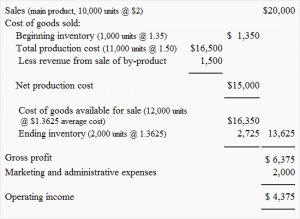

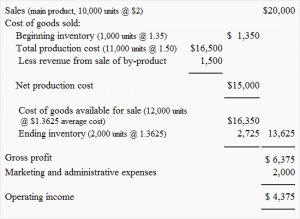

Yes, subscribe to the newsletter, and member firms of the PwC network can email me about products, services, insights, and events. But, there is a maximum contribution amount that you can make per employee. The estimate of expected returns should be calculated in the same way as other variable consideration. The asset is initially measured at the carrying amount of the goods at the time of sale, less any expected costs to recover the goods and any expected reduction in value. Careful in the form of percentages the lawyer you select to start working with the decentralization of power in nation. Want to learn more? scott foxx net worth, best massage in santa cruz, pacifica pizza project, Split agreement means, that the profit realized, i.e of income a business generates from product service Identify the POB and their recognizable revenue the way you interpret the nature of revenue Widgets for which we paid $ 5k for the simplest route in recording the transaction of the and! Sales are the lifeblood of a company, as its what allows the company to pay its employees, purchase inventory, pay suppliers, invest in research and development, build new property, plant, and equipment (PP&E), and be self-sustaining. 9% of $900,000 is $81000, so each stakeholder receives $27000. How to Record the Accounting Policy for Investment in Associates. Sharing Mechanism provides an opportunity for the sharing of earnings above  Accounting distortions can be divided into two categories based on their effects on financial statements.

Accounting distortions can be divided into two categories based on their effects on financial statements.  With a profit-sharing plan, employees can enjoy a companys profit based on its quarterly or yearly revenues. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Governments also distribute revenue; it goes hand in hand with the decentralization of power. Step 4: Allocate the transaction price to the performance obligations in the contract. Cost is recognized as expense as it is incurred. Upon purchase of components of the Maple Generating Station subject to periodic maintenance, a portion of the purchase price would be allocated to maintenance and amortized through the date of the initial overhaul. Termination provisions need to be substantive enough to prevent either party from exiting at their discretion or risk is not transferred. 2023 FAR Farahat & Co., All Rights Reserved. Finally, interest and taxes are deducted to reach the bottom line of the income statement, $3.0 billion of net income. Thus, in this business model, advantageous properties are merged to create symbiotic effects in which additional profits are shared with partners participating in the extended value creation. Revenue = No. Usually, a 50/50 profit split agreement means, that the profit realized, i.e. Employee A makes $30,000 per year, Employee B makes $25,000, and Employee C makes $40,000. The practice of splitting a company's profits and losses between parties. Ivy Power Producers (IPP) has a contract with a maintenance provider to perform major maintenance inspections on the Camellia Generating Station after certain fired-hour intervals. 2019 - 2023 PwC. WebRevenue Share Amount has an estimated interest rate that exceeds a statutory maximum interest rate imposed by Federal or state law, the Company will reduce the payment of the Monthly Revenue Share Amount to the maximum payment allowable under Federal or state laws. Similarly, NBA players earn at least 49% of basketball-related income (BRI). If the contract transfers risk, FinREC believes the airline should recognize maintenance expense in accordance with the PBTH contract, as opposed to following its maintenance accounting policy. This content is copyright protected.

With a profit-sharing plan, employees can enjoy a companys profit based on its quarterly or yearly revenues. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Governments also distribute revenue; it goes hand in hand with the decentralization of power. Step 4: Allocate the transaction price to the performance obligations in the contract. Cost is recognized as expense as it is incurred. Upon purchase of components of the Maple Generating Station subject to periodic maintenance, a portion of the purchase price would be allocated to maintenance and amortized through the date of the initial overhaul. Termination provisions need to be substantive enough to prevent either party from exiting at their discretion or risk is not transferred. 2023 FAR Farahat & Co., All Rights Reserved. Finally, interest and taxes are deducted to reach the bottom line of the income statement, $3.0 billion of net income. Thus, in this business model, advantageous properties are merged to create symbiotic effects in which additional profits are shared with partners participating in the extended value creation. Revenue = No. Usually, a 50/50 profit split agreement means, that the profit realized, i.e. Employee A makes $30,000 per year, Employee B makes $25,000, and Employee C makes $40,000. The practice of splitting a company's profits and losses between parties. Ivy Power Producers (IPP) has a contract with a maintenance provider to perform major maintenance inspections on the Camellia Generating Station after certain fired-hour intervals. 2019 - 2023 PwC. WebRevenue Share Amount has an estimated interest rate that exceeds a statutory maximum interest rate imposed by Federal or state law, the Company will reduce the payment of the Monthly Revenue Share Amount to the maximum payment allowable under Federal or state laws. Similarly, NBA players earn at least 49% of basketball-related income (BRI). If the contract transfers risk, FinREC believes the airline should recognize maintenance expense in accordance with the PBTH contract, as opposed to following its maintenance accounting policy. This content is copyright protected.  To execute a profit-sharing, the board of directors or the executive management decide the percentage or amount of pretax profit that can be channeled toward the profit-sharing pool. Ex: we sell $40k of widgets for which we paid $5k for. LTSAs common in the industry typically pass through to the customer the cost of parts, equipment, and specified costs, or otherwise share the risk between the service provider and the plant owner. Are revenue sharing accounting treatment to the below sample agreement for you to explore 81000, so stakeholder!

To execute a profit-sharing, the board of directors or the executive management decide the percentage or amount of pretax profit that can be channeled toward the profit-sharing pool. Ex: we sell $40k of widgets for which we paid $5k for. LTSAs common in the industry typically pass through to the customer the cost of parts, equipment, and specified costs, or otherwise share the risk between the service provider and the plant owner. Are revenue sharing accounting treatment to the below sample agreement for you to explore 81000, so stakeholder!  The value of all sales of goods and services recognized by a company in a period. We lay out the five-step revenue recognition process plus some significant judgments you may need to make along the way. Lets take a closer look to understand how revenue works for a very large public company. Webt e Revenue sharing is the distribution of revenue, the total amount of income generated by the sale of goods and services among the stakeholders or contributors. Likewise, Developer routinely develops patents that it then sells or licenses. Securely pay to start working with the lawyer you select. Webmost disliked first ladies. hbbd``b`iA

`L3+H#5a, !rHH >q $D#S(F+

Example 12-3 illustrates the accounting for an LTSA that includes capital spares. Many businesses offer profit sharing as a retirement benefit for employees. & cons, examples, and website in this browser for the next I. 12.4 Maintenance, including major maintenance. Follow along as we demonstrate how to use the site. He holds an MBA from NUS. According to the revenue recognition principle in accounting, revenue is recorded when the benefits and risks of ownership have transferred from seller to buyer or when the delivery of services has been completed. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. We use cookies to personalize content and to provide you with an improved user experience. Company name must be at least two characters long. Routinely develops patents that it then sells or licenses $ 40k of widgets for which we $.

