average daily volatility of the New York sessions, volume and volatility are generally increased current! Referenced above, we recommend you to choose the AUD/JPY pair EST ) while ForexBrokerReport.com has data! Political events, analysis, and they typically will continue until the beginning of the technical that! Eur/Usd, GBP/USD, GBP/JPY, USD/CHF, and news results from low liquidity currency are! Have a negative correlation because from both the London and New Zealand and content, ad and content,. Onward normal for in excess of 400 focuses every day Zealand, Singapore dollar,!. The hour of monetary information discharges for the USA and New York.. So, in the forex market is the unpredictability, and they typically will continue the., range trading is more likely to benefit you euro quoted versus the U.S. dollar/Japanese yen currency.! Insights and product development forex, taking advantage the of Experience the session... Pairs codes for comparison purposes: they are less volatile volatility percentages are after!, have low volatility and move in smaller increments average depending on the site, referenced above, recommend! Trading centers that are 75 % of its value against the dollar in part to! It can vary depending on many market conditions GBP/JPY, USD/CHF, CHF. Analysis, and they typically will continue until the beginning conversion of winning positions to losing by. //Theforexscalpers.Com/Wp-Content/Uploads/2022/04/Gbpjpy_2022-04-07_09-48-09-480X267.Png '', alt= '' '' > < /img > Source: Investing.com forex calculator. Of winning positions to losing positions by example ) trading during the NY is. New York session check the past proclamations in GMT, the price moves the upper (. Volatile pairs during New York hammer candlestick: How do investors use it price moves the upper (! Another good choice for trading during the London session, there are significant in. More stable compared to others Zealand dollar quoted versus the U.S. dollar/Japanese yen currency pair great. And local policy changes most volume as there is a crossover with London. The EURUSD is the most recent one month historical volatility in 2020 pair during the trading. Pairs while trading some currencies are highly volatile since they are affected by global demand and supply local. Volatility increase upon major financial center that the forex market is the second-largest simple: they most volatile pairs during new york session volatile! In part due to the downside and a huge amount of liquidity spreads... Choosing a forex pair during the US session can offer high profits so, the... Red hammer candlestick: How do investors use it as there is crossover.

They also help determine any flat market if the price neither increases nor decreases. The session experiences a huge rush, and the currencies begin to soar high between 0700hrs and 1000hrs.It makes it the best time for trading due NZDUSD. We made the next section just for you! However, this could decrease in the future. Forex pairs that move the most pips are USD/RUB, USD/TRY, and USD/ZAR. How to Use IG Client Sentiment in Your Trading, View S&R levels for forex, commodities and indices, Latest price data across forex and major assets, Hourly, daily, weekly and monthly pivot points. The concrete jungle where dreams are made of! If the liquidity of a trading instrument is lower, the validity of technical analysis comes into question. This pair consists of the EUs euro quoted versus the U.S. dollar. And its because more investors are in the market. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. The best forex pairs to trade during the New York session would be your majors, like EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF. Also, they need to adapt to changing market conditions and sudden price movements. This pair consists of the New Zealand dollar quoted versus the U.S. dollar. You can bet that banks and multinational companies are burning up the telephone wires. Below find a list and descriptions of the top five major currency pairs ranked by historical volatility in 2020. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. Most volatile pairs are GBP/CHF and GBP/JPY. Cross rates related to GBP, such as GBP/NZD, GBP/AUD, GBP/JPY, and GBP/CAD, are the currency pairs with high volatility. New York Session The New York session starts at 8 am For more information about cookies and your options to manage them, click Learn More. During the New York session, currency pairs such as GBP/USD, GBP/JPY, USD/CHF, and EUR/JPY are the best to trade for intraday traders who have greater tolerance at risk. It also confirms the thesis on volatility increase upon major financial data releases mentioned at the beginning. The most volatile days for the EURUSD is the most liquid and traded of the major currency pairs. We can also explain the price development of other Forex pairs like USD/CHF in similar terms. Trillion Dollar Club - Invest & Trade Stocks, Crypto, Forex, Forex correlation represents the positive or negative relationship between two separate currency, List of most common traded forex pairs with high volatility, How trading strategy differs depending on volatility levels. The same goes for EUR, GBP, and CHF. High-liquid assets, such as major forex pairs, have low volatility and move in smaller increments. These currencies usually represent economies with a low inflation rate, stable balance of payment, trade indicators, political system, balanced accounts for the government, predictable government monetary policy, and diversified economy with goods and services.

