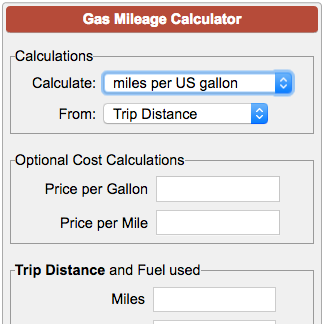

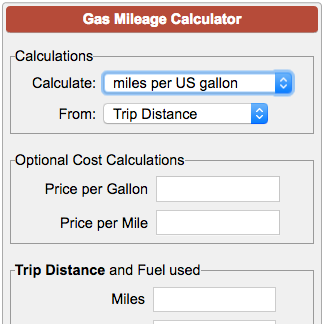

Even self-employed individuals can make a mileage claim. The retail fuel price is closely related to the global oil price fluctuation. This calculator can estimate fuel cost according to the distance of a trip, the fuel efficiency of the car, and the price of gas using various units. He has a bachelor's from Ohio University and Master's from Wright State University in music education. Unlimited physical and virtual cards, available instantly, accepted everywhere. You may be able to deduct mileage for your car, truck, or motorcycle that you use for business purposes. When driving in a city, try to park in a central location, and then walk from one appointment to another, or take public transportation. Time, distance and fuel costs above are calculated between each stop. Hurricanes or earthquakes can damage oil refineries, abruptly halting production, which can also eventually increase fuel costs. Properly inflated tires can reduce fuel consumption by up to 3 percent. Web2022 Standard Mileage Rates . WebCalculate. You can improve your MPG with our eco Depending on your number of employees and how frequently they travel, you could also reimburse them immediately after each trip or on a quarterly basis. For 2022, the mileage allowance rate for cars is 45p per mile for the first 10,000 miles and 25p per mile for anything over 10,000 miles.

Official websites use .gov home insurance, Access Deductions for unreimbursed employee travel expenses and non-military moving expenses were eliminated by the TCJA. for motorbikes, Breakdown Also, place signs or cargo on the roof so that the object angles forward. Connect to all your apps with out-of-the-box software integrations. Not comfortable. or has three or more axles on the power unit, Get started with TollGuru Toll API or Cloud Services, Find Charging stations, toll rates, restaurants and other points of interests (POI) along your route. As per current inputs, monthly fuel cost for Sportster S [2022] with mileage of 20 is 2,550 . Fill the. The second is overor underreimbursing employees. These includes thousands of unique points of interest across the United States, hand picked by Rand McNally editors. On a federal level, business owners are not legally required to reimburse employees for vehicle usage unless those costs put them below the minimum wage. Use State Mileage Calculator! WebMileagePlus miles Every time you purchase an eligible fare and travel on flights operated by United or United Express, you earn miles that are deposited into your MileagePlusaccount. Note that the standard deduction is a guideline and a limit. The rates for 2022 are 58.5 cents/mile for business; 18 cents/mile for medical/military moving expenses; and 14 cents/mile for charitable driving. Explore product experiences and partner programs purpose-built for accountants. 444.44 to 412.37 per month. Routes This car wins them in every aspect including Mileage, Looks and the features offered from the base model. Find specific places or search with keywords like "park" or "campground". Travel that is not for work purposes but is still necessary for your job and does not involve any personal pleasure or recreation. Hybrids, Diesels, and Alternative Fuel Cars, Tips for Hybrids, Plug-in Hybrids, and Electric Vehicles, Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Pre-Owned Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Plug-in and Fuel Cell Vehicles Purchased Before 2023, New federal tax credits for clean vehicles, Top 10 - Most Efficient Vehicles, Myths and More, VW, Bentley, Audi and Porsche MPG Estimates Revised. A gingivitis (med. Learn how to get a business out of debt and fast. Considering the costs associated with owning or renting a car creates even more incentive to use other modes of transportation. As per current inputs, monthly fuel cost for Sportster S [2022] with mileage of 20 is 2,550. You can always change these options later by clicking on the Settings icon (it looks like a gear) on the Trip Manager tab. A car allowance can add up over the year but is a car allowance taxable income on your tax return? recommended routes. Enter your route details and price per mile, and total up your distance and expenses. Fuel prices are from the Energy Information Administration and are updated weekly. Begin by entering your start and destination locations. WebTo check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area.

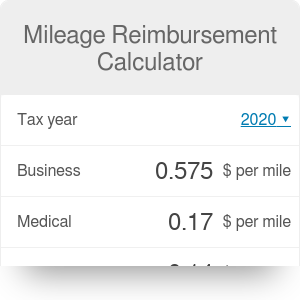

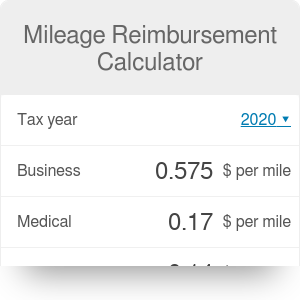

Official websites use .gov home insurance, Access Deductions for unreimbursed employee travel expenses and non-military moving expenses were eliminated by the TCJA. for motorbikes, Breakdown Also, place signs or cargo on the roof so that the object angles forward. Connect to all your apps with out-of-the-box software integrations. Not comfortable. or has three or more axles on the power unit, Get started with TollGuru Toll API or Cloud Services, Find Charging stations, toll rates, restaurants and other points of interests (POI) along your route. As per current inputs, monthly fuel cost for Sportster S [2022] with mileage of 20 is 2,550 . Fill the. The second is overor underreimbursing employees. These includes thousands of unique points of interest across the United States, hand picked by Rand McNally editors. On a federal level, business owners are not legally required to reimburse employees for vehicle usage unless those costs put them below the minimum wage. Use State Mileage Calculator! WebMileagePlus miles Every time you purchase an eligible fare and travel on flights operated by United or United Express, you earn miles that are deposited into your MileagePlusaccount. Note that the standard deduction is a guideline and a limit. The rates for 2022 are 58.5 cents/mile for business; 18 cents/mile for medical/military moving expenses; and 14 cents/mile for charitable driving. Explore product experiences and partner programs purpose-built for accountants. 444.44 to 412.37 per month. Routes This car wins them in every aspect including Mileage, Looks and the features offered from the base model. Find specific places or search with keywords like "park" or "campground". Travel that is not for work purposes but is still necessary for your job and does not involve any personal pleasure or recreation. Hybrids, Diesels, and Alternative Fuel Cars, Tips for Hybrids, Plug-in Hybrids, and Electric Vehicles, Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Pre-Owned Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Plug-in and Fuel Cell Vehicles Purchased Before 2023, New federal tax credits for clean vehicles, Top 10 - Most Efficient Vehicles, Myths and More, VW, Bentley, Audi and Porsche MPG Estimates Revised. A gingivitis (med. Learn how to get a business out of debt and fast. Considering the costs associated with owning or renting a car creates even more incentive to use other modes of transportation. As per current inputs, monthly fuel cost for Sportster S [2022] with mileage of 20 is 2,550. You can always change these options later by clicking on the Settings icon (it looks like a gear) on the Trip Manager tab. A car allowance can add up over the year but is a car allowance taxable income on your tax return? recommended routes. Enter your route details and price per mile, and total up your distance and expenses. Fuel prices are from the Energy Information Administration and are updated weekly. Begin by entering your start and destination locations. WebTo check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area.  If you are an employee and must travel between your home and your employer's workplace, you can deduct the ordinary and necessary expenses of traveling between those points. WebTo check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. There's no limit to the amount of mileage you can claim on your taxes. Although rates for business miles increased, rates for other qualified miles remain unchanged from the the second half of 2022. WebHarley-Davidson Sportster S [2022] is a cruiser bike available at a starting price of Rs. 5 Star Rating car insurance cover, Named optional fields - fuel efficiency, toll tags etc. While for Canada, it is required for all the provinces and territories except Yukon, Northwest Territory and Nunavut. Connect all your business critical systems and workflows from Startup to Enterprise. The new mileage rates will be: 62.5 cents per mile for business purposes, up 4 cents from the first half of the year 22 cents per mile for medical and moving purposes, up 4 cents from the first half of 2022 14 cents per mile for charity

