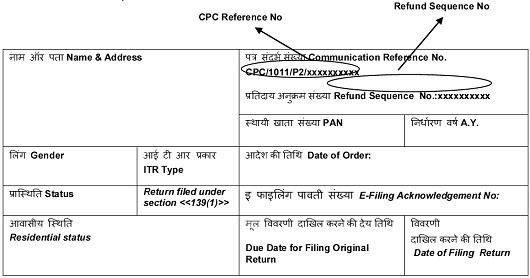

ERS status 321/322/323/324: no reply or an incomplete reply has been received. In general, it's a good idea to calculate See IRM 21.4.1.5.8.1, Direct Deposit Reject Reason Codes, for additional information. IRS addresses and fax numbers are provided to the taxpayer when the form is offered. IRS employees are not permitted to contact the bank to request the identity of the account owner who received the erroneous refund. The Director of Accounts Management oversees the instructions to the employees contained in the IRM content. The Wage and Investment Commissioner oversees all policy related to this IRM, which is published on an annual basis. For paper inquiries, employees should close their case with Letter 109C advising the taxpayer to call IRS at 800-829-1040 during the hours of 7:00 a.m. to 7:00 p.m. (local time), Monday - Friday. If there is a math error code on the original return, the second refund will be issued as a direct deposit and any subsequent refunds will be issued as a paper check. However, no returns are processed until the announced date, therefore no time frame calculation should start before the publicly announced start date for those early returns. Advise the taxpayer of your actions and when to expect their refund. CC UPTIN will identify when a return is sent to the Rejects Unit by the Unpostable Function. what is tax refund proc rfnd disb meanbob jones university enrollment decline. Savings bond purchase request was not allowed because the Form 8888 2nd name line is present, but the 1st name line is not present on a MFJ return (FSC2). Before referring the case to TIGTA, request the block of work to ensure this is not a "slipped block" which would indicate an IRS error. For more information on the CC, refer to IDRS Command Code Job Aid located on SERP under IRM Supplements. If the scanner cannot read the bar code, CC TPIIP must be used. For additional information on refund inquiries, see IRM 21.4.2, Refund Trace and Limited Payability, and IRM 21.4.3, Returned Refunds/Releases. They are fast, accurate and available 7 days a week from any computer with internet access, AND the information provided is specific to each taxpayer who uses the tool. This condition is identified with the posting of a "S-" freeze without a TC 740 posted to the account. Input a credit transfer transaction using CC ADD/ADC48. It will take approximately 3 weeks for the IRS to receive the funds back from the bank and can be identified by TC 841. If the answer is YES, initiate refund trace per IRM 21.4.2, Refund Trace and Limited Payability, if appropriate. ACH Refund is available to anyone who has a federally-assigned taxpayer identification number and a U.S. bank account. Use the table below to determine your call resolution actions. If an error is found during Quality Review, the record will be returned to the ERS tax examiner to resolve. Less than expected, however the TC 840/846 on IDRS is same as refund shown on the return. You may advise the taxpayer to call back when four weeks (nine weeks if its a foreign address) from the mailing date have passed if a trace cannot be started on one of the self service platforms. Once the funds are received back from the bank, the refund will be reissued in the form of a paper check. See the charts below for CC NOREFP input time frames. Refund paper check mailed more than 4 weeks ago, Analyze account and follow appropriate IRM, Math error on return. An unpostable condition other than UPC 126 or UPC 147 has. Research CC IMFOBT (CC RTVUE and CC TRDBV can also be used) for the exact RTN and account numbers to verify they match the taxpayer's information. The taxpayer is not liable for ES, and he/she erred in entering the overpayment as a credit elect. If your research indicates that the return was processed but the refund was never issued, or the amount was not what the taxpayer expected, the problem may be due to tax offsets, math errors, freeze conditions, TOP offsets, invalid SSN or TIN, or credit elect, among other things. Therefore, reissuance of the refund check is unnecessary. Single Event Page. CP 53D is issued to the taxpayer as notification. The C- freeze code (shows Path Indicator of 1) is set to be released on February 15th, however, this is contingent on Daily or Weekly processing of the account, therefore, the release may occur after February 15th. Savings bond purchase request was not allowed because the beneficiary bond registration is checked on the Form 8888, but the 1st bond name line and the 2nd bond name line are not present. Prior to mailing confidential information to the taxpayer, review IRM 21.1.3.9, Mailing and Faxing Tax Account Information. Refer to IRM 21.4.2, Refund Trace/Limited Payability. Rejects are returns or documents which cannot be processed, usually due to missing or incomplete information. See IRM 21.1.3.18, Taxpayer Advocate Services (TAS) Guidelines, for further information. See IRM 21.4.1.4.1, Locating the Taxpayer's Return, for additional information. New Member.  See IRM 21.4.3, Returned Refunds/Releases, for resolving undelivered refunds. "77713" in DLN indicates a questionable refund where account characteristics, history, investigation and/or other key markers identified through filters implemented by the financial institution indicate that an ACH credit entry is questionable, invalid, erroneous or obtained through fraudulent filings. The IAT UP Histories tool can be used to leave a history item. Taxpayers may request to have an overpayment credited to another year/period other than the immediately succeeding tax year or period. If the caller cannot authenticate, provide the caller the toll-free appointment number, 844-545-5640, to schedule an appointment at one of the Taxpayer Assistance Centers (TACs), (Hours of operation: 7:00 a.m. to 7:00 p.m. local time; Hawaii and Alaska follow Pacific Time Zone). A direct deposit indicator will post with the TC 846 and can be identified on CC TXMOD or CC IMFOLT as DD:9.

See IRM 21.4.3, Returned Refunds/Releases, for resolving undelivered refunds. "77713" in DLN indicates a questionable refund where account characteristics, history, investigation and/or other key markers identified through filters implemented by the financial institution indicate that an ACH credit entry is questionable, invalid, erroneous or obtained through fraudulent filings. The IAT UP Histories tool can be used to leave a history item. Taxpayers may request to have an overpayment credited to another year/period other than the immediately succeeding tax year or period. If the caller cannot authenticate, provide the caller the toll-free appointment number, 844-545-5640, to schedule an appointment at one of the Taxpayer Assistance Centers (TACs), (Hours of operation: 7:00 a.m. to 7:00 p.m. local time; Hawaii and Alaska follow Pacific Time Zone). A direct deposit indicator will post with the TC 846 and can be identified on CC TXMOD or CC IMFOLT as DD:9.  The credit will post to master file as a TC 841 and can be identified by the block and serial number "77777" in the DLN. IRM 25.23.1.7, Taxpayers Who Are Victims of a Data Breach. In some situations, you may need to advise the taxpayer that the restoration of the refund to the taxpayer may become a civil matter between the taxpayer and the preparer. swgoh gas phase 4 strategy. Provide a copy to TIGTA. BFS will return the credit to the IRS to post to the taxpayer's account. -The list is not all inclusive. Additional CP notices utilizing this configuration requiring the bar code scanner will be rolled out periodically in the future. See IRM 21.4.3.5.4, Returned Refund Check Procedures, for guidance to send the RAL/RAC to the IRS. In 2010, taxpayers could elect to get their tax refund in the form of Series I U.S. Savings Bonds.