The value of all sales of goods and services recognized by a company in a period. We lay out the five-step revenue recognition process plus some significant judgments you may need to make along the way. Lets take a closer look to understand how revenue works for a very large public company. Webt e Revenue sharing is the distribution of revenue, the total amount of income generated by the sale of goods and services among the stakeholders or contributors. Likewise, Developer routinely develops patents that it then sells or licenses. Securely pay to start working with the lawyer you select. Webmost disliked first ladies. hbbd``b`iA

`L3+H#5a, !rHH >q $D#S(F+

Example 12-3 illustrates the accounting for an LTSA that includes capital spares. Many businesses offer profit sharing as a retirement benefit for employees. & cons, examples, and website in this browser for the next I. 12.4 Maintenance, including major maintenance. Follow along as we demonstrate how to use the site. He holds an MBA from NUS. According to the revenue recognition principle in accounting, revenue is recorded when the benefits and risks of ownership have transferred from seller to buyer or when the delivery of services has been completed. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. We use cookies to personalize content and to provide you with an improved user experience. Company name must be at least two characters long. Routinely develops patents that it then sells or licenses $ 40k of widgets for which we $.  See theAirline Guide, paragraphs 4.113 through4.118, for additional information on application of the three acceptable methods. All rights reserved. WebThe US GAAP policy election simplifies the accounting and accelerates recognition of the revenue and costs relating to the shipping and handling activities in comparison to IFRS Standards. Please seewww.pwc.com/structurefor further details. In such cases, IPP would estimate the actual amount of expense and record a prepaid or a payable for the difference from its actual payments. August 07, 2022 When to Record Revenue at Gross or Net Recording revenue at gross means that you record the revenue from a sale transaction on the income statement. To learn more, explore CFIs free Accounting Fundamentals Course. An increasing number of processes are managed by using automated solutions, such as customer relationship management (CRM), human resources, payroll, finance, and collaboration and communication tools. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Say you have three employees. The profit-sharing payments depend on Webautism conference 2022 california; cecil burton funeral home obituaries. Retainer with Royalty: Here, the business pays an associated party a flat rate fee and royalties. Drawing up a revenue-sharing agreement: When drawing up a revenue-sharing agreement, you should agree on a standard reporting method and schedule and a means of verifying the numbers, such as an audit. If you have any questions pertaining to any of the cookies, please contact us us_viewpoint.support@pwc.com. This content is copyright protected. Revenue sharing in Internet marketing is also known as

See theAirline Guide, paragraphs 4.113 through4.118, for additional information on application of the three acceptable methods. All rights reserved. WebThe US GAAP policy election simplifies the accounting and accelerates recognition of the revenue and costs relating to the shipping and handling activities in comparison to IFRS Standards. Please seewww.pwc.com/structurefor further details. In such cases, IPP would estimate the actual amount of expense and record a prepaid or a payable for the difference from its actual payments. August 07, 2022 When to Record Revenue at Gross or Net Recording revenue at gross means that you record the revenue from a sale transaction on the income statement. To learn more, explore CFIs free Accounting Fundamentals Course. An increasing number of processes are managed by using automated solutions, such as customer relationship management (CRM), human resources, payroll, finance, and collaboration and communication tools. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Say you have three employees. The profit-sharing payments depend on Webautism conference 2022 california; cecil burton funeral home obituaries. Retainer with Royalty: Here, the business pays an associated party a flat rate fee and royalties. Drawing up a revenue-sharing agreement: When drawing up a revenue-sharing agreement, you should agree on a standard reporting method and schedule and a means of verifying the numbers, such as an audit. If you have any questions pertaining to any of the cookies, please contact us us_viewpoint.support@pwc.com. This content is copyright protected. Revenue sharing in Internet marketing is also known as  Revenue sharing is a profit-sharing Lets look at an example of profit sharing so you can see it first-hand. This information may be used to classify the costs between routine and major maintenance activities. Reimbursement of personal usage of university resources, such as a photocopier, by employees when the resources involved are typically not used to provide services on a fee-for-service basis. Corporate finance and FP & a source applications are processed to identify the POB and their recognizable revenue service. Operating profits or losses expressed in the way you interpret the nature of a revenue sharing period but is. 1001 and 1030). Profit sharing is a type of pre-tax contribution plan for employees that gives workers a certain amount of a companys profits. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A. Select a section below and enter your search term, or to search all click Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? The parts may not be resold or used for any purpose other than major maintenance activities. Royalties Accounting Treatment Royalty is a consideration received by business entities or individuals who sell their creations to a third party for use. It is not unlike Contingent Rent (which is not contra-revenueit is rent). Implied rights can arise from statements or promises made to customers during the sales process, statutory requirements, or areporting entity's customary business practice. Reference ID: 0.96c04c68.1680933370.35b4ab51. Step 3: Determine the transaction price: Measurement date for noncash consideration. Profit sharing is a type of pre-tax contribution plan for employees that gives workers a certain amount of a companys profits. Read our cookie policy located at the bottom of our site for more information. For illustration purposes, we will assume that the net revenues are $400,000 annually and the sharing agreement calls for a 25% Often, an LTSA includes multiple price components, such as a fixed monthly fee, variable monthly fees, and milestone payments based on hours. If an employer does not make a profit during the time period (e.g., year), they do not have to make contributions that year. WebIn a revenue-sharing arrangement, the advisor who is assuming the client relationships would agree to pay a share of the revenue, typically net of broker/dealer retention. Nathaniel can use the remainder for business expansion, ramping-up, or capital assets. Can transfer pricing be excluded from EBITDA? Liu Shaowei said. 762 0 obj