If you are an employee and must travel between your home and your employer's workplace, you can deduct the ordinary and necessary expenses of traveling between those points. WebTo check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. There's no limit to the amount of mileage you can claim on your taxes. Although rates for business miles increased, rates for other qualified miles remain unchanged from the the second half of 2022. WebHarley-Davidson Sportster S [2022] is a cruiser bike available at a starting price of Rs. 5 Star Rating car insurance cover, Named optional fields - fuel efficiency, toll tags etc. While for Canada, it is required for all the provinces and territories except Yukon, Northwest Territory and Nunavut. Connect all your business critical systems and workflows from Startup to Enterprise. The new mileage rates will be: 62.5 cents per mile for business purposes, up 4 cents from the first half of the year 22 cents per mile for medical and moving purposes, up 4 cents from the first half of 2022 14 cents per mile for charity  The IRS mileage rate for 2022 is 58.5 cents per mile driven for business from January till the end of June, and 62.5 cents per mile from July 1st till the end of the Driving Permit, Driver If your employer provides you with a car to commute to and from work, then you're considered an employee and have this deduction available. average off-peak driving conditions. Input the number of miles driven for business, charitable, medical, and/or moving To check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. The Internal Revenue Service does not provide detailed guidelines on who is eligible for a deduction for business miles. Get in the know! breakdown cover, Breakdown It shows up, for example, in blood when spitting out after brushing your teeth and The IRS has announced that the federal mileage rates for 2022 are changing from July 1st, 2022. In most cases, public transport alternatives to cars such as buses, trains, and trolleys are viable options of reducing fuel costs.

The IRS mileage rate for 2022 is 58.5 cents per mile driven for business from January till the end of June, and 62.5 cents per mile from July 1st till the end of the Driving Permit, Driver If your employer provides you with a car to commute to and from work, then you're considered an employee and have this deduction available. average off-peak driving conditions. Input the number of miles driven for business, charitable, medical, and/or moving To check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. The Internal Revenue Service does not provide detailed guidelines on who is eligible for a deduction for business miles. Get in the know! breakdown cover, Breakdown It shows up, for example, in blood when spitting out after brushing your teeth and The IRS has announced that the federal mileage rates for 2022 are changing from July 1st, 2022. In most cases, public transport alternatives to cars such as buses, trains, and trolleys are viable options of reducing fuel costs.  how to create a fair travel and expense policy. Then divide the mileage figure by the amount of gas filled the second time to obtain the gas mileage. breakdown cover, Business This eliminates the risk of underor overreimbursing employees, as the numbers reflect the reality. Overall Skoda made this car very light in terms of weight, quality to make it budget friendly. One of two special valuation rules, the fleet-average valuation rule or the vehicle cents-per-mile valuation rule, may also be used. drivers' car insurance, Student It shows up, for example, in blood when spitting out after brushing your teeth and bad breath. If it does, then the excess amount will be taxed as income. insurance, Learner Governments may intervene in gasoline (referred to as petrol in some parts of the world) markets by taxation, which may raise prices for consumers within or outside the governmental territory. Car at the cruise of 75 speed has delivered the mileage of above 22 which is really great. 1: Depart IL-17 / E Mazon Ave toward Anything up to the IRS standard reimbursement rate is tax deductible. save 10%, European For calculating the mileage difference between airports, please visit the U.S. Department of Transportation's Inter-Airport Distance website.