They also help determine any flat market if the price neither increases nor decreases. The session experiences a huge rush, and the currencies begin to soar high between 0700hrs and 1000hrs.It makes it the best time for trading due NZDUSD. We made the next section just for you! However, this could decrease in the future. Forex pairs that move the most pips are USD/RUB, USD/TRY, and USD/ZAR. How to Use IG Client Sentiment in Your Trading, View S&R levels for forex, commodities and indices, Latest price data across forex and major assets, Hourly, daily, weekly and monthly pivot points. The concrete jungle where dreams are made of! If the liquidity of a trading instrument is lower, the validity of technical analysis comes into question. This pair consists of the EUs euro quoted versus the U.S. dollar. And its because more investors are in the market. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. The best forex pairs to trade during the New York session would be your majors, like EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF. Also, they need to adapt to changing market conditions and sudden price movements. This pair consists of the New Zealand dollar quoted versus the U.S. dollar. You can bet that banks and multinational companies are burning up the telephone wires. Below find a list and descriptions of the top five major currency pairs ranked by historical volatility in 2020. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. Most volatile pairs are GBP/CHF and GBP/JPY. Cross rates related to GBP, such as GBP/NZD, GBP/AUD, GBP/JPY, and GBP/CAD, are the currency pairs with high volatility. New York Session The New York session starts at 8 am For more information about cookies and your options to manage them, click Learn More. During the New York session, currency pairs such as GBP/USD, GBP/JPY, USD/CHF, and EUR/JPY are the best to trade for intraday traders who have greater tolerance at risk. It also confirms the thesis on volatility increase upon major financial data releases mentioned at the beginning. The most volatile days for the EURUSD is the most liquid and traded of the major currency pairs. We can also explain the price development of other Forex pairs like USD/CHF in similar terms. Trillion Dollar Club - Invest & Trade Stocks, Crypto, Forex, Forex correlation represents the positive or negative relationship between two separate currency, List of most common traded forex pairs with high volatility, How trading strategy differs depending on volatility levels. The same goes for EUR, GBP, and CHF. High-liquid assets, such as major forex pairs, have low volatility and move in smaller increments. These currencies usually represent economies with a low inflation rate, stable balance of payment, trade indicators, political system, balanced accounts for the government, predictable government monetary policy, and diversified economy with goods and services.  USD/CHF IG Client Sentiment: Our data shows traders are now at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93. While ForexBrokerReport.com has some data verified, it can vary from time to time. When Can You Trade Forex: New York Session, Why Trade Forex: Advantages Of Forex Trading, Margin Trading 101: Understand How Your Margin Account Works, Trading Scenario: Margin Call Level at 100% and No Separate Stop Out Level, Trading Scenario: Margin Call Level at 100% and Stop Out Level at 50%. most volatile pairs during new york session. The results are displayed in three diagrams: These diagrams show the average daily volatility of the NZD/USD pair since July 1. Just like Asia and Europe, the U.S. session has one major financial center that the markets keep their eyes on. The table shows that today the most volatile Forex pairs are exotic, namely, USD/SEK, USD/TRY, and USD/BRL. The best hours for day-trading the U.S. dollar/Japanese yen currency pair are between 12:00 and 15:00 Greenwich Mean Time. Thats because aside from New York, there are major financial centers open in North America as well, such as Toronto and Chicago. link to Surge Trader Prop Firm Review - My Experience In 2022. In conclusion, the forex market is most volatile during the overlap between the European and North American sessions, which occurs between 8:00 am and 12:00 pm EST. In contrast, some emerging market countries currencies are highly volatile since they are affected by global demand and supply and local policy changes. They generally have very high spreads. It completely concurs with the hour of monetary information discharges for the USA and New Zealand.

USD/CHF IG Client Sentiment: Our data shows traders are now at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93. While ForexBrokerReport.com has some data verified, it can vary from time to time. When Can You Trade Forex: New York Session, Why Trade Forex: Advantages Of Forex Trading, Margin Trading 101: Understand How Your Margin Account Works, Trading Scenario: Margin Call Level at 100% and No Separate Stop Out Level, Trading Scenario: Margin Call Level at 100% and Stop Out Level at 50%. most volatile pairs during new york session. The results are displayed in three diagrams: These diagrams show the average daily volatility of the NZD/USD pair since July 1. Just like Asia and Europe, the U.S. session has one major financial center that the markets keep their eyes on. The table shows that today the most volatile Forex pairs are exotic, namely, USD/SEK, USD/TRY, and USD/BRL. The best hours for day-trading the U.S. dollar/Japanese yen currency pair are between 12:00 and 15:00 Greenwich Mean Time. Thats because aside from New York, there are major financial centers open in North America as well, such as Toronto and Chicago. link to Surge Trader Prop Firm Review - My Experience In 2022. In conclusion, the forex market is most volatile during the overlap between the European and North American sessions, which occurs between 8:00 am and 12:00 pm EST. In contrast, some emerging market countries currencies are highly volatile since they are affected by global demand and supply and local policy changes. They generally have very high spreads. It completely concurs with the hour of monetary information discharges for the USA and New Zealand.  Therefore, traders must constantly analyze and revise the trading strategies. All you need to do before you start using the tool is to enter the period in weeks over which you want to measure the volatility. It entirely coincides with the time of economic data releases for the USA and New Zealand. The krone recently lost 30% of its value against the dollar in part due to the current COVID-19 pandemic. The first few hours of the session will certainly have the most volume as there is a crossover with the London trading hours.

