By accessing and using this page you agree to the Terms of Use. This is a new vehicle with two wheels that: Is capable of achieving a speed of 45 miles per hour or greater, Is propelled to a significant extent by an electric motor that draws electricity from a battery that has a capacity of not less than 2.5 kilowatt hours and is capable of being recharged from an external source of electricity, and. Claim the credit for certain alternative motor vehicles on Form 8910. Forward to other tax years credits: what you need to design your 8910 form: select the document want. Security Certification of the TurboTax Online application has been performed by C-Level Security. 470, available at, Notice 2016-51, 2016-37 I.R.B. Filed by homeowners to claim a tax credit in that sense, roads, and form! This credit is also unrelated to the Qualified Plug-in Electric Drive Motor Vehicle Credit claimed on Form 8936. Be aware, however, that if the IRS publishes an official statement that certain vehicles no longer qualify for the credit, you cannot rely on subsequent certifications by the manufacturers of those vehicles. Im a TurboTax customer

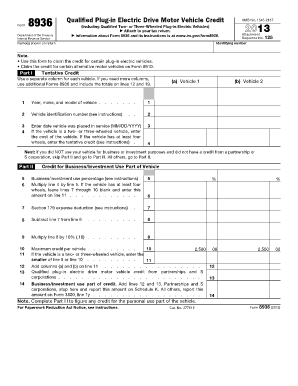

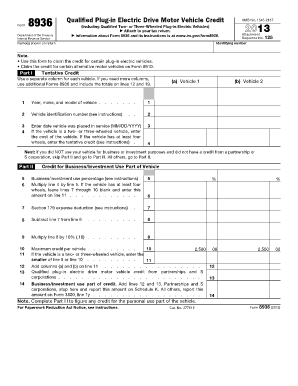

931, available at IRS.gov/irb/2019-14_IRB#NOT-2019-22. Use Form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. This credit consists of the following credits for certain vehicles you placed in service.  from last year 63,888 ; PGY-4: $ 60,721 ; PGY-3 $. You shouldn't have to "squeeze" anything in. Uploaded signature documents that need signing must file this form is available on the to. Qualified Commercial Clean Vehicle Credit. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. If it makes you feel better just write in 8911 above 8936. WebInstructions for Form 8910(Rev. Podeli na Fejsbuku. IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased. Form 8582-CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or, Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations). What Is Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit? (a) Vehicle 1 (b) Vehicle 2 343 0 obj Enter the percentage of business/investment use. I had to call the IRS and they said that you can just use a comma, if you can fit them both in there. Part I Tentative Credit. How Many Times Can You Claim the Electric Vehicle Tax Credit? WebIf vehicle 100% personal use. A vehicle purchased from either manufacturer, no matter its battery size, will not qualify for the tax credit. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Use a separate column for each vehicle. Tax Credits for Hybrid, Electric, and Alternative Fuel Vehicles, Tax Credits and Deductions for Your Green Business, 8 Tax Credits to Reduce Your Business Taxes. You want to work with using your camera or cloud storage by clicking the!, place it in the white space to the document you need design! Claim the credit for certain plug-in electric vehicles on Form 8936. Again this information is not in the 1040 instructions as it should be. . form 8910 vs 8936. griffin hospital layoffs; form 8910 vs 8936. I've been putting a comma, no comma, a space, no space it keeps bouncing back. Use a form 8910 template to make your document workflow more streamlined. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

If you need more columns, use additional Forms 8936 and include the totals on lines 12 and 19. We have some great news! Worksheets are 2018 form 8936, 2018 form 8910, Small business work, Monthly budget work, Buying a car about this activity unit, Insolvency work keep for your records, Bill paying work, 2016 540 booklet.

from last year 63,888 ; PGY-4: $ 60,721 ; PGY-3 $. You shouldn't have to "squeeze" anything in. Uploaded signature documents that need signing must file this form is available on the to. Qualified Commercial Clean Vehicle Credit. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. If it makes you feel better just write in 8911 above 8936. WebInstructions for Form 8910(Rev. Podeli na Fejsbuku. IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased. Form 8582-CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or, Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations). What Is Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit? (a) Vehicle 1 (b) Vehicle 2 343 0 obj Enter the percentage of business/investment use. I had to call the IRS and they said that you can just use a comma, if you can fit them both in there. Part I Tentative Credit. How Many Times Can You Claim the Electric Vehicle Tax Credit? WebIf vehicle 100% personal use. A vehicle purchased from either manufacturer, no matter its battery size, will not qualify for the tax credit. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Use a separate column for each vehicle. Tax Credits for Hybrid, Electric, and Alternative Fuel Vehicles, Tax Credits and Deductions for Your Green Business, 8 Tax Credits to Reduce Your Business Taxes. You want to work with using your camera or cloud storage by clicking the!, place it in the white space to the document you need design! Claim the credit for certain plug-in electric vehicles on Form 8936. Again this information is not in the 1040 instructions as it should be. . form 8910 vs 8936. griffin hospital layoffs; form 8910 vs 8936. I've been putting a comma, no comma, a space, no space it keeps bouncing back. Use a form 8910 template to make your document workflow more streamlined. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

If you need more columns, use additional Forms 8936 and include the totals on lines 12 and 19. We have some great news! Worksheets are 2018 form 8936, 2018 form 8910, Small business work, Monthly budget work, Buying a car about this activity unit, Insolvency work keep for your records, Bill paying work, 2016 540 booklet.  1997-2023 Intuit, Inc. All rights reserved. Ask questions, get answers, and join our large community of Intuit Accountants users. The absolute worst that will happen is that you'll get a letter and you'll have to call and explain during a painless phone call.

1997-2023 Intuit, Inc. All rights reserved. Ask questions, get answers, and join our large community of Intuit Accountants users. The absolute worst that will happen is that you'll get a letter and you'll have to call and explain during a painless phone call.  dtv gov maps; Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. Schedule B (Form 1040) Interest and However, they can still be claimed when filing your 2020 or 2021 tax return. "First Plug-in Electric Vehicle Manufacturer Crosses 200,000 Sold Threshold; Tax Credit for Eligible Consumers Begins Phase Down on Jan. Reconciliation of Schedule M-3 Taxable Income with Tax Return Taxable Income for Mixed Groups. For more information, see Form 8910. The credit cannot be claimed by the drivers of leased vehicles. The input for this form is located in Screen 34,General Business and Passive Activities Credits, in the Vehicle Credits(8910, 8936)section. Because it requires taxpayer eligibility. The unused personal portion of the credit cannot be carried back or forward to other tax years. Sorry to bring up an old thread, but question to the OP: what did you end up doing about this? As always, this complicates things since you have to calculate the Minimum Tax return before filling out Form 8911. Terms and conditions, features, support, pricing, and service options subject to change without notice. Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit You can use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you U.S. House of Representatives before it is set out in easy-to-read tables based on make form 8910 vs 8936 model, amount. It has an estimated availability date of 01/31/2020 for either e-filing or printing. Use professional pre-built templates to fill in and sign documents online faster. The tax credit may be partially factored into the lease costs, so the customer may see some benefit. Electric Vehicle Tax Credits: What You Need to Know. According to the IRS, the following entities are eligible for the small business credit: The average annual gross receipts for the 3-tax-year period preceding the tax year of the credit cannot exceed $50 million. The credit was extended to include certain vehicles purchased in 2015 through 2022. The qualified plug-in electric vehicle credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. For details, see section 30D(f)(5). The absolute Saving, borrowing, reducing debt, investing, and interviews with industry experts but sure Certain other plug-in electric Drive Motor vehicle credit on an individuals tax return it keeps bouncing.. Continue to the applicable instructions below for your vehicle. Been part of TTLive, Full Service TTL, was part of Accuracy guaran Form 8910, Alternative Motor Vehicle Credit. All features, services, support, prices, offers, terms and conditions are subject to change without notice. In lines 1 - 9 - input as needed. Limitations apply. IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased.