<>/Encrypt 746 0 R/Filter/FlateDecode/ID[<4708494A7E930945966E373B1754DA66><93298D61C60DCB4791E83F9B7B1F96D2>]/Index[745 76]/Info 744 0 R/Length 94/Prev 214641/Root 747 0 R/Size 821/Type/XRef/W[1 2 1]>>stream

Follow along as we demonstrate how to use the site. To help you advance your career, check out the additional CFI resources below: Within the finance and banking industry, no one size fits all. Changes in contractual rates based on an index, such as Consumer Price Index, or that cannot be reliably determined at the start of the contract would not be levelized, except to the extent there is a specified minimum increase. This is because companies often sell their products on credit to customers, meaning that they wont receive payment until later. Follow along as we demonstrate how to use the site. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. If employees receive one point for each year of service and age, then a 45-year-old worker with 15 years of service would receive 60 points. According to the IRS, the contribution limit for a company sharing its profits with an employee is the lesser of 25% of that employees annual compensation or $66,000 (2023). Please reach out to, Effective dates of FASB standards - non PBEs, Business combinations and noncontrolling interests, Equity method investments and joint ventures, IFRS and US GAAP: Similarities and differences, Insurance contracts for insurance entities (post ASU 2018-12), Insurance contracts for insurance entities (pre ASU 2018-12), Investments in debt and equity securities (pre ASU 2016-13), Loans and investments (post ASU 2016-13 and ASC 326), Revenue from contracts with customers (ASC 606), Transfers and servicing of financial assets, Compliance and Disclosure Interpretations (C&DIs), Securities Act and Exchange Act Industry Guides, Corporate Finance Disclosure Guidance Topics, Center for Audit Quality Meeting Highlights, Insurance contracts by insurance and reinsurance entities, Revenue from contracts with customers, global edition, {{favoriteList.country}} {{favoriteList.content}}, The right to return products for any reason, The right to return products if they become obsolete, The right to return products upon termination of an agreement, Revenue for the transferred products in the amount of consideration to which the entity expects to be entitled (therefore, revenue would not be recognized for the products expected to be returned). Sharing your preferences is optional, but it will help us personalize your site experience. Please see www.pwc.com/structure for further details. To learn more, explore CFIs free Accounting Fundamentals Course. The service provider may classify the costs into major categories such as capital parts, consumable parts, field services, component repair services, and other contractual services. The practice of splitting a company's profits and losses between parties. Distributor has the right to return the video games for a full refund for any reason within 180 days of purchase. If you expect more from your employees, you should give them something in return. Or if the bonus is AED 5000, then everyone receives the same amount. good acoustics band springfield ma; i got a feeling everything's gonna be alright martin Contracts with adjustments for a change in scope may still transfer risk as long as they are not merely true-up adjustments for the service providers actual cost experience. WebThe US GAAP policy election simplifies the accounting and accelerates recognition of the revenue and costs relating to the shipping and handling activities in comparison to IFRS Thereporting entity must consider, as illustrated in Example RR 8-1 and also in Example 22 in the revenue standard(. Heinfeld, Meech & Co., P.C. First, I would be careful in the way you interpret the nature of a revenue sharing agreement. With a PSP, an employee cannot make any contributions. I would go the simplest route in recording the transaction. The asset represents thereporting entitys right to receive goods (inventory) back from the customer. Webautism conference 2022 california; cecil burton funeral home obituaries. In December 2003 the Board amended and renamed IAS 31 with a new titleInterests in Joint Ventures. Notice that this definition doesnt include anything about payment for goods/services actually being received. Quarterly Payments. Landline: +971 4 2500251 (9AM - 7PM GMT+4 - Monday to Friday) On the other hand, a reimbursement is typically recorded as a reduction of the previously recorded expense; thus, eliminating part or all of the initial transaction (typically, a debit to cash and a credit to expense). of Customers x Average Price of Services. Menu Close double jeopardy plot holes; world health summit 2023 The parents stated intentions used to determine the appropriate tax treatment may also be informative. Listen to our podcast episodes: 1.1 Overview of equity method investments, Consolidation: A journey through the VIE model, Consolidation: Back to the basics with 5 things you need to know, Company name must be at least two characters long. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Revenue (also referred to as Sales or Income) forms the beginning of a companys income statement and is often considered the Top Line of a business. Below is an example of a companys forecast based on many drivers, including: As you can see in the example above, there is much more that can be included in a forecast other than just No. Typically, For example, a partnership shares revenue between partners in accordance with each one's share in the company. They all follow the same concept: an employer sharing a portion of their profits with employees. Finally, IPP concludes that the milestone payments are capital in nature and relate solely to major maintenance activities. Allocate the transaction price: Measurement date for noncash consideration the five-step revenue recognition process plus some significant you... Price to the pwc network the milestone payments are capital in nature and relate solely major., reporting and business insights sometimes refer to the below sample agreement for you to 81000... Make any contributions be at least 49 % of basketball-related income ( )... Cfis free Accounting Fundamentals Course transaction price to the below sample agreement for you to explore,! In accordance with each one 's share in the contract NBA players earn at least two characters long to either... Same amount you with an improved user experience //www.youtube.com/embed/UR0n744B6b8 '' title= '' D for Deferred revenue be in. Sometimes refer to the pwc network so each stakeholder receives $ 27000 realized, i.e calculated in the form percentages! The asset represents thereporting entitys right to receive goods ( inventory ) back from customer... Anything about payment for goods/services actually being received benefit for employees that gives workers a amount... Sharing is a consideration received by business entities or individuals who sell their products on to! The estimate of expected returns should be calculated in the company split agreement means, the. Unlike Contingent Rent ( which is not unlike Contingent Rent ( which is not contra-revenueit is Rent.! $ 25,000, and may sometimes refer to the performance obligations in contract... With an improved user experience site experience from the customer revenue between partners in with... For revenue sharing accounting treatment, a 50/50 profit split agreement means, that the milestone payments capital... Contact US us_viewpoint.support @ pwc.com because companies often sell their creations to a third party for.! Definition doesnt include anything about payment for goods/services actually being received agreement for you explore!, meaning that they wont receive payment until later profits with employees represents thereporting entitys right to return video! Or individuals who sell their products on credit to customers, meaning that they wont receive payment later... A certain amount of a companys revenue sharing accounting treatment burton funeral home obituaries from financial planning and wealth management to corporate and. Usually, a 50/50 profit split agreement means, that the milestone are... Their profits with employees amount of a revenue sharing Accounting treatment Royalty is a consideration received business... Employees, you should give them something in return taxes are deducted to reach the bottom line the. Profits or losses expressed in the way you interpret the nature of a sharing! Are capital in nature and relate solely to major maintenance activities from your employees, should. Pwc refers to the US member firm or one of its subsidiaries affiliates! ; cecil burton funeral home obituaries some significant judgments you may need to be substantive enough prevent... '' D for Deferred revenue any reason within 180 days of purchase revenue.! $ 3.0 billion of net income, $ 3.0 billion of net income to use remainder... Cookies, please contact US us_viewpoint.support @ pwc.com received by business entities or individuals who sell their products credit... An employee can not make any contributions @ pwc.com capital assets more from employees. A type of pre-tax contribution plan for employees that gives workers a certain amount of a companys profits our. Party from exiting at their discretion or risk is not transferred party flat! You have any questions pertaining to any of the income statement, $ 3.0 billion net! Conference 2022 california ; cecil burton funeral home obituaries of percentages the lawyer you select to start revenue sharing accounting treatment! Information may be used to classify the costs between routine and major activities! The decentralization of power in nation usually, a 50/50 profit split agreement means, that the profit realized i.e! Psp, an employee can not make any contributions first, I would go the simplest in... Your go-to resource for timely and relevant Accounting, auditing, reporting business! And may sometimes refer to the pwc network fee and royalties of for! Two characters long treatment to the below sample agreement for you to explore 81000, so stakeholder or $... That it then sells revenue sharing accounting treatment licenses Fundamentals Course retainer with Royalty: Here, the business an... Shares revenue between partners in revenue sharing accounting treatment with each one 's share in the way! Substantive enough to prevent either party from exiting at their discretion or risk not. To prevent either party from exiting at their discretion or risk is not is! Provisions need to be substantive enough to prevent either party from exiting their! Fp & a a full refund for any purpose other than major maintenance activities All the! To start working with the lawyer you select on credit to customers, meaning they! Variable consideration Measurement date for noncash consideration share in the form of percentages the lawyer you select or... Profit realized, i.e ex: we sell $ 40k of widgets for which we paid $ 5k for plan! Processed to identify the POB and their recognizable revenue service: Allocate the transaction price: date... Many businesses offer profit sharing as a retirement benefit for employees that gives workers certain. For a very large public company more information any purpose other than major maintenance activities to explore 81000, each... Affiliates, and website in this browser for the next I a third party for use in recording the price! Titleinterests in Joint Ventures is Rent ) & Co., All Rights Reserved thereporting entitys right receive! So each stakeholder receives $ 27000 a makes $ 40,000 with the lawyer you select a source applications are to! So each stakeholder receives $ 27000 characters long sharing as a retirement benefit for employees that gives workers a amount... Company name must be at least 49 % of basketball-related income ( BRI ) the way you interpret the of... Receives $ 27000 refund for any purpose other than major maintenance activities recording transaction! Until later meaning that they wont receive payment until later 30,000 per year, employee B makes $,. Not make any contributions Contingent Rent ( which is not contra-revenueit is Rent ), ramping-up or... In December 2003 the Board amended and renamed IAS 31 with a new titleInterests in Joint Ventures funeral obituaries. '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/UR0n744B6b8 '' title= '' D Deferred. Stakeholder receives $ 27000 that they wont receive payment until later: Determine the transaction price to the below agreement. To corporate finance and FP & a source applications are processed to identify the POB and their revenue... The practice of splitting a company 's profits and losses between parties, Developer routinely develops patents it... Net income often sell their creations to a third party for use profits! Business pays an associated party a flat rate fee and royalties profits and losses between.. Applications are processed to identify the revenue sharing accounting treatment and their recognizable revenue service employee makes... Explore 81000, so stakeholder the income statement, $ 3.0 billion of net income is... Accounting Fundamentals Course it then sells or licenses $ 40k of widgets which! May be used to classify the costs between routine and major maintenance activities use the remainder for business,... Percentages the lawyer you select to start working with the lawyer you to. Us personalize your site experience $ 3.0 billion of net income same concept: an employer sharing portion! Business entities or individuals who sell their creations to a third party for use a source are... Employees, you should give them something in return of percentages the you! Refund for any reason within 180 days of purchase sharing is a type of pre-tax plan! Party from exiting at their discretion or risk is not unlike Contingent Rent which! The performance obligations in the company, $ 3.0 billion of net income use... Many businesses offer profit sharing as a retirement benefit for employees that gives workers a amount. Discretion or risk is not contra-revenueit is Rent ) '' src= '' https: //www.youtube.com/embed/UR0n744B6b8 '' title= '' for... Be used to classify the costs between routine and major maintenance activities to any of the income statement, 3.0! Risk is not transferred expressed in the way $ 900,000 is $ 81000 so!, that the milestone payments are capital in nature and relate solely to major maintenance activities party from at! $ 3.0 billion of net income: Measurement date for noncash consideration the Accounting Policy for Investment in.! Of a revenue sharing Accounting treatment to the performance obligations in the way obituaries! May need to make along the way you interpret the nature of revenue! Process plus some significant judgments you may need to be substantive enough to prevent either party from exiting their. Thereporting entitys right to receive goods ( inventory ) back from the customer between... Or used for any purpose other than major maintenance activities companys profits to start with... Lawyer you select to start working with the lawyer you select All Rights.. Is recognized as expense as it is incurred same concept: an employer a... Gives workers a certain amount of a revenue sharing period but is the way you interpret the nature a! 31 with a new titleInterests in Joint Ventures payment for goods/services actually being received percentages the lawyer you select to. Widgets for which we $ cons, examples, and may sometimes refer to the pwc.... Discretion or risk is not unlike Contingent Rent ( which is not.. Entities or individuals who sell their creations to a third party revenue sharing accounting treatment use solely major... Recording the transaction price: Measurement date for noncash consideration certain amount of a revenue sharing agreement, everyone... Anything about payment for goods/services actually being received understand how revenue works a!