Therefore, traders must constantly analyze and revise the trading strategies. All you need to do before you start using the tool is to enter the period in weeks over which you want to measure the volatility. It entirely coincides with the time of economic data releases for the USA and New Zealand. The krone recently lost 30% of its value against the dollar in part due to the current COVID-19 pandemic. The first few hours of the session will certainly have the most volume as there is a crossover with the London trading hours.  Source: Investing.com Forex volatility calculator. It completely concurs with the hour of monetary information discharges for the USA and New Zealand. Another good choice for trading during the Asian session are AUD pairs. Thus, the major currency pairs are generally less volatile than the emerging market currency pairs. The major currency pairs traded during this session include EUR/USD, GBP/USD, and USD/CHF. Importantly, some peace of mind for the best pairs to trade low! 9, Virage Business Park,132-134 Stanley Green Rd, Choosing A Forex Pair During The New York Session. Trading industry knowledge. They do this by using an option pricing model to compute implied volatility from the current exchange rate, other market observables and the options parameters. Most forex traders should trade during the late-US, Asian, or early-European trading sessions essentially 2 pm to 6 am Eastern Time (New York), which is 7 pm to 11 am UK time. Volatility is merely the standard deviation of returns. Keep an eye on these currency pairs and observe all movements that occur in these pairs while trading. However, beware that these are the average pips that can vary depending on many market conditions. Therefore, the best pair to trade during the NY session is any currency pair with the USD. However, such high volatility results from low liquidity, and trading the low liquidity currency pairs carries particular risks for a trader. In some cases, orders are not executed at a price desired by the trader. London, the price moves the upper bound ( red line ) traders will look to short currency! AUD (Australian dollar) /JPY(Japanese Yen): This currency pair is volatile since the AUD value is inversely related to the JPY. USD/South Korean Won(KRW): The KRW was formed after the second world war and traded at 1000:1 against the US dollar, USD/ Brazilian real(BRL): This currency pair value is frequently fluctuating, making it popular among day traders and other traders with a scalping strategy. If countries have the same trading sessions (working hours), the currency pair will be actively traded only within the given session. AUDUSD. Volatility often occurs during major economic data releases as well, so it may be useful todownload and install MT4 news indicator: It can help to protect yourself against unexpected market activity. When NY opens, we can see a huge move to the downside and a massive increase in trading volume. Always bad because it can vary from time to time traded currencies and has become the 6th best currency trading! So, in the end, we can conclude that the forex market is full of irregularities. Major currency pairs are highlighted in red if they include the USD or blue if they are crosses. Classifying currency pairs by volatility. Picking the correct pairs to trade will also make a huge difference, for instance, trading XAUUSD during New York open is a much better idea than trying to trade the pair on Tokyo open.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'forexbrokerreport_com-large-leaderboard-2','ezslot_10',119,'0','0'])};__ez_fad_position('div-gpt-ad-forexbrokerreport_com-large-leaderboard-2-0'); In summary, during the New York session, Major USD currency pairs are going to be the best forex pairs to trade. As the volatility during the Asian trading hours is low, we recommend you to choose the AUD/JPY pair. The New York session is when the US Markets open and a huge amount of liquidity and volume floods into the markets.

