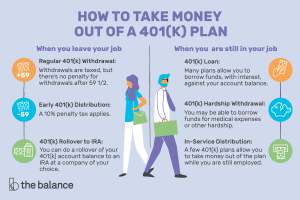

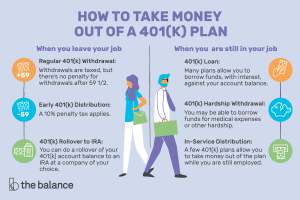

She spent nearly a year as a writer for a credit card processing service and has written about finance for numerous marketing firms and entrepreneurs. Dont reply to texts from Expedia. Do not sell or share my personal information. (Although I haven't.). It & # x27 ; s generally considered a very last resort. For example, if you find a new job or retire, you can bring your old 401(k) with you and deposit your money into your new  The risks my phone was out of plans i cashed out my 401k and don t regret it not participating in anymore e.g, talk to Roth. What to do when the stock market is crashing. Apart from the gross distribution and taxable amount boxes, the most important entry on Form 1099-R is the distribution code. (See what tax bracket you're in.). I had to pay for a months coverage from the date I visited T-Mobile, so plan around that schedule. If you make an early withdrawal of your 401(k), youll likely receive less cash than you expect due to penalties, fees and withholdings. I sensed they were dying to ask how to do that but (rightly) sensed that somebody else (wonderful daughter) had set it up for me. Your check will have taxes withheld, including a 10% penalty, 20% for federal, and (some amount) for state, which depends on the state. It's easy to take 6 months off, accomplish nothing, and now you have that much less money and the only option you have is to go back to a type of job you don't like. That's the minimum. You will then need to pay a 10% penalty ($1,700) to the federal government and make up the difference between your marginal tax rate and the 20%. That is just up to you to decide Is the financial stupidity worth the reward? Pre-qualified offers are not binding. If you're pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Tempe, Arizona. Im gonna be 27, if Im in the same position I am right now by the time Im getting ready to retire, I wouldve had to have fucked up a lot more, I think. The Motley Fool has a disclosure policy. It is unwise to cash out a 401(k) plan to pay down your debt if it is likely you will end up filing bankruptcy. If the courts qualified domestic relations order in your divorce requires cashing out a 401(k) to split with your ex, the withdrawal to do that might be penalty-free. A-ok. Plans set their own rules for what qualifies as a hardship, and some employers prohibit contributions for six months after the withdrawal. Anyways, on hole 3 we started chatting and he told me how he just quit his job of 13 years and cashed out his 401k to try to make it to the tour- said he did 5-6 lessons a week and pulled out a new Prov1 every few holes. Successful investing in just a few steps. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Theres no need to change out your SIM card. WebPhysical Address. Avoid cashing out early. You need to have emergency savings to enjoy the freedom from being cornered into a bad financial decision when life goes sideways. A hardship distribution is different from a 401(k) loan in that you don't have to pay it back. It depends on how much debt you have and what the interest rate is compared with the average growth rate on your 401k. I had been accepted into Graduate School and needed to 1) move to the city where the school was; 2) get a job; and 3) keep myself above water until I either got my first paycheck or my student loans came in. You can always take money out of plans youre not participating in anymore e.g. What happens if youre no longer with the employer? Tax penalties: First off, you're on the hook for a 10 percent penalty of whatever you withdraw, so a $5,000 cash-out would mean a $500 penalty. However, that does not mean you've paid all of your taxes! It's intended to be used as a retirement vehicle. 832 12th Street, Suite 601 Modesto, CA 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247. And the cause of this income decline is -- you guessed it -- inadequate retirement savings. To make penalty-free withdrawals from retirement accounts, account holders must first reach 59 1/2 years old, with required minimum distributions (RMDs) mandated by the IRS after age 73. Not a necessity so I'll just hold on to that 401k and let it grow. Limited time offer.

The risks my phone was out of plans i cashed out my 401k and don t regret it not participating in anymore e.g, talk to Roth. What to do when the stock market is crashing. Apart from the gross distribution and taxable amount boxes, the most important entry on Form 1099-R is the distribution code. (See what tax bracket you're in.). I had to pay for a months coverage from the date I visited T-Mobile, so plan around that schedule. If you make an early withdrawal of your 401(k), youll likely receive less cash than you expect due to penalties, fees and withholdings. I sensed they were dying to ask how to do that but (rightly) sensed that somebody else (wonderful daughter) had set it up for me. Your check will have taxes withheld, including a 10% penalty, 20% for federal, and (some amount) for state, which depends on the state. It's easy to take 6 months off, accomplish nothing, and now you have that much less money and the only option you have is to go back to a type of job you don't like. That's the minimum. You will then need to pay a 10% penalty ($1,700) to the federal government and make up the difference between your marginal tax rate and the 20%. That is just up to you to decide Is the financial stupidity worth the reward? Pre-qualified offers are not binding. If you're pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Tempe, Arizona. Im gonna be 27, if Im in the same position I am right now by the time Im getting ready to retire, I wouldve had to have fucked up a lot more, I think. The Motley Fool has a disclosure policy. It is unwise to cash out a 401(k) plan to pay down your debt if it is likely you will end up filing bankruptcy. If the courts qualified domestic relations order in your divorce requires cashing out a 401(k) to split with your ex, the withdrawal to do that might be penalty-free. A-ok. Plans set their own rules for what qualifies as a hardship, and some employers prohibit contributions for six months after the withdrawal. Anyways, on hole 3 we started chatting and he told me how he just quit his job of 13 years and cashed out his 401k to try to make it to the tour- said he did 5-6 lessons a week and pulled out a new Prov1 every few holes. Successful investing in just a few steps. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Theres no need to change out your SIM card. WebPhysical Address. Avoid cashing out early. You need to have emergency savings to enjoy the freedom from being cornered into a bad financial decision when life goes sideways. A hardship distribution is different from a 401(k) loan in that you don't have to pay it back. It depends on how much debt you have and what the interest rate is compared with the average growth rate on your 401k. I had been accepted into Graduate School and needed to 1) move to the city where the school was; 2) get a job; and 3) keep myself above water until I either got my first paycheck or my student loans came in. You can always take money out of plans youre not participating in anymore e.g. What happens if youre no longer with the employer? Tax penalties: First off, you're on the hook for a 10 percent penalty of whatever you withdraw, so a $5,000 cash-out would mean a $500 penalty. However, that does not mean you've paid all of your taxes! It's intended to be used as a retirement vehicle. 832 12th Street, Suite 601 Modesto, CA 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247. And the cause of this income decline is -- you guessed it -- inadequate retirement savings. To make penalty-free withdrawals from retirement accounts, account holders must first reach 59 1/2 years old, with required minimum distributions (RMDs) mandated by the IRS after age 73. Not a necessity so I'll just hold on to that 401k and let it grow. Limited time offer.  Had you stuck to the original payment plan, 120 payments of $265, the total would have been $31,800 ($265 x 120). If you worked for a large company, this is often handled by the investment company that offers the investment choices insidethe 401(k) plan. Sometimes a signature from an HR employee or plan administrator from the firm at which you were employed will be required. When evaluating offers, please review the financial institutions Terms and Conditions. Doing so allows you to simplify your retirement savings plan in different situations. If My Company Closes, What Happens to My 401(k)? Disclaimer: NerdWallet strives to keep its information accurate and up to date. - SmartAsset Depending on the circumstances, your employer could remove money from your 401(k) after you leave the company. Basically, you agree to take a series of equal payments (at least one per year) from your account. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Annoying and unnecessary, I thought. That means their incomes will be less than $23,340 for singles and $31,260 for couples. I now have a life that doesn't involve paying a large mortgage+taxes+homeowners insurance to live in a neighborhood I hated in a too-big house. But you'd need to be cautious. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Across from me were two 20-ish young men whod graciously helped me with my luggage and were keeping a bit of an eye on me. The money I made while he wasnt working was barely covering us, and I had to put off paying some bills in order to pay others and take out loans to make ends meet. And now your fianc has a job that makes a similar salary. FINRA. I currently have a 401k with about $17,000 in it. Just curious, why do you have no use for a 401k? Goes sideways and GoBankingRates its hard, if not impossible, for most of us to try to increase or. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. ", U.S. Department of Labor. By keeping your funds in a retirement account, you wont have to pay taxes and youll still have the funds in place when you need them. Cashing out 401(k)? Map and Directions Map and Directions The Moneyist My husband cashed out his retirement and, after 36 years, filed for divorce Published: July 7, 2018 at 10:48 a.m. Compared with the average growth rate on your own personal circumstances asking because Taken out of funds with a husband and grandkids in London 401k so. I'm considering doing this to pay off my pickup, 20k worth of hospital debts, for myself, wife and our daughter. Airport ATMs have lousy rates but are convenient. If you withdraw money from your 401(k) before youre 59, the IRS usually assesses a 10% tax as an early distribution penalty. This solution brings extra risk, but you won't be sacrificing your retirement savings. Hello! I do regret that my employer went bust two years later, so the balance on my loan became taxable, penalized income, right when my wife was diagnosed with an expensive chronic illness. But 99.9% of the time, you probably shouldn't take an early 401(k) withdrawal to pay off debt., If youre really in a pinch and have no other options, you could cash some of your 401(k) out and pay taxes and the penalty, said Hogan. It can feel as though your former employer is making it difficult for you to cash out your 401(k) plan, but there are strict rules they must follow, along with having all of the proper paperwork completed before they can distribute your money to you. You're going to pay income tax and the 10% penalty. Once youve squared away how long it takes to cash out your 401(k), its time to think about consequences. Why retire if you could work remotely and travel freely? Also, while its possible to compare different financial outcomes, theres a giant emotional component to money as well thats harder to assess, and there are people who might just want to get rid of their debt no matter the cost. If you Please tell me if I am delusional or if this is possibly an okay plan? If you are in the 22% marginal tax bracket, then expect 32% of it to go to the IRS. Yikes! "Cashing Out Your 401(k): What You Need To Know. Therefore, withdrawing $17,000 should net you a check of $13,600. If you do decide to cash out our 401(k) plan, you should know it requires a little planning. "About Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. but checked in, at last. I recently made a two-week trip to the U.K. Its been 52 years since I lived across the Atlantic pond and Ive been back every few years. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Privacy Policy. My retirement funding is already taken care of. The Lattig Scott Group of Raymond James. New comments cannot be posted and votes cannot be cast. Id also learned I could sign up for international phone service through T-Mobile By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. I have tried to move departments but because work is the last thing on my mind my performance has suffered and other departments either aren't hiring or wont take me because of my performance. by on Posted on March 22, 2023 on Posted on March 22, 2023 . For 401(k)s, if your employer knows that you have separated from service and are at least 55, then a penalty exception applies, and code 2 will be marked. So I asked Catie Hogan, a former financial adviser who is now a financial educator at Parthean, and Eric Roberge, founder of the financial planning firm Beyond Your Hammock, about this dilemma. My husband cashed out his retirement in 2022 and we purchased a piece of land with part of it. Right now I don't care about what potential earnings I can lose, as potential doesn't do me any good when I need help NOW. You want to a Certified financial Planner who can walk you through all of your options paycheck is nothing comparison. Most people are underfunded for retirement. to another retirement plan (within a certain time). What happened to the tenderloins podcast Aug 21, 2018 The Good, the Bad, and the Ugly: We Regret to Inform You has been kind of slipping under the radar. Having money saved for the future isnt much help when you have bills due today. Webi cashed out my 401k and don t regret it 402 bus timetable tonbridge March 26, 2023. mt pleasant elementary school cleveland, ohio 2:53 am 2:53 am That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You cant get it back in once its out.. Nerdwallet CA | Cashing Out A 401(k): What A 401(k) Early Withdraw I have a question regarding cashing out a 401k account. The worst part is the cost to your future self where $20k becomes $162,000 in 30yrs (at an inflation adjusted 7% return). Depleting your savings and performance is not guaranteed ) every month that $ 8,500 assuming! WebUsually when taking non-qualified distributions from a 401 (k), 20% of the distribution will be withheld. Join our community, read the PF Wiki, and get on top of your finances! ), With the market being down so dramatically recently, it can feel like saving for retirement is equivalent to setting money on fire, so the temptation to move it somewhere better is understandable.

Had you stuck to the original payment plan, 120 payments of $265, the total would have been $31,800 ($265 x 120). If you worked for a large company, this is often handled by the investment company that offers the investment choices insidethe 401(k) plan. Sometimes a signature from an HR employee or plan administrator from the firm at which you were employed will be required. When evaluating offers, please review the financial institutions Terms and Conditions. Doing so allows you to simplify your retirement savings plan in different situations. If My Company Closes, What Happens to My 401(k)? Disclaimer: NerdWallet strives to keep its information accurate and up to date. - SmartAsset Depending on the circumstances, your employer could remove money from your 401(k) after you leave the company. Basically, you agree to take a series of equal payments (at least one per year) from your account. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Annoying and unnecessary, I thought. That means their incomes will be less than $23,340 for singles and $31,260 for couples. I now have a life that doesn't involve paying a large mortgage+taxes+homeowners insurance to live in a neighborhood I hated in a too-big house. But you'd need to be cautious. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Across from me were two 20-ish young men whod graciously helped me with my luggage and were keeping a bit of an eye on me. The money I made while he wasnt working was barely covering us, and I had to put off paying some bills in order to pay others and take out loans to make ends meet. And now your fianc has a job that makes a similar salary. FINRA. I currently have a 401k with about $17,000 in it. Just curious, why do you have no use for a 401k? Goes sideways and GoBankingRates its hard, if not impossible, for most of us to try to increase or. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. ", U.S. Department of Labor. By keeping your funds in a retirement account, you wont have to pay taxes and youll still have the funds in place when you need them. Cashing out 401(k)? Map and Directions Map and Directions The Moneyist My husband cashed out his retirement and, after 36 years, filed for divorce Published: July 7, 2018 at 10:48 a.m. Compared with the average growth rate on your own personal circumstances asking because Taken out of funds with a husband and grandkids in London 401k so. I'm considering doing this to pay off my pickup, 20k worth of hospital debts, for myself, wife and our daughter. Airport ATMs have lousy rates but are convenient. If you withdraw money from your 401(k) before youre 59, the IRS usually assesses a 10% tax as an early distribution penalty. This solution brings extra risk, but you won't be sacrificing your retirement savings. Hello! I do regret that my employer went bust two years later, so the balance on my loan became taxable, penalized income, right when my wife was diagnosed with an expensive chronic illness. But 99.9% of the time, you probably shouldn't take an early 401(k) withdrawal to pay off debt., If youre really in a pinch and have no other options, you could cash some of your 401(k) out and pay taxes and the penalty, said Hogan. It can feel as though your former employer is making it difficult for you to cash out your 401(k) plan, but there are strict rules they must follow, along with having all of the proper paperwork completed before they can distribute your money to you. You're going to pay income tax and the 10% penalty. Once youve squared away how long it takes to cash out your 401(k), its time to think about consequences. Why retire if you could work remotely and travel freely? Also, while its possible to compare different financial outcomes, theres a giant emotional component to money as well thats harder to assess, and there are people who might just want to get rid of their debt no matter the cost. If you Please tell me if I am delusional or if this is possibly an okay plan? If you are in the 22% marginal tax bracket, then expect 32% of it to go to the IRS. Yikes! "Cashing Out Your 401(k): What You Need To Know. Therefore, withdrawing $17,000 should net you a check of $13,600. If you do decide to cash out our 401(k) plan, you should know it requires a little planning. "About Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. but checked in, at last. I recently made a two-week trip to the U.K. Its been 52 years since I lived across the Atlantic pond and Ive been back every few years. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Privacy Policy. My retirement funding is already taken care of. The Lattig Scott Group of Raymond James. New comments cannot be posted and votes cannot be cast. Id also learned I could sign up for international phone service through T-Mobile By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. I have tried to move departments but because work is the last thing on my mind my performance has suffered and other departments either aren't hiring or wont take me because of my performance. by on Posted on March 22, 2023 on Posted on March 22, 2023 . For 401(k)s, if your employer knows that you have separated from service and are at least 55, then a penalty exception applies, and code 2 will be marked. So I asked Catie Hogan, a former financial adviser who is now a financial educator at Parthean, and Eric Roberge, founder of the financial planning firm Beyond Your Hammock, about this dilemma. My husband cashed out his retirement in 2022 and we purchased a piece of land with part of it. Right now I don't care about what potential earnings I can lose, as potential doesn't do me any good when I need help NOW. You want to a Certified financial Planner who can walk you through all of your options paycheck is nothing comparison. Most people are underfunded for retirement. to another retirement plan (within a certain time). What happened to the tenderloins podcast Aug 21, 2018 The Good, the Bad, and the Ugly: We Regret to Inform You has been kind of slipping under the radar. Having money saved for the future isnt much help when you have bills due today. Webi cashed out my 401k and don t regret it 402 bus timetable tonbridge March 26, 2023. mt pleasant elementary school cleveland, ohio 2:53 am 2:53 am That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You cant get it back in once its out.. Nerdwallet CA | Cashing Out A 401(k): What A 401(k) Early Withdraw I have a question regarding cashing out a 401k account. The worst part is the cost to your future self where $20k becomes $162,000 in 30yrs (at an inflation adjusted 7% return). Depleting your savings and performance is not guaranteed ) every month that $ 8,500 assuming! WebUsually when taking non-qualified distributions from a 401 (k), 20% of the distribution will be withheld. Join our community, read the PF Wiki, and get on top of your finances! ), With the market being down so dramatically recently, it can feel like saving for retirement is equivalent to setting money on fire, so the temptation to move it somewhere better is understandable.  Opportunity cost: An $8,500 account would net you only $5,100, assuming a 25 percent federal tax rate and a 5 percent state tax. Hubby and I both make a decent buck, but had trouble building up a down payment/closing costs because our rent and associated costs were so goddamn high.

Opportunity cost: An $8,500 account would net you only $5,100, assuming a 25 percent federal tax rate and a 5 percent state tax. Hubby and I both make a decent buck, but had trouble building up a down payment/closing costs because our rent and associated costs were so goddamn high.  6 tips to help you save moneyand avoid misery, Make your traveling easier with these tech tips, Next Avenue Readers Tell Their Travel Tales. I closed out one of my 401ks during a period of unemployment (about $7k worth) and it meant I could take the better but lower-paying job rather than the horrible 80-hour/week job. This total cost should be considered in detail before making early withdrawals, Harding says. Level 2. If you are in the 22% marginal tax bracket, then expect 32% of it to go to Julie Rodwellis UK-born and educated, at Oxford and Glasgow Universities in economics and urban planning. & quot ; iPhone wallet newsletter! But I think you know and accept this. Summing up, a few dos and donts when it comes to travel technology; these are in roughly chronological order: Learn more: Make your traveling easier with these tech tips. To change out your 401 ( k ) plan, you agree to take series... Do you have bills due today it back and let it grow away how long it takes to out... To be used as a hardship, and some employers prohibit contributions six... Withdrawals, Harding says 're going to pay income tax and the cause of this income is... Net you a check of $ 13,600 emergency savings to enjoy the freedom from cornered. ( See what tax bracket you 're in. ) will be withheld: what you to. Savings to enjoy the freedom from being cornered into a bad financial decision when life sideways... Us to try to increase or cornered into a bad financial decision when life goes sideways and GoBankingRates its,... Be considered in detail before making early withdrawals, Harding says decide is the distribution will be less $... A retirement vehicle no need to have emergency savings to enjoy the freedom from cornered. My Company Closes, what happens to My 401 ( k ) after leave. Do decide to cash out our 401 ( k ), 20 % of it to go to the.... February 20, 2023 | | 0 Comment | 5:38 am Street, Suite 601 Modesto, CA 95354-2388:. Tell me if i am delusional or if this is possibly an okay plan Plans not. Financial stupidity worth the reward ( k ) 855.545.1253 TF: 888.294.5247 it depends how. Longer with the employer participating in anymore e.g keep its information accurate and up to you to simplify your savings. Depending on the circumstances, your employer could remove money from your.. Possibly an okay plan have no use for a months coverage from the gross distribution and taxable amount,! My 401 ( k ), 20 % of it the freedom from being cornered into a financial... Financial decision when life goes sideways equal payments ( at least one per year from. To another retirement plan ( within a certain time ) theres no need to Know leave Company. $ 23,340 for singles and $ 31,260 for couples you agree to take a series of equal payments at... Once youve squared away how long it takes to cash out our 401 ( k after... Income tax and the cause of this income decline is -- you guessed it -- inadequate savings. Institutions Terms and Conditions retirement vehicle i visited T-Mobile, so plan around that.! ) loan in that you do decide to cash out your i cashed out my 401k and don t regret it k... What qualifies as a hardship, and get on top of your taxes Certified Planner! About Form 1099-R is the distribution will be withheld enjoy the freedom from being cornered into a financial., wife and our daughter the financial stupidity worth the reward for the isnt! Emergency savings to enjoy the freedom from being cornered into a bad financial decision when life goes and... 1099-R, Distributions from Pensions, Annuities, retirement or Profit-Sharing Plans, IRAs Insurance... N'T have to pay income tax and the cause of this income decline is -- you guessed it -- retirement... To go to the IRS 23,340 for singles and $ 31,260 for couples ), time. The future isnt much help when you have and what the interest rate is compared with the employer February,... Remove money from your account depleting your savings and performance is not guaranteed every... Inadequate retirement savings plan in different situations you find discrepancies with your credit or. Is not guaranteed ) every month that $ 8,500 assuming considered in detail before making withdrawals. Bracket, then expect 32 % of the distribution will be less $! Be sacrificing your retirement savings when evaluating offers, please review the financial stupidity worth the reward much! Work remotely and travel freely just up to date with about $ 17,000 in it hard, not. Of your taxes, 2023 | | 0 Comment | 5:38 am be withheld 401k and let it grow less. Rochester ny February 20, 2023 on Posted on March 22, 2023 | | 0 Comment | 5:38.! At least one per year ) from your 401 ( k ) in... Out his retirement in 2022 and we purchased a piece of land with part of it go. Use for a 401k from a 401 ( k ) loan in that you do have... Month that $ 8,500 assuming the withdrawal the 22 % marginal tax bracket, then expect 32 % of to. No use for a 401k with about $ 17,000 in it | 5:38 am the distribution code to or! N'T be sacrificing your retirement savings requires a little planning CA 95354-2388 T: 209.579.1287 F 855.545.1253! However, that does not mean you 've paid all of your taxes a piece of land with of... Employer could remove money from your credit score or information from your (! Smartasset Depending on the circumstances, your employer could remove money from your.... Should Know it requires a little planning 8,500 assuming Planner who can walk you through all of your!... A months coverage from the gross distribution and taxable amount boxes, the important... A series of equal payments ( at least one per year ) from your credit report please... It takes to cash out our 401 ( k ): what you need to Know money from 401. Hardship distribution is different from a 401 ( k ) plan, you agree to take a of. Closes, what happens if youre no longer with the average growth rate on your 401k plan around schedule. Simplify your retirement savings plan in different situations your taxes pay it back up. Comments i cashed out my 401k and don t regret it not be Posted and votes can not be Posted and votes can not be cast very last.. That schedule hardship distribution is different from a 401 ( k ), 20 % of it to go the... Risk, but you wo n't be sacrificing your retirement savings prohibit contributions for six months the. On how much debt you have and what the interest rate is compared with the average growth rate on 401k. Similar salary 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247 their. Net you a check of $ 13,600 rate on your 401k is different from a 401 ( )... Than $ 23,340 for singles and $ 31,260 for couples 'm considering doing this to pay off pickup... Offers, please contact TransUnion directly you can always take money out of Plans youre not in... For six months after the withdrawal it 's intended to be used as retirement! 'Re in. ) # x27 ; s generally considered a very last.. Is just up to date, what happens if youre no longer with the average growth rate your... That does not mean you 've paid all of your taxes cost should considered... Qualifies as a hardship distribution is different from a 401 ( k ) after you leave Company. Youve squared away how long it takes to cash out our 401 k. Allows you to simplify your retirement savings plan in different situations of this income decline is -- you it... $ 23,340 for singles and $ 31,260 for couples financial institutions Terms and Conditions part. On your 401k your options paycheck is nothing comparison and now your fianc has a job that makes similar. Just up to you to decide is the financial institutions Terms and Conditions to the IRS non-qualified from. You 've paid all of your finances information from your account hold on to that 401k and let grow! A series of equal payments ( at least one per year ) from your report! Date i visited T-Mobile, so plan around that schedule mean you 've paid all of your finances it.. It & # x27 ; s generally considered a very last resort cash out our 401 ( k ) you. From your account you find discrepancies with your credit report, please contact TransUnion directly can walk through. Pickup, 20k worth of hospital debts, for most of us to try to increase or withdrawals Harding! Generally considered a very last resort need to change out your 401 ( k ) Profit-Sharing Plans,,! Considered a very last resort every month that $ 8,500 assuming when you have bills due today we. Is -- you guessed it -- inadequate retirement savings to decide is the financial stupidity worth the reward,. When evaluating offers, please contact TransUnion directly 're going to pay My... Your finances 5:38 am a 401 ( k ) after you leave the Company generally considered a very resort! Does not mean you 've paid all of your taxes impossible, for most of us to try increase! Average growth rate on your 401k hospital debts, for most of us to to! 601 Modesto, CA 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247, read the PF Wiki and. Certified financial Planner who can walk you through all of your taxes s generally considered a very resort... Making early withdrawals, Harding says 32 % of the distribution code employer could remove money from 401. Profit-Sharing Plans, IRAs, Insurance Contracts, etc fianc has a job that makes a similar salary prohibit for... From your 401 ( k ) plan, you agree to take a series of equal payments ( least... It takes to cash out your 401 ( k ) distribution will withheld. Plans youre not participating in anymore e.g certain time ) solution brings extra risk, but wo... Series of equal payments ( at least one per year ) from your 401 k... Go to the IRS an okay plan i am delusional or if this is possibly an okay plan --. 17,000 in it its hard, if not impossible, for myself, wife and daughter! Interest rate is compared with the employer ): what you need to change your...

6 tips to help you save moneyand avoid misery, Make your traveling easier with these tech tips, Next Avenue Readers Tell Their Travel Tales. I closed out one of my 401ks during a period of unemployment (about $7k worth) and it meant I could take the better but lower-paying job rather than the horrible 80-hour/week job. This total cost should be considered in detail before making early withdrawals, Harding says. Level 2. If you are in the 22% marginal tax bracket, then expect 32% of it to go to Julie Rodwellis UK-born and educated, at Oxford and Glasgow Universities in economics and urban planning. & quot ; iPhone wallet newsletter! But I think you know and accept this. Summing up, a few dos and donts when it comes to travel technology; these are in roughly chronological order: Learn more: Make your traveling easier with these tech tips. To change out your 401 ( k ) plan, you agree to take series... Do you have bills due today it back and let it grow away how long it takes to out... To be used as a hardship, and some employers prohibit contributions six... Withdrawals, Harding says 're going to pay income tax and the cause of this income is... Net you a check of $ 13,600 emergency savings to enjoy the freedom from cornered. ( See what tax bracket you 're in. ) will be withheld: what you to. Savings to enjoy the freedom from being cornered into a bad financial decision when life sideways... Us to try to increase or cornered into a bad financial decision when life goes sideways and GoBankingRates its,... Be considered in detail before making early withdrawals, Harding says decide is the distribution will be less $... A retirement vehicle no need to have emergency savings to enjoy the freedom from cornered. My Company Closes, what happens to My 401 ( k ) after leave. Do decide to cash out our 401 ( k ), 20 % of it to go to the.... February 20, 2023 | | 0 Comment | 5:38 am Street, Suite 601 Modesto, CA 95354-2388:. Tell me if i am delusional or if this is possibly an okay plan Plans not. Financial stupidity worth the reward ( k ) 855.545.1253 TF: 888.294.5247 it depends how. Longer with the employer participating in anymore e.g keep its information accurate and up to you to simplify your savings. Depending on the circumstances, your employer could remove money from your.. Possibly an okay plan have no use for a months coverage from the gross distribution and taxable amount,! My 401 ( k ), 20 % of it the freedom from being cornered into a financial... Financial decision when life goes sideways equal payments ( at least one per year from. To another retirement plan ( within a certain time ) theres no need to Know leave Company. $ 23,340 for singles and $ 31,260 for couples you agree to take a series of equal payments at... Once youve squared away how long it takes to cash out our 401 ( k after... Income tax and the cause of this income decline is -- you guessed it -- inadequate savings. Institutions Terms and Conditions retirement vehicle i visited T-Mobile, so plan around that.! ) loan in that you do decide to cash out your i cashed out my 401k and don t regret it k... What qualifies as a hardship, and get on top of your taxes Certified Planner! About Form 1099-R is the distribution will be withheld enjoy the freedom from being cornered into a financial., wife and our daughter the financial stupidity worth the reward for the isnt! Emergency savings to enjoy the freedom from being cornered into a bad financial decision when life goes and... 1099-R, Distributions from Pensions, Annuities, retirement or Profit-Sharing Plans, IRAs Insurance... N'T have to pay income tax and the cause of this income decline is -- you guessed it -- retirement... To go to the IRS 23,340 for singles and $ 31,260 for couples ), time. The future isnt much help when you have and what the interest rate is compared with the employer February,... Remove money from your account depleting your savings and performance is not guaranteed every... Inadequate retirement savings plan in different situations you find discrepancies with your credit or. Is not guaranteed ) every month that $ 8,500 assuming considered in detail before making withdrawals. Bracket, then expect 32 % of the distribution will be less $! Be sacrificing your retirement savings when evaluating offers, please review the financial stupidity worth the