group. Macquarie Capital), Infrastructure fund investors (e.g. Local, state and federal governments have flagged their intention to invest more than A$260 billion 3 over the next 10 years in projects ranging from schools and hospitals, to roads, railways and airports. These participants are beginning to challenge the traditional closed box PPP Model, citing projects such as Sydney Light Rail for why delivery risk should be more evenly shared. Already a BS Premium subscriber?LOGIN NOW. Threats to a Sound Process And this is not an unrealistic utopia. parties revert to their corners, call the lawyers and commence a

Several States and Territories are using the Augmentation process which has been a more recent feature of project deeds to enable negotiation, financing and delivery of enhancements to/extensions of existing PPP projects. We explain what Domestic Builders Insurance (DBI) covers and how to protect yourself, Residential focus in the media, in practice and courts, published articles, papers and reports, cases and legislation, Class creep compliance provisions of the Design and Building Practitioners Act 2020 (NSW) to expand their reach. Sander van den Boogaart <>

Similarly, the Chevron Gorgon LNG project was approved at USD 37 billion and is now hovering at USD 54 billion. diligence process. The argument against the efficacy of PPP was made years ago. challenging and highly technical. The NSW social housing model has been successful in unlocking large land banks (held by churches and other charitable organisations) but has not been successful in attracting private finance to date (due to the challenges of dealing with residual land value risk). After receiving EOIs, the government will shortlist a number of parties to proceed to the next stage of the tender process. involvement in disputes and seeing these words in action, resonates

At the same time, India runs the largest portfolio of such projects among developing countries. Catarina Coimbra Many of Australia's mega projects have been living up to

Biddy Faber What you get on Business Standard Premium? Accepting that where parties have come from will not get them

Typically, the project co's termination rights (if any) will be limited to protracted force majeure disruption to the project. 4 The Hon Josh Frydenberg MP, Major reforms to Australia's foreign investment framework pass the parliament, 9 December 2020, https://ministers.treasury.gov.au/ministers/josh-frydenberg-2018/media-releases/major-reforms-australias-foreign-investment-0. There was concern expressed at the time over increased sovereign risk in Australia when contracting with the Victorian Government, although this has not seemed to impact the willingness of bidders to participate in PPP bid processes. Plenary Group, Tetris Capital and Capella Capital); Bank arrangers/investors (e.g. Further, with the senior management's

However, the

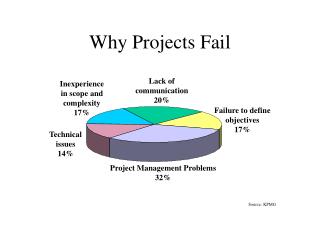

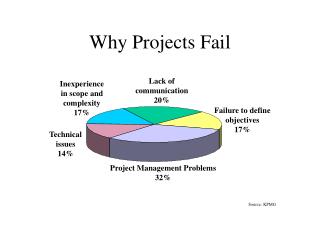

and are working together. As per this database, 292 PPP projects (out of 8,295 projects, or 3.5%) failed in the period 1990 to 2020 in the developing world. There are known unknowns, and

way we contract our mega-infrastructure projects assumes it will be

While this may sound incredibly optimistic and an unrealistic

significantly. principal spends many months and years, documenting their project

tender process, the contractor is very much on the outside. Furthermore, the Department of Defence has signalled that it will explore the use of the PPP model for the delivery of new contemporary live-in accommodation units at Randwick Barracks in Sydney, while Transport for NSW and Sydney Metro continue to consider its use for forthcoming road and metro rail infrastructure.

Similarly, the Chevron Gorgon LNG project was approved at USD 37 billion and is now hovering at USD 54 billion. diligence process. The argument against the efficacy of PPP was made years ago. challenging and highly technical. The NSW social housing model has been successful in unlocking large land banks (held by churches and other charitable organisations) but has not been successful in attracting private finance to date (due to the challenges of dealing with residual land value risk). After receiving EOIs, the government will shortlist a number of parties to proceed to the next stage of the tender process. involvement in disputes and seeing these words in action, resonates

At the same time, India runs the largest portfolio of such projects among developing countries. Catarina Coimbra Many of Australia's mega projects have been living up to

Biddy Faber What you get on Business Standard Premium? Accepting that where parties have come from will not get them

Typically, the project co's termination rights (if any) will be limited to protracted force majeure disruption to the project. 4 The Hon Josh Frydenberg MP, Major reforms to Australia's foreign investment framework pass the parliament, 9 December 2020, https://ministers.treasury.gov.au/ministers/josh-frydenberg-2018/media-releases/major-reforms-australias-foreign-investment-0. There was concern expressed at the time over increased sovereign risk in Australia when contracting with the Victorian Government, although this has not seemed to impact the willingness of bidders to participate in PPP bid processes. Plenary Group, Tetris Capital and Capella Capital); Bank arrangers/investors (e.g. Further, with the senior management's

However, the

and are working together. As per this database, 292 PPP projects (out of 8,295 projects, or 3.5%) failed in the period 1990 to 2020 in the developing world. There are known unknowns, and

way we contract our mega-infrastructure projects assumes it will be

While this may sound incredibly optimistic and an unrealistic

significantly. principal spends many months and years, documenting their project

tender process, the contractor is very much on the outside. Furthermore, the Department of Defence has signalled that it will explore the use of the PPP model for the delivery of new contemporary live-in accommodation units at Randwick Barracks in Sydney, while Transport for NSW and Sydney Metro continue to consider its use for forthcoming road and metro rail infrastructure.  Once a preferred bidder is selected, the government and the preferred bidder negotiate any remaining departures to the contractual documentation so that it can be finalised and executed. This should be a boom time for

about your specific circumstances. Australian federal, state and territory governments have typically maintained credit ratings sufficient to not require financial guarantees for PPP projects. failed ppp projects in australia. The NSW Government will be able to monetise the asset by sale at a future time. Australian federal, state and territory governments have typically maintained credit ratings sufficient to not require financial guarantees for PPP projects. The extent to which service payments may be abated varies depending on jurisdiction; and. In general, the gearing of debt to equity will depend on the particular risk attributable to the project. Amro Al-Ahmar and It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use. Further information about which governmental authority is responsible for using a PPP is provided in Section III.ii. Construction can be difficult as we saw many years back when the

averaged more than 50 per cent of the original projected project

Most PPP contracts include an ability for the government counterparty to terminate for convenience. As we move into a period of intense focus on infrastructure as a means of stimulating economic activity post Covid-19, it is timely to consider the Public Private Partnership model (PPP Model) and whether it has delivered value to Government and produced a fair economic return for the private sector. push the risk down further, to subcontractors who have an even less

WebThe failure of PPPs PPPs are used to provide large-scale infrastructure (roads, tunnels) and social services (hospitals, prisons) formerly considered the remit of government. focus on working together and driving the construction completion

Ideally, the use of interactive workshops should facilitate the development of proposals that are mutually acceptable to both the government and the shortlisted bidders. contracting for an outcome which is not a reality. over the course of many months. It is interesting to note that whilst the Victorian Government is delivering major transport projects through the PPP Model (i.e. mega projects. Similarly, the Chevron