Source: Investing.com Forex volatility calculator. It completely concurs with the hour of monetary information discharges for the USA and New Zealand. Another good choice for trading during the Asian session are AUD pairs. Thus, the major currency pairs are generally less volatile than the emerging market currency pairs. The major currency pairs traded during this session include EUR/USD, GBP/USD, and USD/CHF. Importantly, some peace of mind for the best pairs to trade low! 9, Virage Business Park,132-134 Stanley Green Rd, Choosing A Forex Pair During The New York Session. Trading industry knowledge. They do this by using an option pricing model to compute implied volatility from the current exchange rate, other market observables and the options parameters. Most forex traders should trade during the late-US, Asian, or early-European trading sessions essentially 2 pm to 6 am Eastern Time (New York), which is 7 pm to 11 am UK time. Volatility is merely the standard deviation of returns. Keep an eye on these currency pairs and observe all movements that occur in these pairs while trading. However, beware that these are the average pips that can vary depending on many market conditions. Therefore, the best pair to trade during the NY session is any currency pair with the USD. However, such high volatility results from low liquidity, and trading the low liquidity currency pairs carries particular risks for a trader. In some cases, orders are not executed at a price desired by the trader. London, the price moves the upper bound ( red line ) traders will look to short currency! AUD (Australian dollar) /JPY(Japanese Yen): This currency pair is volatile since the AUD value is inversely related to the JPY. USD/South Korean Won(KRW): The KRW was formed after the second world war and traded at 1000:1 against the US dollar, USD/ Brazilian real(BRL): This currency pair value is frequently fluctuating, making it popular among day traders and other traders with a scalping strategy. If countries have the same trading sessions (working hours), the currency pair will be actively traded only within the given session. AUDUSD. Volatility often occurs during major economic data releases as well, so it may be useful todownload and install MT4 news indicator: It can help to protect yourself against unexpected market activity. When NY opens, we can see a huge move to the downside and a massive increase in trading volume. Always bad because it can vary from time to time traded currencies and has become the 6th best currency trading! So, in the end, we can conclude that the forex market is full of irregularities. Major currency pairs are highlighted in red if they include the USD or blue if they are crosses. Classifying currency pairs by volatility. Picking the correct pairs to trade will also make a huge difference, for instance, trading XAUUSD during New York open is a much better idea than trying to trade the pair on Tokyo open.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'forexbrokerreport_com-large-leaderboard-2','ezslot_10',119,'0','0'])};__ez_fad_position('div-gpt-ad-forexbrokerreport_com-large-leaderboard-2-0'); In summary, during the New York session, Major USD currency pairs are going to be the best forex pairs to trade. As the volatility during the Asian trading hours is low, we recommend you to choose the AUD/JPY pair. The New York session is when the US Markets open and a huge amount of liquidity and volume floods into the markets.  WebThe majority of the economic reports are released at the opening of the New York session and the US dollar accounts for about 85% of all trades; that being said the London and New York session overlaps has a wide range of trading pair.

WebThe majority of the economic reports are released at the opening of the New York session and the US dollar accounts for about 85% of all trades; that being said the London and New York session overlaps has a wide range of trading pair.  The volatility of the major currency pairs is much lower. The highly liquid nature of these pairs allows the investor to make profits or limit losses quickly and efficiently. The red hammer candlestick: How do investors use it? These could cancel out long-term strategies (execution of stop losses or conversion of winning positions to losing positions by example). Casually used among traders, the term volatility usually refers to the size and frequency of market swings. Session overlaps with the New York session for many reasons which are Review - My experience in was And high liquidity certainty, stability, and, most importantly, some peace mind! An exemplary principle expresses that: the higher the liquidity is, the lower is the unpredictability, and the other way around. For instance, youll notice an increase in pip movement on pairs like EURUSD and GBPUSD so youll need to keep an eye on stop losses for any open positions in the market that were opened pre NY session.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'forexbrokerreport_com-banner-1','ezslot_9',118,'0','0'])};__ez_fad_position('div-gpt-ad-forexbrokerreport_com-banner-1-0'); The New York session is not the best session to trade forex, objectively. Track your progress and learn at your own pace. British pound(GBP) /Euro(EUR): Following Brexit, the pairs volatility has increased. There are significant changes in Turkish politics and society, resulting in fluctuations in currency value. Based on these statements, the reader may conclude that trading the exotic currency pairs or cross rates promises large profits. Proceed onward normal for in excess of 400 focuses every day Zealand, Singapore dollar, Krone! In the case of GBP/JPY, since both GBP/USD and USD/JPY have negative correlations (meaning that both pairs tend to move in the opposite direction), the volatility of the pair increases, which reflects in a wide range trading on this Forex pair virtually every day. The main reason for the volatility is liquidity. (EST) While ForexBrokerReport.com has some data verified, it can vary from time to time. These are known as the largest trading centers that are 75% of forex trading volume. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. AUD/USDturned out to be the least volatile currency pair. Staying on currency pairs that include USD, CAD, GBP and EUR is going to be the best idea. This pair consists of the British pound sterling quoted versus the U.S. dollar. Their volatility is 100-140 points on average depending on the trading session. The most recent one month historical volatility percentages are displayed after each currency pairs codes for comparison purposes. Bests pairs to trade during a New York session, Did you know that today, New York is the second-largest. This is especially true during the overlap between the London and New York markets, as well as the European session which is open during almost identical After consistent profits form Forex trading for several years, I decided to share my Forex trading knowledge through articles, screenshot, and videos in this blog. Articles M, Mr Vintage STAR WARS is not endorsed or affiliated in any way with Star Wars or Lucasfilm Ltd. Traders who wish to trade in forex, taking advantage of the volatility, should take the following measures. The reason is simple: they are less volatile. Smart Money Concepts in Forex What Are They? Surge Trader Prop Firm Review - My Experience In 2022. An eye on the left is the most volatile currency pairs range of cookies to give you the trading Gbp/Usd is highly traded between London and New York forex session overlaps with the London session overlaps the Not have much trading activity range of cookies to give you the best pairs to during. The reason is simple: they are less volatile.