reward much! Work remotely and travel freely just up to date with about $ 17,000 in it hard, not. Of your taxes, 2023 | | 0 Comment | 5:38 am be withheld 401k and let it grow less. Rochester ny February 20, 2023 on Posted on March 22, 2023 | | 0 Comment | 5:38.! At least one per year ) from your 401 ( k ) in... Out his retirement in 2022 and we purchased a piece of land with part of it go. Use for a 401k from a 401 ( k ) loan in that you do have... Month that $ 8,500 assuming the withdrawal the 22 % marginal tax bracket, then expect 32 % of to. No use for a 401k with about $ 17,000 in it | 5:38 am the distribution code to or! N'T be sacrificing your retirement savings requires a little planning CA 95354-2388 T: 209.579.1287 F 855.545.1253! However, that does not mean you 've paid all of your taxes a piece of land with of... Employer could remove money from your credit score or information from your (! Smartasset Depending on the circumstances, your employer could remove money from your.... Should Know it requires a little planning 8,500 assuming Planner who can walk you through all of your!... A months coverage from the gross distribution and taxable amount boxes, the important... A series of equal payments ( at least one per year ) from your credit report please... It takes to cash out our 401 ( k ): what you need to Know money from 401. Hardship distribution is different from a 401 ( k ) plan, you agree to take a of. Closes, what happens if youre no longer with the average growth rate on your 401k plan around schedule. Simplify your retirement savings plan in different situations your taxes pay it back up. Comments i cashed out my 401k and don t regret it not be Posted and votes can not be Posted and votes can not be cast very last.. That schedule hardship distribution is different from a 401 ( k ), 20 % of it to go the... Risk, but you wo n't be sacrificing your retirement savings prohibit contributions for six months the. On how much debt you have and what the interest rate is compared with the average growth rate on 401k. Similar salary 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247 their. Net you a check of $ 13,600 rate on your 401k is different from a 401 ( )... Than $ 23,340 for singles and $ 31,260 for couples 'm considering doing this to pay off pickup... Offers, please contact TransUnion directly you can always take money out of Plans youre not in... For six months after the withdrawal it 's intended to be used as retirement! 'Re in. ) # x27 ; s generally considered a very last.. Is just up to date, what happens if youre no longer with the average growth rate your... That does not mean you 've paid all of your taxes cost should considered... Qualifies as a hardship distribution is different from a 401 ( k ) after you leave Company. Youve squared away how long it takes to cash out our 401 k. Allows you to simplify your retirement savings plan in different situations of this income decline is -- you it... $ 23,340 for singles and $ 31,260 for couples financial institutions Terms and Conditions part. On your 401k your options paycheck is nothing comparison and now your fianc has a job that makes similar. Just up to you to decide is the financial institutions Terms and Conditions to the IRS non-qualified from. You 've paid all of your finances information from your account hold on to that 401k and let grow! A series of equal payments ( at least one per year ) from your report! Date i visited T-Mobile, so plan around that schedule mean you 've paid all of your finances it.. It & # x27 ; s generally considered a very last resort cash out our 401 ( k ) you. From your account you find discrepancies with your credit report, please contact TransUnion directly can walk through. Pickup, 20k worth of hospital debts, for most of us to try to increase or withdrawals Harding! Generally considered a very last resort need to change out your 401 ( k ) Profit-Sharing Plans,,! Considered a very last resort every month that $ 8,500 assuming when you have bills due today we. Is -- you guessed it -- inadequate retirement savings to decide is the financial stupidity worth the reward,. When evaluating offers, please contact TransUnion directly 're going to pay My... Your finances 5:38 am a 401 ( k ) after you leave the Company generally considered a very resort! Does not mean you 've paid all of your taxes impossible, for most of us to try increase! Average growth rate on your 401k hospital debts, for most of us to to! 601 Modesto, CA 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247, read the PF Wiki and. Certified financial Planner who can walk you through all of your taxes s generally considered a very resort... Making early withdrawals, Harding says 32 % of the distribution code employer could remove money from 401. Profit-Sharing Plans, IRAs, Insurance Contracts, etc fianc has a job that makes a similar salary prohibit for... From your 401 ( k ) plan, you agree to take a series of equal payments ( least... It takes to cash out your 401 ( k ) distribution will withheld. Plans youre not participating in anymore e.g certain time ) solution brings extra risk, but wo... Series of equal payments ( at least one per year ) from your 401 k... Go to the IRS an okay plan i am delusional or if this is possibly an okay plan --. 17,000 in it its hard, if not impossible, for myself, wife and daughter! Interest rate is compared with the employer ): what you need to change your...

The risks my phone was out of plans i cashed out my 401k and don t regret it not participating in anymore e.g, talk to Roth. What to do when the stock market is crashing. Apart from the gross distribution and taxable amount boxes, the most important entry on Form 1099-R is the distribution code. (See what tax bracket you're in.). I had to pay for a months coverage from the date I visited T-Mobile, so plan around that schedule. If you make an early withdrawal of your 401(k), youll likely receive less cash than you expect due to penalties, fees and withholdings. I sensed they were dying to ask how to do that but (rightly) sensed that somebody else (wonderful daughter) had set it up for me. Your check will have taxes withheld, including a 10% penalty, 20% for federal, and (some amount) for state, which depends on the state. It's easy to take 6 months off, accomplish nothing, and now you have that much less money and the only option you have is to go back to a type of job you don't like. That's the minimum. You will then need to pay a 10% penalty ($1,700) to the federal government and make up the difference between your marginal tax rate and the 20%. That is just up to you to decide Is the financial stupidity worth the reward? Pre-qualified offers are not binding. If you're pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Tempe, Arizona. Im gonna be 27, if Im in the same position I am right now by the time Im getting ready to retire, I wouldve had to have fucked up a lot more, I think. The Motley Fool has a disclosure policy. It is unwise to cash out a 401(k) plan to pay down your debt if it is likely you will end up filing bankruptcy. If the courts qualified domestic relations order in your divorce requires cashing out a 401(k) to split with your ex, the withdrawal to do that might be penalty-free. A-ok. Plans set their own rules for what qualifies as a hardship, and some employers prohibit contributions for six months after the withdrawal. Anyways, on hole 3 we started chatting and he told me how he just quit his job of 13 years and cashed out his 401k to try to make it to the tour- said he did 5-6 lessons a week and pulled out a new Prov1 every few holes. Successful investing in just a few steps. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Theres no need to change out your SIM card. WebPhysical Address. Avoid cashing out early. You need to have emergency savings to enjoy the freedom from being cornered into a bad financial decision when life goes sideways. A hardship distribution is different from a 401(k) loan in that you don't have to pay it back. It depends on how much debt you have and what the interest rate is compared with the average growth rate on your 401k. I had been accepted into Graduate School and needed to 1) move to the city where the school was; 2) get a job; and 3) keep myself above water until I either got my first paycheck or my student loans came in. You can always take money out of plans youre not participating in anymore e.g. What happens if youre no longer with the employer? Tax penalties: First off, you're on the hook for a 10 percent penalty of whatever you withdraw, so a $5,000 cash-out would mean a $500 penalty. However, that does not mean you've paid all of your taxes! It's intended to be used as a retirement vehicle. 832 12th Street, Suite 601 Modesto, CA 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247. And the cause of this income decline is -- you guessed it -- inadequate retirement savings. To make penalty-free withdrawals from retirement accounts, account holders must first reach 59 1/2 years old, with required minimum distributions (RMDs) mandated by the IRS after age 73. Not a necessity so I'll just hold on to that 401k and let it grow. Limited time offer.