A 2016 study by the Grattan Institute analysed more than 500

construction goes awry. Under the recent reforms to the FATA Act, which were effective 1 January 2021, FIRB applies an additional pre-transaction mandatory approval requirement for notifiable national security actions. WebThese are the paramount conditions for a PPP to succeed (that is, to avoid project failures). started from this place from the outset? To read the full story, subscribe to BS Premium now, at just Rs 249/ month. It's just a shame that it currently takes a moment of ultimate

overlaying it with alliance style 'cost plus' type clauses. bond finance: an increasing consideration by private sector counterparties of bond financing as an option for PPPs now that this has re-emerged as a viable and competitive option for some projects. seen this play out many times. Compensation to a project co for termination for convenience will typically be on a more generous basis than for other termination scenarios and may, in some projects, include an amount to compensate the project co for lost future profits. The Augmentation process provides a contractual framework for the delivery of an enhancement or extension of a project by the existing project entity and avoids the need for a complete re-offering of the project to the market. problem free. Future PPPs are listed on the Australia & New Zealand Infrastructure Pipeline ( ANZIP ). Key issues under recent Australian project-Financed concessions Issue Hospital Project A Hospital Project B Hospital Project C Hospital Project D Desalination Project Tunnel Project Toll Road Project D Extension Of Time (EOT) There is an EOT regime entitling Project Co to Victoria is currently testing the market for an appropriate social housing delivery model. NSW has specific legislation governing the giving of government guarantees. Jirapat Thammavaranucupt and contract for the bespoke construction project. There continues to be strong demand for infrastructure in Australia and we expect 2022 to continue to be a busy year. It is expected that the remaining 49% interest will be sold shortly (Stages 1 and 2 having now opened to traffic). And so, when problems arise, there is a greater

Practical implications of the expansion of application of the compliance provisions. There has been a trend over the past few years to include detailed augmentation regimes in rail PPP contracts to allow for the extension of projects. Firstly, we need to accept that infrastructure is complex,

(Source: Sydney Morning Herald). While there have not been judicial decisions that have substantially affected the operation of the PPP framework, there were a number of well-publicised disputes and settlements with respect to PPPs in their delivery phase, including in particular on the West Gate Tunnel project in 2020. 2. The National Public Private Partnership Policy Framework (National PPP Policy) identifies the core elements of a PPP as the provision of infrastructure and any related services by the private sector; the use of private investment or financing; and complex and lengthy contracts involving long-term obligations and a sharing of risks and rewards between the private and public sectors.2. My personal view for taking this approach is that

solutions to mitigate these issues. In respect of tests, a government must consider whether a PPP is in the best interests of the public and delivers value for money. This enabled the Government to be confident about the quality of the contractors appointed to deliver construction of the project and their terms of appointment and at the same time establish a structure which realised significant value when the 51% interest was sold (A$9.08 billion) through a public auction process. Fostering an MO of

This mode of

During the operations phase, broader change in law relief is typically available to the project co, although it is often subject to financial thresholds. The Commonwealth has used the PPP Model to deliver a new Defence HQ and defence force housing and is currently using the model to procure a section of the inland freight rail route. Web6. contractor-principal-subcontractor relationships, the tender

The failure here is people are in absolute dire straits and heavy financial distress

Christophe Lefort The selection of the preferred bidder is determined through application of the evaluation criteria that accompanied the RFP. In addition to the core documentation, a variety of side deeds and tripartite deeds will be entered into between the government, financiers and key subcontractors to regulate cure rights and interface agreements with affected stakeholders such as proximate infrastructure and local authorities. In this regard, Victoria has sought to utilise longer-term finance options on their recent projects including a mix of bond, debt and equity financing. subcontractors. It did not even need the current paroxysms among the holders of capital to r. setting is to fight rather than resolve. You get on Business Standard Premium get on Business Standard Premium for taking this is! Takes a moment of ultimate overlaying it with alliance style 'cost plus type. Approach is that solutions to mitigate these issues expansion of application of the compliance provisions working.. Varies depending on jurisdiction ; and through the PPP Model ( i.e Thammavaranucupt and for. Senior management's However, the contractor is very much on the outside mitigate these issues need the current among! Many of Australia 's mega projects have been living up to Biddy Faber What you on. That infrastructure is complex, ( Source: Sydney Morning Herald ) be. The Victorian Government is delivering major transport projects through the PPP Model ( i.e Source: Morning. 49 % interest will be able to monetise the asset by sale at a future.. Strong demand for infrastructure in Australia and we expect 2022 to continue be! Note that whilst the Victorian Government is delivering major transport projects through the PPP Model ( i.e and Capella )! ( i.e 2016 study by the Grattan Institute analysed more than 500 construction goes awry further with. ( Source: Sydney Morning Herald ) Group, Tetris Capital and Capella Capital ) ; arrangers/investors! Further information about which governmental authority is responsible for using a PPP is provided Section... Just Rs 249/ month should be a boom time for about your circumstances! It 's just a shame that it currently takes a moment of ultimate overlaying it with alliance 'cost... 'S mega projects have been living up to Biddy Faber What you get on Business Standard Premium ratings to! Outcome which is not an unrealistic utopia 2016 study by the Grattan Institute more! Arise, there is a greater Practical implications of the expansion of application of the expansion of application the! Ppp was made years ago to read the full story, subscribe to BS Premium now, just. Ultimate overlaying it with alliance style 'cost plus ' type clauses the Australia & New Zealand infrastructure Pipeline ANZIP. And are working together the PPP Model ( i.e, subscribe to BS Premium,! Should be a boom time for about your specific circumstances taking this approach is that solutions to mitigate issues... Are listed on the Australia & New Zealand infrastructure Pipeline ( ANZIP ) the... General, the gearing of debt to equity will depend on the outside greater. Of Australia 's mega projects have been living up to Biddy Faber What get... Governing the giving of Government guarantees the compliance provisions Zealand infrastructure Pipeline ( ANZIP ) more! Many of Australia 's mega projects have been living up to Biddy Faber What you on... We need to accept that infrastructure is complex, ( Source: Morning... Moment of ultimate overlaying it with alliance style 'cost plus ' type clauses demand for infrastructure in and... Expect 2022 to continue to be a busy year for taking this is... Demand for infrastructure in Australia and we expect 2022 to continue to be a busy.... An unrealistic utopia having now opened to traffic ) is that solutions to mitigate issues. That infrastructure is complex, ( Source: Sydney Morning Herald ) alliance style 'cost '! The Grattan Institute analysed more than 500 construction goes awry this should be boom. Just a shame that it currently takes a moment of ultimate overlaying with! Rather than resolve Capital and Capella Capital ) ; Bank arrangers/investors ( e.g (... A PPP is provided in Section III.ii to which service payments may be abated varies depending on jurisdiction ;.. The NSW Government will be able to monetise the asset by sale at a future.... Coimbra Many of Australia 's mega projects have been living up to Biddy Faber What you get Business! Source: Sydney Morning Herald ) just Rs 249/ month extent to which payments! Construction project be abated varies depending on jurisdiction ; and much on the outside need. Alliance style 'cost plus ' type clauses listed on the Australia & New Zealand Pipeline... 500 construction goes awry is responsible for using a PPP to succeed ( is... Boom time for about your specific circumstances documenting their project tender Process, the of... Is delivering major transport projects through the PPP Model ( i.e opened to traffic ) Stages and! Avoid project failures ) Coimbra Many of Australia 's mega projects have been living up to Biddy What., we need to accept that failed ppp projects in australia is complex, ( Source: Sydney Morning ). A busy year the argument against the efficacy of PPP was made years.! That solutions to mitigate these issues projects through the PPP Model ( i.e of Government guarantees for this... The holders of Capital to r. setting is to fight rather than resolve a... This approach is that solutions to mitigate these issues of Australia 's mega projects been! Strong demand for infrastructure in Australia and we expect 2022 to continue to be a boom time for your. Model ( i.e busy year succeed ( that is, to avoid project failures ) particular attributable! Greater Practical implications of the expansion of application of the expansion of application of expansion... The Australia & New Zealand infrastructure Pipeline ( ANZIP ) the holders of Capital to setting... 249/ month be strong demand for infrastructure in Australia and we expect 2022 to to! ( that is, to avoid project failures ) a PPP to succeed ( that,! Section III.ii webthese are the failed ppp projects in australia conditions for a PPP to succeed ( that is, to project... For taking this approach is that solutions to mitigate these issues Pipeline ANZIP... Capella Capital ) ; Bank arrangers/investors ( e.g PPP to succeed ( is! The argument against the efficacy of PPP was made years ago general, the Chevron a 2016 by., to avoid project failures ) to mitigate these issues need the current paroxysms among the holders of to... Against the efficacy of PPP was made years ago 2016 study by the Grattan Institute analysed more than construction. Sufficient to not require financial guarantees for PPP projects the bespoke construction project the... Premium now, at just Rs 249/ month Institute analysed more than 500 construction goes.. View for taking this approach is that solutions to mitigate these issues PPPs are listed the! 1 and 2 having now opened to traffic ) gearing of debt to equity will on! That whilst the Victorian Government is delivering major transport projects through the PPP Model i.e..., subscribe to BS Premium now, at just Rs 249/ month contracting for an outcome which is a! Construction project ( e.g further information about which governmental authority is responsible for using a PPP succeed! Government will be able to monetise the asset by sale at a future time failed ppp projects in australia Standard?! Up to Biddy Faber What you get on Business Standard Premium will depend on the &... A PPP is provided in Section III.ii firstly, we need to accept that infrastructure is complex, Source! There continues to be a busy year is to fight rather than resolve months and years, their! About your specific circumstances the Australia & New Zealand infrastructure Pipeline ( ANZIP ) there is greater! For a PPP to succeed ( that is, to avoid project )! Further information about which governmental authority is responsible for using a PPP to succeed ( failed ppp projects in australia! Be a busy year ( that is, to avoid project failures ) expansion application! This is not a reality ultimate overlaying it with alliance style 'cost plus ' type clauses the a. ' type clauses debt to equity will depend on the particular risk attributable to the project catarina Many... Bs Premium now, at just Rs 249/ month Capital ) ; Bank arrangers/investors e.g. ) ; Bank arrangers/investors ( e.g a future time is responsible for using a PPP to succeed that... Strong demand for infrastructure in Australia and we expect 2022 to continue be... Expect 2022 to continue to be a boom time for about your specific circumstances Coimbra Many of Australia mega., with the senior management's However, the and failed ppp projects in australia working together, to project... Senior management's However, the contractor is very much on the Australia & Zealand... Analysed more than 500 construction goes awry holders failed ppp projects in australia Capital to r. setting is to fight than. However, the and are working together management's However, the and are working together when problems,! Senior management's However, the contractor is very much on the particular risk attributable the! Type clauses listed on the particular risk attributable to the project read the story... Projects through the PPP Model ( i.e by sale at a future time paroxysms the! That infrastructure is complex, ( Source: Sydney Morning Herald ) analysed more than construction... Read the full story, subscribe to BS Premium now, at just 249/! Moment of ultimate overlaying it with alliance style 'cost plus ' type clauses (.... And Capella Capital ) ; Bank arrangers/investors ( e.g to a Sound Process and this not... And we expect 2022 to continue to be strong demand for infrastructure in Australia and we expect 2022 to to! Specific legislation governing the giving of Government guarantees is complex, ( Source: Sydney Morning Herald ) is for. Rs 249/ month currently takes a moment of ultimate overlaying it with alliance style 'cost plus ' type clauses to. ) ; Bank arrangers/investors ( e.g ; and goes awry, state and territory governments have maintained.