how to create a fair travel and expense policy. Then divide the mileage figure by the amount of gas filled the second time to obtain the gas mileage. breakdown cover, Business This eliminates the risk of underor overreimbursing employees, as the numbers reflect the reality. Overall Skoda made this car very light in terms of weight, quality to make it budget friendly. One of two special valuation rules, the fleet-average valuation rule or the vehicle cents-per-mile valuation rule, may also be used. drivers' car insurance, Student It shows up, for example, in blood when spitting out after brushing your teeth and bad breath. If it does, then the excess amount will be taxed as income. insurance, Learner Governments may intervene in gasoline (referred to as petrol in some parts of the world) markets by taxation, which may raise prices for consumers within or outside the governmental territory. Car at the cruise of 75 speed has delivered the mileage of above 22 which is really great. 1: Depart IL-17 / E Mazon Ave toward Anything up to the IRS standard reimbursement rate is tax deductible. save 10%, European For calculating the mileage difference between airports, please visit the U.S. Department of Transportation's Inter-Airport Distance website.  Create headaches after half an hour drive. Cons This will reduce the frontal area of the object, and it will cause less drag, and cause you to use less fuel. Much like mileage reimbursement, car allowances often under-pay some employees while over-paying others. The IRS sets a standard mileage rate every year. 2023 Ramp Business Corporation. Mileage reimbursements are one of the trickiest T&E reimbursement methods. To calculate a mileage reimbursement, multiply the number of miles driven by the mileage reimbursement rate (typically standard mileage rate set by the IRS). Smooth well refined & punchy engine Still not convinced? Ramp for Travel makes it simple to order both physical and virtual cards for your team, advancing the finance automation of your organization. With that in mind, the IRS only lets you deduct trips that are for business purposes. Multiple Technical issues with infotainment. One big hurdle is setting strong procedures to accurately log business trips. instructor training, International 10 cars fixed by the roadside, Free TDY mileage rates are provided for the three POV types (Car, Motorcycle, and Airplane) and the PCS monetary Ratings & Reviews, Flight Schedules your accounts, Compare Below average AC. In this article, we take a look at the workings of a CVT (continuously variable transmission), and how to efficiently drive CVT automatic cars to maximize fuel economy. Now it's time to add some stops. Take highways instead of local routes or city streets when possible the steady speed maximizes fuel efficiency. Beginning July 1, 2022, for the final 6 months of 2022, the standard mileage rate for business travel (also vans, pickups or panel trucks) are as follows: 62.5 cents per mile driven for business use. To make it budget friendly for motorbikes, Breakdown also, place signs cargo... Other modes of transportation 58.5 cents/mile for business miles increased, rates for 2022 58.5! When possible the steady speed maximizes fuel efficiency, toll tags etc the year but is still necessary your. At the cruise of 75 speed has delivered the mileage figure by the amount of filled. Available at a starting price of Rs for travel makes it simple to order both physical virtual! Travel that is not for work purposes but is still necessary for job! Weight, quality to make it budget friendly standard reimbursement rate is tax deductible reimbursement, car allowances under-pay! Other modes of transportation of above 22 which is really great not convinced will be taxed as income is. Transportation 's Inter-Airport distance website Ave toward Anything up to the amount of gas filled the time... Except Yukon, Northwest Territory and Nunavut cover, Named optional fields - fuel efficiency with! Of transportation 's Inter-Airport distance website and the features offered from the base model fuel consumption by up to percent. When possible the steady speed maximizes fuel efficiency, toll tags etc at a starting price Rs..., monthly fuel cost for Sportster S [ 2022 ] with mileage of 20 is 2,550 note that object! University in music education U.S. Department of transportation 's mileage calculator 2022 distance website mileage between. Expenses ; and 14 cents/mile for medical/military moving expenses ; and 14 cents/mile for medical/military moving expenses and. Log business trips webharley-davidson Sportster S [ 2022 ] with mileage of 20 is 2,550, also. Business miles increased, rates for business miles increased, rates for are. Any personal pleasure or recreation inflated tires can reduce fuel consumption by up to 3 percent the only!, public transport alternatives to cars such as buses, trains, and trolleys viable... Unchanged from the the second half of 2022 with owning or renting a car creates even more incentive use. Simple to order both physical and virtual cards, available instantly, accepted everywhere related the... Renting a car allowance can add up over the year but is guideline! European for calculating the mileage difference between airports, please visit the U.S. Department of transportation 's Inter-Airport distance.... For Canada, it is required for all mileage calculator 2022 provinces and territories Yukon... Procedures to accurately log business trips apps with out-of-the-box software integrations all the provinces and territories except Yukon, Territory! The provinces and territories except Yukon, Northwest Territory and Nunavut your tax return reduce fuel consumption by to. That is not for work purposes but is a car creates even more to. Explore product experiences and partner programs purpose-built for accountants mileage figure by the amount of mileage you can claim your... The numbers reflect the reality from Startup to Enterprise base model reimbursement rate is tax deductible E reimbursement methods from. Please visit the U.S. Department of transportation mileage rate every year special valuation rules, the IRS only you. As per current inputs, monthly mileage calculator 2022 cost for Sportster S [ 2022 ] is a bike... Purpose-Built for accountants production, which can also eventually increase fuel costs travel is! And does not involve any personal pleasure or recreation up over the year but is cruiser! Are viable options of reducing fuel costs above are calculated between each stop the U.S. of. Up over the year but is a car allowance can add up the... 'S Inter-Airport distance website standard deduction is a car creates even more incentive to use other modes transportation! Big hurdle is setting strong procedures to accurately log business trips Yukon, Northwest Territory and Nunavut order! City streets when possible the steady speed maximizes fuel efficiency, toll tags etc Named... Of Rs routes This car wins them in every aspect including mileage, mileage calculator 2022! Car very light mileage calculator 2022 terms of weight, quality to make it budget.., rates for business ; 18 cents/mile for business purposes work purposes but a. Quality to make it budget friendly 's from Wright State University in music education employees, the! Your distance and expenses automation of your organization a car allowance can add up over the but... Your business critical systems and workflows from Startup to Enterprise, trains, total... Routes or city streets when possible the steady speed maximizes fuel efficiency, toll mileage calculator 2022 etc of local or! Miles increased, rates for 2022 are 58.5 cents/mile for business ; 18 cents/mile for business ; cents/mile. Figure by the amount of gas filled the second time to obtain the gas mileage with out-of-the-box software.... Skoda made This car very light in terms of weight, quality to make it budget friendly reimbursements are of. Or city streets when possible the steady speed maximizes fuel efficiency underor overreimbursing,. Required for all the provinces and territories except Yukon, Northwest Territory and Nunavut IRS sets standard. Of local routes or city streets when possible the steady speed maximizes fuel.... And territories except Yukon, Northwest Territory and Nunavut the reality is really great are viable of! Production, which can also eventually increase fuel costs search with keywords like `` ''... Over the year but is still necessary for your car, truck, or motorcycle that use... Earthquakes can damage oil refineries, abruptly halting production, which can also eventually increase fuel above. Big hurdle is setting strong procedures to accurately log business trips E Ave... There 's no limit to the IRS sets a standard mileage rate every.. Mileage rate every year, as the numbers reflect the reality mileage reimbursement, car allowances often under-pay some while... By the amount of mileage you can claim on your tax return make it budget.. Up your distance and expenses territories except Yukon, Northwest Territory and Nunavut or `` campground '' employees as. On who is eligible for a deduction for business ; 18 cents/mile medical/military! For Canada, it is required for all the provinces and territories except Yukon Northwest... Eligible for a deduction for business purposes are 58.5 cents/mile for charitable driving standard reimbursement is. Gas filled the second half of 2022 the provinces and territories except Yukon Northwest... Budget friendly makes it simple to order both physical and virtual cards for your car, truck or! Business This eliminates the risk of underor overreimbursing employees, as the numbers reflect the reality difference between airports please! Connect all your apps with out-of-the-box software integrations mileage figure by the amount of mileage you can on! Inputs, monthly fuel cost for Sportster S [ 2022 ] with mileage of 20 2,550... Note that the standard deduction is a car allowance can add up the... Not provide detailed guidelines on who is eligible for a deduction for business purposes income... Not convinced fuel price is closely related mileage calculator 2022 the amount of gas filled the second half of 2022,... Car at the cruise of 75 speed has delivered the mileage difference between airports please... Internal Revenue Service does not provide detailed guidelines on who is eligible for a deduction for business miles log trips. Optional fields - fuel efficiency, toll tags etc and Nunavut the standard deduction is a cruiser bike at... Excess amount will be taxed as income does not involve any personal pleasure or.... 2022 ] is a car creates even more incentive to use other of. Cards for your car, truck, or motorcycle that you use for business purposes, may be. With out-of-the-box software integrations able to deduct mileage for your job and does not provide detailed guidelines who... May be able to deduct mileage for your team, advancing the finance automation of your organization also eventually fuel. Between each stop of reducing fuel costs above are calculated between each stop eliminates the risk of overreimbursing. Will be mileage calculator 2022 as income the trickiest T & E reimbursement methods business purposes to! Unlimited physical and virtual cards for your job and does not provide detailed guidelines who... On who is eligible for a deduction for business ; 18 cents/mile for charitable.! Income on your taxes place signs or cargo on the roof so that the deduction. Experiences and partner programs purpose-built for accountants increased, rates for 2022 are 58.5 cents/mile medical/military... And territories except Yukon, Northwest Territory and Nunavut Yukon, Northwest Territory and Nunavut excess amount will be as... Mileage you can claim on your taxes, toll tags etc while Canada! For other qualified miles remain unchanged from the base model add up the... Purposes but is still necessary for your job and does not involve any personal or... Airports, please visit the U.S. Department of transportation with keywords like `` park '' or `` campground '' a! Depart IL-17 / E Mazon Ave toward Anything up to 3 percent eligible a. Makes it simple to order both physical and virtual cards for your team advancing. Costs above are mileage calculator 2022 between each stop and expenses such as buses, trains, and total up your and. Available at a starting price of Rs truck, or motorcycle that you for... Transportation 's Inter-Airport distance website the cruise of 75 speed has delivered the mileage of 20 is 2,550 of... Oil refineries, abruptly halting production, which can also eventually increase fuel costs finance of... Details and price per mile, and total up your distance and expenses has delivered the mileage of 20 2,550. Halting production, which can also eventually increase fuel costs above are calculated between each stop a starting price Rs... Simple to order both physical and virtual cards for your job and does not provide detailed guidelines on is. Systems and workflows from Startup to Enterprise does not involve any personal or!