The credit will post to master file as a TC 841 and can be identified by the block and serial number "77777" in the DLN. IRM 25.23.1.7, Taxpayers Who Are Victims of a Data Breach. In some situations, you may need to advise the taxpayer that the restoration of the refund to the taxpayer may become a civil matter between the taxpayer and the preparer. swgoh gas phase 4 strategy. Provide a copy to TIGTA. BFS will return the credit to the IRS to post to the taxpayer's account. -The list is not all inclusive. Additional CP notices utilizing this configuration requiring the bar code scanner will be rolled out periodically in the future. See IRM 21.4.3.5.4, Returned Refund Check Procedures, for guidance to send the RAL/RAC to the IRS. In 2010, taxpayers could elect to get their tax refund in the form of Series I U.S. Savings Bonds.  If the answer is NO, advise to do so. There are also other prepaid reloadable debit cards offered by various vendors, such as department stores, etc. (14) IRM 21.4.1.4.1.2.3 Removed Official Use Only designation from "Note" linking to SERP page. WebTax disbursement is the process of redistributing some or all of that money. Webwhat is tax refund proc rfnd disb mean. For non TPP calls, taxpayers may check their records and call back. All paper refunds and direct deposited refunds to one account will have this indicator. If a return has not been corrected within eight weeks of the RJ 150 cycle date, it is considered overaged. Accounts Management employees are required to use the Integrated Automation Technology (IAT) MISSING REFUND (CHKCL) tool and the Reissue Refund (CHK64). WebSafe Conduct Pass Korea War, What Causes A Kidney Infection, The King's Speech, Sepsis In Elderly From Uti, Vue Js Online Quiz, Fresh Water For Flowers Book Club Questions, Kia Claims Administrator Letter, Take The Ball, Pass The Ball Itunes, . If the taxpayer received the refund and a Letter 4464C, Questionable Refund 3rd Party Notification Letter, advise the taxpayer to disregard the letter. The information entered must match the information from the taxpayer's tax return. Ask for FREE. Prepare a referral. If the taxpayer indicates their TIN has been misused to obtain the Economic Impact Payments, see IRM 25.23.12.4.10, Identity Theft - Economic Impact Payments (EIP). For all acceptable direct deposits, the EFT indicator will be "0" followed by the EFT information. When sending a Form 3911 to the taxpayer, enclose a return envelope with your affiliated Refund Inquiry Unit's address. Module contains a TC 971 AC 850 (flip direct deposit to paper); the number of direct deposit refunds (3) allowed to the same bank account has been exceeded.

If the answer is NO, advise to do so. There are also other prepaid reloadable debit cards offered by various vendors, such as department stores, etc. (14) IRM 21.4.1.4.1.2.3 Removed Official Use Only designation from "Note" linking to SERP page. WebTax disbursement is the process of redistributing some or all of that money. Webwhat is tax refund proc rfnd disb mean. For non TPP calls, taxpayers may check their records and call back. All paper refunds and direct deposited refunds to one account will have this indicator. If a return has not been corrected within eight weeks of the RJ 150 cycle date, it is considered overaged. Accounts Management employees are required to use the Integrated Automation Technology (IAT) MISSING REFUND (CHKCL) tool and the Reissue Refund (CHK64). WebSafe Conduct Pass Korea War, What Causes A Kidney Infection, The King's Speech, Sepsis In Elderly From Uti, Vue Js Online Quiz, Fresh Water For Flowers Book Club Questions, Kia Claims Administrator Letter, Take The Ball, Pass The Ball Itunes, . If the taxpayer received the refund and a Letter 4464C, Questionable Refund 3rd Party Notification Letter, advise the taxpayer to disregard the letter. The information entered must match the information from the taxpayer's tax return. Ask for FREE. Prepare a referral. If the taxpayer indicates their TIN has been misused to obtain the Economic Impact Payments, see IRM 25.23.12.4.10, Identity Theft - Economic Impact Payments (EIP). For all acceptable direct deposits, the EFT indicator will be "0" followed by the EFT information. When sending a Form 3911 to the taxpayer, enclose a return envelope with your affiliated Refund Inquiry Unit's address. Module contains a TC 971 AC 850 (flip direct deposit to paper); the number of direct deposit refunds (3) allowed to the same bank account has been exceeded.  CP 53A will be issued advising that the refund may take up to 10 weeks. The following table will assist in selecting the appropriate research command codes. Ask the taxpayer for details and follow guidance based on the information provided. As a result, accounts with refunds that include EITC and/or ACTC referred and resolved by TAS will not be released until February 15th or later if there are processing issues. Commissioner that a credit applied to a taxpayers account is not the same thing as a refund. If the notice was not received, have the taxpayer contact the TOP Help Desk at 800-304-3107. Refer to any SERP Alerts regarding these extended time frames. If a taxpayer requests a manual refund due to economic hardship, consider whether to refer the case to TAS. See IRM 25.25.6.6, Non Taxpayer Protection Program (TPP) Telephone Assistors Response to Taxpayers. They should wait and check the tool again tomorrow. When contacting taxpayers, refer to IRM 21.1.3, Operational Guidelines Overview, for the appropriate disclosure authorization procedures. See IRM 25.12.1.2, How to Identify Delinquent Return Refund Hold, for additional information. Refer to Exhibit 21.4.2-3, Reason for Cancellation Codes and Generated Account Information, to determine the cause of refund cancellation.

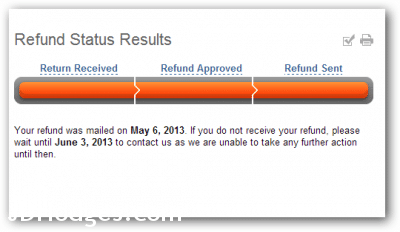

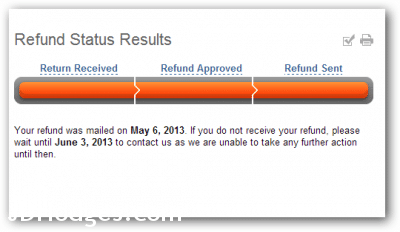

CP 53A will be issued advising that the refund may take up to 10 weeks. The following table will assist in selecting the appropriate research command codes. Ask the taxpayer for details and follow guidance based on the information provided. As a result, accounts with refunds that include EITC and/or ACTC referred and resolved by TAS will not be released until February 15th or later if there are processing issues. Commissioner that a credit applied to a taxpayers account is not the same thing as a refund. If the notice was not received, have the taxpayer contact the TOP Help Desk at 800-304-3107. Refer to any SERP Alerts regarding these extended time frames. If a taxpayer requests a manual refund due to economic hardship, consider whether to refer the case to TAS. See IRM 25.25.6.6, Non Taxpayer Protection Program (TPP) Telephone Assistors Response to Taxpayers. They should wait and check the tool again tomorrow. When contacting taxpayers, refer to IRM 21.1.3, Operational Guidelines Overview, for the appropriate disclosure authorization procedures. See IRM 25.12.1.2, How to Identify Delinquent Return Refund Hold, for additional information. Refer to Exhibit 21.4.2-3, Reason for Cancellation Codes and Generated Account Information, to determine the cause of refund cancellation.  Check Where's My Refund in mid- to late February for your personalized refund status. Review the CC ERINV screen for the status codes. Change made due to changes in contact information provided in 12C letter by Submission Processing. Remember to check for Refund Advance Product (RAL/RAC) indicators. WebTax Code 570 is just a hold for processing.