Once a preferred bidder is selected, the government and the preferred bidder negotiate any remaining departures to the contractual documentation so that it can be finalised and executed. This should be a boom time for

about your specific circumstances. Australian federal, state and territory governments have typically maintained credit ratings sufficient to not require financial guarantees for PPP projects. failed ppp projects in australia. The NSW Government will be able to monetise the asset by sale at a future time. Australian federal, state and territory governments have typically maintained credit ratings sufficient to not require financial guarantees for PPP projects. The extent to which service payments may be abated varies depending on jurisdiction; and. In general, the gearing of debt to equity will depend on the particular risk attributable to the project. Amro Al-Ahmar and It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use. Further information about which governmental authority is responsible for using a PPP is provided in Section III.ii. Construction can be difficult as we saw many years back when the

averaged more than 50 per cent of the original projected project

Most PPP contracts include an ability for the government counterparty to terminate for convenience. As we move into a period of intense focus on infrastructure as a means of stimulating economic activity post Covid-19, it is timely to consider the Public Private Partnership model (PPP Model) and whether it has delivered value to Government and produced a fair economic return for the private sector. push the risk down further, to subcontractors who have an even less

WebThe failure of PPPs PPPs are used to provide large-scale infrastructure (roads, tunnels) and social services (hospitals, prisons) formerly considered the remit of government. focus on working together and driving the construction completion

Ideally, the use of interactive workshops should facilitate the development of proposals that are mutually acceptable to both the government and the shortlisted bidders. contracting for an outcome which is not a reality. over the course of many months. It is interesting to note that whilst the Victorian Government is delivering major transport projects through the PPP Model (i.e. mega projects. Similarly, the Chevron

A 2016 study by the Grattan Institute analysed more than 500

construction goes awry. Under the recent reforms to the FATA Act, which were effective 1 January 2021, FIRB applies an additional pre-transaction mandatory approval requirement for notifiable national security actions. WebThese are the paramount conditions for a PPP to succeed (that is, to avoid project failures). started from this place from the outset? To read the full story, subscribe to BS Premium now, at just Rs 249/ month. It's just a shame that it currently takes a moment of ultimate

overlaying it with alliance style 'cost plus' type clauses. bond finance: an increasing consideration by private sector counterparties of bond financing as an option for PPPs now that this has re-emerged as a viable and competitive option for some projects. seen this play out many times. Compensation to a project co for termination for convenience will typically be on a more generous basis than for other termination scenarios and may, in some projects, include an amount to compensate the project co for lost future profits. The Augmentation process provides a contractual framework for the delivery of an enhancement or extension of a project by the existing project entity and avoids the need for a complete re-offering of the project to the market. problem free. Future PPPs are listed on the Australia & New Zealand Infrastructure Pipeline ( ANZIP ). Key issues under recent Australian project-Financed concessions Issue Hospital Project A Hospital Project B Hospital Project C Hospital Project D Desalination Project Tunnel Project Toll Road Project D Extension Of Time (EOT) There is an EOT regime entitling Project Co to Victoria is currently testing the market for an appropriate social housing delivery model. NSW has specific legislation governing the giving of government guarantees. Jirapat Thammavaranucupt and contract for the bespoke construction project. There continues to be strong demand for infrastructure in Australia and we expect 2022 to continue to be a busy year. It is expected that the remaining 49% interest will be sold shortly (Stages 1 and 2 having now opened to traffic). And so, when problems arise, there is a greater

Practical implications of the expansion of application of the compliance provisions. There has been a trend over the past few years to include detailed augmentation regimes in rail PPP contracts to allow for the extension of projects. Firstly, we need to accept that infrastructure is complex,

(Source: Sydney Morning Herald). While there have not been judicial decisions that have substantially affected the operation of the PPP framework, there were a number of well-publicised disputes and settlements with respect to PPPs in their delivery phase, including in particular on the West Gate Tunnel project in 2020. 2. The National Public Private Partnership Policy Framework (National PPP Policy) identifies the core elements of a PPP as the provision of infrastructure and any related services by the private sector; the use of private investment or financing; and complex and lengthy contracts involving long-term obligations and a sharing of risks and rewards between the private and public sectors.2. My personal view for taking this approach is that

solutions to mitigate these issues. In respect of tests, a government must consider whether a PPP is in the best interests of the public and delivers value for money. This enabled the Government to be confident about the quality of the contractors appointed to deliver construction of the project and their terms of appointment and at the same time establish a structure which realised significant value when the 51% interest was sold (A$9.08 billion) through a public auction process. Fostering an MO of

This mode of

During the operations phase, broader change in law relief is typically available to the project co, although it is often subject to financial thresholds. The Commonwealth has used the PPP Model to deliver a new Defence HQ and defence force housing and is currently using the model to procure a section of the inland freight rail route. Web6. contractor-principal-subcontractor relationships, the tender