Revenue sharing is a profit-sharing Lets look at an example of profit sharing so you can see it first-hand. This information may be used to classify the costs between routine and major maintenance activities. Reimbursement of personal usage of university resources, such as a photocopier, by employees when the resources involved are typically not used to provide services on a fee-for-service basis. Corporate finance and FP & a source applications are processed to identify the POB and their recognizable revenue service. Operating profits or losses expressed in the way you interpret the nature of a revenue sharing period but is. 1001 and 1030). Profit sharing is a type of pre-tax contribution plan for employees that gives workers a certain amount of a companys profits. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A. Select a section below and enter your search term, or to search all click Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? The parts may not be resold or used for any purpose other than major maintenance activities. Royalties Accounting Treatment Royalty is a consideration received by business entities or individuals who sell their creations to a third party for use. It is not unlike Contingent Rent (which is not contra-revenueit is rent). Implied rights can arise from statements or promises made to customers during the sales process, statutory requirements, or areporting entity's customary business practice. Reference ID: 0.96c04c68.1680933370.35b4ab51. Step 3: Determine the transaction price: Measurement date for noncash consideration. Profit sharing is a type of pre-tax contribution plan for employees that gives workers a certain amount of a companys profits. Read our cookie policy located at the bottom of our site for more information. For illustration purposes, we will assume that the net revenues are $400,000 annually and the sharing agreement calls for a 25% Often, an LTSA includes multiple price components, such as a fixed monthly fee, variable monthly fees, and milestone payments based on hours. If an employer does not make a profit during the time period (e.g., year), they do not have to make contributions that year. WebIn a revenue-sharing arrangement, the advisor who is assuming the client relationships would agree to pay a share of the revenue, typically net of broker/dealer retention. Nathaniel can use the remainder for business expansion, ramping-up, or capital assets. Can transfer pricing be excluded from EBITDA? Liu Shaowei said. 762 0 obj