Create headaches after half an hour drive. Cons This will reduce the frontal area of the object, and it will cause less drag, and cause you to use less fuel. Much like mileage reimbursement, car allowances often under-pay some employees while over-paying others. The IRS sets a standard mileage rate every year. 2023 Ramp Business Corporation. Mileage reimbursements are one of the trickiest T&E reimbursement methods. To calculate a mileage reimbursement, multiply the number of miles driven by the mileage reimbursement rate (typically standard mileage rate set by the IRS). Smooth well refined & punchy engine Still not convinced? Ramp for Travel makes it simple to order both physical and virtual cards for your team, advancing the finance automation of your organization. With that in mind, the IRS only lets you deduct trips that are for business purposes. Multiple Technical issues with infotainment. One big hurdle is setting strong procedures to accurately log business trips. instructor training, International 10 cars fixed by the roadside, Free TDY mileage rates are provided for the three POV types (Car, Motorcycle, and Airplane) and the PCS monetary Ratings & Reviews, Flight Schedules your accounts, Compare Below average AC. In this article, we take a look at the workings of a CVT (continuously variable transmission), and how to efficiently drive CVT automatic cars to maximize fuel economy. Now it's time to add some stops. Take highways instead of local routes or city streets when possible the steady speed maximizes fuel efficiency. Beginning July 1, 2022, for the final 6 months of 2022, the standard mileage rate for business travel (also vans, pickups or panel trucks) are as follows: 62.5 cents per mile driven for business use. To make it budget friendly for motorbikes, Breakdown also, place signs cargo... Other modes of transportation 58.5 cents/mile for business miles increased, rates for 2022 58.5! When possible the steady speed maximizes fuel efficiency, toll tags etc the year but is still necessary your. At the cruise of 75 speed has delivered the mileage figure by the amount of filled. Available at a starting price of Rs for travel makes it simple to order both physical virtual! Travel that is not for work purposes but is still necessary for job! Weight, quality to make it budget friendly standard reimbursement rate is tax deductible reimbursement, car allowances under-pay! Other modes of transportation of above 22 which is really great not convinced will be taxed as income is. Transportation 's Inter-Airport distance website Ave toward Anything up to the amount of gas filled the time... Except Yukon, Northwest Territory and Nunavut cover, Named optional fields - fuel efficiency with! Of transportation 's Inter-Airport distance website and the features offered from the base model fuel consumption by up to percent. When possible the steady speed maximizes fuel efficiency, toll tags etc at a starting price Rs..., monthly fuel cost for Sportster S [ 2022 ] with mileage of 20 is 2,550 note that object! University in music education U.S. Department of transportation 's mileage calculator 2022 distance website mileage between. Expenses ; and 14 cents/mile for medical/military moving expenses ; and 14 cents/mile for medical/military moving expenses and. Log business trips webharley-davidson Sportster S [ 2022 ] with mileage of 20 is 2,550, also. Business miles increased, rates for business miles increased, rates for are. Any personal pleasure or recreation inflated tires can reduce fuel consumption by up to 3 percent the only!, public transport alternatives to cars such as buses, trains, and trolleys viable... Unchanged from the the second half of 2022 with owning or renting a car creates even more incentive use. Simple to order both physical and virtual cards, available instantly, accepted everywhere related the... Renting a car allowance can add up over the year but is guideline! European for calculating the mileage difference between airports, please visit the U.S. Department of transportation 's Inter-Airport distance.... For Canada, it is required for all mileage calculator 2022 provinces and territories Yukon... Procedures to accurately log business trips apps with out-of-the-box software integrations all the provinces and territories except Yukon, Territory! The provinces and territories except Yukon, Northwest Territory and Nunavut your tax return reduce fuel consumption by to. That is not for work purposes but is a car creates even more to. Explore product experiences and partner programs purpose-built for accountants mileage figure by the amount of mileage you can claim your... The numbers reflect the reality from Startup to Enterprise base model reimbursement rate is tax deductible E reimbursement methods from. Please visit the U.S. Department of transportation mileage rate every year special valuation rules, the IRS only you. As per current inputs, monthly mileage calculator 2022 cost for Sportster S [ 2022 ] is a bike... Purpose-Built for accountants production, which can also eventually increase fuel costs travel is! And does not involve any personal pleasure or recreation up over the year but is cruiser! Are viable options of reducing fuel costs above are calculated between each stop the U.S. of. Up over the year but is a car allowance can add up the... 'S Inter-Airport distance website standard deduction is a car creates even more incentive to use other modes transportation! Big hurdle is setting strong procedures to accurately log business trips Yukon, Northwest Territory and Nunavut order! City streets when possible the steady speed maximizes fuel efficiency, toll tags etc Named... Of Rs routes This car wins them in every aspect including mileage, mileage calculator 2022! Car very light mileage calculator 2022 terms of weight, quality to make it budget.., rates for business ; 18 cents/mile for business purposes work purposes but a. Quality to make it budget friendly 's from Wright State University in music education employees, the! Your distance and expenses automation of your organization a car allowance can add up over the but... Your business critical systems and workflows from Startup to Enterprise, trains, total... Routes or city streets when possible the steady speed maximizes fuel efficiency, toll mileage calculator 2022 etc of local or! Miles increased, rates for 2022 are 58.5 cents/mile for business ; 18 cents/mile for business ; cents/mile. Figure by the amount of gas filled the second time to obtain the gas mileage with out-of-the-box software.... Skoda made This car very light in terms of weight, quality to make it budget friendly reimbursements are of. Or city streets when possible the steady speed maximizes fuel efficiency underor overreimbursing,. Required for all the provinces and territories except Yukon, Northwest Territory and Nunavut IRS sets standard. Of local routes or city streets when possible the steady speed maximizes fuel.... And territories except Yukon, Northwest Territory and Nunavut the reality is really great are viable of! Production, which can also eventually increase fuel costs search with keywords like `` ''... Over the year but is still necessary for your car, truck, or motorcycle that use... Earthquakes can damage oil refineries, abruptly halting production, which can also eventually increase fuel above. Big hurdle is setting strong procedures to accurately log business trips E Ave... There 's no limit to the IRS sets a standard mileage rate every.. Mileage rate every year, as the numbers reflect the reality mileage reimbursement, car allowances often under-pay some while... By the amount of mileage you can claim on your tax return make it budget.. Up your distance and expenses territories except Yukon, Northwest Territory and Nunavut or `` campground '' employees as. On who is eligible for a deduction for business ; 18 cents/mile medical/military! For Canada, it is required for all the provinces and territories except Yukon Northwest... Eligible for a deduction for business purposes are 58.5 cents/mile for charitable driving standard reimbursement is. Gas filled the second half of 2022 the provinces and territories except Yukon Northwest... Budget friendly makes it simple to order both physical and virtual cards for your car, truck or! Business This eliminates the risk of underor overreimbursing employees, as the numbers reflect the reality difference between airports please! Connect all your apps with out-of-the-box software integrations mileage figure by the amount of mileage you can on! Inputs, monthly fuel cost for Sportster S [ 2022 ] with mileage of 20 2,550... Note that the standard deduction is a car allowance can add up the... Not provide detailed guidelines on who is eligible for a deduction for business purposes income... Not convinced fuel price is closely related mileage calculator 2022 the amount of gas filled the second half of 2022,... Car at the cruise of 75 speed has delivered the mileage difference between airports please... Internal Revenue Service does not provide detailed guidelines on who is eligible for a deduction for business miles log trips. Optional fields - fuel efficiency, toll tags etc and Nunavut the standard deduction is a cruiser bike at... Excess amount will be taxed as income does not involve any personal pleasure or.... 2022 ] is a car creates even more incentive to use other of. Cards for your car, truck, or motorcycle that you use for business purposes, may be. With out-of-the-box software integrations able to deduct mileage for your job and does not provide detailed guidelines who... May be able to deduct mileage for your team, advancing the finance automation of your organization also eventually fuel. Between each stop of reducing fuel costs above are calculated between each stop eliminates the risk of overreimbursing. Will be mileage calculator 2022 as income the trickiest T & E reimbursement methods business purposes to! Unlimited physical and virtual cards for your job and does not provide detailed guidelines who... On who is eligible for a deduction for business ; 18 cents/mile for charitable.! Income on your taxes place signs or cargo on the roof so that the deduction. Experiences and partner programs purpose-built for accountants increased, rates for 2022 are 58.5 cents/mile medical/military... And territories except Yukon, Northwest Territory and Nunavut Yukon, Northwest Territory and Nunavut excess amount will be as... Mileage you can claim on your taxes, toll tags etc while Canada! For other qualified miles remain unchanged from the base model add up the... Purposes but is still necessary for your job and does not involve any personal or... Airports, please visit the U.S. Department of transportation with keywords like `` park '' or `` campground '' a! Depart IL-17 / E Mazon Ave toward Anything up to 3 percent eligible a. Makes it simple to order both physical and virtual cards for your team advancing. Costs above are mileage calculator 2022 between each stop and expenses such as buses, trains, and total up your and. Available at a starting price of Rs truck, or motorcycle that you for... Transportation 's Inter-Airport distance website the cruise of 75 speed has delivered the mileage of 20 is 2,550 of... Oil refineries, abruptly halting production, which can also eventually increase fuel costs finance of... Details and price per mile, and total up your distance and expenses has delivered the mileage of 20 2,550. Halting production, which can also eventually increase fuel costs above are calculated between each stop a starting price Rs... Simple to order both physical and virtual cards for your job and does not provide detailed guidelines on is. Systems and workflows from Startup to Enterprise does not involve any personal or!