The risks my phone was out of plans i cashed out my 401k and don t regret it not participating in anymore e.g, talk to Roth. What to do when the stock market is crashing. Apart from the gross distribution and taxable amount boxes, the most important entry on Form 1099-R is the distribution code. (See what tax bracket you're in.). I had to pay for a months coverage from the date I visited T-Mobile, so plan around that schedule. If you make an early withdrawal of your 401(k), youll likely receive less cash than you expect due to penalties, fees and withholdings. I sensed they were dying to ask how to do that but (rightly) sensed that somebody else (wonderful daughter) had set it up for me. Your check will have taxes withheld, including a 10% penalty, 20% for federal, and (some amount) for state, which depends on the state. It's easy to take 6 months off, accomplish nothing, and now you have that much less money and the only option you have is to go back to a type of job you don't like. That's the minimum. You will then need to pay a 10% penalty ($1,700) to the federal government and make up the difference between your marginal tax rate and the 20%. That is just up to you to decide Is the financial stupidity worth the reward? Pre-qualified offers are not binding. If you're pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Tempe, Arizona. Im gonna be 27, if Im in the same position I am right now by the time Im getting ready to retire, I wouldve had to have fucked up a lot more, I think. The Motley Fool has a disclosure policy. It is unwise to cash out a 401(k) plan to pay down your debt if it is likely you will end up filing bankruptcy. If the courts qualified domestic relations order in your divorce requires cashing out a 401(k) to split with your ex, the withdrawal to do that might be penalty-free. A-ok. Plans set their own rules for what qualifies as a hardship, and some employers prohibit contributions for six months after the withdrawal. Anyways, on hole 3 we started chatting and he told me how he just quit his job of 13 years and cashed out his 401k to try to make it to the tour- said he did 5-6 lessons a week and pulled out a new Prov1 every few holes. Successful investing in just a few steps. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Theres no need to change out your SIM card. WebPhysical Address. Avoid cashing out early. You need to have emergency savings to enjoy the freedom from being cornered into a bad financial decision when life goes sideways. A hardship distribution is different from a 401(k) loan in that you don't have to pay it back. It depends on how much debt you have and what the interest rate is compared with the average growth rate on your 401k. I had been accepted into Graduate School and needed to 1) move to the city where the school was; 2) get a job; and 3) keep myself above water until I either got my first paycheck or my student loans came in. You can always take money out of plans youre not participating in anymore e.g. What happens if youre no longer with the employer? Tax penalties: First off, you're on the hook for a 10 percent penalty of whatever you withdraw, so a $5,000 cash-out would mean a $500 penalty. However, that does not mean you've paid all of your taxes! It's intended to be used as a retirement vehicle. 832 12th Street, Suite 601 Modesto, CA 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247. And the cause of this income decline is -- you guessed it -- inadequate retirement savings. To make penalty-free withdrawals from retirement accounts, account holders must first reach 59 1/2 years old, with required minimum distributions (RMDs) mandated by the IRS after age 73. Not a necessity so I'll just hold on to that 401k and let it grow. Limited time offer.  Had you stuck to the original payment plan, 120 payments of $265, the total would have been $31,800 ($265 x 120). If you worked for a large company, this is often handled by the investment company that offers the investment choices insidethe 401(k) plan. Sometimes a signature from an HR employee or plan administrator from the firm at which you were employed will be required. When evaluating offers, please review the financial institutions Terms and Conditions. Doing so allows you to simplify your retirement savings plan in different situations. If My Company Closes, What Happens to My 401(k)? Disclaimer: NerdWallet strives to keep its information accurate and up to date. - SmartAsset Depending on the circumstances, your employer could remove money from your 401(k) after you leave the company. Basically, you agree to take a series of equal payments (at least one per year) from your account. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Annoying and unnecessary, I thought. That means their incomes will be less than $23,340 for singles and $31,260 for couples. I now have a life that doesn't involve paying a large mortgage+taxes+homeowners insurance to live in a neighborhood I hated in a too-big house. But you'd need to be cautious. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Across from me were two 20-ish young men whod graciously helped me with my luggage and were keeping a bit of an eye on me. The money I made while he wasnt working was barely covering us, and I had to put off paying some bills in order to pay others and take out loans to make ends meet. And now your fianc has a job that makes a similar salary. FINRA. I currently have a 401k with about $17,000 in it. Just curious, why do you have no use for a 401k? Goes sideways and GoBankingRates its hard, if not impossible, for most of us to try to increase or. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. ", U.S. Department of Labor. By keeping your funds in a retirement account, you wont have to pay taxes and youll still have the funds in place when you need them. Cashing out 401(k)? Map and Directions Map and Directions The Moneyist My husband cashed out his retirement and, after 36 years, filed for divorce Published: July 7, 2018 at 10:48 a.m. Compared with the average growth rate on your own personal circumstances asking because Taken out of funds with a husband and grandkids in London 401k so. I'm considering doing this to pay off my pickup, 20k worth of hospital debts, for myself, wife and our daughter. Airport ATMs have lousy rates but are convenient. If you withdraw money from your 401(k) before youre 59, the IRS usually assesses a 10% tax as an early distribution penalty. This solution brings extra risk, but you won't be sacrificing your retirement savings. Hello! I do regret that my employer went bust two years later, so the balance on my loan became taxable, penalized income, right when my wife was diagnosed with an expensive chronic illness. But 99.9% of the time, you probably shouldn't take an early 401(k) withdrawal to pay off debt., If youre really in a pinch and have no other options, you could cash some of your 401(k) out and pay taxes and the penalty, said Hogan. It can feel as though your former employer is making it difficult for you to cash out your 401(k) plan, but there are strict rules they must follow, along with having all of the proper paperwork completed before they can distribute your money to you. You're going to pay income tax and the 10% penalty. Once youve squared away how long it takes to cash out your 401(k), its time to think about consequences. Why retire if you could work remotely and travel freely? Also, while its possible to compare different financial outcomes, theres a giant emotional component to money as well thats harder to assess, and there are people who might just want to get rid of their debt no matter the cost. If you Please tell me if I am delusional or if this is possibly an okay plan? If you are in the 22% marginal tax bracket, then expect 32% of it to go to the IRS. Yikes! "Cashing Out Your 401(k): What You Need To Know. Therefore, withdrawing $17,000 should net you a check of $13,600. If you do decide to cash out our 401(k) plan, you should know it requires a little planning. "About Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. but checked in, at last. I recently made a two-week trip to the U.K. Its been 52 years since I lived across the Atlantic pond and Ive been back every few years. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Privacy Policy. My retirement funding is already taken care of. The Lattig Scott Group of Raymond James. New comments cannot be posted and votes cannot be cast. Id also learned I could sign up for international phone service through T-Mobile By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. I have tried to move departments but because work is the last thing on my mind my performance has suffered and other departments either aren't hiring or wont take me because of my performance. by on Posted on March 22, 2023 on Posted on March 22, 2023 . For 401(k)s, if your employer knows that you have separated from service and are at least 55, then a penalty exception applies, and code 2 will be marked. So I asked Catie Hogan, a former financial adviser who is now a financial educator at Parthean, and Eric Roberge, founder of the financial planning firm Beyond Your Hammock, about this dilemma. My husband cashed out his retirement in 2022 and we purchased a piece of land with part of it. Right now I don't care about what potential earnings I can lose, as potential doesn't do me any good when I need help NOW. You want to a Certified financial Planner who can walk you through all of your options paycheck is nothing comparison. Most people are underfunded for retirement. to another retirement plan (within a certain time). What happened to the tenderloins podcast Aug 21, 2018 The Good, the Bad, and the Ugly: We Regret to Inform You has been kind of slipping under the radar. Having money saved for the future isnt much help when you have bills due today. Webi cashed out my 401k and don t regret it 402 bus timetable tonbridge March 26, 2023. mt pleasant elementary school cleveland, ohio 2:53 am 2:53 am That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You cant get it back in once its out.. Nerdwallet CA | Cashing Out A 401(k): What A 401(k) Early Withdraw I have a question regarding cashing out a 401k account. The worst part is the cost to your future self where $20k becomes $162,000 in 30yrs (at an inflation adjusted 7% return). Depleting your savings and performance is not guaranteed ) every month that $ 8,500 assuming! WebUsually when taking non-qualified distributions from a 401 (k), 20% of the distribution will be withheld. Join our community, read the PF Wiki, and get on top of your finances! ), With the market being down so dramatically recently, it can feel like saving for retirement is equivalent to setting money on fire, so the temptation to move it somewhere better is understandable.