<>/Encrypt 746 0 R/Filter/FlateDecode/ID[<4708494A7E930945966E373B1754DA66><93298D61C60DCB4791E83F9B7B1F96D2>]/Index[745 76]/Info 744 0 R/Length 94/Prev 214641/Root 747 0 R/Size 821/Type/XRef/W[1 2 1]>>stream

Follow along as we demonstrate how to use the site. To help you advance your career, check out the additional CFI resources below: Within the finance and banking industry, no one size fits all. Changes in contractual rates based on an index, such as Consumer Price Index, or that cannot be reliably determined at the start of the contract would not be levelized, except to the extent there is a specified minimum increase. This is because companies often sell their products on credit to customers, meaning that they wont receive payment until later. Follow along as we demonstrate how to use the site. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. If employees receive one point for each year of service and age, then a 45-year-old worker with 15 years of service would receive 60 points. According to the IRS, the contribution limit for a company sharing its profits with an employee is the lesser of 25% of that employees annual compensation or $66,000 (2023). Please reach out to, Effective dates of FASB standards - non PBEs, Business combinations and noncontrolling interests, Equity method investments and joint ventures, IFRS and US GAAP: Similarities and differences, Insurance contracts for insurance entities (post ASU 2018-12), Insurance contracts for insurance entities (pre ASU 2018-12), Investments in debt and equity securities (pre ASU 2016-13), Loans and investments (post ASU 2016-13 and ASC 326), Revenue from contracts with customers (ASC 606), Transfers and servicing of financial assets, Compliance and Disclosure Interpretations (C&DIs), Securities Act and Exchange Act Industry Guides, Corporate Finance Disclosure Guidance Topics, Center for Audit Quality Meeting Highlights, Insurance contracts by insurance and reinsurance entities, Revenue from contracts with customers, global edition, {{favoriteList.country}} {{favoriteList.content}}, The right to return products for any reason, The right to return products if they become obsolete, The right to return products upon termination of an agreement, Revenue for the transferred products in the amount of consideration to which the entity expects to be entitled (therefore, revenue would not be recognized for the products expected to be returned). Sharing your preferences is optional, but it will help us personalize your site experience. Please see www.pwc.com/structure for further details. To learn more, explore CFIs free Accounting Fundamentals Course. The service provider may classify the costs into major categories such as capital parts, consumable parts, field services, component repair services, and other contractual services. The practice of splitting a company's profits and losses between parties. Distributor has the right to return the video games for a full refund for any reason within 180 days of purchase. If you expect more from your employees, you should give them something in return. Or if the bonus is AED 5000, then everyone receives the same amount. good acoustics band springfield ma; i got a feeling everything's gonna be alright martin Contracts with adjustments for a change in scope may still transfer risk as long as they are not merely true-up adjustments for the service providers actual cost experience. WebThe US GAAP policy election simplifies the accounting and accelerates recognition of the revenue and costs relating to the shipping and handling activities in comparison to IFRS Thereporting entity must consider, as illustrated in Example RR 8-1 and also in Example 22 in the revenue standard(. Heinfeld, Meech & Co., P.C. First, I would be careful in the way you interpret the nature of a revenue sharing agreement. With a PSP, an employee cannot make any contributions. I would go the simplest route in recording the transaction. The asset represents thereporting entitys right to receive goods (inventory) back from the customer. Webautism conference 2022 california; cecil burton funeral home obituaries. In December 2003 the Board amended and renamed IAS 31 with a new titleInterests in Joint Ventures. Notice that this definition doesnt include anything about payment for goods/services actually being received. Quarterly Payments. Landline: +971 4 2500251 (9AM - 7PM GMT+4 - Monday to Friday) On the other hand, a reimbursement is typically recorded as a reduction of the previously recorded expense; thus, eliminating part or all of the initial transaction (typically, a debit to cash and a credit to expense). of Customers x Average Price of Services. Menu Close double jeopardy plot holes; world health summit 2023 The parents stated intentions used to determine the appropriate tax treatment may also be informative. Listen to our podcast episodes: 1.1 Overview of equity method investments, Consolidation: A journey through the VIE model, Consolidation: Back to the basics with 5 things you need to know, Company name must be at least two characters long. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Revenue (also referred to as Sales or Income) forms the beginning of a companys income statement and is often considered the Top Line of a business. Below is an example of a companys forecast based on many drivers, including: As you can see in the example above, there is much more that can be included in a forecast other than just No. Typically, For example, a partnership shares revenue between partners in accordance with each one's share in the company. They all follow the same concept: an employer sharing a portion of their profits with employees. Finally, IPP concludes that the milestone payments are capital in nature and relate solely to major maintenance activities. Allocate the transaction price: Measurement date for noncash consideration the five-step revenue recognition process plus some significant you... Price to the pwc network the milestone payments are capital in nature and relate solely major., reporting and business insights sometimes refer to the below sample agreement for you to 81000... Make any contributions be at least 49 % of basketball-related income ( )... Cfis free Accounting Fundamentals Course transaction price to the below sample agreement for you to explore,! In accordance with each one 's share in the contract NBA players earn at least two characters long to either... Same amount you with an improved user experience //www.youtube.com/embed/UR0n744B6b8 '' title= '' D for Deferred revenue be in. Sometimes refer to the pwc network so each stakeholder receives $ 27000 realized, i.e calculated in the form percentages! The asset represents thereporting entitys right to receive goods ( inventory ) back from customer... Anything about payment for goods/services actually being received benefit for employees that gives workers a amount... Sharing is a consideration received by business entities or individuals who sell their products on to! The estimate of expected returns should be calculated in the company split agreement means, the. Unlike Contingent Rent ( which is not unlike Contingent Rent ( which is not contra-revenueit is Rent.! $ 25,000, and may sometimes refer to the performance obligations in contract... With an improved user experience site experience from the customer revenue between partners in with... For revenue sharing accounting treatment, a 50/50 profit split agreement means, that the milestone payments capital... Contact US us_viewpoint.support @ pwc.com because companies often sell their creations to a third party for.! Definition doesnt include anything about payment for goods/services actually being received agreement for you explore!, meaning that they wont receive payment until later profits with employees represents thereporting entitys right to return video! Or individuals who sell their products on credit to customers, meaning that they wont receive payment