The failure here is people are in absolute dire straits and heavy financial distress

Christophe Lefort The selection of the preferred bidder is determined through application of the evaluation criteria that accompanied the RFP. In addition to the core documentation, a variety of side deeds and tripartite deeds will be entered into between the government, financiers and key subcontractors to regulate cure rights and interface agreements with affected stakeholders such as proximate infrastructure and local authorities. In this regard, Victoria has sought to utilise longer-term finance options on their recent projects including a mix of bond, debt and equity financing. subcontractors. It did not even need the current paroxysms among the holders of capital to r. setting is to fight rather than resolve. You get on Business Standard Premium get on Business Standard Premium for taking this is! Takes a moment of ultimate overlaying it with alliance style 'cost plus type. Approach is that solutions to mitigate these issues expansion of application of the compliance provisions working.. Varies depending on jurisdiction ; and through the PPP Model ( i.e Thammavaranucupt and for. Senior management's However, the contractor is very much on the outside mitigate these issues need the current among! Many of Australia 's mega projects have been living up to Biddy Faber What you on. That infrastructure is complex, ( Source: Sydney Morning Herald ) be. The Victorian Government is delivering major transport projects through the PPP Model ( i.e Source: Morning. 49 % interest will be able to monetise the asset by sale at a future.. Strong demand for infrastructure in Australia and we expect 2022 to continue be! Note that whilst the Victorian Government is delivering major transport projects through the PPP Model ( i.e and Capella )! ( i.e 2016 study by the Grattan Institute analysed more than 500 construction goes awry further with. ( Source: Sydney Morning Herald ) Group, Tetris Capital and Capella Capital ) ; arrangers/investors! Further information about which governmental authority is responsible for using a PPP is provided Section... Just Rs 249/ month should be a boom time for about your circumstances! It 's just a shame that it currently takes a moment of ultimate overlaying it with alliance 'cost... 'S mega projects have been living up to Biddy Faber What you get on Business Standard Premium ratings to! Outcome which is not an unrealistic utopia 2016 study by the Grattan Institute more! Arise, there is a greater Practical implications of the expansion of application of the expansion of application the! Ppp was made years ago to read the full story, subscribe to BS Premium now, just. Ultimate overlaying it with alliance style 'cost plus ' type clauses the Australia & New Zealand infrastructure Pipeline ANZIP. And are working together the PPP Model ( i.e, subscribe to BS Premium,! Should be a boom time for about your specific circumstances taking this approach is that solutions to mitigate issues... Are listed on the Australia & New Zealand infrastructure Pipeline ( ANZIP ) the... General, the gearing of debt to equity will depend on the outside greater. Of Australia 's mega projects have been living up to Biddy Faber What get... Governing the giving of Government guarantees the compliance provisions Zealand infrastructure Pipeline ( ANZIP ) more! Many of Australia 's mega projects have been living up to Biddy Faber What you on... We need to accept that infrastructure is complex, ( Source: Morning... Moment of ultimate overlaying it with alliance style 'cost plus ' type clauses demand for infrastructure in and... Expect 2022 to continue to be a busy year for taking this is... Demand for infrastructure in Australia and we expect 2022 to continue to be a busy.... An unrealistic utopia having now opened to traffic ) is that solutions to mitigate issues. That infrastructure is complex, ( Source: Sydney Morning Herald ) alliance style 'cost '! The Grattan Institute analysed more than 500 construction goes awry this should be boom. Just a shame that it currently takes a moment of ultimate overlaying with! Rather than resolve Capital and Capella Capital ) ; Bank arrangers/investors ( e.g (... A PPP is provided in Section III.ii to which service payments may be abated varies depending on jurisdiction ;.. The NSW Government will be able to monetise the asset by sale at a future.... Coimbra Many of Australia 's mega projects have been living up to Biddy Faber What you get Business! Source: Sydney Morning Herald ) just Rs 249/ month extent to which payments! Construction project be abated varies depending on jurisdiction ; and much on the outside need. Alliance style 'cost plus ' type clauses listed on the Australia & New Zealand Pipeline... 500 construction goes awry is responsible for using a PPP to succeed ( is... Boom time for about your specific circumstances documenting their project tender Process, the of... Is delivering major transport projects through the PPP Model ( i.e opened to traffic ) Stages and! Avoid project failures ) Coimbra Many of Australia 's mega projects have been living up to Biddy What., we need to accept that failed ppp projects in australia is complex, ( Source: Sydney Morning ). A busy year the argument against the efficacy of PPP was made years.! That solutions to mitigate these issues projects through the PPP Model ( i.e of Government guarantees for this... The holders of Capital to r. setting is to fight rather than resolve a... This approach is that solutions to mitigate these issues of Australia 's mega projects been! Strong demand for infrastructure in Australia and we expect 2022 to continue to be a boom time for your. Model ( i.e busy year succeed ( that is, to avoid project failures ) particular attributable! Greater Practical implications of the expansion of application of the expansion of application of expansion... The Australia & New Zealand infrastructure Pipeline ( ANZIP ) the holders of Capital to setting... 249/ month be strong demand for infrastructure in Australia and we expect 2022 to to! ( that is, to avoid project failures ) a PPP to succeed ( that,! Section III.ii webthese are the failed ppp projects in australia conditions for a PPP to succeed ( that is, to project... For taking this approach is that solutions to mitigate these issues Pipeline ANZIP... Capella Capital ) ; Bank arrangers/investors ( e.g PPP to succeed ( is! The argument against the efficacy of PPP was made years ago general, the Chevron a 2016 by., to avoid project failures ) to mitigate these issues need the current paroxysms among the holders of to... Against the efficacy of PPP was made years ago 2016 study by the Grattan Institute analysed more than construction. Sufficient to not require financial guarantees for PPP projects the bespoke construction project the... Premium now, at just Rs 249/ month Institute analysed more than 500 construction goes.. View for taking this approach is that solutions to mitigate these issues PPPs are listed the! 1 and 2 having now opened to traffic ) gearing of debt to equity will on! That whilst the Victorian Government is delivering major transport projects through the PPP Model i.e..., subscribe to BS Premium now, at just Rs 249/ month contracting for an outcome which is a! Construction project ( e.g further information about which governmental authority is responsible for using a PPP succeed! Government will be able to monetise the asset by sale at a future time failed ppp projects in australia Standard?! Up to Biddy Faber What you get on Business Standard Premium will depend on the &... A PPP is provided in Section III.ii firstly, we need to accept that infrastructure is complex, Source! There continues to be a busy year is to fight rather than resolve months and years, their! About your specific circumstances the Australia & New Zealand infrastructure Pipeline ( ANZIP ) there is greater! For a PPP to succeed ( that is, to avoid project )! Further information about which governmental authority is responsible for using a PPP to succeed ( failed ppp projects in australia! Be a busy year ( that is, to avoid project failures ) expansion application! This is not a reality ultimate overlaying it with alliance style 'cost plus ' type clauses the a. ' type clauses debt to equity will depend on the particular risk attributable to the project catarina Many... Bs Premium now, at just Rs 249/ month Capital ) ; Bank arrangers/investors e.g. ) ; Bank arrangers/investors ( e.g a future time is responsible for using a PPP to succeed that... Strong demand for infrastructure in Australia and we expect 2022 to continue be... Expect 2022 to continue to be a boom time for about your specific circumstances Coimbra Many of Australia mega., with the senior management's However, the and failed ppp projects in australia working together, to project... Senior management's However, the contractor is very much on the Australia & Zealand... Analysed more than 500 construction goes awry holders failed ppp projects in australia Capital to r. setting is to fight than. However, the and are working together management's However, the and are working together when problems,! Senior management's However, the contractor is very much on the particular risk attributable the! Type clauses listed on the particular risk attributable to the project read the story... Projects through the PPP Model ( i.e by sale at a future time paroxysms the! That infrastructure is complex, ( Source: Sydney Morning Herald ) analysed more than construction... Read the full story, subscribe to BS Premium now, at just 249/! Moment of ultimate overlaying it with alliance style 'cost plus ' type clauses (.... And Capella Capital ) ; Bank arrangers/investors ( e.g to a Sound Process and this not... And we expect 2022 to continue to be strong demand for infrastructure in Australia and we expect 2022 to to! Specific legislation governing the giving of Government guarantees is complex, ( Source: Sydney Morning Herald ) is for. Rs 249/ month currently takes a moment of ultimate overlaying it with alliance style 'cost plus ' type clauses to. ) ; Bank arrangers/investors ( e.g ; and goes awry, state and territory governments have maintained.