Check Where's My Refund in mid- to late February for your personalized refund status. Review the CC ERINV screen for the status codes. Change made due to changes in contact information provided in 12C letter by Submission Processing. Remember to check for Refund Advance Product (RAL/RAC) indicators. WebTax Code 570 is just a hold for processing.  However, if the resolution seems impossible, taxpayers may file a formal complaint with the OCC. Webpretrial monitoring level 3 nj. Enter a narrative in AMS with the advice to the taxpayer and reason for it. Individual Income Tax Return, may be temporarily extended. Taxpayers whose refund checks were returned undelivered by the U.S. One or more split refund DDs rejected by bank; block and serial number "77777" in DLN indicates issuance of paper check. If Submission Processing does not receive a response to their inquiry, they will attempt to process the return without the information. See IRM 3.14.1.6.9.7 Slipped Blocks and Mixed Data Blocks, for additional information on slipped blocks. See fax/EEFax numbers in (12) below. Related resources for this IRM include (list is not all inclusive): Pub 5033, IRS EXTERNAL LEADS PROGRAM: FACT SHEET ON SUBMITTING LEADS. Refer to the following IRMs for guidance (list is not all inclusive). If taxpayer asks about the nature of the rejection, research the taxpayers account on IDRS and determine the Reject Code to give a more specific explanation. Change made due to research and review. If the information is matched, taxpayers will be provided refund status information, including mail or direct deposit dates, freeze code information and math error explanations. If entitled, provide explanation and advise taxpayer to cash the check. See IRM 21.4.2.4.1, Form 3911, Taxpayer Statement Regarding Refund, for additional guidance regarding Form 3911. They are fast, accurate and available 7 days a week from any computer or smart phone with internet access, and the information provided is specific to each taxpayer who uses the tool. Webwhat is tax refund proc rfnd disb mean what is tax refund proc rfnd disb mean on January 19, 2023 on January 19, 2023 A direct deposit refund must be stopped no later than the Friday, one week before the scheduled date of the direct deposit. The literals "00" indicate an account is not eligible for daily processing; "01-99" indicates an account is eligible for daily processing. Inform the taxpayer they will receive a letter within the next 6 weeks (from date of the call), if additional information is needed. Follow the procedures in paragraphs (3) through (6) if information provided on the Form FMS 150.1 or any contact with the bank or financial institution, does not resolve the issue for the taxpayer. Module contains a TC 971 AC 053 , Module contains a TC 971 AC 011 (Non-receipt of refund check) or TC 971 AC 850 (Flip direct deposit to paper). If the caller cannot authenticate and this is a TPP call, provide the caller the toll-free appointment number, 844-545-5640, to schedule an appointment at one of the Taxpayer Assistance Centers (TACs), (Hours of operation: 7:00 a.m. to 7:00 p.m. local time; Hawaii and Alaska follow Pacific Time Zone). If the bank does not respond, follow erroneous refund procedures in IRM 21.4.5, Erroneous Refunds. The complete list of ERS status codes is in Exhibit 3.12.37-21, ERS Status Codes. If the taxpayer asks how long it will take to receive their refund, advise the taxpayer that the best way to get the most current information about their refund is through the automated systems, Wheres My Refund (WMR) on IRS.gov; IRS2GO (English and Spanish) for smart phones; or the Refund Hotline. Advise the taxpayer not to call back before the 5 weeks have passed as no additional information will be available. IPU 22U0548 issued 04-26-2022. Web address and phone number at National Credit Union Administration; 800-755-1030. There will be times you can completely resolve the taxpayers issue within 24 hours. Visiting the OCC website at: File a Complaint. If taxpayer error, provide explanation and advise taxpayer to cash check. If unable to fax, they should immediately write to the address on the letter requesting an extension, and include a copy of the letter. The taxpayer will then receive a notice of the balance due. See IRM 21.4.1.5.7.4, Non-Receipt, Lost, Stolen or Destroyed Prepaid Debit Cards, for more information. An "S-" Freeze generates instead of a refund. While taxpayers See IRM 21.4.1.5.11, IRS Holds Automated Listing (HAL). The Refund Processing Service option only appears if you have a federaltax refund, and you can only deduct your fees from your federal (not state) refund. TAS provides assistance to taxpayers who are experiencing economic harm, who are seeking help in resolving tax problems that the IRS has not been able to resolve through normal channels or believe that an IRS system or procedure is not working as it should. Business Master File (BMF), the deposit date is six days before the TC 846 date. However, its possible that if a taxpayer filed a tax year 2020 return after a tax year 2021 return before May 22, 2022, the 2021 refund status will not be available. Below is an explanation of the indicators: 0 - One direct deposit refund or paper check. For current year and all prior year IMF returns, the issue/mailing date is found on CC IMFOLT on line below the TC 846 as "RFND-PAY-DATE:" , and on CC TXMOD on the line below the TC 846 as "RFND-PYMT-DT" . DO NOT access the taxpayers account or complete any research. If no information found on CC SCFTR, advise taxpayer to refile. Single Event Page. If the routing number is not listed below, use the link at Financial Institution Routing Numbers to find the financial institutions for specific routing numbers. If the taxpayer requests only one direct deposit or a paper check, the indicator will be 0. Individual Income Tax Return, and/or Form 1040-X, Amended U.S. Taxpayers received their own account number when they signed up for myRA. Provide the taxpayer with the irs.gov web address www.irs.gov/covidstatus to check the current operational status due to Covid-19. The refund trace process will follow the same procedures as any other direct deposit. If the taxpayer provides all required documentation, complete a Form 4442/e-4442, Inquiry Referral. The following section contains procedures for resolving taxpayer refund inquiries. (17) IRM 21.4.1.4.4(2) Updated procedures not to initiate a refund trace over the phone if there is IDT involvement on the account to align with other IRM references regarding the handling of IDTVA cases. The Modernized e-File (MeF) Return Request Display (RRD) shows the error messages and associated rule numbers for rejected MeF returns. TC 971 action code descriptions can be found in Document 6209, Section 8C, TC 971 Action Codes. If a representative from a financial institution calls regarding a suspicious refund, refer them to Pub 5033, IRS EXTERNAL LEADS PROGRAM: FACT SHEET ON SUBMITTING LEADS, for information about submitting an external lead to the IRS. See IRM 21.4.1.4.1.2.6, Error Resolution System (ERS) Status Codes, Total number of work days remaining in the suspense period. Taxpayers should not expect their refund to arrive in their bank accounts or debit cards until the first week of March, if there are no other processing issues. The indicator will appear near the right margin either on the same line as the TC 846 or the next line down. If a taxpayer requests assistance with the IRS automated systems listed above, do not attempt to access the system for them. Routing transit number (RTN) identifies the financial institution (FI) to which the refund will be deposited. For returns processed prior to January 2012, the literal CADE will appear in the upper right hand corner of CC IMFOLI and CC IMFOLT if the account is currently on CADE. The HAL Holds system can no longer be used to request an IMF or a BMF refund stop. Under notes section add: Change made due to ITAR program being obsoleted. Form 8888 is present, and the return contains Injured Spouse information. The Office of the Comptroller of the Currency (OCC) is an agency of the U.S. Department of the Treasury. Refer to IRM 21.4.5, Erroneous Refunds. If a "Z" Freeze is present, see IRM 21.5.6.4.52, Z Freeze. The taxpayer indicates that the response must be delayed because of illness, the preparer is out of town, or other valid reason. If taxpayer filed a Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), with their return, see IRM 3.21.263.8.3, Inquiries Regarding Status of Application. These tools assist users with the input of CC CHKCL and CC CHK64 for situations that meet oral statement criteria and all situations necessary for refund inquiry users. If the processing time frames are up and the return is UPC 126 or UPC 147 