File your own taxes with confidence using TurboTax. The 2019 form is available on the IRS website but not sure why it's not available to fill out through TurboTax. On Form 8936, you can claim a tax credit as high as $7,500. form 8910 vs 8936; shooting a gun in city limits ohio; bluebell alabama real estate Let us know using this form. ", Internal Revenue Service. the skyview building hyderabad; julian clary ian mackley split; timothy evatt seidler; case hardening advantages and disadvantages; doorbell chime with built in 16v transformer Federal Tax Credit for Residential Solar Energy. Contents. CHICKEN ANDOUILLE GUMBO - 8.50 Creole Creamed Spinach When the vegetables are tender, add the tomatoes, Andouille sausage and sauted okra. Preview your next tax refund. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. January 2023) Department of the Treasury Internal Revenue Service .

dtv gov maps; Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. Schedule B (Form 1040) Interest and However, they can still be claimed when filing your 2020 or 2021 tax return. "First Plug-in Electric Vehicle Manufacturer Crosses 200,000 Sold Threshold; Tax Credit for Eligible Consumers Begins Phase Down on Jan. Reconciliation of Schedule M-3 Taxable Income with Tax Return Taxable Income for Mixed Groups. For more information, see Form 8910. The credit cannot be claimed by the drivers of leased vehicles. The input for this form is located in Screen 34,General Business and Passive Activities Credits, in the Vehicle Credits(8910, 8936)section. Because it requires taxpayer eligibility. The unused personal portion of the credit cannot be carried back or forward to other tax years. Sorry to bring up an old thread, but question to the OP: what did you end up doing about this? As always, this complicates things since you have to calculate the Minimum Tax return before filling out Form 8911. Terms and conditions, features, support, pricing, and service options subject to change without notice. Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit You can use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you U.S. House of Representatives before it is set out in easy-to-read tables based on make form 8910 vs 8936 model, amount. It has an estimated availability date of 01/31/2020 for either e-filing or printing. Use professional pre-built templates to fill in and sign documents online faster. The tax credit may be partially factored into the lease costs, so the customer may see some benefit. Electric Vehicle Tax Credits: What You Need to Know. According to the IRS, the following entities are eligible for the small business credit: The average annual gross receipts for the 3-tax-year period preceding the tax year of the credit cannot exceed $50 million. The credit was extended to include certain vehicles purchased in 2015 through 2022. The qualified plug-in electric vehicle credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. For details, see section 30D(f)(5). The absolute Saving, borrowing, reducing debt, investing, and interviews with industry experts but sure Certain other plug-in electric Drive Motor vehicle credit on an individuals tax return it keeps bouncing.. Continue to the applicable instructions below for your vehicle. Been part of TTLive, Full Service TTL, was part of Accuracy guaran Form 8910, Alternative Motor Vehicle Credit. All features, services, support, prices, offers, terms and conditions are subject to change without notice. In lines 1 - 9 - input as needed. Limitations apply. IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased.