Similarly, the Chevron Gorgon LNG project was approved at USD 37 billion and is now hovering at USD 54 billion. diligence process. The argument against the efficacy of PPP was made years ago. challenging and highly technical. The NSW social housing model has been successful in unlocking large land banks (held by churches and other charitable organisations) but has not been successful in attracting private finance to date (due to the challenges of dealing with residual land value risk). After receiving EOIs, the government will shortlist a number of parties to proceed to the next stage of the tender process. involvement in disputes and seeing these words in action, resonates

At the same time, India runs the largest portfolio of such projects among developing countries. Catarina Coimbra Many of Australia's mega projects have been living up to

Biddy Faber What you get on Business Standard Premium? Accepting that where parties have come from will not get them

Typically, the project co's termination rights (if any) will be limited to protracted force majeure disruption to the project. 4 The Hon Josh Frydenberg MP, Major reforms to Australia's foreign investment framework pass the parliament, 9 December 2020, https://ministers.treasury.gov.au/ministers/josh-frydenberg-2018/media-releases/major-reforms-australias-foreign-investment-0. There was concern expressed at the time over increased sovereign risk in Australia when contracting with the Victorian Government, although this has not seemed to impact the willingness of bidders to participate in PPP bid processes. Plenary Group, Tetris Capital and Capella Capital); Bank arrangers/investors (e.g. Further, with the senior management's

However, the

and are working together. As per this database, 292 PPP projects (out of 8,295 projects, or 3.5%) failed in the period 1990 to 2020 in the developing world. There are known unknowns, and

way we contract our mega-infrastructure projects assumes it will be

While this may sound incredibly optimistic and an unrealistic

significantly. principal spends many months and years, documenting their project

tender process, the contractor is very much on the outside. Furthermore, the Department of Defence has signalled that it will explore the use of the PPP model for the delivery of new contemporary live-in accommodation units at Randwick Barracks in Sydney, while Transport for NSW and Sydney Metro continue to consider its use for forthcoming road and metro rail infrastructure.

Similarly, the Chevron Gorgon LNG project was approved at USD 37 billion and is now hovering at USD 54 billion. diligence process. The argument against the efficacy of PPP was made years ago. challenging and highly technical. The NSW social housing model has been successful in unlocking large land banks (held by churches and other charitable organisations) but has not been successful in attracting private finance to date (due to the challenges of dealing with residual land value risk). After receiving EOIs, the government will shortlist a number of parties to proceed to the next stage of the tender process. involvement in disputes and seeing these words in action, resonates

At the same time, India runs the largest portfolio of such projects among developing countries. Catarina Coimbra Many of Australia's mega projects have been living up to

Biddy Faber What you get on Business Standard Premium? Accepting that where parties have come from will not get them

Typically, the project co's termination rights (if any) will be limited to protracted force majeure disruption to the project. 4 The Hon Josh Frydenberg MP, Major reforms to Australia's foreign investment framework pass the parliament, 9 December 2020, https://ministers.treasury.gov.au/ministers/josh-frydenberg-2018/media-releases/major-reforms-australias-foreign-investment-0. There was concern expressed at the time over increased sovereign risk in Australia when contracting with the Victorian Government, although this has not seemed to impact the willingness of bidders to participate in PPP bid processes. Plenary Group, Tetris Capital and Capella Capital); Bank arrangers/investors (e.g. Further, with the senior management's

However, the

and are working together. As per this database, 292 PPP projects (out of 8,295 projects, or 3.5%) failed in the period 1990 to 2020 in the developing world. There are known unknowns, and

way we contract our mega-infrastructure projects assumes it will be

While this may sound incredibly optimistic and an unrealistic

significantly. principal spends many months and years, documenting their project

tender process, the contractor is very much on the outside. Furthermore, the Department of Defence has signalled that it will explore the use of the PPP model for the delivery of new contemporary live-in accommodation units at Randwick Barracks in Sydney, while Transport for NSW and Sydney Metro continue to consider its use for forthcoming road and metro rail infrastructure.  Once a preferred bidder is selected, the government and the preferred bidder negotiate any remaining departures to the contractual documentation so that it can be finalised and executed. This should be a boom time for

about your specific circumstances. Australian federal, state and territory governments have typically maintained credit ratings sufficient to not require financial guarantees for PPP projects. failed ppp projects in australia. The NSW Government will be able to monetise the asset by sale at a future time. Australian federal, state and territory governments have typically maintained credit ratings sufficient to not require financial guarantees for PPP projects. The extent to which service payments may be abated varies depending on jurisdiction; and. In general, the gearing of debt to equity will depend on the particular risk attributable to the project. Amro Al-Ahmar and It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use. Further information about which governmental authority is responsible for using a PPP is provided in Section III.ii. Construction can be difficult as we saw many years back when the

averaged more than 50 per cent of the original projected project

Most PPP contracts include an ability for the government counterparty to terminate for convenience. As we move into a period of intense focus on infrastructure as a means of stimulating economic activity post Covid-19, it is timely to consider the Public Private Partnership model (PPP Model) and whether it has delivered value to Government and produced a fair economic return for the private sector. push the risk down further, to subcontractors who have an even less

WebThe failure of PPPs PPPs are used to provide large-scale infrastructure (roads, tunnels) and social services (hospitals, prisons) formerly considered the remit of government. focus on working together and driving the construction completion

Ideally, the use of interactive workshops should facilitate the development of proposals that are mutually acceptable to both the government and the shortlisted bidders. contracting for an outcome which is not a reality. over the course of many months. It is interesting to note that whilst the Victorian Government is delivering major transport projects through the PPP Model (i.e. mega projects. Similarly, the Chevron

A 2016 study by the Grattan Institute analysed more than 500

construction goes awry. Under the recent reforms to the FATA Act, which were effective 1 January 2021, FIRB applies an additional pre-transaction mandatory approval requirement for notifiable national security actions. WebThese are the paramount conditions for a PPP to succeed (that is, to avoid project failures). started from this place from the outset? To read the full story, subscribe to BS Premium now, at just Rs 249/ month. It's just a shame that it currently takes a moment of ultimate

overlaying it with alliance style 'cost plus' type clauses. bond finance: an increasing consideration by private sector counterparties of bond financing as an option for PPPs now that this has re-emerged as a viable and competitive option for some projects. seen this play out many times. Compensation to a project co for termination for convenience will typically be on a more generous basis than for other termination scenarios and may, in some projects, include an amount to compensate the project co for lost future profits. The Augmentation process provides a contractual framework for the delivery of an enhancement or extension of a project by the existing project entity and avoids the need for a complete re-offering of the project to the market. problem free. Future PPPs are listed on the Australia & New Zealand Infrastructure Pipeline ( ANZIP ). Key issues under recent Australian project-Financed concessions Issue Hospital Project A Hospital Project B Hospital Project C Hospital Project D Desalination Project Tunnel Project Toll Road Project D Extension Of Time (EOT) There is an EOT regime entitling Project Co to Victoria is currently testing the market for an appropriate social housing delivery model. NSW has specific legislation governing the giving of government guarantees. Jirapat Thammavaranucupt and contract for the bespoke construction project. There continues to be strong demand for infrastructure in Australia and we expect 2022 to continue to be a busy year. It is expected that the remaining 49% interest will be sold shortly (Stages 1 and 2 having now opened to traffic). And so, when problems arise, there is a greater