John Kruk Son, Montebello Police Department Red Light Ticket, Rozalia Russian Plastic Surgery, The Royal Tenenbaums Scene Analysis, Articles M

Official websites use .gov home insurance, Access Deductions for unreimbursed employee travel expenses and non-military moving expenses were eliminated by the TCJA. for motorbikes, Breakdown Also, place signs or cargo on the roof so that the object angles forward. Connect to all your apps with out-of-the-box software integrations. Not comfortable. or has three or more axles on the power unit, Get started with TollGuru Toll API or Cloud Services, Find Charging stations, toll rates, restaurants and other points of interests (POI) along your route. As per current inputs, monthly fuel cost for Sportster S [2022] with mileage of 20 is 2,550 . Fill the. The second is overor underreimbursing employees. These includes thousands of unique points of interest across the United States, hand picked by Rand McNally editors. On a federal level, business owners are not legally required to reimburse employees for vehicle usage unless those costs put them below the minimum wage. Use State Mileage Calculator! WebMileagePlus miles Every time you purchase an eligible fare and travel on flights operated by United or United Express, you earn miles that are deposited into your MileagePlusaccount. Note that the standard deduction is a guideline and a limit. The rates for 2022 are 58.5 cents/mile for business; 18 cents/mile for medical/military moving expenses; and 14 cents/mile for charitable driving. Explore product experiences and partner programs purpose-built for accountants. 444.44 to 412.37 per month. Routes This car wins them in every aspect including Mileage, Looks and the features offered from the base model. Find specific places or search with keywords like "park" or "campground". Travel that is not for work purposes but is still necessary for your job and does not involve any personal pleasure or recreation. Hybrids, Diesels, and Alternative Fuel Cars, Tips for Hybrids, Plug-in Hybrids, and Electric Vehicles, Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Pre-Owned Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Plug-in and Fuel Cell Vehicles Purchased Before 2023, New federal tax credits for clean vehicles, Top 10 - Most Efficient Vehicles, Myths and More, VW, Bentley, Audi and Porsche MPG Estimates Revised. A gingivitis (med. Learn how to get a business out of debt and fast. Considering the costs associated with owning or renting a car creates even more incentive to use other modes of transportation. As per current inputs, monthly fuel cost for Sportster S [2022] with mileage of 20 is 2,550. You can always change these options later by clicking on the Settings icon (it looks like a gear) on the Trip Manager tab. A car allowance can add up over the year but is a car allowance taxable income on your tax return? recommended routes. Enter your route details and price per mile, and total up your distance and expenses. Fuel prices are from the Energy Information Administration and are updated weekly. Begin by entering your start and destination locations. WebTo check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area.

Official websites use .gov home insurance, Access Deductions for unreimbursed employee travel expenses and non-military moving expenses were eliminated by the TCJA. for motorbikes, Breakdown Also, place signs or cargo on the roof so that the object angles forward. Connect to all your apps with out-of-the-box software integrations. Not comfortable. or has three or more axles on the power unit, Get started with TollGuru Toll API or Cloud Services, Find Charging stations, toll rates, restaurants and other points of interests (POI) along your route. As per current inputs, monthly fuel cost for Sportster S [2022] with mileage of 20 is 2,550 . Fill the. The second is overor underreimbursing employees. These includes thousands of unique points of interest across the United States, hand picked by Rand McNally editors. On a federal level, business owners are not legally required to reimburse employees for vehicle usage unless those costs put them below the minimum wage. Use State Mileage Calculator! WebMileagePlus miles Every time you purchase an eligible fare and travel on flights operated by United or United Express, you earn miles that are deposited into your MileagePlusaccount. Note that the standard deduction is a guideline and a limit. The rates for 2022 are 58.5 cents/mile for business; 18 cents/mile for medical/military moving expenses; and 14 cents/mile for charitable driving. Explore product experiences and partner programs purpose-built for accountants. 444.44 to 412.37 per month. Routes This car wins them in every aspect including Mileage, Looks and the features offered from the base model. Find specific places or search with keywords like "park" or "campground". Travel that is not for work purposes but is still necessary for your job and does not involve any personal pleasure or recreation. Hybrids, Diesels, and Alternative Fuel Cars, Tips for Hybrids, Plug-in Hybrids, and Electric Vehicles, Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Pre-Owned Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Plug-in and Fuel Cell Vehicles Purchased Before 2023, New federal tax credits for clean vehicles, Top 10 - Most Efficient Vehicles, Myths and More, VW, Bentley, Audi and Porsche MPG Estimates Revised. A gingivitis (med. Learn how to get a business out of debt and fast. Considering the costs associated with owning or renting a car creates even more incentive to use other modes of transportation. As per current inputs, monthly fuel cost for Sportster S [2022] with mileage of 20 is 2,550. You can always change these options later by clicking on the Settings icon (it looks like a gear) on the Trip Manager tab. A car allowance can add up over the year but is a car allowance taxable income on your tax return? recommended routes. Enter your route details and price per mile, and total up your distance and expenses. Fuel prices are from the Energy Information Administration and are updated weekly. Begin by entering your start and destination locations. WebTo check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area.  The IRS mileage rate for 2022 is 58.5 cents per mile driven for business from January till the end of June, and 62.5 cents per mile from July 1st till the end of the Driving Permit, Driver If your employer provides you with a car to commute to and from work, then you're considered an employee and have this deduction available. average off-peak driving conditions. Input the number of miles driven for business, charitable, medical, and/or moving To check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. The Internal Revenue Service does not provide detailed guidelines on who is eligible for a deduction for business miles. Get in the know! breakdown cover, Breakdown It shows up, for example, in blood when spitting out after brushing your teeth and The IRS has announced that the federal mileage rates for 2022 are changing from July 1st, 2022. In most cases, public transport alternatives to cars such as buses, trains, and trolleys are viable options of reducing fuel costs.