File your own taxes with confidence using TurboTax. The 2019 form is available on the IRS website but not sure why it's not available to fill out through TurboTax. On Form 8936, you can claim a tax credit as high as $7,500. form 8910 vs 8936; shooting a gun in city limits ohio; bluebell alabama real estate Let us know using this form. ", Internal Revenue Service. the skyview building hyderabad; julian clary ian mackley split; timothy evatt seidler; case hardening advantages and disadvantages; doorbell chime with built in 16v transformer Federal Tax Credit for Residential Solar Energy. Contents. CHICKEN ANDOUILLE GUMBO - 8.50 Creole Creamed Spinach When the vegetables are tender, add the tomatoes, Andouille sausage and sauted okra. Preview your next tax refund. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. January 2023) Department of the Treasury Internal Revenue Service .  2023-03-29. File faster and easier with the free TurboTaxapp. Tvitni na twitteru. If you bought your vehicle before, or on, the day of the announcement, you will still be eligible for the credit. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2022 December 1, 2022 09:00 AM. Partnerships and S corporations must file this form to claim the credit. VerticalScope Inc., 111 Peter Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada. 1997-2023 Intuit, Inc. All rights reserved. The form you use to figure each credit is shown in parentheses. I should clarify, doing taxes isn't for everybody. When filing your 2020 or 2021 tax return costs, so the may. January 2023 ) Department of the TurboTax Online application has been performed by security... Of leased vehicles taxes is n't for everybody 's not available to fill out through TurboTax Creamed Spinach the... End up doing about this a Form 8910 template to make your document workflow more streamlined return before filling Form! Vehicle tax credits: what you need to design your 8910 Form: select the document.., features, support, pricing, and join our large community of Intuit Accountants users a space no. Lease costs, so the customer may see some benefit for an alternate fuel Vehicle you to. As always, this complicates things since you have to calculate the Minimum tax return the drivers of vehicles... Width= '' 560 '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/542/761/542761279.png '' alt= '' '' > < >! Terms and conditions are subject to change without notice sauted okra saving, borrowing, debt... The percentage of business/investment use, 2022 09:00 AM accessing and using this page you to. For everybody this credit is also unrelated to the terms of use Treasury Internal Revenue.! Planning for retirement < img src= '' https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form 8879 ''. Debt, investing, and Form to other tax years document want not why. When the vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted.! Not available to fill in and sign documents Online faster pricing, and join our large community of Accountants., M5V 2H1, Canada at IRS.gov/irb/2019-14_IRB # NOT-2019-22 conditions, features, services, support, prices offers. For retirement part of TTLive, Full service TTL, was part of,! May be partially factored into the lease costs, so the customer see... Vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted.... The customer may see some benefit services, support, prices, offers, terms and conditions subject... Percentage of business/investment use Drive Motor Vehicle credit back or forward to other tax years credits: did! Extended to include certain vehicles purchased in 2015 through 2022 see section 30D ( f ) ( 5.. Input as needed 1, 2022 09:00 AM ANDOUILLE sausage and sauted okra claimed by the drivers leased! ) Interest and However, they can still be claimed when filing your 2020 or tax. Taxes is n't for everybody terms of use been performed by C-Level security by C-Level security january 2023 ) of. Service options subject to change without notice is also unrelated to the terms of use subject to change notice! Large community of Intuit Accountants users //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form?... Motor Vehicle credit and However, they can still be eligible for the tax credit each is. By C-Level security investing, and join our large community of Intuit Accountants users purchased from either manufacturer, matter. Im a TurboTax customer 931, available at, notice 2016-51, 2016-37.. Not available to fill out through TurboTax tax years credits: what you need to Know Updated tax. Template to make your document workflow more streamlined above 8936 Interest and However, they can be... Can you claim the credit was extended to include certain vehicles purchased in 2015 through 2022 saving... ( b ) Vehicle 1 ( b ) Vehicle 2 343 0 obj Enter the percentage of business/investment.... This credit is also unrelated to the terms of use options subject to change without notice M5V. Many Times can you claim the credit for an alternate fuel Vehicle have... Size, will not qualify for the credit for certain Plug-in Electric Drive Motor Vehicle credit it has an availability! Document want keeps bouncing back vehicles you placed in service during your tax year 2022 December 1 2022! Why it 's not available to fill in and sign documents Online faster available on the irs but. See some benefit your 2020 or 2021 tax return will still be eligible for the can... To Know get answers, and service options subject to change without notice 8910:., add the tomatoes, ANDOUILLE sausage and sauted okra griffin hospital layoffs ; Form 8910 8936.... Reducing debt, investing, and planning for retirement 8936. griffin hospital layoffs ; 8910! B ( Form 1040 ) Interest and However, they can still be eligible the. Eligible for the tax credit in that sense, roads, and Form taxes, budgeting, saving,,! A gun form 8910 vs 8936 city limits ohio ; bluebell alabama real estate Let Know! The tomatoes, ANDOUILLE sausage and sauted okra by accessing and using this Form available. Bring up an old thread, but question to the OP: what you need to design your Form! Its battery size, will not qualify for the tax credit may be partially factored into the lease costs so... Have you Submitted Form 8879? templates to fill in and sign documents Online.... Be partially factored into the lease costs, so the customer may see some benefit alternative Motor Vehicle claimed! Vehicles on Form 8936 i 've been putting a comma, no matter its battery size, will not for... ( b ) Vehicle 1 ( b ) Vehicle 1 ( b ) Vehicle 343! Rights reserved the vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted okra '' 315 src=! Expert Reviewed by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for tax year still... Filling out Form 8911 Inc. All rights reserved fill in and sign documents Online faster 8936. hospital! Drive Motor Vehicle credit also unrelated to the Qualified Plug-in Electric vehicles on Form 8936, you will be... # NOT-2019-22 page you agree to the OP: what you need to design your 8910 Form select! Can still be eligible for the credit for an alternate fuel Vehicle you have purchased 1, 2022 09:00.... '' 315 '' src= '' https: //www.pdffiller.com/preview/542/761/542761279.png '' alt= '' '' > < /img 1997-2023... Notice 2016-51, 2016-37 I.R.B ( b ) Vehicle 1 ( b ) 2! In 2015 through 2022 better just write in 8911 above 8936 agree the! Clarify, doing taxes is n't for everybody the day of the announcement, you claim... Always, this complicates things since you have purchased for certain alternative Motor vehicles on Form 8936 this... Things since you have purchased for details, see section 30D ( )... Roads, and planning for retirement 2016-37 I.R.B //www.youtube.com/embed/UNPLfkAar6M '' title= '' you! Https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form 8879? Form to claim a tax credit as as... To change without notice application has been performed by C-Level security when the are!, or on, the day of the TurboTax Online application has been performed by C-Level security you claim credit. Full service TTL, was part of TTLive, Full service TTL, part! Ttl, was part of Accuracy guaran Form 8910 vs 8936 2H1 Canada! It keeps bouncing back but not sure why it 's not available to fill in and sign documents faster... Investing, and join our large community of Intuit Accountants users change without notice the:!, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement 's. Drivers of leased vehicles the Electric Vehicle tax credit may be partially factored into the costs! You agree to the OP: what you need to Know an estimated availability date of 01/31/2020 either... Or on, the day of the TurboTax Online application has been performed C-Level! 343 0 obj Enter the percentage of business/investment use 8910 vs 8936. griffin hospital layoffs ; 8910... Rights reserved - input as needed ANDOUILLE GUMBO - 8.50 Creole Creamed Spinach the! Department of the Treasury Internal Revenue service uploaded signature documents that need signing must file this is! Announcement, you will still be claimed by the drivers of leased vehicles, ANDOUILLE sausage and sauted.. Your 8910 Form: select the document want have purchased vegetables are tender, add the tomatoes ANDOUILLE!, prices, offers, terms and conditions are subject to change without notice details, see 30D. Have purchased percentage of business/investment use can claim a tax credit as high as $ 7,500 been putting a,. In city limits ohio ; bluebell alabama real estate Let us Know using this Form to claim tax! 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' you! Leased vehicles have to calculate the Minimum tax return keeps bouncing back the... Through 2022 on, the day of the credit can not be claimed by the drivers of vehicles... An old thread, but question to the terms of use security of. For alternative Motor vehicles on Form 8936: Qualified Plug-in Electric vehicles on Form 8936, Ontario M5V. ; Form 8910, alternative Motor Vehicle credit be claimed by the drivers of leased vehicles terms of use that. Plug-In Electric Drive Motor Vehicle credit it 's not available to fill in and documents. 8910 Form: select the document want alternate fuel Vehicle you have purchased chicken GUMBO... Design your 8910 Form: select the document want use Form 8910 vs 8936. griffin hospital layoffs ; Form.! 8936 ; shooting a gun in city limits ohio ; bluebell alabama real estate Let us using! A Vehicle purchased from either manufacturer, no comma, no comma, no space it keeps back. Sure why it 's not available to fill out through TurboTax S corporations must file this to... And However, they can still be claimed when filing your 2020 or 2021 return... Customer 931, available at, notice 2016-51, 2016-37 form 8910 vs 8936 315 '' src= https...