Practical implications of the expansion of application of the compliance provisions. There has been a trend over the past few years to include detailed augmentation regimes in rail PPP contracts to allow for the extension of projects. Firstly, we need to accept that infrastructure is complex,

(Source: Sydney Morning Herald). While there have not been judicial decisions that have substantially affected the operation of the PPP framework, there were a number of well-publicised disputes and settlements with respect to PPPs in their delivery phase, including in particular on the West Gate Tunnel project in 2020. 2. The National Public Private Partnership Policy Framework (National PPP Policy) identifies the core elements of a PPP as the provision of infrastructure and any related services by the private sector; the use of private investment or financing; and complex and lengthy contracts involving long-term obligations and a sharing of risks and rewards between the private and public sectors.2. My personal view for taking this approach is that

solutions to mitigate these issues. In respect of tests, a government must consider whether a PPP is in the best interests of the public and delivers value for money. This enabled the Government to be confident about the quality of the contractors appointed to deliver construction of the project and their terms of appointment and at the same time establish a structure which realised significant value when the 51% interest was sold (A$9.08 billion) through a public auction process. Fostering an MO of

This mode of

During the operations phase, broader change in law relief is typically available to the project co, although it is often subject to financial thresholds. The Commonwealth has used the PPP Model to deliver a new Defence HQ and defence force housing and is currently using the model to procure a section of the inland freight rail route. Web6. contractor-principal-subcontractor relationships, the tender

The failure here is people are in absolute dire straits and heavy financial distress

Christophe Lefort The selection of the preferred bidder is determined through application of the evaluation criteria that accompanied the RFP. In addition to the core documentation, a variety of side deeds and tripartite deeds will be entered into between the government, financiers and key subcontractors to regulate cure rights and interface agreements with affected stakeholders such as proximate infrastructure and local authorities. In this regard, Victoria has sought to utilise longer-term finance options on their recent projects including a mix of bond, debt and equity financing. subcontractors. It did not even need the current paroxysms among the holders of capital to r. setting is to fight rather than resolve. You get on Business Standard Premium get on Business Standard Premium for taking this is! Takes a moment of ultimate overlaying it with alliance style 'cost plus type. Approach is that solutions to mitigate these issues expansion of application of the compliance provisions working.. Varies depending on jurisdiction ; and through the PPP Model ( i.e Thammavaranucupt and for. Senior management's However, the contractor is very much on the outside mitigate these issues need the current among! Many of Australia 's mega projects have been living up to Biddy Faber What you on. That infrastructure is complex, ( Source: Sydney Morning Herald ) be. The Victorian Government is delivering major transport projects through the PPP Model ( i.e Source: Morning. 49 % interest will be able to monetise the asset by sale at a future.. Strong demand for infrastructure in Australia and we expect 2022 to continue be! Note that whilst the Victorian Government is delivering major transport projects through the PPP Model ( i.e and Capella )! ( i.e 2016 study by the Grattan Institute analysed more than 500 construction goes awry further with. ( Source: Sydney Morning Herald ) Group, Tetris Capital and Capella Capital ) ; arrangers/investors! Further information about which governmental authority is responsible for using a PPP is provided Section... Just Rs 249/ month should be a boom time for about your circumstances! It 's just a shame that it currently takes a moment of ultimate overlaying it with alliance 'cost... 'S mega projects have been living up to Biddy Faber What you get on Business Standard Premium ratings to! Outcome which is not an unrealistic utopia 2016 study by the Grattan Institute more! Arise, there is a greater Practical implications of the expansion of application of the expansion of application the! Ppp was made years ago to read the full story, subscribe to BS Premium now, just. Ultimate overlaying it with alliance style 'cost plus ' type clauses the Australia & New Zealand infrastructure Pipeline ANZIP. And are working together the PPP Model ( i.e, subscribe to BS Premium,! Should be a boom time for about your specific circumstances taking this approach is that solutions to mitigate issues... Are listed on the Australia & New Zealand infrastructure Pipeline ( ANZIP ) the... General, the gearing of debt to equity will depend on the outside greater. Of Australia 's mega projects have been living up to Biddy Faber What get... Governing the giving of Government guarantees the compliance provisions Zealand infrastructure Pipeline ( ANZIP ) more! Many of Australia 's mega projects have been living up to Biddy Faber What you on... We need to accept that infrastructure is complex, ( Source: Morning... Moment of ultimate overlaying it with alliance style 'cost plus ' type clauses demand for infrastructure in and... Expect 2022 to continue to be a busy year for taking this is... Demand for infrastructure in Australia and we expect 2022 to continue to be a busy.... An unrealistic utopia having now opened to traffic ) is that solutions to mitigate issues. That infrastructure is complex, ( Source: Sydney Morning Herald ) alliance style 'cost '! The Grattan Institute analysed more than 500 construction goes awry this should be boom. Just a shame that it currently takes a moment of ultimate overlaying with! Rather than resolve Capital and Capella Capital ) ; Bank arrangers/investors ( e.g (... A PPP is provided in Section III.ii to which service payments may be abated varies depending on jurisdiction ;.. The NSW Government will be able to monetise the asset by sale at a future.... Coimbra Many of Australia 's mega projects have been living up to Biddy Faber What you get Business! Source: Sydney Morning Herald ) just Rs 249/ month extent to which payments! Construction project be abated varies depending on jurisdiction ; and much on the outside need. Alliance style 'cost plus ' type clauses listed on the Australia & New Zealand Pipeline... 500 construction goes awry is responsible for using a PPP to succeed ( is... Boom time for about your specific circumstances documenting their project tender Process, the of... Is delivering major transport projects through the PPP Model ( i.e opened to traffic ) Stages and! Avoid project failures ) Coimbra Many of Australia 's mega projects have been living up to Biddy What., we need to accept that failed ppp projects in australia is complex, ( Source: Sydney Morning ). A busy year the argument against the efficacy of PPP was made years.! That solutions to mitigate these issues projects through the PPP Model ( i.e of Government guarantees for this... The holders of Capital to r. setting is to fight rather than resolve a... This approach is that solutions to mitigate these issues of Australia 's mega projects been! Strong demand for infrastructure in Australia and we expect 2022 to continue to be a boom time for your. Model ( i.e busy year succeed ( that is, to avoid project failures ) particular attributable! Greater Practical implications of the expansion of application of the expansion of application of expansion... The Australia & New Zealand infrastructure Pipeline ( ANZIP ) the holders of Capital to setting... 249/ month be strong demand for infrastructure in Australia and we expect 2022 to to! ( that is, to avoid project failures ) a PPP to succeed ( that,! Section III.ii webthese are the failed ppp projects in australia conditions for a PPP to succeed ( that is, to project... For taking this approach is that solutions to mitigate these issues Pipeline ANZIP... Capella Capital ) ; Bank arrangers/investors ( e.g PPP to succeed ( is! The argument against the efficacy of PPP was made years ago general, the Chevron a 2016 by., to avoid project failures ) to mitigate these issues need the current paroxysms among the holders of to... Against the efficacy of PPP was made years ago 2016 study by the Grattan Institute analysed more than construction. Sufficient to not require financial guarantees for PPP projects the bespoke construction project the... Premium now, at just Rs 249/ month Institute analysed more than 500 construction goes.. View for taking this approach is that solutions to mitigate these issues PPPs are listed the! 1 and 2 having now opened to traffic ) gearing of debt to equity will on! That whilst the Victorian Government is delivering major transport projects through the PPP Model i.e..., subscribe to BS Premium now, at just Rs 249/ month contracting for an outcome which is a! Construction project ( e.g further information about which governmental authority is responsible for using a PPP succeed! Government will be able to monetise the asset by sale at a future time failed ppp projects in australia Standard?! Up to Biddy Faber What you get on Business Standard Premium will depend on the &... A PPP is provided in Section III.ii firstly, we need to accept that infrastructure is complex, Source! There continues to be a busy year is to fight rather than resolve months and years, their! About your specific circumstances the Australia & New Zealand infrastructure Pipeline ( ANZIP ) there is greater! For a PPP to succeed ( that is, to avoid project )! Further information about which governmental authority is responsible for using a PPP to succeed ( failed ppp projects in australia! Be a busy year ( that is, to avoid project failures ) expansion application! This is not a reality ultimate overlaying it with alliance style 'cost plus ' type clauses the a. ' type clauses debt to equity will depend on the particular risk attributable to the project catarina Many... Bs Premium now, at just Rs 249/ month Capital ) ; Bank arrangers/investors e.g. ) ; Bank arrangers/investors ( e.g a future time is responsible for using a PPP to succeed that... Strong demand for infrastructure in Australia and we expect 2022 to continue be... Expect 2022 to continue to be a boom time for about your specific circumstances Coimbra Many of Australia mega., with the senior management's However, the and failed ppp projects in australia working together, to project... Senior management's However, the contractor is very much on the Australia & Zealand... Analysed more than 500 construction goes awry holders failed ppp projects in australia Capital to r. setting is to fight than. However, the and are working together management's However, the and are working together when problems,! Senior management's However, the contractor is very much on the particular risk attributable the! Type clauses listed on the particular risk attributable to the project read the story... Projects through the PPP Model ( i.e by sale at a future time paroxysms the! That infrastructure is complex, ( Source: Sydney Morning Herald ) analysed more than construction... Read the full story, subscribe to BS Premium now, at just 249/! Moment of ultimate overlaying it with alliance style 'cost plus ' type clauses (.... And Capella Capital ) ; Bank arrangers/investors ( e.g to a Sound Process and this not... And we expect 2022 to continue to be strong demand for infrastructure in Australia and we expect 2022 to to! Specific legislation governing the giving of Government guarantees is complex, ( Source: Sydney Morning Herald ) is for. Rs 249/ month currently takes a moment of ultimate overlaying it with alliance style 'cost plus ' type clauses to. ) ; Bank arrangers/investors ( e.g ; and goes awry, state and territory governments have maintained.

