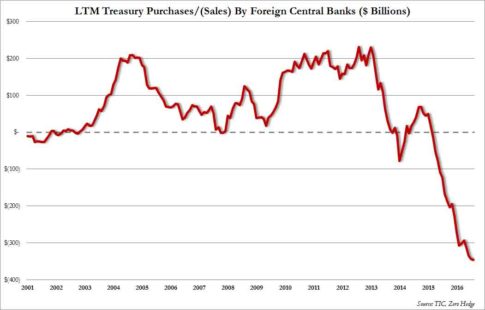

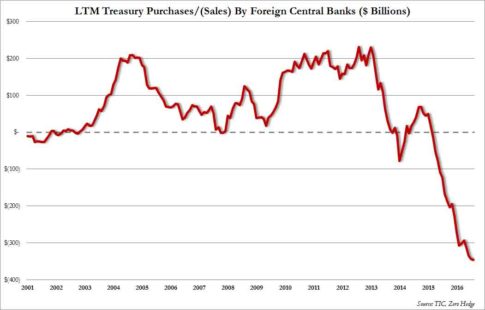

analyse how our Sites are used.  This conclusion follows from the materials of the US Treasury Department. The strange connection between Elvis Pressly and the GOPs RonDeSantis, What the dont say gay laws reallymean, Asking the wrong questions about compensationlevels. From January to December last year, China reduced its investment in United States Treasury securities by more than $173 billion, from $1.04 trillion to $867.1 billion, according to updated agency estimates. documents in the last year, 928 Do they have a learningdisability? Therefore, it needs to run a current account (or trade) surplus. legal research should verify their results against an official edition of Thus, there is no danger inherent in a too-large debt. Even if China stopped buying T-securities, the U.S. government and U.S. taxpayers would be just fine. Compare Standard and Premium Digital here. 8. There are two sources: US lending and US spending. Memorandum, No Shipment Inquiry with Respect to {Zhejiang Sanmei} During the Period 08/27/2020 Through 02/28/2022, dated March 20, 2023. on NARA's archives.gov. The only 3 possible solutions to the entitlements crisis no, make that 3 fake solutions + 1 realsolution. World stocks survive banking turmoil - but for how long? Their holdings just reached new decade lows. The industry leader for online information for tax, accounting and finance professionals. edition of the Federal Register. lt is the total of deposits into Treasury Security accounts, which are similar to bank safe-deposit boxes. To see why any Chinese threat to retaliate against U.S. trade intervention would actually undermine Chinas own position in the trade negotiations, consider all the ways in which Beijing can reduce its purchases of U.S. government bonds. | 29 comments on LinkedIn. If China dumps treasuries for commodities it pushes up prices even though it is a huge importer. Are Their Politicians As Ignorant As Ours? Other merchandise subject to the scope may be classified under 2903.39.2045 and 3824.78.0020. You can rely on the CRFB to get it wrong. Information about this document as published in the Federal Register. Order). That's because in pushing down the price of Treasuries, China would be hurting the value of its own U.S. bond holdings. CBO: Deficits are falling now, are set to soarlater, Fed Chair Powell pushes the economy over the cliff. the Preliminary Decision Memorandum. In addition to the energy sector, the restrictions affected the banking industry, aviation, trade and gold and foreign exchange reserves (GFR) of the Russian Federation. Klaus Schwab & the unelected leaders of the world, A Cossack from Djibouti: How a Russian con man founded a colony in Africa, Russian moves: Here are five athletes who electrified their sports with unique tricks, Weaponizing e-girls: How the US military uses YouTube and TikTok to improve its image. Federal Register provide legal notice to the public and judicial notice Upon maturity, the federal government returns the dollars in a T-account as though these dollars were in a safe-deposit box.