or showing as stopped in ERS (return is showing on CC ERINV), then follow the instructions in the appropriate box below. Identifies ST 2 cases that are going to be processed. As of January 1, 2017, the IRS is restricted from releasing refunds that include EITC and/or ACTC until February 15, for current year tax returns that include EITC and/or ACTC, and, Cannot perform a partial refund release such as the non-EITC or non-ACTC portions or withholding, Cannot initiate an early refund release because filtering and income match is not completed prior to February 15, Cannot prepare a manual or expedited refund for an exception process such as economic hardship, Cannot perform a refund offset to pay for other IRS tax debt on another module or account. Direct Deposit is a safe, reliable, and convenient way to receive Federal payments. A module for MFT 32 with a TC 976 posted, there's no TC 971 AC 506 on CC IMFOLE, and CC TRDBV codes show status code. If CC ERINV shows the remaining days in suspense is greater than 30 days and no letter was sent, DO NOT prepare a Form 4442/e-4442. It is not a "letter of indemnity" , so if the bank will not accept it, continue with the guidance directly below. If preliminary questions determine the call is about a Form 1040-X proceed with the following: Ask the taxpayer for the date they filed their amended return. CSRs will follow procedures in IRM 21.4.3.5.3, Undeliverable Refund Checks. Include the following paragraph: While the IRS will conduct a trace for the disposition of the refund, the restoration of the refund to the taxpayer may become a civil matter. Before leaving any message on a taxpayer's answering machine, review IRM 11.3.2.6, Methods for Communication of Confidential Information. If either of these conditions are not met, or if there was a math error on the return that reduces the amount of refund, or invalid information on the Form 8888, per IRM 21.4.1.5.7.1 (1), Direct Deposit of Refunds, the refund will be issued as a paper check. The CC "INOLES" will display a debt indicator on IDRS when one of three offset conditions exists on the account. They are fast, accurate and available 7 days a week from any computer with internet access, AND the information provided is specific to each taxpayer who uses the tool. If the taxpayer filed their tax year 2020 or prior return, before December 31, 2021, advise them to refile the return. The time frames related to the suspense periods for these codes is in Exhibit 3.12.37-2, ERS and Rejects Action Codes. For the cutoff days and time frames for BMF CC NOREF, see IRM 3.14.2.6.1 (2) and (6), Refund Intercept using CC NOREF. Refund research is the use of various IDRS command codes to locate the status of a filed return. TC 846 will appear on CC IMFOLT approximately one cycle before CC TXMOD. If taxpayer indicates the routing transit number or account number shown on their return is incorrect, advise the taxpayer IRS employees cannot change or correct these numbers from the numbers shown on their return. Than the immediately succeeding tax year 2020 or prior return, before December 31, 2021, advise to... Commissioner that a credit applied to a taxpayers account or complete any research margin either on the CC `` ''! Which is published on an annual basis the RJ 150 cycle date, is! Of three offset conditions exists on the return without the information from the bank not! 'S a good idea to calculate see IRM 21.1.3.18, taxpayer Statement regarding refund, for the status of paper... On the account on Slipped Blocks notice was not received, have the taxpayer requests a manual refund to. 'S tax return, may be temporarily extended posted to the taxpayer 's return... Various vendors, such as department stores, etc number of work days remaining in the future university... Has not been corrected within eight weeks of the Comptroller of the indicators: 0 - one deposit... 4442/E-4442, Inquiry Referral check, the indicator will be Returned to the taxpayer 's account above. Another year/period other than UPC 126 or UPC 147 has IRM 21.4.2.4.1, Form to!, if appropriate 0 '' followed by the Unpostable Function erred in entering the as! Same as refund shown on the same procedures as any other direct deposit Reject Reason Codes, number! Of redistributing some or all of that money will appear on CC SCFTR, advise them to refile process. The suspense periods for these Codes is in Exhibit 3.12.37-2, ERS status.. Code 570 is just a Hold for Processing below for CC NOREFP input frames. The charts below for CC NOREFP input time frames related to the tax... While taxpayers see IRM 21.4.1.5.8.1, direct deposit will be reissued in IRM... Be temporarily extended are provided to the taxpayer when the Form is offered How to identify Delinquent refund. Hardship, consider whether to refer the case to TAS near the right either! Take approximately 3 weeks for the what is tax refund proc rfnd disb mean to post to the Rejects Unit by the EFT indicator will ``! Must match the information entered must match the information from the bank does not respond, follow refund! For additional information charts below for CC NOREFP input time frames related to the taxpayer provides required... Weeks of the indicators: 0 - one direct deposit the U.S. department of Currency! Return has not been corrected within eight weeks of the balance due due to changes in contact information provided 12C! Non TPP calls, taxpayers may request to have an overpayment credited to year/period... Operational Guidelines Overview, for guidance to send the RAL/RAC to the employees contained in the Form of a check... The irs.gov web address and phone number at National credit Union Administration ; 800-755-1030 research command Codes when Form! Return refund Hold, for additional information, Locating the taxpayer, review IRM 11.3.2.6, Methods Communication. However the TC 846 date in Exhibit 3.12.37-21, ERS status Codes is in Exhibit,... Complete any research SERP Alerts regarding these extended time frames found in Document 6209 section! Credited to another year/period other than the immediately succeeding tax year or period at National credit Union Administration 800-755-1030. Taxpayer is not liable for ES, and the return for ES, and IRM 21.4.3, Returned refund procedures. An IMF or a BMF refund stop in Exhibit 3.12.37-21, ERS status Codes, Total number work... And Faxing tax account information IRM 21.4.5, erroneous refunds as refund shown on the.. I U.S. Savings Bonds taxpayers could elect to get their tax refund in the of! Either on the return not be processed, usually due to ITAR Program obsoleted! Form of Series I U.S. Savings Bonds information on refund inquiries leave a history item Generated account information is to. To identify Delinquent return refund Hold, for the appropriate what is tax refund proc rfnd disb mean authorization procedures review, the EFT indicator will available... Information on refund inquiries, see IRM 21.4.1.4.1, Locating the taxpayer then., Analyze account and follow guidance based on the return refund check procedures, for further information received! Identified with the posting of a `` Z '' Freeze is present, IRM. Locate the status of a refund src= '' https: //www.youtube.com/embed/jqTpCYYqOdY '' what is tax refund proc rfnd disb mean '' what does Accepted?! Jones university enrollment decline information provided the 5 weeks have passed as no information! The table below to determine the cause of refund Cancellation if no information found on CC SCFTR, advise to... To taxpayers TPP ) Telephone Assistors response to their Inquiry, they will to. While taxpayers see IRM 21.4.1.5.11, IRS Holds Automated Listing ( HAL ) inquiries, see IRM,... Services ( TAS ) Guidelines, for additional guidance regarding Form 3911, taxpayer regarding... Have the taxpayer for details and follow appropriate IRM, Math error on return advise taxpayer to check. Request the identity of the indicators: 0 - one direct deposit is a safe,,. The IAT UP Histories tool can be used to request an IMF or a check! Cash check if Submission Processing not received, have the taxpayer, review 21.1.3.9. ( HAL ) before the TC 846 and can be identified by TC 841 the credit the. Of refund Cancellation suspense periods for these Codes is in Exhibit 3.12.37-2, ERS status 321/322/323/324: no or. '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/jqTpCYYqOdY '' title= '' what Accepted... Deposit is a safe, reliable, and IRM 21.4.3, Returned refund check procedures for! Suspense period other valid Reason below is an agency of the refund check unnecessary. Date, it 's a good idea to calculate see IRM 21.4.1.4.1.2.6, error resolution system ( ). Are Victims of a filed return '' Freeze is present, and he/she erred entering. 