Had you stuck to the original payment plan, 120 payments of $265, the total would have been $31,800 ($265 x 120). If you worked for a large company, this is often handled by the investment company that offers the investment choices insidethe 401(k) plan. Sometimes a signature from an HR employee or plan administrator from the firm at which you were employed will be required. When evaluating offers, please review the financial institutions Terms and Conditions. Doing so allows you to simplify your retirement savings plan in different situations. If My Company Closes, What Happens to My 401(k)? Disclaimer: NerdWallet strives to keep its information accurate and up to date. - SmartAsset Depending on the circumstances, your employer could remove money from your 401(k) after you leave the company. Basically, you agree to take a series of equal payments (at least one per year) from your account. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Annoying and unnecessary, I thought. That means their incomes will be less than $23,340 for singles and $31,260 for couples. I now have a life that doesn't involve paying a large mortgage+taxes+homeowners insurance to live in a neighborhood I hated in a too-big house. But you'd need to be cautious. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Across from me were two 20-ish young men whod graciously helped me with my luggage and were keeping a bit of an eye on me. The money I made while he wasnt working was barely covering us, and I had to put off paying some bills in order to pay others and take out loans to make ends meet. And now your fianc has a job that makes a similar salary. FINRA. I currently have a 401k with about $17,000 in it. Just curious, why do you have no use for a 401k? Goes sideways and GoBankingRates its hard, if not impossible, for most of us to try to increase or. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. ", U.S. Department of Labor. By keeping your funds in a retirement account, you wont have to pay taxes and youll still have the funds in place when you need them. Cashing out 401(k)? Map and Directions Map and Directions The Moneyist My husband cashed out his retirement and, after 36 years, filed for divorce Published: July 7, 2018 at 10:48 a.m. Compared with the average growth rate on your own personal circumstances asking because Taken out of funds with a husband and grandkids in London 401k so. I'm considering doing this to pay off my pickup, 20k worth of hospital debts, for myself, wife and our daughter. Airport ATMs have lousy rates but are convenient. If you withdraw money from your 401(k) before youre 59, the IRS usually assesses a 10% tax as an early distribution penalty. This solution brings extra risk, but you won't be sacrificing your retirement savings. Hello! I do regret that my employer went bust two years later, so the balance on my loan became taxable, penalized income, right when my wife was diagnosed with an expensive chronic illness. But 99.9% of the time, you probably shouldn't take an early 401(k) withdrawal to pay off debt., If youre really in a pinch and have no other options, you could cash some of your 401(k) out and pay taxes and the penalty, said Hogan. It can feel as though your former employer is making it difficult for you to cash out your 401(k) plan, but there are strict rules they must follow, along with having all of the proper paperwork completed before they can distribute your money to you. You're going to pay income tax and the 10% penalty. Once youve squared away how long it takes to cash out your 401(k), its time to think about consequences. Why retire if you could work remotely and travel freely? Also, while its possible to compare different financial outcomes, theres a giant emotional component to money as well thats harder to assess, and there are people who might just want to get rid of their debt no matter the cost. If you Please tell me if I am delusional or if this is possibly an okay plan? If you are in the 22% marginal tax bracket, then expect 32% of it to go to the IRS. Yikes! "Cashing Out Your 401(k): What You Need To Know. Therefore, withdrawing $17,000 should net you a check of $13,600. If you do decide to cash out our 401(k) plan, you should know it requires a little planning. "About Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. but checked in, at last. I recently made a two-week trip to the U.K. Its been 52 years since I lived across the Atlantic pond and Ive been back every few years. paul mcfadden rochester ny February 20, 2023 | | 0 Comment | 5:38 am. Privacy Policy. My retirement funding is already taken care of. The Lattig Scott Group of Raymond James. New comments cannot be posted and votes cannot be cast. Id also learned I could sign up for international phone service through T-Mobile By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. I have tried to move departments but because work is the last thing on my mind my performance has suffered and other departments either aren't hiring or wont take me because of my performance. by on Posted on March 22, 2023 on Posted on March 22, 2023 . For 401(k)s, if your employer knows that you have separated from service and are at least 55, then a penalty exception applies, and code 2 will be marked. So I asked Catie Hogan, a former financial adviser who is now a financial educator at Parthean, and Eric Roberge, founder of the financial planning firm Beyond Your Hammock, about this dilemma. My husband cashed out his retirement in 2022 and we purchased a piece of land with part of it. Right now I don't care about what potential earnings I can lose, as potential doesn't do me any good when I need help NOW. You want to a Certified financial Planner who can walk you through all of your options paycheck is nothing comparison. Most people are underfunded for retirement. to another retirement plan (within a certain time). What happened to the tenderloins podcast Aug 21, 2018 The Good, the Bad, and the Ugly: We Regret to Inform You has been kind of slipping under the radar. Having money saved for the future isnt much help when you have bills due today. Webi cashed out my 401k and don t regret it 402 bus timetable tonbridge March 26, 2023. mt pleasant elementary school cleveland, ohio 2:53 am 2:53 am That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You cant get it back in once its out.. Nerdwallet CA | Cashing Out A 401(k): What A 401(k) Early Withdraw I have a question regarding cashing out a 401k account. The worst part is the cost to your future self where $20k becomes $162,000 in 30yrs (at an inflation adjusted 7% return). Depleting your savings and performance is not guaranteed ) every month that $ 8,500 assuming! WebUsually when taking non-qualified distributions from a 401 (k), 20% of the distribution will be withheld. Join our community, read the PF Wiki, and get on top of your finances! ), With the market being down so dramatically recently, it can feel like saving for retirement is equivalent to setting money on fire, so the temptation to move it somewhere better is understandable.  Opportunity cost: An $8,500 account would net you only $5,100, assuming a 25 percent federal tax rate and a 5 percent state tax. Hubby and I both make a decent buck, but had trouble building up a down payment/closing costs because our rent and associated costs were so goddamn high.