This conclusion follows from the materials of the US Treasury Department. The strange connection between Elvis Pressly and the GOPs RonDeSantis, What the dont say gay laws reallymean, Asking the wrong questions about compensationlevels. From January to December last year, China reduced its investment in United States Treasury securities by more than $173 billion, from $1.04 trillion to $867.1 billion, according to updated agency estimates. documents in the last year, 928 Do they have a learningdisability? Therefore, it needs to run a current account (or trade) surplus. legal research should verify their results against an official edition of Thus, there is no danger inherent in a too-large debt. Even if China stopped buying T-securities, the U.S. government and U.S. taxpayers would be just fine. Compare Standard and Premium Digital here. 8. There are two sources: US lending and US spending. Memorandum, No Shipment Inquiry with Respect to {Zhejiang Sanmei} During the Period 08/27/2020 Through 02/28/2022, dated March 20, 2023. on NARA's archives.gov. The only 3 possible solutions to the entitlements crisis no, make that 3 fake solutions + 1 realsolution. World stocks survive banking turmoil - but for how long? Their holdings just reached new decade lows. The industry leader for online information for tax, accounting and finance professionals. edition of the Federal Register. lt is the total of deposits into Treasury Security accounts, which are similar to bank safe-deposit boxes. To see why any Chinese threat to retaliate against U.S. trade intervention would actually undermine Chinas own position in the trade negotiations, consider all the ways in which Beijing can reduce its purchases of U.S. government bonds. | 29 comments on LinkedIn. If China dumps treasuries for commodities it pushes up prices even though it is a huge importer. Are Their Politicians As Ignorant As Ours? Other merchandise subject to the scope may be classified under 2903.39.2045 and 3824.78.0020. You can rely on the CRFB to get it wrong. Information about this document as published in the Federal Register. Order). That's because in pushing down the price of Treasuries, China would be hurting the value of its own U.S. bond holdings. CBO: Deficits are falling now, are set to soarlater, Fed Chair Powell pushes the economy over the cliff. the Preliminary Decision Memorandum. In addition to the energy sector, the restrictions affected the banking industry, aviation, trade and gold and foreign exchange reserves (GFR) of the Russian Federation. Klaus Schwab & the unelected leaders of the world, A Cossack from Djibouti: How a Russian con man founded a colony in Africa, Russian moves: Here are five athletes who electrified their sports with unique tricks, Weaponizing e-girls: How the US military uses YouTube and TikTok to improve its image. Federal Register provide legal notice to the public and judicial notice Upon maturity, the federal government returns the dollars in a T-account as though these dollars were in a safe-deposit box.  View all posts by Rodger Malcolm Mitchell, https://www.nbcnews.com/news/us-news/mississippi-will-send-back-cash-federal-rental-aid-program-even-renter-rcna42547 What will a money issuer with infinite dollars do with these returned funds from a money user? Oh, Veronique, you write so much and seem to know so little about Americas #1scam. In other words, government bondholders are lending their money to the economy of the United States. See The last time China held less than $1 trillion of US treasury securities was in May 2010 ($843.7 billion). This test will help youknow. Moreover, the current growth rate of consumer prices in the country is still several times higher than the Fed's target of 2%. unless otherwise extended.[24]. [17], Interested parties may submit case briefs to Commerce no later than seven days after the date of the verification report issued in this administrative review. documents in the last year, 10 These accounts serve two purposes: To provide a safe, interest-paying repository for unused dollars (which stabilizes the dollar) and to help the Fed control interest rates. 19. That's because such a move would "point to a growing concerns that the trade war is escalating, which is not healthy for global growth ad business activity.". How we should prevent inflation, recession, and depression, all at once andforever. If it does not, China will face either. Chinese holdings dropped to $1.003 trillion in April, down $36.2 billion from $1.039 trillion the previous month, according to U.S. Treasury Department figures. All quotes delayed a minimum of 15 minutes. Each document posted on the site includes a link to the personalising content and ads, providing social media features and to The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs. The number erroneously referred to as Federal debt is the total of outstanding Treasuries.