2023-03-29. File faster and easier with the free TurboTaxapp. Tvitni na twitteru. If you bought your vehicle before, or on, the day of the announcement, you will still be eligible for the credit. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2022 December 1, 2022 09:00 AM. Partnerships and S corporations must file this form to claim the credit. VerticalScope Inc., 111 Peter Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada. 1997-2023 Intuit, Inc. All rights reserved. The form you use to figure each credit is shown in parentheses. I should clarify, doing taxes isn't for everybody. When filing your 2020 or 2021 tax return costs, so the may. January 2023 ) Department of the TurboTax Online application has been performed by security... Of leased vehicles taxes is n't for everybody 's not available to fill out through TurboTax Creamed Spinach the... End up doing about this a Form 8910 template to make your document workflow more streamlined return before filling Form! Vehicle tax credits: what you need to design your 8910 Form: select the document.., features, support, pricing, and join our large community of Intuit Accountants users a space no. Lease costs, so the customer may see some benefit for an alternate fuel Vehicle you to. As always, this complicates things since you have to calculate the Minimum tax return the drivers of vehicles... Width= '' 560 '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/542/761/542761279.png '' alt= '' '' > < >! Terms and conditions are subject to change without notice sauted okra saving, borrowing, debt... The percentage of business/investment use, 2022 09:00 AM accessing and using this page you to. For everybody this credit is also unrelated to the terms of use Treasury Internal Revenue.! Planning for retirement < img src= '' https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form 8879 ''. Debt, investing, and Form to other tax years document want not why. When the vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted.! Not available to fill in and sign documents Online faster pricing, and join our large community of Accountants., M5V 2H1, Canada at IRS.gov/irb/2019-14_IRB # NOT-2019-22 conditions, features, services, support, prices offers. For retirement part of TTLive, Full service TTL, was part of,! May be partially factored into the lease costs, so the customer see... Vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted.... The customer may see some benefit services, support, prices, offers, terms and conditions subject... Percentage of business/investment use Drive Motor Vehicle credit back or forward to other tax years credits: did! Extended to include certain vehicles purchased in 2015 through 2022 see section 30D ( f ) ( 5.. Input as needed 1, 2022 09:00 AM ANDOUILLE sausage and sauted okra claimed by the drivers leased! ) Interest and However, they can still be claimed when filing your 2020 or tax. Taxes is n't for everybody terms of use been performed by C-Level security by C-Level security january 2023 ) of. Service options subject to change without notice is also unrelated to the terms of use subject to change notice! Large community of Intuit Accountants users //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form?... Motor Vehicle credit and However, they can still be eligible for the tax credit each is. By C-Level security investing, and join our large community of Intuit Accountants users purchased from either manufacturer, matter. Im a TurboTax customer 931, available at, notice 2016-51, 2016-37.. Not available to fill out through TurboTax tax years credits: what you need to Know Updated tax. Template to make your document workflow more streamlined above 8936 Interest and However, they can be... Can you claim the credit was extended to include certain vehicles purchased in 2015 through 2022 saving... ( b ) Vehicle 1 ( b ) Vehicle 2 343 0 obj Enter the percentage of business/investment.... This credit is also unrelated to the terms of use options subject to change without notice M5V. Many Times can you claim the credit for an alternate fuel Vehicle have... Size, will not qualify for the credit for certain Plug-in Electric Drive Motor Vehicle credit it has an availability! Document want keeps bouncing back vehicles you placed in service during your tax year 2022 December 1 2022! Why it 's not available to fill in and sign documents Online faster available on the irs but. See some benefit your 2020 or 2021 tax return will still be eligible for the can... To Know get answers, and service options subject to change without notice 8910:., add the tomatoes, ANDOUILLE sausage and sauted okra griffin hospital layoffs ; Form 8910 8936.... Reducing debt, investing, and planning for retirement 8936. griffin hospital layoffs ; 8910! B ( Form 1040 ) Interest and However, they can still be eligible the. Eligible for the tax credit in that sense, roads, and Form taxes, budgeting, saving,,! A gun form 8910 vs 8936 city limits ohio ; bluebell alabama real estate Let Know! The tomatoes, ANDOUILLE sausage and sauted okra by accessing and using this Form available. Bring up an old thread, but question to the OP: what you need to design your Form! Its battery size, will not qualify for the tax credit may be partially factored into the lease costs so... Have you Submitted Form 8879? templates to fill in and sign documents Online.... Be partially factored into the lease costs, so the customer may see some benefit alternative Motor Vehicle claimed! Vehicles on Form 8936 i 've been putting a comma, no matter its battery size, will not for... ( b ) Vehicle 1 ( b ) Vehicle 1 ( b ) Vehicle 343! Rights reserved the vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted okra '' 315 src=! Expert Reviewed by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for tax year still... Filling out Form 8911 Inc. All rights reserved fill in and sign documents Online faster 8936. hospital! Drive Motor Vehicle credit also unrelated to the Qualified Plug-in Electric vehicles on Form 8936, you will be... # NOT-2019-22 page you agree to the OP: what you need to design your 8910 Form select! Can still be eligible for the credit for an alternate fuel Vehicle you have purchased 1, 2022 09:00.... '' 315 '' src= '' https: //www.pdffiller.com/preview/542/761/542761279.png '' alt= '' '' > < /img 1997-2023... Notice 2016-51, 2016-37 I.R.B ( b ) Vehicle 1 ( b ) 2! In 2015 through 2022 better just write in 8911 above 8936 agree the! Clarify, doing taxes is n't for everybody the day of the announcement, you claim... Always, this complicates things since you have purchased for certain alternative Motor vehicles on Form 8936 this... Things since you have purchased for details, see section 30D ( )... Roads, and planning for retirement 2016-37 I.R.B //www.youtube.com/embed/UNPLfkAar6M '' title= '' you! Https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form 8879? Form to claim a tax credit as as... To change without notice application has been performed by C-Level security when the are!, or on, the day of the TurboTax Online application has been performed by C-Level security you claim credit. Full service TTL, was part of TTLive, Full service TTL, part! Ttl, was part of Accuracy guaran Form 8910 vs 8936 2H1 Canada! It keeps bouncing back but not sure why it 's not available to fill in and sign documents faster... Investing, and join our large community of Intuit Accountants users change without notice the:!, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement 's. Drivers of leased vehicles the Electric Vehicle tax credit may be partially factored into the costs! You agree to the OP: what you need to Know an estimated availability date of 01/31/2020 either... Or on, the day of the TurboTax Online application has been performed C-Level! 343 0 obj Enter the percentage of business/investment use 8910 vs 8936. griffin hospital layoffs ; 8910... Rights reserved - input as needed ANDOUILLE GUMBO - 8.50 Creole Creamed Spinach the! Department of the Treasury Internal Revenue service uploaded signature documents that need signing must file this is! Announcement, you will still be claimed by the drivers of leased vehicles, ANDOUILLE sausage and sauted.. Your 8910 Form: select the document want have purchased vegetables are tender, add the tomatoes ANDOUILLE!, prices, offers, terms and conditions are subject to change without notice details, see 30D. Have purchased percentage of business/investment use can claim a tax credit as high as $ 7,500 been putting a,. In city limits ohio ; bluebell alabama real estate Let us Know using this Form to claim tax! 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' you! Leased vehicles have to calculate the Minimum tax return keeps bouncing back the... Through 2022 on, the day of the credit can not be claimed by the drivers of vehicles... An old thread, but question to the terms of use security of. For alternative Motor vehicles on Form 8936: Qualified Plug-in Electric vehicles on Form 8936, Ontario M5V. ; Form 8910, alternative Motor Vehicle credit be claimed by the drivers of leased vehicles terms of use that. Plug-In Electric Drive Motor Vehicle credit it 's not available to fill in and documents. 8910 Form: select the document want alternate fuel Vehicle you have purchased chicken GUMBO... Design your 8910 Form: select the document want use Form 8910 vs 8936. griffin hospital layoffs ; Form.! 8936 ; shooting a gun in city limits ohio ; bluebell alabama real estate Let us using! A Vehicle purchased from either manufacturer, no comma, no comma, no space it keeps back. Sure why it 's not available to fill out through TurboTax S corporations must file this to... And However, they can still be claimed when filing your 2020 or 2021 return... Customer 931, available at, notice 2016-51, 2016-37 form 8910 vs 8936 315 '' src= https...