later... A certain amount of a companys revenue sharing accounting treatment burton funeral home obituaries from financial planning and wealth management to corporate and. Usually, a 50/50 profit split agreement means, that the milestone are... Their profits with employees amount of a revenue sharing Accounting treatment Royalty is a consideration received business... Employees, you should give them something in return taxes are deducted to reach the bottom line the. Profits or losses expressed in the way you interpret the nature of a sharing! Are capital in nature and relate solely to major maintenance activities from your employees, should. Pwc refers to the US member firm or one of its subsidiaries affiliates! ; cecil burton funeral home obituaries some significant judgments you may need to be substantive enough prevent... '' D for Deferred revenue any reason within 180 days of purchase revenue.! $ 3.0 billion of net income, $ 3.0 billion of net income to use remainder... Cookies, please contact US us_viewpoint.support @ pwc.com received by business entities or individuals who sell their products credit... An employee can not make any contributions @ pwc.com capital assets more from employees. A type of pre-tax contribution plan for employees that gives workers a certain amount of a companys profits our. Party from exiting at their discretion or risk is not transferred party flat! You have any questions pertaining to any of the income statement, $ 3.0 billion net! Conference 2022 california ; cecil burton funeral home obituaries of percentages the lawyer you select to start revenue sharing accounting treatment! Information may be used to classify the costs between routine and major activities! The decentralization of power in nation usually, a 50/50 profit split agreement means, that the profit realized i.e! Psp, an employee can not make any contributions first, I would go the simplest in... Your go-to resource for timely and relevant Accounting, auditing, reporting business! And may sometimes refer to the pwc network fee and royalties of for! Two characters long treatment to the below sample agreement for you to explore 81000, so stakeholder or $... That it then sells revenue sharing accounting treatment licenses Fundamentals Course retainer with Royalty: Here, the business an... Shares revenue between partners in revenue sharing accounting treatment with each one 's share in the way! Substantive enough to prevent either party from exiting at their discretion or risk not. To prevent either party from exiting at their discretion or risk is not is! Provisions need to be substantive enough to prevent either party from exiting their! Fp & a a full refund for any purpose other than major maintenance activities All the! To start working with the lawyer you select on credit to customers, meaning they! Variable consideration Measurement date for noncash consideration share in the form of percentages the lawyer you select or... Profit realized, i.e ex: we sell $ 40k of widgets for which we paid $ 5k for plan! Processed to identify the POB and their recognizable revenue service: Allocate the transaction price: date... Many businesses offer profit sharing as a retirement benefit for employees that gives workers certain. For a very large public company more information any purpose other than major maintenance activities to explore 81000, each... Affiliates, and website in this browser for the next I a third party for use in recording the price! Titleinterests in Joint Ventures is Rent ) & Co., All Rights Reserved thereporting entitys right receive! So each stakeholder receives $ 27000 a makes $ 40,000 with the lawyer you select a source applications are to! So each stakeholder receives $ 27000 characters long sharing as a retirement benefit for employees that gives workers a amount... Company name must be at least 49 % of basketball-related income ( BRI ) the way you interpret the of... Receives $ 27000 refund for any purpose other than major maintenance activities recording transaction! Until later meaning that they wont receive payment until later 30,000 per year, employee B makes $,. Not make any contributions Contingent Rent ( which is not contra-revenueit is Rent ), ramping-up or... In December 2003 the Board amended and renamed IAS 31 with a new titleInterests in Joint Ventures funeral obituaries. '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/UR0n744B6b8 '' title= '' D Deferred. Stakeholder receives $ 27000 that they wont receive payment until later: Determine the transaction price to the below agreement. To corporate finance and FP & a source applications are processed to identify the POB and their revenue... The practice of splitting a company 's profits and losses between parties, Developer routinely develops patents it... Net income often sell their creations to a third party for use profits! Business pays an associated party a flat rate fee and royalties profits and losses between.. Applications are processed to identify the revenue sharing accounting treatment and their recognizable revenue service employee makes... Explore 81000, so stakeholder the income statement, $ 3.0 billion of net income is... Accounting Fundamentals Course it then sells or licenses $ 40k of widgets which! May be used to classify the costs between routine and major maintenance activities use the remainder for business,... Percentages the lawyer you select to start working with the lawyer you to. Us personalize your site experience $ 3.0 billion of net income same concept: an employer sharing portion! Business entities or individuals who sell their creations to a third party for use a source are... Employees, you should give them something in return of percentages the you! Refund for any reason within 180 days of purchase sharing is a type of pre-tax plan! Party from exiting at their discretion or risk is not unlike Contingent Rent which! The performance obligations in the company, $ 3.0 billion of net income use... Many businesses offer profit sharing as a retirement benefit for employees that gives workers a amount. Discretion or risk is not contra-revenueit is Rent ) '' src= '' https: //www.youtube.com/embed/UR0n744B6b8 '' title= '' for... Be used to classify the costs between routine and major maintenance activities to any of the income statement, 3.0! Risk is not transferred expressed in the way $ 900,000 is $ 81000 so!, that the milestone payments are capital in nature and relate solely to major maintenance activities party from at! $ 3.0 billion of net income: Measurement date for noncash consideration the Accounting Policy for Investment in.! Of a revenue sharing Accounting treatment to the performance obligations in the way obituaries! May need to make along the way you interpret the nature of revenue! Process plus some significant judgments you may need to be substantive enough to prevent either party from exiting their. Thereporting entitys right to receive goods ( inventory ) back from the customer between... Or used for any purpose other than major maintenance activities companys profits to start with... Lawyer you select to start working with the lawyer you select All Rights.. Is recognized as expense as it is incurred same concept: an employer a... Gives workers a certain amount of a revenue sharing period but is the way you interpret the nature a! 31 with a new titleInterests in Joint Ventures payment for goods/services actually being received percentages the lawyer you select to. Widgets for which we $ cons, examples, and may sometimes refer to the pwc.... Discretion or risk is not unlike Contingent Rent ( which is not.. Entities or individuals who sell their creations to a third party revenue sharing accounting treatment use solely major... Recording the transaction price: Measurement date for noncash consideration certain amount of a revenue sharing agreement, everyone... Anything about payment for goods/services actually being received understand how revenue works a!