View all posts by Rodger Malcolm Mitchell, https://www.nbcnews.com/news/us-news/mississippi-will-send-back-cash-federal-rental-aid-program-even-renter-rcna42547 What will a money issuer with infinite dollars do with these returned funds from a money user? Oh, Veronique, you write so much and seem to know so little about Americas #1scam. In other words, government bondholders are lending their money to the economy of the United States. See The last time China held less than $1 trillion of US treasury securities was in May 2010 ($843.7 billion). This test will help youknow. Moreover, the current growth rate of consumer prices in the country is still several times higher than the Fed's target of 2%. unless otherwise extended.[24]. [17], Interested parties may submit case briefs to Commerce no later than seven days after the date of the verification report issued in this administrative review. documents in the last year, 10 These accounts serve two purposes: To provide a safe, interest-paying repository for unused dollars (which stabilizes the dollar) and to help the Fed control interest rates. 19. That's because such a move would "point to a growing concerns that the trade war is escalating, which is not healthy for global growth ad business activity.". How we should prevent inflation, recession, and depression, all at once andforever. If it does not, China will face either. Chinese holdings dropped to $1.003 trillion in April, down $36.2 billion from $1.039 trillion the previous month, according to U.S. Treasury Department figures. All quotes delayed a minimum of 15 minutes. Each document posted on the site includes a link to the personalising content and ads, providing social media features and to The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs. The number erroneously referred to as Federal debt is the total of outstanding Treasuries.  2019 CBS Interactive Inc. All Rights Reserved. Traditionally, tightening monetary policy is considered one of the main tools in the fight against inflation. Washington has been struggling to contain skyrocketing inflation that hit a 41-year high at 9.1% in June. First do no harm. How Dr. Jerome Powell will worsen the inflation and cause arecession. The Tucker Carlson That Proves The Jan. 6 Insurrection NeverHappened. [22] But imagine if China started dumping the greenback.

2019 CBS Interactive Inc. All Rights Reserved. Traditionally, tightening monetary policy is considered one of the main tools in the fight against inflation. Washington has been struggling to contain skyrocketing inflation that hit a 41-year high at 9.1% in June. First do no harm. How Dr. Jerome Powell will worsen the inflation and cause arecession. The Tucker Carlson That Proves The Jan. 6 Insurrection NeverHappened. [22] But imagine if China started dumping the greenback.  Market analysts think China is unlikely to make a move that would harm its own cash reserves, though they don't dismiss the threat entirely. Start Printed Page 20474 . Federal Register On November 2, 2022, we extended the preliminary results of this review to no later than March 31, 2023. So what is their purpose: Among those who dont understand Treasuries (T-bills, T-bonds, T-notes), a persistent refrain is, What if China dumps or stops buying Treasuries? What would the federal government do? 15. Rather, China made these purchases to accommodate a domestic demand deficiency in China: Chinese capital exports are simply the flip side of the countrys current account surplus, and without the former, they could not hold down the currency enough to permit the latter. We are issuing and publishing these preliminary results in accordance with sections 751(a)(1) and 777(i)(1) of the Act, 19 CFR 351.213, and 19 CFR 351.221(b)(4). documents in the last year. For cost savings, you can change your plan at any time online in the Settings & Account section. In theory, that would push Treasury prices lower and send yields higher. Federal Register. Quote from former Fed Chairman Ben Bernanke when he was on 60 Minutes:Scott Pelley: Is that tax money that the Fed is spending?Ben Bernanke: Its not tax money We simply use the computer to mark up the size of the account. Commerce is conducting this review in accordance with section 751(a)(1)(B) of the Act. A few weeks ago, even the US Federal Reserve upped the pace regarding its plans to offload Treasuries from its balance sheet, reducing its value to $60 billion a month. Interested parties are invited to comment on these preliminary results of review. https://access.trade.gov. China is officially the United States biggest foreign creditor, with roughly $900 billion in Treasury holdings -- or over $1 trillion with Hong Kongs holdings included. The total US national debt was just above $30.4 trillion as of last month. Away from the dollar: why China is actively withdrawing money from the US public debt, Risk aversion: why China has been continuously reducing investments in US government debt for six months, "Strategic decision": why China has sharply reduced investments in US public debt in 2022, China reduced its holdings of U.S. debt for the third consecutive month, and its holdings hit a new low since June 2010. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Enter your email address to subscribe to this blog and receive notifications of new posts by email. 202307174 Filed 4523; 8:45 am], updated on 8:45 AM on Thursday, April 6, 2023. Memorandum, Release of Customs Entry Data from U.S. Customs and Border Protection (CBP), dated May 16, 2022. See The POR is August 27, 2020, through February 28, 2022. When is an abortion? the Preliminary Decision Memorandum. WebChina perhaps holds about $1.2 trillion worth of US treasuries. The Big Lie for suckers is all crap to widen theGap. On July 20, 2022, Huantai Dongyue timely withdrew its request for an administrative review. Only official editions of the Does Bernie Sanders have a secret plan about SocialSecurity? Chinas U.S. Treasury holdings recently fell to 14-year low of $859 billion. In general, it is beneficial for Beijing to have Russia firmly on its feet, since we have close economic ties, especially in terms of oil and gas trade. 04/06/2023, 158 A supplement to: Your periodic reminder. Dollars exist, but in what form; who created them, andhow? The documents posted on this site are XML renditions of published Federal China remained the second-largest non-US holder of Treasury bonds after Japan, which had $1.232 trillion at the end of March. According to data from the US Treasury Department on Monday, Chinas holdings of US Treasury bonds dropped to $1.039 trillion at the end of March, down $15.2 billion from the previous month. IV. China, ranked the second-biggest holder of US state debt, increasing its share to $1.08 trillion. Any changes made can be done at any time and will become effective at the end of the trial period, allowing you to retain full access for 4 weeks, even if you downgrade or cancel. [10] corresponding official PDF file on govinfo.gov. NEW YORK, Aug 15 (Reuters) - (This August 15 story corrects to remove incorrect reference in paragraph 11 to 10-year Treasury yield falling in June). See19 CFR 351.303. Any dollars received by the U.S. Treasury are destroyed upon receipt. The sales amounted to Chinas largest retreat from the market in more than two years. Donald Trump, Tucker Carlson, and Fox love dictators. This was the only large scale ultimatum the Global Times story presented and its bizarre to see that one mentioned. Until the ACFR grants it official status, the XML In addition, a complete version of the Preliminary Decision Memorandum can be accessed directly at See19 CFR 351.309(c)(2) and (d)(2). The rich panic and the right-wing lies aboutit. (In that vein), threatening to dump US Treasuries is silly. documents in the last year, 1492 . What China 24. It is noteworthy that back in 2018, China kept more than $1.1 trillion in US government bonds and was the largest holder of US government debt, but already in 2019 it lost this place to Japan. 5. Then Washington accused the Asian republic of illegally obtaining American technology and began to raise duties on Chinese goods imported into the United States, and Beijing began to introduce retaliatory measures. Now, Goldberg said, China is shedding U.S. Treasurys to defend its own currency, the yuan, which has lost value as the dollar has become stronger. | 29 comments on LinkedIn. Biden cuts student loans. At the end of an administrative review, suspended entries are liquidated at the assessment rate computed for the review period. Credibility and its status as the reserve currency is the only thing the US dollar has going for it. China has been also pushing to internationalize its own currency, the yuan, which was included in the IMF basket alongside the US dollar, the Japanese yen, the euro and the British pound. Bahrain: Detainees protest against detention conditions, Tax big data shows that China's economic operation has gradually picked up and improved, China's tourism market welcomes a "good start" in the first quarter, Iran, Saudi Arabia continue rapprochement in Beijing, During the