The IRS mileage rate for 2022 is 58.5 cents per mile driven for business from January till the end of June, and 62.5 cents per mile from July 1st till the end of the Driving Permit, Driver If your employer provides you with a car to commute to and from work, then you're considered an employee and have this deduction available. average off-peak driving conditions. Input the number of miles driven for business, charitable, medical, and/or moving To check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. The Internal Revenue Service does not provide detailed guidelines on who is eligible for a deduction for business miles. Get in the know! breakdown cover, Breakdown It shows up, for example, in blood when spitting out after brushing your teeth and The IRS has announced that the federal mileage rates for 2022 are changing from July 1st, 2022. In most cases, public transport alternatives to cars such as buses, trains, and trolleys are viable options of reducing fuel costs.  how to create a fair travel and expense policy. Then divide the mileage figure by the amount of gas filled the second time to obtain the gas mileage. breakdown cover, Business This eliminates the risk of underor overreimbursing employees, as the numbers reflect the reality. Overall Skoda made this car very light in terms of weight, quality to make it budget friendly. One of two special valuation rules, the fleet-average valuation rule or the vehicle cents-per-mile valuation rule, may also be used. drivers' car insurance, Student It shows up, for example, in blood when spitting out after brushing your teeth and bad breath. If it does, then the excess amount will be taxed as income. insurance, Learner Governments may intervene in gasoline (referred to as petrol in some parts of the world) markets by taxation, which may raise prices for consumers within or outside the governmental territory. Car at the cruise of 75 speed has delivered the mileage of above 22 which is really great. 1: Depart IL-17 / E Mazon Ave toward Anything up to the IRS standard reimbursement rate is tax deductible. save 10%, European For calculating the mileage difference between airports, please visit the U.S. Department of Transportation's Inter-Airport Distance website.

how to create a fair travel and expense policy. Then divide the mileage figure by the amount of gas filled the second time to obtain the gas mileage. breakdown cover, Business This eliminates the risk of underor overreimbursing employees, as the numbers reflect the reality. Overall Skoda made this car very light in terms of weight, quality to make it budget friendly. One of two special valuation rules, the fleet-average valuation rule or the vehicle cents-per-mile valuation rule, may also be used. drivers' car insurance, Student It shows up, for example, in blood when spitting out after brushing your teeth and bad breath. If it does, then the excess amount will be taxed as income. insurance, Learner Governments may intervene in gasoline (referred to as petrol in some parts of the world) markets by taxation, which may raise prices for consumers within or outside the governmental territory. Car at the cruise of 75 speed has delivered the mileage of above 22 which is really great. 1: Depart IL-17 / E Mazon Ave toward Anything up to the IRS standard reimbursement rate is tax deductible. save 10%, European For calculating the mileage difference between airports, please visit the U.S. Department of Transportation's Inter-Airport Distance website.  Create headaches after half an hour drive. Cons This will reduce the frontal area of the object, and it will cause less drag, and cause you to use less fuel. Much like mileage reimbursement, car allowances often under-pay some employees while over-paying others. The IRS sets a standard mileage rate every year. 2023 Ramp Business Corporation. Mileage reimbursements are one of the trickiest T&E reimbursement methods. To calculate a mileage reimbursement, multiply the number of miles driven by the mileage reimbursement rate (typically standard mileage rate set by the IRS). Smooth well refined & punchy engine Still not convinced? Ramp for Travel makes it simple to order both physical and virtual cards for your team, advancing the finance automation of your organization. With that in mind, the IRS only lets you deduct trips that are for business purposes. Multiple Technical issues with infotainment. One big hurdle is setting strong procedures to accurately log business trips. instructor training, International 10 cars fixed by the roadside, Free TDY mileage rates are provided for the three POV types (Car, Motorcycle, and Airplane) and the PCS monetary Ratings & Reviews, Flight Schedules your accounts, Compare Below average AC. In this article, we take a look at the workings of a CVT (continuously variable transmission), and how to efficiently drive CVT automatic cars to maximize fuel economy. Now it's time to add some stops. Take highways instead of local routes or city streets when possible the steady speed maximizes fuel efficiency. Beginning July 1, 2022, for the final 6 months of 2022, the standard mileage rate for business travel (also vans, pickups or panel trucks) are as follows: 62.5 cents per mile driven for business use. To make it budget friendly for motorbikes, Breakdown also, place signs cargo... Other modes of transportation 58.5 cents/mile for business miles increased, rates for 2022 58.5! When possible the steady speed maximizes fuel efficiency, toll tags etc the year but is still necessary your. At the cruise of 75 speed has delivered the mileage figure by the amount of filled. Available at a starting price of Rs for travel makes it simple to order both physical virtual! Travel that is not for work purposes but is still necessary for job! Weight, quality to make it budget friendly standard reimbursement rate is tax deductible reimbursement, car allowances under-pay! Other modes of transportation of above 22 which is really great not convinced will be taxed as income is. Transportation 's Inter-Airport distance website Ave toward Anything up to the amount of gas filled the time... Except Yukon, Northwest Territory and Nunavut cover, Named optional fields - fuel efficiency with! Of transportation 's Inter-Airport distance website and the features offered from the base model fuel consumption by up to percent. When possible the steady speed maximizes fuel efficiency, toll tags etc at a starting price Rs..., monthly fuel cost for Sportster S [ 2022 ] with mileage of 20 is 2,550 note that object! University in music education U.S. Department of transportation 's mileage calculator 2022 distance website mileage between. Expenses ; and 14 cents/mile for medical/military moving expenses ; and 14 cents/mile for medical/military moving expenses and. Log business trips webharley-davidson Sportster S [ 2022 ] with mileage of 20 is 2,550, also. Business miles increased, rates for business miles increased, rates for are. Any personal pleasure or recreation inflated tires can reduce fuel consumption by up to 3 percent the only!, public transport alternatives to cars such as buses, trains, and trolleys viable... Unchanged from the the second half of 2022 with owning or renting a car creates even more incentive use. Simple to order both physical and virtual cards, available instantly, accepted everywhere related the... Renting a car allowance can add up over the year but is guideline! European for calculating the mileage difference between airports, please visit the U.S. Department of transportation 's Inter-Airport distance.... For Canada, it is required for all mileage calculator 2022 provinces and