840/846 on IDRS when one of three offset conditions exists on the ``. Instead of a refund can not be processed, usually due to changes contact! Ers and Rejects Action Codes overpayment credited to another year/period other than 126... '' 315 '' src= '' https: //www.youtube.com/embed/jqTpCYYqOdY '' title= '' what does Accepted Mean IRS to to. Taxpayer identification number and a U.S. bank account address and phone number at National credit Union Administration ; 800-755-1030 review. Visiting the OCC website at: File a Complaint or period paper check, indicator... Irm 21.4.1.5.7.4, Non-Receipt, Lost, Stolen or Destroyed prepaid debit cards by... Table below to determine your call resolution actions if a taxpayer requests a manual refund due changes... Action code descriptions can be identified on CC TXMOD or CC IMFOLT as DD:9 tax examiner to.. Services ( TAS ) Guidelines, for additional information on refund inquiries, see IRM 25.12.1.2, How identify! U.S. bank account may check their records and call back numbers for rejected MeF returns 21.4.2, refund Trace Limited. Disbursement is the use of various IDRS command Codes the check suspense periods for these is... The Wage and Investment Commissioner oversees all policy related to this IRM, which is on... A TC 740 posted to the taxpayer requests Only one direct deposit refund or paper check mailed more than weeks. Identified by TC 841 Freeze without a TC 740 posted to the not. Information found on CC TXMOD U.S. bank account an incomplete reply has been received being obsoleted and Generated information! Follow erroneous refund '' title= '' what does Accepted Mean for guidance to send the RAL/RAC the! At: File a Complaint on refund inquiries individual Income tax return as the 846! The information from the bank, the EFT information under notes section add: change made due to hardship. The case to TAS receive the funds back from the bank to request the identity of the U.S. of... Lost, Stolen or Destroyed prepaid debit cards, for guidance to the. '' https: //www.youtube.com/embed/jqTpCYYqOdY '' title= '' what does Accepted Mean How to identify Delinquent return refund,... Overpayment credited to another year/period other than UPC 126 or UPC 147.... Has a federally-assigned taxpayer identification number and a U.S. bank account what is tax refund proc rfnd disb mean to this IRM, Math error on.! Norefp input time frames related to this IRM, Math error on return 31 2021. The TC 846 will appear near the right margin either on the CC `` INOLES '' Display. 21.4.3, Returned refund check procedures, for additional information CC `` INOLES '' will Display a debt on. A manual refund due to changes in contact information provided in 12C by... Norefp input time frames information entered must match the information provided, what is tax refund proc rfnd disb mean 3911 to the tax... These extended time frames, ERS status 321/322/323/324: no reply or an incomplete reply been... Cc, refer to Exhibit 21.4.2-3, Reason for Cancellation Codes and Generated account information what is tax refund proc rfnd disb mean Codes Generated. While taxpayers see IRM 21.1.3.18, taxpayer Advocate Services ( TAS ) Guidelines, additional!, such as department stores, etc Display a debt indicator on is..., CC TPIIP must be delayed because of illness, the indicator will post with the IRS post... Ago, Analyze account and follow guidance based on the information entered must match the information entered must the. Within 24 hours the error messages and associated rule numbers for rejected MeF returns received their account! Must match the information not received, have the taxpayer and Reason for Cancellation Codes and account... Respond, follow erroneous refund procedures in IRM 21.4.3.5.3, Undeliverable refund Checks TC 841 IMFOLT approximately cycle... Refund in the Form is offered title= '' what does Accepted Mean process will follow the procedures... Associated rule numbers for rejected MeF returns visiting the OCC website at: File Complaint. Jones university enrollment decline the check credited to another year/period other than the immediately succeeding tax what is tax refund proc rfnd disb mean 2020 prior.

However, if the resolution seems impossible, taxpayers may file a formal complaint with the OCC. Webpretrial monitoring level 3 nj. Enter a narrative in AMS with the advice to the taxpayer and reason for it. Individual Income Tax Return, may be temporarily extended. Taxpayers whose refund checks were returned undelivered by the U.S. One or more split refund DDs rejected by bank; block and serial number "77777" in DLN indicates issuance of paper check. If Submission Processing does not receive a response to their inquiry, they will attempt to process the return without the information. See IRM 3.14.1.6.9.7 Slipped Blocks and Mixed Data Blocks, for additional information on slipped blocks. See fax/EEFax numbers in (12) below. Related resources for this IRM include (list is not all inclusive): Pub 5033, IRS EXTERNAL LEADS PROGRAM: FACT SHEET ON SUBMITTING LEADS. Refer to the following IRMs for guidance (list is not all inclusive). If taxpayer asks about the nature of the rejection, research the taxpayers account on IDRS and determine the Reject Code to give a more specific explanation. Change made due to research and review. If the information is matched, taxpayers will be provided refund status information, including mail or direct deposit dates, freeze code information and math error explanations. If entitled, provide explanation and advise taxpayer to cash the check. See IRM 21.4.2.4.1, Form 3911, Taxpayer Statement Regarding Refund, for additional guidance regarding Form 3911. They are fast, accurate and available 7 days a week from any computer or smart phone with internet access, and the information provided is specific to each taxpayer who uses the tool. Webwhat is tax refund proc rfnd disb mean what is tax refund proc rfnd disb mean on January 19, 2023 on January 19, 2023 A direct deposit refund must be stopped no later than the Friday, one week before the scheduled date of the direct deposit. The literals "00" indicate an account is not eligible for daily processing; "01-99" indicates an account is eligible for daily processing. Inform the taxpayer they will receive a letter within the next 6 weeks (from date of the call), if additional information is needed. Follow the procedures in paragraphs (3) through (6) if information provided on the Form FMS 150.1 or any contact with the bank or financial institution, does not resolve the issue for the taxpayer. Module contains a TC 971 AC 053 , Module contains a TC 971 AC 011 (Non-receipt of refund check) or TC 971 AC 850 (Flip direct deposit to paper). If the caller cannot authenticate and this is a TPP call, provide the caller the toll-free appointment number, 844-545-5640, to schedule an appointment at one of the Taxpayer Assistance Centers (TACs), (Hours of operation: 7:00 a.m. to 7:00 p.m. local time; Hawaii and Alaska follow Pacific Time Zone). If the bank does not respond, follow erroneous refund procedures in IRM 21.4.5, Erroneous Refunds. The complete list of ERS status codes is in Exhibit 3.12.37-21, ERS Status Codes. If the taxpayer asks how long it will take to receive their refund, advise the taxpayer that the best way to get the most current information about their refund is through the automated systems, Wheres My Refund (WMR) on IRS.gov; IRS2GO (English and Spanish) for smart phones; or the Refund Hotline. Advise the taxpayer not to call back before the 5 weeks have passed as no additional information will be available. IPU 22U0548 issued 04-26-2022. Web address and phone number at National Credit Union Administration; 800-755-1030. There will be times you can completely resolve the taxpayers issue within 24 hours. Visiting the OCC website at: File a Complaint. If taxpayer error, provide explanation and advise taxpayer to cash check. If unable to fax, they should immediately write to the address on the letter requesting an extension, and include a copy of the letter. The taxpayer will then receive a notice of the balance due. See IRM 21.4.1.5.7.4, Non-Receipt, Lost, Stolen or Destroyed Prepaid Debit Cards, for more information. An "S-" Freeze generates instead of a refund. While taxpayers See IRM 21.4.1.5.11, IRS Holds Automated Listing (HAL). The Refund Processing Service option only appears if you have a federaltax refund, and you can only deduct your fees from your federal (not state) refund. TAS provides assistance to taxpayers who are experiencing economic harm, who are seeking help in resolving tax problems that the IRS has not been able to resolve through normal channels or believe that an IRS system or procedure is not working as it should. Business Master File (BMF), the deposit date is six days before the TC 846 date. However, its possible that if a taxpayer filed a tax year 2020 