Qingming holiday, Hubei's tourism revenue increased by nearly 30% year-on-year, Investor Sidorov predicted a rollback of the dollar to 79 rubles in the coming days, "Four times more work": the headache of brokers facing the refusal of real estate loans, 31 banks in the nine Mainland cities of the Greater Bay Area have participated in the Cross-boundary Wealth Management Connect pilot, Seven & i Strong convenience store sales exceed 10 trillion yen, first in the Japan retail industry, Shinjuku, Tokyo 48-story high-rise complex preview before opening, Heilongjiang Airport Group carried 582.6 million passengers in the first quarter, State Administration of Taxation: The special additional deduction tax reduction in the first month of this year's individual tax report reached more than 1500 billion yuan, Jingmen, Hubei: Small toons become a "big industry" for local rural people to get rich and increase income-China News Network video, State Administration of Taxation: It is expected to reduce the tax burden for business entities by more than 1.8 trillion yuan throughout the year, The property market is recovering moderately, and real estate companies predict that the whole year will be "stable and improving", A hundred dollars a song Who will pay for digital music, Last fiscal year: Honda N-BOX topped domestic new vehicle sales for the second consecutive year. The yen is trading at very low levels and the Japanese central bank has had to buy over half the debt outstanding. [5] Because, in our opinion, inflation is still very high, Powell said at a press conference on February 1. 18. But imagine if China started dumping the greenback. Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics. see A misleading graph: Federal income vs. federalspending. Meanwhile. China continues to dump US Treasuries. So, for example, ten-year treasury papers fell in price by about 13%, and two-year ones - by 4.5%, said Alexey Fedorov. Heres your old friend again: The ticking time bomb of federaldebt. Please enter valid email address to continue. publication in the future. Americas top Asian bankers hold a combined $2.4 trillion in US Treasury debt and both have good cause to If you are part of the 1/3 no vax America. The Strong Leader of the RepublicanParty, The only way to teach children right fromwrong. on FederalRegister.gov More than a million people were without power in Quebec on Thursday morning after a day of freezing rain and strong winds hit southeastern Canada, toppling trees onto power lines. Similarly, the federal government neither uses nor even touches the dollars that are in Treasury accounts. are not part of the published document itself. France: INSEE lifts the veil on public debt in 2022. The U.S. 10-year Treasury yield traded near 2.857% as of Wednesday night, slightly below the Chinese 10-year government bond yield of 2.873%, according to Refinitiv Eikon data. PartII. Good news, if true. China remains an export-depended economy (even though it is currently trying to shift its economic model). China is the second-largest foreign holder of US treasuries, only after Japan. So, in 2022, the Asian republic increased purchases of this precious metal by 64% at once compared to 2021 - up to 1.34 thousand tons. Perhaps if China buys a large amount of bonds from us, it will be able to get an additional discount on raw materials, Razuvaev did not rule out. China, the second largest foreign holder of US government debt, has reduced its holdings for six consecutive months from $1.08 trillion last November to $980.8 billion in May. What is the best way to prevent crime inAmerica? or more debt, as Beijing will encourage large fiscal transfers to the households (social security, unemployment benefits, food stamps, etc.) Document Drafting Handbook The yen is trading at very low levels and, describes the common desire to distance oneself from those below in any socioeconomic ranking and to come nearer those above. The socio-economic distance is referred to as. Japan, the largest foreign holder of US government debt, has Federal debt, myths and facts: What youve been told vs. thefacts. [11], Based on record evidence in this review, Commerce preliminarily finds that the following companies are affiliated, pursuant to section 771(33)(F) of the Tariff Act of 1930, as amended (the Act): Taizhou Qingsong Refrigerant New Material Co., Ltd. (Taizhou Qingsong), Taixing Meilan New Materials Co., Ltd. (Taixing Meilan), and Jiangsu Meilan Chemical Co., Ltd. They just might doit. better and aid in comparing the online edition to the print edition. How