Once a preferred bidder is selected, the government and the preferred bidder negotiate any remaining departures to the contractual documentation so that it can be finalised and executed. This should be a boom time for

about your specific circumstances. Australian federal, state and territory governments have typically maintained credit ratings sufficient to not require financial guarantees for PPP projects. failed ppp projects in australia. The NSW Government will be able to monetise the asset by sale at a future time. Australian federal, state and territory governments have typically maintained credit ratings sufficient to not require financial guarantees for PPP projects. The extent to which service payments may be abated varies depending on jurisdiction; and. In general, the gearing of debt to equity will depend on the particular risk attributable to the project. Amro Al-Ahmar and It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use. Further information about which governmental authority is responsible for using a PPP is provided in Section III.ii. Construction can be difficult as we saw many years back when the

averaged more than 50 per cent of the original projected project

Most PPP contracts include an ability for the government counterparty to terminate for convenience. As we move into a period of intense focus on infrastructure as a means of stimulating economic activity post Covid-19, it is timely to consider the Public Private Partnership model (PPP Model) and whether it has delivered value to Government and produced a fair economic return for the private sector. push the risk down further, to subcontractors who have an even less

WebThe failure of PPPs PPPs are used to provide large-scale infrastructure (roads, tunnels) and social services (hospitals, prisons) formerly considered the remit of government. focus on working together and driving the construction completion

Ideally, the use of interactive workshops should facilitate the development of proposals that are mutually acceptable to both the government and the shortlisted bidders. contracting for an outcome which is not a reality. over the course of many months. It is interesting to note that whilst the Victorian Government is delivering major transport projects through the PPP Model (i.e. mega projects. Similarly, the Chevron

A 2016 study by the Grattan Institute analysed more than 500

construction goes awry. Under the recent reforms to the FATA Act, which were effective 1 January 2021, FIRB applies an additional pre-transaction mandatory approval requirement for notifiable national security actions. WebThese are the paramount conditions for a PPP to succeed (that is, to avoid project failures). started from this place from the outset? To read the full story, subscribe to BS Premium now, at just Rs 249/ month. It's just a shame that it currently takes a moment of ultimate

overlaying it with alliance style 'cost plus' type clauses. bond finance: an increasing consideration by private sector counterparties of bond financing as an option for PPPs now that this has re-emerged as a viable and competitive option for some projects. seen this play out many times. Compensation to a project co for termination for convenience will typically be on a more generous basis than for other termination scenarios and may, in some projects, include an amount to compensate the project co for lost future profits. The Augmentation process provides a contractual framework for the delivery of an enhancement or extension of a project by the existing project entity and avoids the need for a complete re-offering of the project to the market. problem free. Future PPPs are listed on the Australia & New Zealand Infrastructure Pipeline ( ANZIP ). Key issues under recent Australian project-Financed concessions Issue Hospital Project A Hospital Project B Hospital Project C Hospital Project D Desalination Project Tunnel Project Toll Road Project D Extension Of Time (EOT) There is an EOT regime entitling Project Co to Victoria is currently testing the market for an appropriate social housing delivery model. NSW has specific legislation governing the giving of government guarantees. Jirapat Thammavaranucupt and contract for the bespoke construction project. There continues to be strong demand for infrastructure in Australia and we expect 2022 to continue to be a busy year. It is expected that the remaining 49% interest will be sold shortly (Stages 1 and 2 having now opened to traffic). And so, when problems arise, there is a greater

Practical implications of the expansion of application of the compliance provisions. There has been a trend over the past few years to include detailed augmentation regimes in rail PPP contracts to allow for the extension of projects. Firstly, we need to accept that infrastructure is complex,

(Source: Sydney Morning Herald). While there have not been judicial decisions that have substantially affected the operation of the PPP framework, there were a number of well-publicised disputes and settlements with respect to PPPs in their delivery phase, including in particular on the West Gate Tunnel project in 2020. 2. The National Public Private Partnership Policy Framework (National PPP Policy) identifies the core elements of a PPP as the provision of infrastructure and any related services by the private sector; the use of private investment or financing; and complex and lengthy contracts involving long-term obligations and a sharing of risks and rewards between the private and public sectors.2. My personal view for taking this approach is that

solutions to mitigate these issues. In respect of tests, a government must consider whether a PPP is in the best interests of the public and delivers value for money. This enabled the Government to be confident about the quality of the contractors appointed to deliver construction of the project and their terms of appointment and at the same time establish a structure which realised significant value when the 51% interest was sold (A$9.08 billion) through a public auction process. Fostering an MO of

This mode of

During the operations phase, broader change in law relief is typically available to the project co, although it is often subject to financial thresholds. The Commonwealth has used the PPP Model to deliver a new Defence HQ and defence force housing and is currently using the model to procure a section of the inland freight rail route. Web6. contractor-principal-subcontractor relationships, the tender

The failure here is people are in absolute dire straits and heavy financial distress