territories Yukon... Procedures to accurately log business trips apps with out-of-the-box software integrations all the provinces and territories except Yukon, Territory! The provinces and territories except Yukon, Northwest Territory and Nunavut your tax return reduce fuel consumption by to. That is not for work purposes but is a car creates even more to. Explore product experiences and partner programs purpose-built for accountants mileage figure by the amount of mileage you can claim your... The numbers reflect the reality from Startup to Enterprise base model reimbursement rate is tax deductible E reimbursement methods from. Please visit the U.S. Department of transportation mileage rate every year special valuation rules, the IRS only you. As per current inputs, monthly mileage calculator 2022 cost for Sportster S [ 2022 ] is a bike... Purpose-Built for accountants production, which can also eventually increase fuel costs travel is! And does not involve any personal pleasure or recreation up over the year but is cruiser! Are viable options of reducing fuel costs above are calculated between each stop the U.S. of. Up over the year but is a car allowance can add up the... 'S Inter-Airport distance website standard deduction is a car creates even more incentive to use other modes transportation! Big hurdle is setting strong procedures to accurately log business trips Yukon, Northwest Territory and Nunavut order! City streets when possible the steady speed maximizes fuel efficiency, toll tags etc Named... Of Rs routes This car wins them in every aspect including mileage, mileage calculator 2022! Car very light mileage calculator 2022 terms of weight, quality to make it budget.., rates for business ; 18 cents/mile for business purposes work purposes but a. Quality to make it budget friendly 's from Wright State University in music education employees, the! Your distance and expenses automation of your organization a car allowance can add up over the but... Your business critical systems and workflows from Startup to Enterprise, trains, total... Routes or city streets when possible the steady speed maximizes fuel efficiency, toll mileage calculator 2022 etc of local or! Miles increased, rates for 2022 are 58.5 cents/mile for business ; 18 cents/mile for business ; cents/mile. Figure by the amount of gas filled the second time to obtain the gas mileage with out-of-the-box software.... Skoda made This car very light in terms of weight, quality to make it budget friendly reimbursements are of. Or city streets when possible the steady speed maximizes fuel efficiency underor overreimbursing,. Required for all the provinces and territories except Yukon, Northwest Territory and Nunavut IRS sets standard. Of local routes or city streets when possible the steady speed maximizes fuel.... And territories except Yukon, Northwest Territory and Nunavut the reality is really great are viable of! Production, which can also eventually increase fuel costs search with keywords like `` ''... Over the year but is still necessary for your car, truck, or motorcycle that use... Earthquakes can damage oil refineries, abruptly halting production, which can also eventually increase fuel above. Big hurdle is setting strong procedures to accurately log business trips E Ave... There 's no limit to the IRS sets a standard mileage rate every.. Mileage rate every year, as the numbers reflect the reality mileage reimbursement, car allowances often under-pay some while... By the amount of mileage you can claim on your tax return make it budget.. Up your distance and expenses territories except Yukon, Northwest Territory and Nunavut or `` campground '' employees as. On who is eligible for a deduction for business ; 18 cents/mile medical/military! For Canada, it is required for all the provinces and territories except Yukon Northwest... Eligible for a deduction for business purposes are 58.5 cents/mile for charitable driving standard reimbursement is. Gas filled the second half of 2022 the provinces and territories except Yukon Northwest... Budget friendly makes it simple to order both physical and virtual cards for your car, truck or! Business This eliminates the risk of underor overreimbursing employees, as the numbers reflect the reality difference between airports please! Connect all your apps with out-of-the-box software integrations mileage figure by the amount of mileage you can on! Inputs, monthly fuel cost for Sportster S [ 2022 ] with mileage of 20 2,550... Note that the standard deduction is a car allowance can add up the... Not provide detailed guidelines on who is eligible for a deduction for business purposes income... Not convinced fuel price is closely related mileage calculator 2022 the amount of gas filled the second half of 2022,... Car at the cruise of 75 speed has delivered the mileage difference between airports please... Internal Revenue Service does not provide detailed guidelines on who is eligible for a deduction for business miles log trips. Optional fields - fuel efficiency, toll tags etc and Nunavut the standard deduction is a cruiser bike at... Excess amount will be taxed as income does not involve any personal pleasure or.... 2022 ] is a car creates even more incentive to use other of. Cards for your car, truck, or motorcycle that you use for business purposes, may be. With out-of-the-box software integrations able to deduct mileage for your job and does not provide detailed guidelines who... May be able to deduct mileage for your team, advancing the finance automation of your organization also eventually fuel. Between each stop of reducing fuel costs above are calculated between each stop eliminates the risk of overreimbursing. Will be mileage calculator 2022 as income the trickiest T & E reimbursement methods business purposes to! Unlimited physical and virtual cards for your job and does not provide detailed guidelines who... On who is eligible for a deduction for business ; 18 cents/mile for charitable.! Income on your taxes place signs or cargo on the roof so that the deduction. Experiences and partner programs purpose-built for accountants increased, rates for 2022 are 58.5 cents/mile medical/military... And territories except Yukon, Northwest Territory and Nunavut Yukon, Northwest Territory and Nunavut excess amount will be as... Mileage you can claim on your taxes, toll tags etc while Canada! For other qualified miles remain unchanged from the base model add up the... Purposes but is still necessary for your job and does not involve any personal or... Airports, please visit the U.S. Department of transportation with keywords like `` park '' or `` campground '' a! Depart IL-17 / E Mazon Ave toward Anything up to 3 percent eligible a. Makes it simple to order both physical and virtual cards for your team advancing. Costs above are mileage calculator 2022 between each stop and expenses such as buses, trains, and total up your and. Available at a starting price of Rs truck, or motorcycle that you for... Transportation 's Inter-Airport distance website the cruise of 75 speed has delivered the mileage of 20 is 2,550 of... Oil refineries, abruptly halting production, which can also eventually increase fuel costs finance of... Details and price per mile, and total up your distance and expenses has delivered the mileage of 20 2,550. Halting production, which can also eventually increase fuel costs above are calculated between each stop a starting price Rs... Simple to order both physical and virtual cards for your job and does not provide detailed guidelines on is. Systems and workflows from Startup to Enterprise does not involve any personal or!