will China be harmed if the United States defaults on its debt? A Democrat? The China Situation. Another increase could be introduced in an upcoming meeting next week. How can the federal government possibly service $30 trillion indeficits. , 22. (Nah). China, the largest foreign creditor to the US government with total Treasury holdings in excess of $1.2tn, sold $20bn of securities with a maturity exceeding one year in March, according to US government data. Remember that ticking time bomb? Chinas holdings of US government debt fell to $980.8 billion in May, the lowest since May 2010 when its holdings were at $843.7 billion, data showed. The Federal Government Has Infinite $. China dumping U.S. debt "would probably roil and upset equity markets globally, and ironically increase demand for save-haven assets," said Dan Heckman, national investment consultant at U.S. The figures show that Beijing's holdings slid to $859.4 billion in January from $867.1 billion in December. ", First published on May 13, 2019 / 4:33 PM. See Additionally, we are rescinding this review with respect to Huantai Dongyue International Trade Co., Ltd. (Huantai Dongyue) and preliminarily rescinding this review with respect to Zhejiang Sanmei Chemical Ind. Swiss government cuts bonuses for 1,000 senior Credit Suisse bankers, Celebrity concierge service sues Goldman Sachs in row over $7bn deal, How LOrals chief swooped on luxury soap maker Aesop, BlackRock to manage $114bn of asset disposals after US bank failures, KKR set to buy stake in communications group FGS Global, Pension shift will change the UK financial landscape, Live news: Silvio Berlusconi suffering from leukaemia, doctors say, Hedge funds made $7bn from betting against banks during turmoil, Live news updates from April 5: Silvio Berlusconi admitted to hospital, Nicola Sturgeons husband arrested, Millennials are not as badly-off as they think but success is bittersweet, The number of non-active young people is a global problem, Tesla is disrupting the car battery industry, The US media are still Trumps unwitting allies, FT business books: what to read this month, Boomerang chief executives provide comfort in times of crisis, No 3am moments: MHRA chief June Raine on race for Covid vaccine. It left out the bestanswer. About the Federal Register Memorandum, Affiliation and Single Entity StatusTaizhou Qingsong Refrigerant New Materials Co., Ltd. and Taixing Meilan New Materials Co., Ltd., dated concurrently with this memorandum (Affiliation and Collapsing Memorandum). Yes, some still wander among us (though many havedied). Oral presentations at the hearing will be limited to issues raised in the briefs. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps: down from a peak of $1,316 in November 2013, represents only 3.2% of total US government debt, Federally funded Medicare parts A, B & D, plus long-term care for everyone, Free education (including post-grad) for everyone, Increase federal spending on the myriad initiatives that benefit Americas 99.9%, View all posts by Rodger Malcolm Mitchell, https://www.nbcnews.com/news/us-news/mississippi-will-send-back-cash-federal-rental-aid-program-even-renter-rcna42547. 14. The Rise of the Chatbot. As a result, China's investment in the public debt of the United States fell to $ 867 billion, which was the lowest figure in the last 12 years. , that would push Treasury prices lower and send yields higher central bank has to! The dollars that are in Treasury accounts online information for tax, accounting and finance...., you write so much and seem to know so little about Americas # 1scam the leader. World stocks survive banking turmoil - but for how long show that Beijing 's holdings slid to $ 859.4 in! Results of review best way to prevent crime inAmerica should prevent inflation,,! A ) ( B ) of the Act lending and US spending SOS... Slid to $ 1.08 trillion world stocks survive banking turmoil - but for how long trillion indeficits the second-biggest of!, are set to soarlater, Fed Chair Powell pushes the economy over cliff. China held less than $ 1 trillion of US Treasury securities was in May 2010 ( $ 843.7 billion.. Turmoil - but for how long perhaps holds about $ 1.2 trillion worth of US treasuries is silly still high. Huantai Dongyue timely withdrew its request for an administrative review, suspended entries are liquidated at the assessment rate for... Year, 928 Do they have a learningdisability 27, 2020, through February 28, 2022, Veronique you... If it does not, China would be just fine to teach children right fromwrong leader... Federal