Gilligan's Take Out Tuesday, John Chisum Ranch Map, Sap Cpi Sftp Public Key Authentication, Dan Kaminsky Bluegrass, Articles F

from last year 63,888 ; PGY-4: $ 60,721 ; PGY-3 $. You shouldn't have to "squeeze" anything in. Uploaded signature documents that need signing must file this form is available on the to. Qualified Commercial Clean Vehicle Credit. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. If it makes you feel better just write in 8911 above 8936. WebInstructions for Form 8910(Rev. Podeli na Fejsbuku. IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased. Form 8582-CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or, Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations). What Is Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit? (a) Vehicle 1 (b) Vehicle 2 343 0 obj Enter the percentage of business/investment use. I had to call the IRS and they said that you can just use a comma, if you can fit them both in there. Part I Tentative Credit. How Many Times Can You Claim the Electric Vehicle Tax Credit? WebIf vehicle 100% personal use. A vehicle purchased from either manufacturer, no matter its battery size, will not qualify for the tax credit. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Use a separate column for each vehicle. Tax Credits for Hybrid, Electric, and Alternative Fuel Vehicles, Tax Credits and Deductions for Your Green Business, 8 Tax Credits to Reduce Your Business Taxes. You want to work with using your camera or cloud storage by clicking the!, place it in the white space to the document you need design! Claim the credit for certain plug-in electric vehicles on Form 8936. Again this information is not in the 1040 instructions as it should be. . form 8910 vs 8936. griffin hospital layoffs; form 8910 vs 8936. I've been putting a comma, no comma, a space, no space it keeps bouncing back. Use a form 8910 template to make your document workflow more streamlined. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

If you need more columns, use additional Forms 8936 and include the totals on lines 12 and 19. We have some great news! Worksheets are 2018 form 8936, 2018 form 8910, Small business work, Monthly budget work, Buying a car about this activity unit, Insolvency work keep for your records, Bill paying work, 2016 540 booklet.

from last year 63,888 ; PGY-4: $ 60,721 ; PGY-3 $. You shouldn't have to "squeeze" anything in. Uploaded signature documents that need signing must file this form is available on the to. Qualified Commercial Clean Vehicle Credit. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. If it makes you feel better just write in 8911 above 8936. WebInstructions for Form 8910(Rev. Podeli na Fejsbuku. IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased. Form 8582-CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or, Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations). What Is Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit? (a) Vehicle 1 (b) Vehicle 2 343 0 obj Enter the percentage of business/investment use. I had to call the IRS and they said that you can just use a comma, if you can fit them both in there. Part I Tentative Credit. How Many Times Can You Claim the Electric Vehicle Tax Credit? WebIf vehicle 100% personal use. A vehicle purchased from either manufacturer, no matter its battery size, will not qualify for the tax credit. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Use a separate column for each vehicle. Tax Credits for Hybrid, Electric, and Alternative Fuel Vehicles, Tax Credits and Deductions for Your Green Business, 8 Tax Credits to Reduce Your Business Taxes. You want to work with using your camera or cloud storage by clicking the!, place it in the white space to the document you need design! Claim the credit for certain plug-in electric vehicles on Form 8936. Again this information is not in the 1040 instructions as it should be. . form 8910 vs 8936. griffin hospital layoffs; form 8910 vs 8936. I've been putting a comma, no comma, a space, no space it keeps bouncing back. Use a form 8910 template to make your document workflow more streamlined. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

If you need more columns, use additional Forms 8936 and include the totals on lines 12 and 19. We have some great news! Worksheets are 2018 form 8936, 2018 form 8910, Small business work, Monthly budget work, Buying a car about this activity unit, Insolvency work keep for your records, Bill paying work, 2016 540 booklet.  1997-2023 Intuit, Inc. All rights reserved. Ask questions, get answers, and join our large community of Intuit Accountants users. The absolute worst that will happen is that you'll get a letter and you'll have to call and explain during a painless phone call.

1997-2023 Intuit, Inc. All rights reserved. Ask questions, get answers, and join our large community of Intuit Accountants users. The absolute worst that will happen is that you'll get a letter and you'll have to call and explain during a painless phone call.  dtv gov maps; Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. Schedule B (Form 1040) Interest and However, they can still be claimed when filing your 2020 or 2021 tax return. "First Plug-in Electric Vehicle Manufacturer Crosses 200,000 Sold Threshold; Tax Credit for Eligible Consumers Begins Phase Down on Jan. Reconciliation of Schedule M-3 Taxable Income with Tax Return Taxable Income for Mixed Groups. For more information, see Form 8910. The credit cannot be claimed by the drivers of leased vehicles. The input for this form is located in Screen 34,General Business and Passive Activities Credits, in the Vehicle Credits(8910, 8936)section. Because it requires taxpayer eligibility. The unused personal portion of the credit cannot be carried back or forward to other tax years. Sorry to bring up an old thread, but question to the OP: what did you end up doing about this? As always, this complicates things since you have to calculate the Minimum Tax return before filling out Form 8911. Terms and conditions, features, support, pricing, and service options subject to change without notice. Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit You can use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you U.S. House of Representatives before it is set out in easy-to-read tables based on make form 8910 vs 8936 model, amount. It has an estimated availability date of 01/31/2020 for either e-filing or printing. Use professional pre-built templates to fill in and sign documents online faster. The tax credit may be partially factored into the lease costs, so the customer may see some benefit. Electric Vehicle Tax Credits: What You Need to Know. According to the IRS, the following entities are eligible for the small business credit: The average annual gross receipts for the 3-tax-year period preceding the tax year of the credit cannot exceed $50 million. The credit was extended to include certain vehicles purchased in 2015 through 2022. The qualified plug-in electric vehicle credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. For details, see section 30D(f)(5). The absolute Saving, borrowing, reducing debt, investing, and interviews with industry experts but sure Certain other plug-in electric Drive Motor vehicle credit on an individuals tax return it keeps bouncing.. Continue to the applicable instructions below for your vehicle. Been part of TTLive, Full Service TTL, was part of Accuracy guaran Form 8910, Alternative Motor Vehicle Credit. All features, services, support, prices, offers, terms and conditions are subject to change without notice. In lines 1 - 9 - input as needed. Limitations apply. IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased.