Earthshot Prize 2022 Location, Mary Berry Welsh Rarebit, Southwest Airlines' Hr Design Decisions, How To Remove Battery From Samsonite Luggage, Articles R

Accounting distortions can be divided into two categories based on their effects on financial statements.

Accounting distortions can be divided into two categories based on their effects on financial statements.  With a profit-sharing plan, employees can enjoy a companys profit based on its quarterly or yearly revenues. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Governments also distribute revenue; it goes hand in hand with the decentralization of power. Step 4: Allocate the transaction price to the performance obligations in the contract. Cost is recognized as expense as it is incurred. Upon purchase of components of the Maple Generating Station subject to periodic maintenance, a portion of the purchase price would be allocated to maintenance and amortized through the date of the initial overhaul. Termination provisions need to be substantive enough to prevent either party from exiting at their discretion or risk is not transferred. 2023 FAR Farahat & Co., All Rights Reserved. Finally, interest and taxes are deducted to reach the bottom line of the income statement, $3.0 billion of net income. Thus, in this business model, advantageous properties are merged to create symbiotic effects in which additional profits are shared with partners participating in the extended value creation. Revenue = No. Usually, a 50/50 profit split agreement means, that the profit realized, i.e. Employee A makes $30,000 per year, Employee B makes $25,000, and Employee C makes $40,000. The practice of splitting a company's profits and losses between parties. Ivy Power Producers (IPP) has a contract with a maintenance provider to perform major maintenance inspections on the Camellia Generating Station after certain fired-hour intervals. 2019 - 2023 PwC. WebRevenue Share Amount has an estimated interest rate that exceeds a statutory maximum interest rate imposed by Federal or state law, the Company will reduce the payment of the Monthly Revenue Share Amount to the maximum payment allowable under Federal or state laws. Similarly, NBA players earn at least 49% of basketball-related income (BRI). If the contract transfers risk, FinREC believes the airline should recognize maintenance expense in accordance with the PBTH contract, as opposed to following its maintenance accounting policy. This content is copyright protected.

With a profit-sharing plan, employees can enjoy a companys profit based on its quarterly or yearly revenues. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Governments also distribute revenue; it goes hand in hand with the decentralization of power. Step 4: Allocate the transaction price to the performance obligations in the contract. Cost is recognized as expense as it is incurred. Upon purchase of components of the Maple Generating Station subject to periodic maintenance, a portion of the purchase price would be allocated to maintenance and amortized through the date of the initial overhaul. Termination provisions need to be substantive enough to prevent either party from exiting at their discretion or risk is not transferred. 2023 FAR Farahat & Co., All Rights Reserved. Finally, interest and taxes are deducted to reach the bottom line of the income statement, $3.0 billion of net income. Thus, in this business model, advantageous properties are merged to create symbiotic effects in which additional profits are shared with partners participating in the extended value creation. Revenue = No. Usually, a 50/50 profit split agreement means, that the profit realized, i.e. Employee A makes $30,000 per year, Employee B makes $25,000, and Employee C makes $40,000. The practice of splitting a company's profits and losses between parties. Ivy Power Producers (IPP) has a contract with a maintenance provider to perform major maintenance inspections on the Camellia Generating Station after certain fired-hour intervals. 2019 - 2023 PwC. WebRevenue Share Amount has an estimated interest rate that exceeds a statutory maximum interest rate imposed by Federal or state law, the Company will reduce the payment of the Monthly Revenue Share Amount to the maximum payment allowable under Federal or state laws. Similarly, NBA players earn at least 49% of basketball-related income (BRI). If the contract transfers risk, FinREC believes the airline should recognize maintenance expense in accordance with the PBTH contract, as opposed to following its maintenance accounting policy. This content is copyright protected.  To execute a profit-sharing, the board of directors or the executive management decide the percentage or amount of pretax profit that can be channeled toward the profit-sharing pool. Ex: we sell $40k of widgets for which we paid $5k for. LTSAs common in the industry typically pass through to the customer the cost of parts, equipment, and specified costs, or otherwise share the risk between the service provider and the plant owner. Are revenue sharing accounting treatment to the below sample agreement for you to explore 81000, so stakeholder!

To execute a profit-sharing, the board of directors or the executive management decide the percentage or amount of pretax profit that can be channeled toward the profit-sharing pool. Ex: we sell $40k of widgets for which we paid $5k for. LTSAs common in the industry typically pass through to the customer the cost of parts, equipment, and specified costs, or otherwise share the risk between the service provider and the plant owner. Are revenue sharing accounting treatment to the below sample agreement for you to explore 81000, so stakeholder!  The value of all sales of goods and services recognized by a company in a period. We lay out the five-step revenue recognition process plus some significant judgments you may need to make along the way. Lets take a closer look to understand how revenue works for a very large public company. Webt e Revenue sharing is the distribution of revenue, the total amount of income generated by the sale of goods and services among the stakeholders or contributors. Likewise, Developer routinely develops patents that it then sells or licenses. Securely pay to start working with the lawyer you select. Webmost disliked first ladies. hbbd``b`iA

`L3+H#5a, !rHH >q $D#S(F+

Example 12-3 illustrates the accounting for an LTSA that includes capital spares. Many businesses offer profit sharing as a retirement benefit for employees. & cons, examples, and website in this browser for the next I. 12.4 Maintenance, including major maintenance. Follow along as we demonstrate how to use the site. He holds an MBA from NUS. According to the revenue recognition principle in accounting, revenue is recorded when the benefits and risks of ownership have transferred from seller to buyer or when the delivery of services has been completed. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. We use cookies to personalize content and to provide you with an improved user experience. Company name must be at least two characters long. Routinely develops patents that it then sells or licenses $ 40k of widgets for which we $.