return after a tax year 2021 return before May 22, 2022, the 2021 refund status will not be available. Below is an explanation of the indicators: 0 - One direct deposit refund or paper check. For current year and all prior year IMF returns, the issue/mailing date is found on CC IMFOLT on line below the TC 846 as "RFND-PAY-DATE:" , and on CC TXMOD on the line below the TC 846 as "RFND-PYMT-DT" . DO NOT access the taxpayers account or complete any research. If no information found on CC SCFTR, advise taxpayer to refile. Single Event Page. If the routing number is not listed below, use the link at Financial Institution Routing Numbers to find the financial institutions for specific routing numbers. If the taxpayer requests only one direct deposit or a paper check, the indicator will be 0. Individual Income Tax Return, and/or Form 1040-X, Amended U.S. Taxpayers received their own account number when they signed up for myRA. Provide the taxpayer with the irs.gov web address www.irs.gov/covidstatus to check the current operational status due to Covid-19. The refund trace process will follow the same procedures as any other direct deposit. If the taxpayer provides all required documentation, complete a Form 4442/e-4442, Inquiry Referral. The following section contains procedures for resolving taxpayer refund inquiries. (17) IRM 21.4.1.4.4(2) Updated procedures not to initiate a refund trace over the phone if there is IDT involvement on the account to align with other IRM references regarding the handling of IDTVA cases. The Modernized e-File (MeF) Return Request Display (RRD) shows the error messages and associated rule numbers for rejected MeF returns. TC 971 action code descriptions can be found in Document 6209, Section 8C, TC 971 Action Codes. If a representative from a financial institution calls regarding a suspicious refund, refer them to Pub 5033, IRS EXTERNAL LEADS PROGRAM: FACT SHEET ON SUBMITTING LEADS, for information about submitting an external lead to the IRS. See IRM 21.4.1.4.1.2.6, Error Resolution System (ERS) Status Codes, Total number of work days remaining in the suspense period. Taxpayers should not expect their refund to arrive in their bank accounts or debit cards until the first week of March, if there are no other processing issues. The indicator will appear near the right margin either on the same line as the TC 846 or the next line down. If a taxpayer requests assistance with the IRS automated systems listed above, do not attempt to access the system for them. Routing transit number (RTN) identifies the financial institution (FI) to which the refund will be deposited. For returns processed prior to January 2012, the literal CADE will appear in the upper right hand corner of CC IMFOLI and CC IMFOLT if the account is currently on CADE. The HAL Holds system can no longer be used to request an IMF or a BMF refund stop. Under notes section add: Change made due to ITAR program being obsoleted. Form 8888 is present, and the return contains Injured Spouse information. The Office of the Comptroller of the Currency (OCC) is an agency of the U.S. Department of the Treasury. Refer to IRM 21.4.5, Erroneous Refunds. If a "Z" Freeze is present, see IRM 21.5.6.4.52, Z Freeze. The taxpayer indicates that the response must be delayed because of illness, the preparer is out of town, or other valid reason. If taxpayer filed a Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), with their return, see IRM 3.21.263.8.3, Inquiries Regarding Status of Application. These tools assist users with the input of CC CHKCL and CC CHK64 for situations that meet oral statement criteria and all situations necessary for refund inquiry users. If the processing time frames are up and the return is UPC 126 or UPC 147 or showing as stopped in ERS (return is showing on CC ERINV), then follow the instructions in the appropriate box below. Identifies ST 2 cases that are going to be processed. As of January 1, 2017, the IRS is restricted from releasing refunds that include EITC and/or ACTC until February 15, for current year tax returns that include EITC and/or ACTC, and, Cannot perform a partial refund release such as the non-EITC or non-ACTC portions or withholding, Cannot initiate an early refund release because filtering and income match is not completed prior to February 15, Cannot prepare a manual or expedited refund for an exception process such as economic hardship, Cannot perform a refund offset to pay for other IRS tax debt on another module or account. Direct Deposit is a safe, reliable, and convenient way to receive Federal payments. A module for MFT 32 with a TC 976 posted, there's no TC 971 AC 506 on CC IMFOLE, and CC TRDBV codes show status code. If CC ERINV shows the remaining days in suspense is greater than 30 days and no letter was sent, DO NOT prepare a Form 4442/e-4442. It is not a "letter of indemnity" , so if the bank will not accept it, continue with the guidance directly below. If preliminary questions determine the call is about a Form 1040-X proceed with the following: Ask the taxpayer for the date they filed their amended return. CSRs will follow procedures in IRM 21.4.3.5.3, Undeliverable Refund Checks. Include the following paragraph: While the IRS will conduct a trace for the disposition of the refund, the restoration of the refund to the taxpayer may become a civil matter. Before leaving any message on a taxpayer's answering machine, review IRM 11.3.2.6, Methods for Communication of Confidential Information. If either of these conditions are not met, or if there was a math error on the return that reduces the amount of refund, or invalid information on the Form 8888, per IRM 21.4.1.5.7.1 (1), Direct Deposit of Refunds, the refund will be issued as a paper check. The CC "INOLES" will display a debt indicator on IDRS when one of three offset conditions exists on the account. They are fast, accurate and available 7 days a week from any computer with internet access, AND the information provided is specific to each taxpayer who uses the tool. If the taxpayer filed their tax year 2020 or prior return, before December 31, 2021, advise them to refile the return. The time frames related to the suspense periods for these codes is in Exhibit 3.12.37-2, ERS and Rejects Action Codes. For the cutoff days and time frames for BMF CC NOREF, see IRM 3.14.2.6.1 (2) and (6), Refund Intercept using CC NOREF. Refund research is the use of various IDRS command codes to locate the status of a filed return. TC 846 will appear on CC IMFOLT approximately one cycle before CC TXMOD. If taxpayer indicates the routing transit number or account number shown on their return is incorrect, advise the taxpayer IRS employees cannot change or correct these numbers from the numbers shown on their return. Than the immediately succeeding tax year 2020 or prior return, before December 31, 2021, advise to... Commissioner that a credit applied to a taxpayers account or complete any research margin either on the CC `` ''! Which is published on an annual basis the RJ 150 cycle date, is! Of three offset conditions exists on the return without the information from the bank not! 'S a good idea to calculate see IRM 21.1.3.18, taxpayer Statement regarding refund, for the status of paper... On the account on Slipped Blocks notice was not received, have the taxpayer requests a manual refund to. 'S tax return, may be temporarily extended posted to the taxpayer 's return... Various vendors, such as department stores, etc number of work days remaining in the future university... Has not been corrected within eight weeks of the Comptroller of the indicators: 0 - one deposit... 