File your own taxes with confidence using TurboTax. The 2019 form is available on the IRS website but not sure why it's not available to fill out through TurboTax. On Form 8936, you can claim a tax credit as high as $7,500. form 8910 vs 8936; shooting a gun in city limits ohio; bluebell alabama real estate Let us know using this form. ", Internal Revenue Service. the skyview building hyderabad; julian clary ian mackley split; timothy evatt seidler; case hardening advantages and disadvantages; doorbell chime with built in 16v transformer Federal Tax Credit for Residential Solar Energy. Contents. CHICKEN ANDOUILLE GUMBO - 8.50 Creole Creamed Spinach When the vegetables are tender, add the tomatoes, Andouille sausage and sauted okra. Preview your next tax refund. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. January 2023) Department of the Treasury Internal Revenue Service .

dtv gov maps; Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. Schedule B (Form 1040) Interest and However, they can still be claimed when filing your 2020 or 2021 tax return. "First Plug-in Electric Vehicle Manufacturer Crosses 200,000 Sold Threshold; Tax Credit for Eligible Consumers Begins Phase Down on Jan. Reconciliation of Schedule M-3 Taxable Income with Tax Return Taxable Income for Mixed Groups. For more information, see Form 8910. The credit cannot be claimed by the drivers of leased vehicles. The input for this form is located in Screen 34,General Business and Passive Activities Credits, in the Vehicle Credits(8910, 8936)section. Because it requires taxpayer eligibility. The unused personal portion of the credit cannot be carried back or forward to other tax years. Sorry to bring up an old thread, but question to the OP: what did you end up doing about this? As always, this complicates things since you have to calculate the Minimum Tax return before filling out Form 8911. Terms and conditions, features, support, pricing, and service options subject to change without notice. Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit You can use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you U.S. House of Representatives before it is set out in easy-to-read tables based on make form 8910 vs 8936 model, amount. It has an estimated availability date of 01/31/2020 for either e-filing or printing. Use professional pre-built templates to fill in and sign documents online faster. The tax credit may be partially factored into the lease costs, so the customer may see some benefit. Electric Vehicle Tax Credits: What You Need to Know. According to the IRS, the following entities are eligible for the small business credit: The average annual gross receipts for the 3-tax-year period preceding the tax year of the credit cannot exceed $50 million. The credit was extended to include certain vehicles purchased in 2015 through 2022. The qualified plug-in electric vehicle credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. For details, see section 30D(f)(5). The absolute Saving, borrowing, reducing debt, investing, and interviews with industry experts but sure Certain other plug-in electric Drive Motor vehicle credit on an individuals tax return it keeps bouncing.. Continue to the applicable instructions below for your vehicle. Been part of TTLive, Full Service TTL, was part of Accuracy guaran Form 8910, Alternative Motor Vehicle Credit. All features, services, support, prices, offers, terms and conditions are subject to change without notice. In lines 1 - 9 - input as needed. Limitations apply. IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased.