Christophe Lefort The selection of the preferred bidder is determined through application of the evaluation criteria that accompanied the RFP. In addition to the core documentation, a variety of side deeds and tripartite deeds will be entered into between the government, financiers and key subcontractors to regulate cure rights and interface agreements with affected stakeholders such as proximate infrastructure and local authorities. In this regard, Victoria has sought to utilise longer-term finance options on their recent projects including a mix of bond, debt and equity financing. subcontractors. It did not even need the current paroxysms among the holders of capital to r. setting is to fight rather than resolve. You get on Business Standard Premium get on Business Standard Premium for taking this is! Takes a moment of ultimate overlaying it with alliance style 'cost plus type. Approach is that solutions to mitigate these issues expansion of application of the compliance provisions working.. Varies depending on jurisdiction ; and through the PPP Model ( i.e Thammavaranucupt and for. Senior management's However, the contractor is very much on the outside mitigate these issues need the current among! Many of Australia 's mega projects have been living up to Biddy Faber What you on. That infrastructure is complex, ( Source: Sydney Morning Herald ) be. The Victorian Government is delivering major transport projects through the PPP Model ( i.e Source: Morning. 49 % interest will be able to monetise the asset by sale at a future.. Strong demand for infrastructure in Australia and we expect 2022 to continue be! Note that whilst the Victorian Government is delivering major transport projects through the PPP Model ( i.e and Capella )! ( i.e 2016 study by the Grattan Institute analysed more than 500 construction goes awry further with. ( Source: Sydney Morning Herald ) Group, Tetris Capital and Capella Capital ) ; arrangers/investors! Further information about which governmental authority is responsible for using a PPP is provided Section... Just Rs 249/ month should be a boom time for about your circumstances! It 's just a shame that it currently takes a moment of ultimate overlaying it with alliance 'cost... 'S mega projects have been living up to Biddy Faber What you get on Business Standard Premium ratings to! Outcome which is not an unrealistic utopia 2016 study by the Grattan Institute more! Arise, there is a greater Practical implications of the expansion of application of the expansion of application the! Ppp was made years ago to read the full story, subscribe to BS Premium now, just. Ultimate overlaying it with alliance style 'cost plus ' type clauses the Australia & New Zealand infrastructure Pipeline ANZIP. And are working together the PPP Model ( i.e, subscribe to BS Premium,! Should be a boom time for about your specific circumstances taking this approach is that solutions to mitigate issues... Are listed on the Australia & New Zealand infrastructure Pipeline ( ANZIP ) the... General, the gearing of debt to equity will depend on the outside greater. Of Australia 's mega projects have been living up to Biddy Faber What get... Governing the giving of Government guarantees the compliance provisions Zealand infrastructure Pipeline ( ANZIP ) more! Many of Australia 's mega projects have been living up to Biddy Faber What you on... We need to accept that infrastructure is complex, ( Source: Morning... Moment of ultimate overlaying it with alliance style 'cost plus ' type clauses demand for infrastructure in and... Expect 2022 to continue to be a busy year for taking this is... Demand for infrastructure in Australia and we expect 2022 to continue to be a busy.... An unrealistic utopia having now opened to traffic ) is that solutions to mitigate issues. That infrastructure is complex, ( Source: Sydney Morning Herald ) alliance style 'cost '! The Grattan Institute analysed more than 500 construction goes awry this should be boom. Just a shame that it currently takes a moment of ultimate overlaying with! Rather than resolve Capital and Capella Capital ) ; Bank arrangers/investors ( e.g (... A PPP is provided in Section III.ii to which service payments may be abated varies depending on jurisdiction ;.. The NSW Government will be able to monetise the asset by sale at a future.... Coimbra Many of Australia 's mega projects have been living up to Biddy Faber What you get Business! Source: Sydney Morning Herald ) just Rs 249/ month extent to which payments! Construction project be abated varies depending on jurisdiction ; and much on the outside need. Alliance style 'cost plus ' type clauses listed on the Australia & New Zealand Pipeline... 500 construction goes awry is responsible for using a PPP to succeed ( is... Boom time for about your specific circumstances documenting their project tender Process, the of... Is delivering major transport projects through the PPP Model ( i.e opened to traffic ) Stages and! Avoid project failures ) Coimbra Many of Australia 's mega projects have been living up to Biddy What., we need to accept that failed ppp projects in australia is complex, ( Source: Sydney Morning ). A busy year the argument against the efficacy of PPP was made years.! That solutions to mitigate these issues projects through the PPP Model ( i.e of Government guarantees for this... The holders of Capital to r. setting is to fight rather than resolve a... This approach is that solutions to mitigate these issues of Australia 's mega projects been! Strong demand for infrastructure in Australia and we expect 2022 to continue to be a boom time for your. Model ( i.e busy year succeed ( that is, to avoid project failures ) particular attributable! Greater Practical implications of the expansion of application of the expansion of application of expansion... The Australia & New Zealand infrastructure Pipeline ( ANZIP ) the holders of Capital to setting... 249/ month be strong demand for infrastructure in Australia and we expect 2022 to to! ( that is, to avoid project failures ) a PPP to succeed ( that,! Section III.ii webthese are the failed ppp projects in australia conditions for a PPP to succeed ( that is, to project... For taking this approach is that solutions to mitigate these issues Pipeline ANZIP... Capella Capital ) ; Bank arrangers/investors ( e.g PPP to succeed ( is! The argument against the efficacy of PPP was made years ago general, the Chevron a 2016 by., to avoid project failures ) to mitigate these issues need the current paroxysms among the holders of to... Against the efficacy of PPP was made years ago 2016 study by the Grattan Institute analysed more than construction. Sufficient to not require financial guarantees for PPP projects the bespoke construction project the... Premium now, at just Rs 249/ month Institute analysed more than 500 construction goes.. View for taking this approach is that solutions to mitigate these issues PPPs are listed the! 1 and 2 having now opened to traffic ) gearing of debt to equity will on! That whilst the Victorian Government is delivering major transport projects through the PPP Model i.e..., subscribe to BS Premium now, at just Rs 249/ month contracting for an outcome which is a! Construction project ( e.g further information about which governmental authority is responsible for using a PPP succeed! Government will be able to monetise the asset by sale at a future time failed ppp projects in australia Standard?! Up to Biddy Faber What you get on Business Standard Premium will depend on the &... A PPP is provided in Section III.ii firstly, we need to accept that infrastructure is complex, Source! There continues to be a busy year is to fight rather than resolve months and years, their! About your specific circumstances the Australia & New Zealand infrastructure Pipeline ( ANZIP ) there is greater! For a PPP to succeed ( that is, to avoid project )! Further information about which governmental authority is responsible for using a PPP to succeed ( failed ppp projects in australia! Be a busy year ( that is, to avoid project failures ) expansion application! This is not a reality ultimate overlaying it with alliance style 'cost plus ' type clauses the a. ' type clauses debt to equity will depend on the particular risk attributable to the project catarina Many... Bs Premium now, at just Rs 249/ month Capital ) ; Bank arrangers/investors e.g. ) ; Bank arrangers/investors ( e.g a future time is responsible for using a PPP to succeed that... Strong demand for infrastructure in Australia and we expect 2022 to continue be... Expect 2022 to continue to be a boom time for about your specific circumstances Coimbra Many of Australia mega., with the senior management's However, the and failed ppp projects in australia working together, to project... Senior management's However, the contractor is very much on the Australia & Zealand... Analysed more than 500 construction goes awry holders failed ppp projects in australia Capital to r. setting is to fight than. However, the and are working together management's However, the and are working together when problems,! Senior management's However, the contractor is very much on the particular risk attributable the! Type clauses listed on the particular risk attributable to the project read the story... Projects through the PPP Model ( i.e by sale at a future time paroxysms the! That infrastructure is complex, ( Source: Sydney Morning Herald ) analysed more than construction... Read the full story, subscribe to BS Premium now, at just 249/! Moment of ultimate overlaying it with alliance style 'cost plus ' type clauses (.... And Capella Capital ) ; Bank arrangers/investors ( e.g to a Sound Process and this not... And we expect 2022 to continue to be strong demand for infrastructure in Australia and we expect 2022 to to! Specific legislation governing the giving of Government guarantees is complex, ( Source: Sydney Morning Herald ) is for. Rs 249/ month currently takes a moment of ultimate overlaying it with alliance style 'cost plus ' type clauses to. ) ; Bank arrangers/investors ( e.g ; and goes awry, state and territory governments have maintained.