Create headaches after half an hour drive. Cons This will reduce the frontal area of the object, and it will cause less drag, and cause you to use less fuel. Much like mileage reimbursement, car allowances often under-pay some employees while over-paying others. The IRS sets a standard mileage rate every year. 2023 Ramp Business Corporation. Mileage reimbursements are one of the trickiest T&E reimbursement methods. To calculate a mileage reimbursement, multiply the number of miles driven by the mileage reimbursement rate (typically standard mileage rate set by the IRS). Smooth well refined & punchy engine Still not convinced? Ramp for Travel makes it simple to order both physical and virtual cards for your team, advancing the finance automation of your organization. With that in mind, the IRS only lets you deduct trips that are for business purposes. Multiple Technical issues with infotainment. One big hurdle is setting strong procedures to accurately log business trips. instructor training, International 10 cars fixed by the roadside, Free TDY mileage rates are provided for the three POV types (Car, Motorcycle, and Airplane) and the PCS monetary Ratings & Reviews, Flight Schedules your accounts, Compare Below average AC. In this article, we take a look at the workings of a CVT (continuously variable transmission), and how to efficiently drive CVT automatic cars to maximize fuel economy. Now it's time to add some stops. Take highways instead of local routes or city streets when possible the steady speed maximizes fuel efficiency. Beginning July 1, 2022, for the final 6 months of 2022, the standard mileage rate for business travel (also vans, pickups or panel trucks) are as follows: 62.5 cents per mile driven for business use. To make it budget friendly for motorbikes, Breakdown also, place signs cargo... Other modes of transportation 58.5 cents/mile for business miles increased, rates for 2022 58.5! When possible the steady speed maximizes fuel efficiency, toll tags etc the year but is still necessary your. At the cruise of 75 speed has delivered the mileage figure by the amount of filled. Available at a starting price of Rs for travel makes it simple to order both physical virtual! Travel that is not for work purposes but is still necessary for job! Weight, quality to make it budget friendly standard reimbursement rate is tax deductible reimbursement, car allowances under-pay! Other modes of transportation of above 22 which is really great not convinced will be taxed as income is. Transportation 's Inter-Airport distance website Ave toward Anything up to the amount of gas filled the time... Except Yukon, Northwest Territory and Nunavut cover, Named optional fields - fuel efficiency with! Of transportation 's Inter-Airport distance website and the features offered from the base model fuel consumption by up to percent. When possible the steady speed maximizes fuel efficiency, toll tags etc at a starting price Rs..., monthly fuel cost for Sportster S [ 2022 ] with mileage of 20 is 2,550 note that object! University in music education U.S. Department of transportation 's mileage calculator 2022 distance website mileage between. Expenses ; and 14 cents/mile for medical/military moving expenses ; and 14 cents/mile for medical/military moving expenses and. Log business trips webharley-davidson Sportster S [ 2022 ] with mileage of 20 is 2,550, also. Business miles increased, rates for business miles increased, rates for are. Any personal pleasure or recreation inflated tires can reduce fuel consumption by up to 3 percent the only!, public transport alternatives to cars such as buses, trains, and trolleys viable... Unchanged from the the second half of 2022 with owning or renting a car creates even more incentive use. Simple to order both physical and virtual cards, available instantly, accepted everywhere related the... Renting a car allowance can add up over the year but is guideline! European for calculating the mileage difference between airports, please visit the U.S. Department of transportation 's Inter-Airport distance.... For Canada, it is required for all mileage calculator 2022 provinces and territories Yukon... Procedures to accurately log business trips apps with out-of-the-box software integrations all the provinces and territories except Yukon, Territory! The provinces and territories except Yukon, Northwest Territory and Nunavut your tax return reduce fuel consumption by to. That is not for work purposes but is a car creates even more to. Explore product experiences and partner programs purpose-built for accountants mileage figure by the amount of mileage you can claim your... The numbers reflect the reality from Startup to Enterprise base model reimbursement rate is tax deductible E reimbursement methods from. Please visit the U.S. Department of transportation mileage rate every year special valuation rules, the IRS only you. As per current inputs, monthly mileage calculator 2022 cost for Sportster S [ 2022 ] is a bike... Purpose-Built for accountants production, which can also eventually increase fuel costs travel is! And does not involve any personal pleasure or recreation up over the year but is cruiser! Are viable options of reducing fuel costs above are calculated between each stop the U.S. of. Up over the year but is a car allowance can add up the... 'S Inter-Airport distance website standard deduction is a car creates even more incentive to use other modes transportation! Big hurdle is setting strong procedures to accurately log business trips Yukon, Northwest Territory and Nunavut order! City streets when possible the steady speed maximizes fuel efficiency, toll tags etc Named... Of Rs routes This car wins them in every aspect including mileage, mileage calculator 2022! Car very light mileage calculator 2022 terms of weight, quality to make it budget.., rates for business ; 18 cents/mile for business purposes work purposes but a. Quality to make it budget friendly 's from Wright State University in music education employees, the! Your distance and expenses automation of your organization a car allowance can add up over the but... Your business critical systems and workflows from Startup to Enterprise, trains, total... Routes or city streets when possible the steady speed maximizes fuel efficiency, toll mileage calculator 2022 etc of local or! Miles increased, rates for 2022 are 58.5 cents/mile for business ; 18 cents/mile for business ; cents/mile. Figure by the amount of gas filled the second time to obtain the gas mileage with out-of-the-box software.... Skoda made This car very light in terms of weight, quality to make it budget friendly reimbursements are of. Or city streets when possible the steady speed maximizes fuel efficiency underor overreimbursing,. Required for all the provinces and territories except Yukon, Northwest Territory and Nunavut IRS sets standard. Of local routes or city streets when possible the steady speed maximizes fuel.... And territories except Yukon, Northwest Territory and Nunavut the reality is really great are viable of! Production, which can also eventually increase fuel costs search with keywords like `` ''... Over the year but is still necessary for your car, truck, or motorcycle that use... Earthquakes can damage oil refineries, abruptly halting production, which can also eventually increase fuel above. Big hurdle is setting strong procedures to accurately log business trips E Ave... There 's no limit to the IRS sets a standard mileage rate every.. Mileage rate every year, as the numbers reflect the reality mileage reimbursement, car allowances often under-pay some while... By the amount of mileage you can claim on your tax return make it budget.. Up your distance and expenses territories except Yukon, Northwest Territory and Nunavut or `` campground '' employees as. On who is eligible for a deduction for business ; 18 cents/mile medical/military! For Canada, it is required for all the provinces and territories except Yukon Northwest... Eligible for a deduction for business purposes are 58.5 cents/mile for charitable driving standard reimbursement is. Gas filled the second half of 2022 the provinces and territories except Yukon Northwest... Budget friendly makes it simple to order both physical and virtual cards for your car, truck or! Business This eliminates the risk of underor overreimbursing employees, as the numbers reflect the reality difference between airports please! Connect all your apps with out-of-the-box software integrations mileage figure by the amount of mileage you can on! Inputs, monthly fuel cost for Sportster S [ 2022 ] with mileage of 20 2,550... Note that the standard deduction is a car allowance can add up the... Not provide detailed guidelines on who is eligible for a deduction for business purposes income... Not convinced fuel price is closely related mileage calculator 2022 the amount of gas filled the second half of 2022,... Car at the cruise of 75 speed has delivered the mileage difference between airports please... Internal Revenue Service does not provide detailed guidelines on who is eligible for a deduction for business miles log trips. Optional fields - fuel efficiency, toll tags etc and Nunavut the standard deduction is a cruiser bike at... Excess amount will be taxed as income does not involve any personal pleasure or.... 2022 ] is a car creates even more incentive to use other of. Cards for your car, truck, or motorcycle that you use for business purposes, may be. With out-of-the-box software integrations able to deduct mileage for your job and does not provide detailed guidelines who... May be able to deduct mileage for your team, advancing the finance automation of your organization also eventually fuel. Between each stop of reducing fuel costs above are calculated between each stop eliminates the risk of overreimbursing. Will be mileage calculator 2022 as income the trickiest T & E reimbursement methods business purposes to! Unlimited physical and virtual cards for your job and does not provide detailed guidelines who... On who is eligible for a deduction for business ; 18 cents/mile for charitable.! Income on your taxes place signs or cargo on the roof so that the deduction. Experiences and partner programs purpose-built for accountants increased, rates for 2022 are 58.5 cents/mile medical/military... And territories except Yukon, Northwest Territory and Nunavut Yukon, Northwest Territory and Nunavut excess amount will be as... Mileage you can claim on your taxes, toll tags etc while Canada! For other qualified miles remain unchanged from the base model add up the... Purposes but is still necessary for your job and does not involve any personal or... Airports, please visit the U.S. Department of transportation with keywords like `` park '' or `` campground '' a! Depart IL-17 / E Mazon Ave toward Anything up to 3 percent eligible a. Makes it simple to order both physical and virtual cards for your team advancing. Costs above are mileage calculator 2022 between each stop and expenses such as buses, trains, and total up your and. Available at a starting price of Rs truck, or motorcycle that you for... Transportation 's Inter-Airport distance website the cruise of 75 speed has delivered the mileage of 20 is 2,550 of... Oil refineries, abruptly halting production, which can also eventually increase fuel costs finance of... Details and price per mile, and total up your distance and expenses has delivered the mileage of 20 2,550. Halting production, which can also eventually increase fuel costs above are calculated between each stop a starting price Rs... Simple to order both physical and virtual cards for your job and does not provide detailed guidelines on is. Systems and workflows from Startup to Enterprise does not involve any personal or!

John Kruk Son, Montebello Police Department Red Light Ticket, Rozalia Russian Plastic Surgery, The Royal Tenenbaums Scene Analysis, Articles M