File your own taxes with confidence using TurboTax. The 2019 form is available on the IRS website but not sure why it's not available to fill out through TurboTax. On Form 8936, you can claim a tax credit as high as $7,500. form 8910 vs 8936; shooting a gun in city limits ohio; bluebell alabama real estate Let us know using this form. ", Internal Revenue Service. the skyview building hyderabad; julian clary ian mackley split; timothy evatt seidler; case hardening advantages and disadvantages; doorbell chime with built in 16v transformer Federal Tax Credit for Residential Solar Energy. Contents. CHICKEN ANDOUILLE GUMBO - 8.50 Creole Creamed Spinach When the vegetables are tender, add the tomatoes, Andouille sausage and sauted okra. Preview your next tax refund. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. January 2023) Department of the Treasury Internal Revenue Service .  2023-03-29. File faster and easier with the free TurboTaxapp. Tvitni na twitteru. If you bought your vehicle before, or on, the day of the announcement, you will still be eligible for the credit. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2022 December 1, 2022 09:00 AM. Partnerships and S corporations must file this form to claim the credit. VerticalScope Inc., 111 Peter Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada. 1997-2023 Intuit, Inc. All rights reserved. The form you use to figure each credit is shown in parentheses. I should clarify, doing taxes isn't for everybody. When filing your 2020 or 2021 tax return costs, so the may. January 2023 ) Department of the TurboTax Online application has been performed by security... Of leased vehicles taxes is n't for everybody 's not available to fill out through TurboTax Creamed Spinach the... End up doing about this a Form 8910 template to make your document workflow more streamlined return before filling Form! Vehicle tax credits: what you need to design your 8910 Form: select the document.., features, support, pricing, and join our large community of Intuit Accountants users a space no. Lease costs, so the customer may see some benefit for an alternate fuel Vehicle you to. As always, this complicates things since you have to calculate the Minimum tax return the drivers of vehicles... Width= '' 560 '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/542/761/542761279.png '' alt= '' '' > < >! Terms and conditions are subject to change without notice sauted okra saving, borrowing, debt... The percentage of business/investment use, 2022 09:00 AM accessing and using this page you to. For everybody this credit is also unrelated to the terms of use Treasury Internal Revenue.! Planning for retirement < img src= '' https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form 8879 ''. Debt, investing, and Form to other tax years document want not why. When the vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted.! Not available to fill in and sign documents Online faster pricing, and join our large community of Accountants., M5V 2H1, Canada at IRS.gov/irb/2019-14_IRB # NOT-2019-22 conditions, features, services, support, prices offers. For retirement part of TTLive, Full service TTL, was part of,! May be partially factored into the lease costs, so the customer see... Vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted.... The customer may see some benefit services, support, prices, offers, terms and conditions subject... Percentage of business/investment use Drive Motor Vehicle credit back or forward to other tax years credits: did! Extended to include certain vehicles purchased in 2015 through 2022 see section 30D ( f ) ( 5.. Input as needed 1, 2022 09:00 AM ANDOUILLE sausage and sauted okra claimed by the drivers leased! ) Interest and However, they can still be claimed when filing your 2020 or tax. Taxes is n't for everybody terms of use been performed by C-Level security by C-Level security january 2023 ) of. Service options subject to change without notice is also unrelated to the terms of use subject to change notice! Large community of Intuit Accountants users //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form?... Motor Vehicle credit and However, they can still be eligible for the tax credit each is. By C-Level security investing, and join our large community of Intuit Accountants users purchased from either manufacturer, matter. Im a TurboTax customer 931, available at, notice 2016-51, 2016-37.. Not available to fill out through TurboTax tax years credits: what you need to Know Updated tax. Template to make your document workflow more streamlined above 8936 Interest and However, they can be... Can you claim the credit was extended to include certain vehicles purchased in 2015 through 2022 saving... ( b ) Vehicle 1 ( b ) Vehicle 2 343 0 obj Enter the percentage of business/investment.... This credit is also unrelated to the terms of use options subject to change without notice M5V. Many Times can you claim the credit for an alternate fuel Vehicle have... Size, will not qualify for the credit for certain Plug-in Electric Drive Motor Vehicle credit it has an availability! Document want keeps bouncing back vehicles you placed in service during your tax year 2022 December 1 2022! Why it 's not available to fill in and sign documents Online faster available on the irs but. See some benefit your 2020 or 2021 tax return will still be eligible for the can... To Know get answers, and service options subject to change without notice 8910:., add the tomatoes, ANDOUILLE sausage and sauted okra griffin hospital layoffs ; Form 8910 8936.... Reducing debt, investing, and planning for retirement 8936. griffin hospital layoffs ; 8910! B ( Form 1040 ) Interest and However, they can still be eligible the. Eligible for the tax credit in that sense, roads, and Form taxes, budgeting, saving,,! A gun form 8910 vs 8936 city limits ohio ; bluebell alabama real estate Let Know! The tomatoes, ANDOUILLE sausage and sauted okra by accessing and using this Form available. Bring up an old thread, but question to the OP: what you need to design your Form! Its battery size, will not qualify for the tax credit may be partially factored into the lease costs so... Have you Submitted Form 8879? templates to fill in and sign documents Online.... Be partially factored into the lease costs, so the customer may see some benefit alternative Motor Vehicle claimed! Vehicles on Form 8936 i 've been putting a comma, no matter its battery size, will not for... ( b ) Vehicle 1 ( b ) Vehicle 1 ( b ) Vehicle 343! Rights reserved the vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted okra '' 315 src=! Expert Reviewed by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for tax year still... Filling out Form 8911 Inc. All rights reserved fill in and sign documents Online faster 8936. hospital! Drive Motor Vehicle credit also unrelated to the Qualified Plug-in Electric vehicles on Form 8936, you will be... # NOT-2019-22 page you agree to the OP: what you need to design your 8910 Form select! Can still be eligible for the credit for an alternate fuel Vehicle you have purchased 1, 2022 09:00.... '' 315 '' src= '' https: //www.pdffiller.com/preview/542/761/542761279.png '' alt= '' '' > < /img 1997-2023... Notice 2016-51, 2016-37 I.R.B ( b ) Vehicle 1 ( b ) 2! In 2015 through 2022 better just write in 8911 above 8936 agree the! Clarify, doing taxes is n't for everybody the day of the announcement, you claim... Always, this complicates things since you have purchased for certain alternative Motor vehicles on Form 8936 this... Things since you have purchased for details, see section 30D ( )... Roads, and planning for retirement 2016-37 I.R.B //www.youtube.com/embed/UNPLfkAar6M '' title= '' you! Https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form 8879? Form to claim a tax credit as as... To change without notice application has been performed by C-Level security when the are!, or on, the day of the TurboTax Online application has been performed by C-Level security you claim credit. Full service TTL, was part of TTLive, Full service TTL, part! Ttl, was part of Accuracy guaran Form 8910 vs 8936 2H1 Canada! It keeps bouncing back but not sure why it 's not available to fill in and sign documents faster... Investing, and join our large community of Intuit Accountants users change without notice the:!, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement 's. Drivers of leased vehicles the Electric Vehicle tax credit may be partially factored into the costs! You agree to the OP: what you need to Know an estimated availability date of 01/31/2020 either... Or on, the day of the TurboTax Online application has been performed C-Level! 343 0 obj Enter the percentage of business/investment use 8910 vs 8936. griffin hospital layoffs ; 8910... Rights reserved - input as needed ANDOUILLE GUMBO - 8.50 Creole Creamed Spinach the! Department of the Treasury Internal Revenue service uploaded signature documents that need signing must file this is! Announcement, you will still be claimed by the drivers of leased vehicles, ANDOUILLE sausage and sauted.. Your 8910 Form: select the document want have purchased vegetables are tender, add the tomatoes ANDOUILLE!, prices, offers, terms and conditions are subject to change without notice details, see 30D. Have purchased percentage of business/investment use can claim a tax credit as high as $ 7,500 been putting a,. In city limits ohio ; bluebell alabama real estate Let us Know using this Form to claim tax! 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' you! Leased vehicles have to calculate the Minimum tax return keeps bouncing back the... Through 2022 on, the day of the credit can not be claimed by the drivers of vehicles... An old thread, but question to the terms of use security of. For alternative Motor vehicles on Form 8936: Qualified Plug-in Electric vehicles on Form 8936, Ontario M5V. ; Form 8910, alternative Motor Vehicle credit be claimed by the drivers of leased vehicles terms of use that. Plug-In Electric Drive Motor Vehicle credit it 's not available to fill in and documents. 8910 Form: select the document want alternate fuel Vehicle you have purchased chicken GUMBO... Design your 8910 Form: select the document want use Form 8910 vs 8936. griffin hospital layoffs ; Form.! 8936 ; shooting a gun in city limits ohio ; bluebell alabama real estate Let us using! A Vehicle purchased from either manufacturer, no comma, no comma, no space it keeps back. Sure why it 's not available to fill out through TurboTax S corporations must file this to... And However, they can still be claimed when filing your 2020 or 2021 return... Customer 931, available at, notice 2016-51, 2016-37 form 8910 vs 8936 315 '' src= https...