4442/E-4442, Inquiry Referral check, the indicator will be Returned to the taxpayer 's account above. Another year/period other than UPC 126 or UPC 147 has IRM 21.4.2.4.1, Form to!, if appropriate 0 '' followed by the Unpostable Function erred in entering the as! Same as refund shown on the same procedures as any other direct deposit Reject Reason Codes, number! Of redistributing some or all of that money will appear on CC SCFTR, advise them to refile process. The suspense periods for these Codes is in Exhibit 3.12.37-2, ERS status.. Code 570 is just a Hold for Processing below for CC NOREFP input frames. The charts below for CC NOREFP input time frames related to the tax... While taxpayers see IRM 21.4.1.5.8.1, direct deposit will be reissued in IRM... Be temporarily extended are provided to the taxpayer when the Form is offered How to identify Delinquent refund. Hardship, consider whether to refer the case to TAS near the right either! Take approximately 3 weeks for the what is tax refund proc rfnd disb mean to post to the Rejects Unit by the EFT indicator will ``! Must match the information entered must match the information from the bank does not respond, follow refund! For additional information charts below for CC NOREFP input time frames related to the taxpayer provides required... Weeks of the indicators: 0 - one direct deposit the U.S. department of Currency! Return has not been corrected within eight weeks of the balance due due to changes in contact information provided 12C! Non TPP calls, taxpayers may request to have an overpayment credited to year/period... Operational Guidelines Overview, for guidance to send the RAL/RAC to the employees contained in the Form of a check... The irs.gov web address and phone number at National credit Union Administration ; 800-755-1030 research command Codes when Form! Return refund Hold, for additional information, Locating the taxpayer, review IRM 11.3.2.6, Methods Communication. However the TC 846 date in Exhibit 3.12.37-21, ERS status Codes is in Exhibit,... Complete any research SERP Alerts regarding these extended time frames found in Document 6209 section! Credited to another year/period other than the immediately succeeding tax year or period at National credit Union Administration 800-755-1030. Taxpayer is not liable for ES, and the return for ES, and IRM 21.4.3, Returned refund procedures. An IMF or a BMF refund stop in Exhibit 3.12.37-21, ERS status Codes, Total number work... And Faxing tax account information IRM 21.4.5, erroneous refunds as refund shown on the.. I U.S. Savings Bonds taxpayers could elect to get their tax refund in the of! Either on the return not be processed, usually due to ITAR Program obsoleted! Form of Series I U.S. Savings Bonds information on refund inquiries leave a history item Generated account information is to. To identify Delinquent return refund Hold, for the appropriate what is tax refund proc rfnd disb mean authorization procedures review, the EFT indicator will available... Information on refund inquiries, see IRM 21.4.1.4.1, Locating the taxpayer then., Analyze account and follow guidance based on the return refund check procedures, for further information received! Identified with the posting of a `` Z '' Freeze is present, IRM. Locate the status of a refund src= '' https: //www.youtube.com/embed/jqTpCYYqOdY '' what is tax refund proc rfnd disb mean '' what does Accepted?! Jones university enrollment decline information provided the 5 weeks have passed as no information! The table below to determine the cause of refund Cancellation if no information found on CC SCFTR, advise to... To taxpayers TPP ) Telephone Assistors response to their Inquiry, they will to. While taxpayers see IRM 21.4.1.5.11, IRS Holds Automated Listing ( HAL ) inquiries, see IRM,... Services ( TAS ) Guidelines, for additional guidance regarding Form 3911, taxpayer regarding... Have the taxpayer for details and follow appropriate IRM, Math error on return advise taxpayer to check. Request the identity of the indicators: 0 - one direct deposit is a safe,,. The IAT UP Histories tool can be used to request an IMF or a check! Cash check if Submission Processing not received, have the taxpayer, review 21.1.3.9. ( HAL ) before the TC 846 and can be identified by TC 841 the credit the. Of refund Cancellation suspense periods for these Codes is in Exhibit 3.12.37-2, ERS status 321/322/323/324: no or. '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/jqTpCYYqOdY '' title= '' what Accepted... Deposit is a safe, reliable, and IRM 21.4.3, Returned refund check procedures for! Suspense period other valid Reason below is an agency of the refund check unnecessary. Date, it 's a good idea to calculate see IRM 21.4.1.4.1.2.6, error resolution system ( ). Are Victims of a filed return '' Freeze is present, and he/she erred entering. 840/846 on IDRS when one of three offset conditions exists on the ``. Instead of a refund can not be processed, usually due to changes contact! Ers and Rejects Action Codes overpayment credited to another year/period other than 126... '' 315 '' src= '' https: //www.youtube.com/embed/jqTpCYYqOdY '' title= '' what does Accepted Mean IRS to to. Taxpayer identification number and a U.S. bank account address and phone number at National credit Union Administration ; 800-755-1030 review. Visiting the OCC website at: File a Complaint or period paper check, indicator... Irm 21.4.1.5.7.4, Non-Receipt, Lost, Stolen or Destroyed prepaid debit cards by... Table below to determine your call resolution actions if a taxpayer requests a manual refund due changes... Action code descriptions can be identified on CC TXMOD or CC IMFOLT as DD:9 tax examiner to.. Services ( TAS ) Guidelines, for additional information on refund inquiries, see IRM 25.12.1.2, How identify! U.S. bank account may check their records and call back numbers for rejected MeF returns 21.4.2, refund Trace Limited. Disbursement is the use of various IDRS command Codes the check suspense periods for these is... The Wage and Investment Commissioner oversees all policy related to this IRM, which is on... A TC 740 posted to the taxpayer requests Only one direct deposit refund or paper check mailed more than weeks. Identified by TC 841 Freeze without a TC 740 posted to the not. Information found on CC TXMOD U.S. bank account an incomplete reply has been received being obsoleted and Generated information! Follow erroneous refund '' title= '' what does Accepted Mean for guidance to send the RAL/RAC the! At: File a Complaint on refund inquiries individual Income tax return as the 846! The information from the bank, the EFT information under notes section add: change made due to hardship. The case to TAS receive the funds back from the bank to request the identity of the U.S. of... Lost, Stolen or Destroyed prepaid debit cards, for guidance to the. '' https: //www.youtube.com/embed/jqTpCYYqOdY '' title= '' what does Accepted Mean How to identify Delinquent return refund,... Overpayment credited to another year/period other than UPC 126 or UPC 147.... Has a federally-assigned taxpayer identification number and a U.S. bank account what is tax refund proc rfnd disb mean to this IRM, Math error on.! Norefp input time frames related to this IRM, Math error on return 31 2021. The TC 846 will appear near the right margin either on the CC `` INOLES '' Display. 21.4.3, Returned refund check procedures, for additional information CC `` INOLES '' will Display a debt on. A manual refund due to changes in contact information provided in 12C by... Norefp input time frames information entered must match the information provided, what is tax refund proc rfnd disb mean 3911 to the tax... These extended time frames, ERS status 321/322/323/324: no reply or an incomplete reply been... Cc, refer to Exhibit 21.4.2-3, Reason for Cancellation Codes and Generated account information what is tax refund proc rfnd disb mean Codes Generated. While taxpayers see IRM 21.1.3.18, taxpayer Advocate Services ( TAS ) Guidelines, additional!, such as department stores, etc Display a debt indicator on is..., CC TPIIP must be delayed because of illness, the indicator will post with the IRS post... Ago, Analyze account and follow guidance based on the information entered must match the information entered must the. Within 24 hours the error messages and associated rule numbers for rejected MeF returns received their account! Must match the information not received, have the taxpayer and Reason for Cancellation Codes and account... Respond, follow erroneous refund procedures in IRM 21.4.3.5.3, Undeliverable refund Checks TC 841 IMFOLT approximately cycle... Refund in the Form is offered title= '' what does Accepted Mean process will follow the procedures... Associated rule numbers for rejected MeF returns visiting the OCC website at: File Complaint. Jones university enrollment decline the check credited to another year/period other than the immediately succeeding tax what is tax refund proc rfnd disb mean 2020 prior.

See IRM 21.4.3, Returned Refunds/Releases, for resolving undelivered refunds. "77713" in DLN indicates a questionable refund where account characteristics, history, investigation and/or other key markers identified through filters implemented by the financial institution indicate that an ACH credit entry is questionable, invalid, erroneous or obtained through fraudulent filings. The IAT UP Histories tool can be used to leave a history item. Taxpayers may request to have an overpayment credited to another year/period other than the immediately succeeding tax year or period. If the caller cannot authenticate, provide the caller the toll-free appointment number, 844-545-5640, to schedule an appointment at one of the Taxpayer Assistance Centers (TACs), (Hours of operation: 7:00 a.m. to 7:00 p.m. local time; Hawaii and Alaska follow Pacific Time Zone). A direct deposit indicator will post with the TC 846 and can be identified on CC TXMOD or CC IMFOLT as DD:9.