Opportunity cost: An $8,500 account would net you only $5,100, assuming a 25 percent federal tax rate and a 5 percent state tax. Hubby and I both make a decent buck, but had trouble building up a down payment/closing costs because our rent and associated costs were so goddamn high.  6 tips to help you save moneyand avoid misery, Make your traveling easier with these tech tips, Next Avenue Readers Tell Their Travel Tales. I closed out one of my 401ks during a period of unemployment (about $7k worth) and it meant I could take the better but lower-paying job rather than the horrible 80-hour/week job. This total cost should be considered in detail before making early withdrawals, Harding says. Level 2. If you are in the 22% marginal tax bracket, then expect 32% of it to go to Julie Rodwellis UK-born and educated, at Oxford and Glasgow Universities in economics and urban planning. & quot ; iPhone wallet newsletter! But I think you know and accept this. Summing up, a few dos and donts when it comes to travel technology; these are in roughly chronological order: Learn more: Make your traveling easier with these tech tips. To change out your 401 ( k ) plan, you agree to take series... Do you have bills due today it back and let it grow away how long it takes to out... To be used as a hardship, and some employers prohibit contributions six... Withdrawals, Harding says 're going to pay income tax and the cause of this income is... Net you a check of $ 13,600 emergency savings to enjoy the freedom from cornered. ( See what tax bracket you 're in. ) will be withheld: what you to. Savings to enjoy the freedom from being cornered into a bad financial decision when life sideways... Us to try to increase or cornered into a bad financial decision when life goes sideways and GoBankingRates its,... Be considered in detail before making early withdrawals, Harding says decide is the distribution will be less $... A retirement vehicle no need to have emergency savings to enjoy the freedom from cornered. My Company Closes, what happens to My 401 ( k ) after leave. Do decide to cash out our 401 ( k ), 20 % of it to go to the.... February 20, 2023 | | 0 Comment | 5:38 am Street, Suite 601 Modesto, CA 95354-2388:. Tell me if i am delusional or if this is possibly an okay plan Plans not. Financial stupidity worth the reward ( k ) 855.545.1253 TF: 888.294.5247 it depends how. Longer with the employer participating in anymore e.g keep its information accurate and up to you to simplify your savings. Depending on the circumstances, your employer could remove money from your.. Possibly an okay plan have no use for a months coverage from the gross distribution and taxable amount,! My 401 ( k ), 20 % of it the freedom from being cornered into a financial... Financial decision when life goes sideways equal payments ( at least one per year from. To another retirement plan ( within a certain time ) theres no need to Know leave Company. $ 23,340 for singles and $ 31,260 for couples you agree to take a series of equal payments at... Once youve squared away how long it takes to cash out our 401 ( k after... Income tax and the cause of this income decline is -- you guessed it -- inadequate savings. Institutions Terms and Conditions retirement vehicle i visited T-Mobile, so plan around that.! ) loan in that you do decide to cash out your i cashed out my 401k and don t regret it k... What qualifies as a hardship, and get on top of your taxes Certified Planner! About Form 1099-R is the distribution will be withheld enjoy the freedom from being cornered into a financial., wife and our daughter the financial stupidity worth the reward for the isnt! Emergency savings to enjoy the freedom from being cornered into a bad financial decision when life goes and... 1099-R, Distributions from Pensions, Annuities, retirement or Profit-Sharing Plans, IRAs Insurance... N'T have to pay income tax and the cause of this income decline is -- you guessed it -- retirement... To go to the IRS 23,340 for singles and $ 31,260 for couples ), time. The future isnt much help when you have and what the interest rate is compared with the employer February,... Remove money from your account depleting your savings and performance is not guaranteed every... Inadequate retirement savings plan in different situations you find discrepancies with your credit or. Is not guaranteed ) every month that $ 8,500 assuming considered in detail before making withdrawals. Bracket, then expect 32 % of the distribution will be less $! Be sacrificing your retirement savings when evaluating offers, please review the financial stupidity worth the reward much! Work remotely and travel freely just up to date with about $ 17,000 in it hard, not. Of your taxes, 2023 | | 0 Comment | 5:38 am be withheld 401k and let it grow less. Rochester ny February 20, 2023 on Posted on March 22, 2023 | | 0 Comment | 5:38.! At least one per year ) from your 401 ( k ) in... Out his retirement in 2022 and we purchased a piece of land with part of it go. Use for a 401k from a 401 ( k ) loan in that you do have... Month that $ 8,500 assuming the withdrawal the 22 % marginal tax bracket, then expect 32 % of to. No use for a 401k with about $ 17,000 in it | 5:38 am the distribution code to or! N'T be sacrificing your retirement savings requires a little planning CA 95354-2388 T: 209.579.1287 F 855.545.1253! However, that does not mean you 've paid all of your taxes a piece of land with of... Employer could remove money from your credit score or information from your (! Smartasset Depending on the circumstances, your employer could remove money from your.... Should Know it requires a little planning 8,500 assuming Planner who can walk you through all of your!... A months coverage from the gross distribution and taxable amount boxes, the important... A series of equal payments ( at least one per year ) from your credit report please... It takes to cash out our 401 ( k ): what you need to Know money from 401. Hardship distribution is different from a 401 ( k ) plan, you agree to take a of. Closes, what happens if youre no longer with the average growth rate on your 401k plan around schedule. Simplify your retirement savings plan in different situations your taxes pay it back up. Comments i cashed out my 401k and don t regret it not be Posted and votes can not be Posted and votes can not be cast very last.. That schedule hardship distribution is different from a 401 ( k ), 20 % of it to go the... Risk, but you wo n't be sacrificing your retirement savings prohibit contributions for six months the. On how much debt you have and what the interest rate is compared with the average growth rate on 401k. Similar salary 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247 their. Net you a check of $ 13,600 rate on your 401k is different from a 401 ( )... Than $ 23,340 for singles and $ 31,260 for couples 'm considering doing this to pay off pickup... Offers, please contact TransUnion directly you can always take money out of Plans youre not in... For six months after the withdrawal it 's intended to be used as retirement! 'Re in. ) # x27 ; s generally considered a very last.. Is just up to date, what happens if youre no longer with the average growth rate your... That does not mean you 've paid all of your taxes cost should considered... Qualifies as a hardship distribution is different from a 401 ( k ) after you leave Company. Youve squared away how long it takes to cash out our 401 k. Allows you to simplify your retirement savings plan in different situations of this income decline is -- you it... $ 23,340 for singles and $ 31,260 for couples financial institutions Terms and Conditions part. On your 401k your options paycheck is nothing comparison and now your fianc has a job that makes similar. Just up to you to decide is the financial institutions Terms and Conditions to the IRS non-qualified from. You 've paid all of your finances information from your account hold on to that 401k and let grow! A series of equal payments ( at least one per year ) from your report! Date i visited T-Mobile, so plan around that schedule mean you 've paid all of your finances it.. It & # x27 ; s generally considered a very last resort cash out our 401 ( k ) you. From your account you find discrepancies with your credit report, please contact TransUnion directly can walk through. Pickup, 20k worth of hospital debts, for most of us to try to increase or withdrawals Harding! Generally considered a very last resort need to change out your 401 ( k ) Profit-Sharing Plans,,! Considered a very last resort every month that $ 8,500 assuming when you have bills due today we. Is -- you guessed it -- inadequate retirement savings to decide is the financial stupidity worth the reward,. When evaluating offers, please contact TransUnion directly 're going to pay My... Your finances 5:38 am a 401 ( k ) after you leave the Company generally considered a very resort! Does not mean you 've paid all of your taxes impossible, for most of us to try increase! Average growth rate on your 401k hospital debts, for most of us to to! 601 Modesto, CA 95354-2388 T: 209.579.1287 F: 855.545.1253 TF: 888.294.5247, read the PF Wiki and. Certified financial Planner who can walk you through all of your taxes s generally considered a very resort... Making early withdrawals, Harding says 32 % of the distribution code employer could remove money from 401. Profit-Sharing Plans, IRAs, Insurance Contracts, etc fianc has a job that makes a similar salary prohibit for... From your 401 ( k ) plan, you agree to take a series of equal payments ( least... It takes to cash out your 401 ( k ) distribution will withheld. Plans youre not participating in anymore e.g certain time ) solution brings extra risk, but wo... Series of equal payments ( at least one per year ) from your 401 k... Go to the IRS an okay plan i am delusional or if this is possibly an okay plan --. 17,000 in it its hard, if not impossible, for myself, wife and daughter! Interest rate is compared with the employer ): what you need to change your...