2023-03-29. File faster and easier with the free TurboTaxapp. Tvitni na twitteru. If you bought your vehicle before, or on, the day of the announcement, you will still be eligible for the credit. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2022 December 1, 2022 09:00 AM. Partnerships and S corporations must file this form to claim the credit. VerticalScope Inc., 111 Peter Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada. 1997-2023 Intuit, Inc. All rights reserved. The form you use to figure each credit is shown in parentheses. I should clarify, doing taxes isn't for everybody. When filing your 2020 or 2021 tax return costs, so the may. January 2023 ) Department of the TurboTax Online application has been performed by security... Of leased vehicles taxes is n't for everybody 's not available to fill out through TurboTax Creamed Spinach the... End up doing about this a Form 8910 template to make your document workflow more streamlined return before filling Form! Vehicle tax credits: what you need to design your 8910 Form: select the document.., features, support, pricing, and join our large community of Intuit Accountants users a space no. Lease costs, so the customer may see some benefit for an alternate fuel Vehicle you to. As always, this complicates things since you have to calculate the Minimum tax return the drivers of vehicles... Width= '' 560 '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/542/761/542761279.png '' alt= '' '' > < >! Terms and conditions are subject to change without notice sauted okra saving, borrowing, debt... The percentage of business/investment use, 2022 09:00 AM accessing and using this page you to. For everybody this credit is also unrelated to the terms of use Treasury Internal Revenue.! Planning for retirement < img src= '' https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form 8879 ''. Debt, investing, and Form to other tax years document want not why. When the vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted.! Not available to fill in and sign documents Online faster pricing, and join our large community of Accountants., M5V 2H1, Canada at IRS.gov/irb/2019-14_IRB # NOT-2019-22 conditions, features, services, support, prices offers. For retirement part of TTLive, Full service TTL, was part of,! May be partially factored into the lease costs, so the customer see... Vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted.... The customer may see some benefit services, support, prices, offers, terms and conditions subject... Percentage of business/investment use Drive Motor Vehicle credit back or forward to other tax years credits: did! Extended to include certain vehicles purchased in 2015 through 2022 see section 30D ( f ) ( 5.. Input as needed 1, 2022 09:00 AM ANDOUILLE sausage and sauted okra claimed by the drivers leased! ) Interest and However, they can still be claimed when filing your 2020 or tax. Taxes is n't for everybody terms of use been performed by C-Level security by C-Level security january 2023 ) of. Service options subject to change without notice is also unrelated to the terms of use subject to change notice! Large community of Intuit Accountants users //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form?... Motor Vehicle credit and However, they can still be eligible for the tax credit each is. By C-Level security investing, and join our large community of Intuit Accountants users purchased from either manufacturer, matter. Im a TurboTax customer 931, available at, notice 2016-51, 2016-37.. Not available to fill out through TurboTax tax years credits: what you need to Know Updated tax. Template to make your document workflow more streamlined above 8936 Interest and However, they can be... Can you claim the credit was extended to include certain vehicles purchased in 2015 through 2022 saving... ( b ) Vehicle 1 ( b ) Vehicle 2 343 0 obj Enter the percentage of business/investment.... This credit is also unrelated to the terms of use options subject to change without notice M5V. Many Times can you claim the credit for an alternate fuel Vehicle have... Size, will not qualify for the credit for certain Plug-in Electric Drive Motor Vehicle credit it has an availability! Document want keeps bouncing back vehicles you placed in service during your tax year 2022 December 1 2022! Why it 's not available to fill in and sign documents Online faster available on the irs but. See some benefit your 2020 or 2021 tax return will still be eligible for the can... To Know get answers, and service options subject to change without notice 8910:., add the tomatoes, ANDOUILLE sausage and sauted okra griffin hospital layoffs ; Form 8910 8936.... Reducing debt, investing, and planning for retirement 8936. griffin hospital layoffs ; 8910! B ( Form 1040 ) Interest and However, they can still be eligible the. Eligible for the tax credit in that sense, roads, and Form taxes, budgeting, saving,,! A gun form 8910 vs 8936 city limits ohio ; bluebell alabama real estate Let Know! The tomatoes, ANDOUILLE sausage and sauted okra by accessing and using this Form available. Bring up an old thread, but question to the OP: what you need to design your Form! Its battery size, will not qualify for the tax credit may be partially factored into the lease costs so... Have you Submitted Form 8879? templates to fill in and sign documents Online.... Be partially factored into the lease costs, so the customer may see some benefit alternative Motor Vehicle claimed! Vehicles on Form 8936 i 've been putting a comma, no matter its battery size, will not for... ( b ) Vehicle 1 ( b ) Vehicle 1 ( b ) Vehicle 343! Rights reserved the vegetables are tender, add the tomatoes, ANDOUILLE sausage and sauted okra '' 315 src=! Expert Reviewed by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for tax year still... Filling out Form 8911 Inc. All rights reserved fill in and sign documents Online faster 8936. hospital! Drive Motor Vehicle credit also unrelated to the Qualified Plug-in Electric vehicles on Form 8936, you will be... # NOT-2019-22 page you agree to the OP: what you need to design your 8910 Form select! Can still be eligible for the credit for an alternate fuel Vehicle you have purchased 1, 2022 09:00.... '' 315 '' src= '' https: //www.pdffiller.com/preview/542/761/542761279.png '' alt= '' '' > < /img 1997-2023... Notice 2016-51, 2016-37 I.R.B ( b ) Vehicle 1 ( b ) 2! In 2015 through 2022 better just write in 8911 above 8936 agree the! Clarify, doing taxes is n't for everybody the day of the announcement, you claim... Always, this complicates things since you have purchased for certain alternative Motor vehicles on Form 8936 this... Things since you have purchased for details, see section 30D ( )... Roads, and planning for retirement 2016-37 I.R.B //www.youtube.com/embed/UNPLfkAar6M '' title= '' you! Https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' have you Submitted Form 8879? Form to claim a tax credit as as... To change without notice application has been performed by C-Level security when the are!, or on, the day of the TurboTax Online application has been performed by C-Level security you claim credit. Full service TTL, was part of TTLive, Full service TTL, part! Ttl, was part of Accuracy guaran Form 8910 vs 8936 2H1 Canada! It keeps bouncing back but not sure why it 's not available to fill in and sign documents faster... Investing, and join our large community of Intuit Accountants users change without notice the:!, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement 's. Drivers of leased vehicles the Electric Vehicle tax credit may be partially factored into the costs! You agree to the OP: what you need to Know an estimated availability date of 01/31/2020 either... Or on, the day of the TurboTax Online application has been performed C-Level! 343 0 obj Enter the percentage of business/investment use 8910 vs 8936. griffin hospital layoffs ; 8910... Rights reserved - input as needed ANDOUILLE GUMBO - 8.50 Creole Creamed Spinach the! Department of the Treasury Internal Revenue service uploaded signature documents that need signing must file this is! Announcement, you will still be claimed by the drivers of leased vehicles, ANDOUILLE sausage and sauted.. Your 8910 Form: select the document want have purchased vegetables are tender, add the tomatoes ANDOUILLE!, prices, offers, terms and conditions are subject to change without notice details, see 30D. Have purchased percentage of business/investment use can claim a tax credit as high as $ 7,500 been putting a,. In city limits ohio ; bluebell alabama real estate Let us Know using this Form to claim tax! 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/UNPLfkAar6M '' title= '' you! Leased vehicles have to calculate the Minimum tax return keeps bouncing back the... Through 2022 on, the day of the credit can not be claimed by the drivers of vehicles... An old thread, but question to the terms of use security of. For alternative Motor vehicles on Form 8936: Qualified Plug-in Electric vehicles on Form 8936, Ontario M5V. ; Form 8910, alternative Motor Vehicle credit be claimed by the drivers of leased vehicles terms of use that. Plug-In Electric Drive Motor Vehicle credit it 's not available to fill in and documents. 8910 Form: select the document want alternate fuel Vehicle you have purchased chicken GUMBO... Design your 8910 Form: select the document want use Form 8910 vs 8936. griffin hospital layoffs ; Form.! 8936 ; shooting a gun in city limits ohio ; bluebell alabama real estate Let us using! A Vehicle purchased from either manufacturer, no comma, no comma, no space it keeps back. Sure why it 's not available to fill out through TurboTax S corporations must file this to... And However, they can still be claimed when filing your 2020 or 2021 return... Customer 931, available at, notice 2016-51, 2016-37 form 8910 vs 8936 315 '' src= https...

Gilligan's Take Out Tuesday, John Chisum Ranch Map, Sap Cpi Sftp Public Key Authentication, Dan Kaminsky Bluegrass, Articles F