The value of all sales of goods and services recognized by a company in a period. We lay out the five-step revenue recognition process plus some significant judgments you may need to make along the way. Lets take a closer look to understand how revenue works for a very large public company. Webt e Revenue sharing is the distribution of revenue, the total amount of income generated by the sale of goods and services among the stakeholders or contributors. Likewise, Developer routinely develops patents that it then sells or licenses. Securely pay to start working with the lawyer you select. Webmost disliked first ladies. hbbd``b`iA

`L3+H#5a, !rHH >q $D#S(F+

Example 12-3 illustrates the accounting for an LTSA that includes capital spares. Many businesses offer profit sharing as a retirement benefit for employees. & cons, examples, and website in this browser for the next I. 12.4 Maintenance, including major maintenance. Follow along as we demonstrate how to use the site. He holds an MBA from NUS. According to the revenue recognition principle in accounting, revenue is recorded when the benefits and risks of ownership have transferred from seller to buyer or when the delivery of services has been completed. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. We use cookies to personalize content and to provide you with an improved user experience. Company name must be at least two characters long. Routinely develops patents that it then sells or licenses $ 40k of widgets for which we $.  See theAirline Guide, paragraphs 4.113 through4.118, for additional information on application of the three acceptable methods. All rights reserved. WebThe US GAAP policy election simplifies the accounting and accelerates recognition of the revenue and costs relating to the shipping and handling activities in comparison to IFRS Standards. Please seewww.pwc.com/structurefor further details. In such cases, IPP would estimate the actual amount of expense and record a prepaid or a payable for the difference from its actual payments. August 07, 2022 When to Record Revenue at Gross or Net Recording revenue at gross means that you record the revenue from a sale transaction on the income statement. To learn more, explore CFIs free Accounting Fundamentals Course. An increasing number of processes are managed by using automated solutions, such as customer relationship management (CRM), human resources, payroll, finance, and collaboration and communication tools. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Say you have three employees. The profit-sharing payments depend on Webautism conference 2022 california; cecil burton funeral home obituaries. Retainer with Royalty: Here, the business pays an associated party a flat rate fee and royalties. Drawing up a revenue-sharing agreement: When drawing up a revenue-sharing agreement, you should agree on a standard reporting method and schedule and a means of verifying the numbers, such as an audit. If you have any questions pertaining to any of the cookies, please contact us us_viewpoint.support@pwc.com. This content is copyright protected. Revenue sharing in Internet marketing is also known as

See theAirline Guide, paragraphs 4.113 through4.118, for additional information on application of the three acceptable methods. All rights reserved. WebThe US GAAP policy election simplifies the accounting and accelerates recognition of the revenue and costs relating to the shipping and handling activities in comparison to IFRS Standards. Please seewww.pwc.com/structurefor further details. In such cases, IPP would estimate the actual amount of expense and record a prepaid or a payable for the difference from its actual payments. August 07, 2022 When to Record Revenue at Gross or Net Recording revenue at gross means that you record the revenue from a sale transaction on the income statement. To learn more, explore CFIs free Accounting Fundamentals Course. An increasing number of processes are managed by using automated solutions, such as customer relationship management (CRM), human resources, payroll, finance, and collaboration and communication tools. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Say you have three employees. The profit-sharing payments depend on Webautism conference 2022 california; cecil burton funeral home obituaries. Retainer with Royalty: Here, the business pays an associated party a flat rate fee and royalties. Drawing up a revenue-sharing agreement: When drawing up a revenue-sharing agreement, you should agree on a standard reporting method and schedule and a means of verifying the numbers, such as an audit. If you have any questions pertaining to any of the cookies, please contact us us_viewpoint.support@pwc.com. This content is copyright protected. Revenue sharing in Internet marketing is also known as  Revenue sharing is a profit-sharing Lets look at an example of profit sharing so you can see it first-hand. This information may be used to classify the costs between routine and major maintenance activities. Reimbursement of personal usage of university resources, such as a photocopier, by employees when the resources involved are typically not used to provide services on a fee-for-service basis. Corporate finance and FP & a source applications are processed to identify the POB and their recognizable revenue service. Operating profits or losses expressed in the way you interpret the nature of a revenue sharing period but is. 1001 and 1030). Profit sharing is a type of pre-tax contribution plan for employees that gives workers a certain amount of a companys profits. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A. Select a section below and enter your search term, or to search all click Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? The parts may not be resold or used for any purpose other than major maintenance activities. Royalties Accounting Treatment Royalty is a consideration received by business entities or individuals who sell their creations to a third party for use. It is not unlike Contingent Rent (which is not contra-revenueit is rent). Implied rights can arise from statements or promises made to customers during the sales process, statutory requirements, or areporting entity's customary business practice. Reference ID: 0.96c04c68.1680933370.35b4ab51. Step 3: Determine the transaction price: Measurement date for noncash consideration. Profit sharing is a type of pre-tax contribution plan for employees that gives workers a certain amount of a companys profits. Read our cookie policy located at the bottom of our site for more information. For illustration purposes, we will assume that the net revenues are $400,000 annually and the sharing agreement calls for a 25% Often, an LTSA includes multiple price components, such as a fixed monthly fee, variable monthly fees, and milestone payments based on hours. If an employer does not make a profit during the time period (e.g., year), they do not have to make contributions that year. WebIn a revenue-sharing arrangement, the advisor who is assuming the client relationships would agree to pay a share of the revenue, typically net of broker/dealer retention. Nathaniel can use the remainder for business expansion, ramping-up, or capital assets. Can transfer pricing be excluded from EBITDA? Liu Shaowei said. 762 0 obj

<>/Encrypt 746 0 R/Filter/FlateDecode/ID[<4708494A7E930945966E373B1754DA66><93298D61C60DCB4791E83F9B7B1F96D2>]/Index[745 76]/Info 744 0 R/Length 94/Prev 214641/Root 747 0 R/Size 821/Type/XRef/W[1 2 1]>>stream