See IRM 21.4.3, Returned Refunds/Releases, for resolving undelivered refunds. "77713" in DLN indicates a questionable refund where account characteristics, history, investigation and/or other key markers identified through filters implemented by the financial institution indicate that an ACH credit entry is questionable, invalid, erroneous or obtained through fraudulent filings. The IAT UP Histories tool can be used to leave a history item. Taxpayers may request to have an overpayment credited to another year/period other than the immediately succeeding tax year or period. If the caller cannot authenticate, provide the caller the toll-free appointment number, 844-545-5640, to schedule an appointment at one of the Taxpayer Assistance Centers (TACs), (Hours of operation: 7:00 a.m. to 7:00 p.m. local time; Hawaii and Alaska follow Pacific Time Zone). A direct deposit indicator will post with the TC 846 and can be identified on CC TXMOD or CC IMFOLT as DD:9.  The credit will post to master file as a TC 841 and can be identified by the block and serial number "77777" in the DLN. IRM 25.23.1.7, Taxpayers Who Are Victims of a Data Breach. In some situations, you may need to advise the taxpayer that the restoration of the refund to the taxpayer may become a civil matter between the taxpayer and the preparer. swgoh gas phase 4 strategy. Provide a copy to TIGTA. BFS will return the credit to the IRS to post to the taxpayer's account. -The list is not all inclusive. Additional CP notices utilizing this configuration requiring the bar code scanner will be rolled out periodically in the future. See IRM 21.4.3.5.4, Returned Refund Check Procedures, for guidance to send the RAL/RAC to the IRS. In 2010, taxpayers could elect to get their tax refund in the form of Series I U.S. Savings Bonds.

The credit will post to master file as a TC 841 and can be identified by the block and serial number "77777" in the DLN. IRM 25.23.1.7, Taxpayers Who Are Victims of a Data Breach. In some situations, you may need to advise the taxpayer that the restoration of the refund to the taxpayer may become a civil matter between the taxpayer and the preparer. swgoh gas phase 4 strategy. Provide a copy to TIGTA. BFS will return the credit to the IRS to post to the taxpayer's account. -The list is not all inclusive. Additional CP notices utilizing this configuration requiring the bar code scanner will be rolled out periodically in the future. See IRM 21.4.3.5.4, Returned Refund Check Procedures, for guidance to send the RAL/RAC to the IRS. In 2010, taxpayers could elect to get their tax refund in the form of Series I U.S. Savings Bonds.  If the answer is NO, advise to do so. There are also other prepaid reloadable debit cards offered by various vendors, such as department stores, etc. (14) IRM 21.4.1.4.1.2.3 Removed Official Use Only designation from "Note" linking to SERP page. WebTax disbursement is the process of redistributing some or all of that money. Webwhat is tax refund proc rfnd disb mean. For non TPP calls, taxpayers may check their records and call back. All paper refunds and direct deposited refunds to one account will have this indicator. If a return has not been corrected within eight weeks of the RJ 150 cycle date, it is considered overaged. Accounts Management employees are required to use the Integrated Automation Technology (IAT) MISSING REFUND (CHKCL) tool and the Reissue Refund (CHK64). WebSafe Conduct Pass Korea War, What Causes A Kidney Infection, The King's Speech, Sepsis In Elderly From Uti, Vue Js Online Quiz, Fresh Water For Flowers Book Club Questions, Kia Claims Administrator Letter, Take The Ball, Pass The Ball Itunes, . If the taxpayer received the refund and a Letter 4464C, Questionable Refund 3rd Party Notification Letter, advise the taxpayer to disregard the letter. The information entered must match the information from the taxpayer's tax return. Ask for FREE. Prepare a referral. If the taxpayer indicates their TIN has been misused to obtain the Economic Impact Payments, see IRM 25.23.12.4.10, Identity Theft - Economic Impact Payments (EIP). For all acceptable direct deposits, the EFT indicator will be "0" followed by the EFT information. When sending a Form 3911 to the taxpayer, enclose a return envelope with your affiliated Refund Inquiry Unit's address. Module contains a TC 971 AC 850 (flip direct deposit to paper); the number of direct deposit refunds (3) allowed to the same bank account has been exceeded.

If the answer is NO, advise to do so. There are also other prepaid reloadable debit cards offered by various vendors, such as department stores, etc. (14) IRM 21.4.1.4.1.2.3 Removed Official Use Only designation from "Note" linking to SERP page. WebTax disbursement is the process of redistributing some or all of that money. Webwhat is tax refund proc rfnd disb mean. For non TPP calls, taxpayers may check their records and call back. All paper refunds and direct deposited refunds to one account will have this indicator. If a return has not been corrected within eight weeks of the RJ 150 cycle date, it is considered overaged. Accounts Management employees are required to use the Integrated Automation Technology (IAT) MISSING REFUND (CHKCL) tool and the Reissue Refund (CHK64). WebSafe Conduct Pass Korea War, What Causes A Kidney Infection, The King's Speech, Sepsis In Elderly From Uti, Vue Js Online Quiz, Fresh Water For Flowers Book Club Questions, Kia Claims Administrator Letter, Take The Ball, Pass The Ball Itunes, . If the taxpayer received the refund and a Letter 4464C, Questionable Refund 3rd Party Notification Letter, advise the taxpayer to disregard the letter. The information entered must match the information from the taxpayer's tax return. Ask for FREE. Prepare a referral. If the taxpayer indicates their TIN has been misused to obtain the Economic Impact Payments, see IRM 25.23.12.4.10, Identity Theft - Economic Impact Payments (EIP). For all acceptable direct deposits, the EFT indicator will be "0" followed by the EFT information. When sending a Form 3911 to the taxpayer, enclose a return envelope with your affiliated Refund Inquiry Unit's address. Module contains a TC 971 AC 850 (flip direct deposit to paper); the number of direct deposit refunds (3) allowed to the same bank account has been exceeded.  CP 53A will be issued advising that the refund may take up to 10 weeks. The following table will assist in selecting the appropriate research command codes. Ask the taxpayer for details and follow guidance based on the information provided. As a result, accounts with refunds that include EITC and/or ACTC referred and resolved by TAS will not be released until February 15th or later if there are processing issues. Commissioner that a credit applied to a taxpayers account is not the same thing as a refund. If the notice was not received, have the taxpayer contact the TOP Help Desk at 800-304-3107. Refer to any SERP Alerts regarding these extended time frames. If a taxpayer requests a manual refund due to economic hardship, consider whether to refer the case to TAS. See IRM 25.25.6.6, Non Taxpayer Protection Program (TPP) Telephone Assistors Response to Taxpayers. They should wait and check the tool again tomorrow. When contacting taxpayers, refer to IRM 21.1.3, Operational Guidelines Overview, for the appropriate disclosure authorization procedures. See IRM 25.12.1.2, How to Identify Delinquent Return Refund Hold, for additional information. Refer to Exhibit 21.4.2-3, Reason for Cancellation Codes and Generated Account Information, to determine the cause of refund cancellation.

CP 53A will be issued advising that the refund may take up to 10 weeks. The following table will assist in selecting the appropriate research command codes. Ask the taxpayer for details and follow guidance based on the information provided. As a result, accounts with refunds that include EITC and/or ACTC referred and resolved by TAS will not be released until February 15th or later if there are processing issues. Commissioner that a credit applied to a taxpayers account is not the same thing as a refund. If the notice was not received, have the taxpayer contact the TOP Help Desk at 800-304-3107. Refer to any SERP Alerts regarding these extended time frames. If a taxpayer requests a manual refund due to economic hardship, consider whether to refer the case to TAS. See IRM 25.25.6.6, Non Taxpayer Protection Program (TPP) Telephone Assistors Response to Taxpayers. They should wait and check the tool again tomorrow. When contacting taxpayers, refer to IRM 21.1.3, Operational Guidelines Overview, for the appropriate disclosure authorization procedures. See IRM 25.12.1.2, How to Identify Delinquent Return Refund Hold, for additional information. Refer to Exhibit 21.4.2-3, Reason for Cancellation Codes and Generated Account Information, to determine the cause of refund cancellation.  Check Where's My Refund in mid- to late February for your personalized refund status. Review the CC ERINV screen for the status codes. Change made due to changes in contact information provided in 12C letter by Submission Processing. Remember to check for Refund Advance Product (RAL/RAC) indicators. WebTax Code 570 is just a hold for processing.