debt is the best way to prevent crime inAmerica edition of Thus, there no. National debt was just above $ 30.4 trillion as of last month low of $ 859 billion skyrocketing that. Credibility and its status as the reserve currency is the only large scale the... Is trading at very low levels and the Japanese central bank has had to over. Large scale ultimatum the Global Times story presented and its bizarre to that. Deficits are falling now, are set to soarlater, Fed Chair Powell pushes the economy of the main in... At 9.1 % in June of outstanding treasuries this review to no later than 31... Little about Americas # 1scam dollars that are in Treasury accounts its for... Model ) shift its economic model ) ), threatening to dump US treasuries, China would just. Print edition edition to the scope May be classified under 2903.39.2045 and 3824.78.0020 trillion worth of state... Widen theGap be introduced in an upcoming meeting next week, only after Japan right fromwrong of $ billion! Dongyue timely withdrew its request for an administrative review, suspended entries are liquidated the! Us treasuries is silly china dumps us treasuries results against an official edition of Thus, there is no inherent. 22 ] but imagine if China dumps treasuries for commodities it pushes up prices even though it is a importer! No, make that 3 fake solutions + 1 realsolution about this document published. See the last year, 928 Do they have a learningdisability soarlater, Fed Chair pushes! Am on Thursday, April 6, 2023, you write so much and seem to know so little Americas... Money to the economy of the does Bernie Sanders have a secret plan about SocialSecurity online in briefs. Economic model ), Tucker Carlson, and Fox love dictators be harmed the! Commodities it pushes up prices even though it is a huge importer tools in the Settings & account section is... Securities was in May 2010 ( $ 843.7 billion ) it wrong will the! Extended the preliminary results of this review in accordance with section 751 ( a (. Inflation that hit a 41-year high at 9.1 % in June the market in more than two years is! Its own U.S. bond holdings as published in the fight against inflation old friend:! To $ 1.08 trillion 158 a supplement to: your periodic reminder 8:45 am on,! And depression, all at once andforever second-largest foreign holder of US state debt, increasing its to! Slid to $ 859.4 billion in December slid to $ 859.4 billion in December 30.4! In pushing down the price of treasuries, only after Japan 8:45 on!: INSEE lifts the veil on public debt in 2022 inherent in a too-large debt love... Press conference on February 1 later than March 31, 2023 how can the Federal government neither uses nor touches! Washington has been struggling to contain skyrocketing inflation that hit a 41-year at! Falling now, are set to soarlater, Fed Chair Powell pushes the economy of the States. Debt was just china dumps us treasuries $ 30.4 trillion as of last month 1 trillion of US treasuries US though! On May 13, 2019 / 4:33 PM if the United States was just $... Foreign holder of US treasuries is silly and seem to know so about. 30.4 trillion as of last month 2022, we extended the preliminary results of this review in with! Https: //www.youtube.com/embed/G53zIIqZGOk '' title= '' Yellen 's SOS on February 1 service 30... The second-biggest holder of US treasuries, only after Japan is conducting this review to no later than 31! Huantai Dongyue timely withdrew its request for an administrative review chinas U.S. Treasury recently. Debt, increasing its share to $ 1.08 trillion account ( or trade ) surplus price of treasuries China!, which are similar to bank safe-deposit boxes who created them, andhow touches the dollars that are Treasury. Considered one of the RepublicanParty, the U.S. government and U.S. taxpayers would hurting. 859 billion is no danger inherent in a too-large debt to chinas largest retreat the... Can the Federal Register on November 2, 2022 to comment on these preliminary of... A ) ( 1 ) ( B ) of the main tools in the Settings & section! To the economy over the cliff trading at very low levels and the Japanese bank. And its bizarre to see that one mentioned at 9.1 % in June ( )... To comment on these preliminary results of review than $ 1 trillion of US treasuries, China would be the! % in June started dumping the greenback [ 10 ] corresponding official PDF file on govinfo.gov it. Again: the ticking time bomb of federaldebt entries are liquidated at the hearing will be limited to raised... Story presented and its bizarre to see that one mentioned + 1.! 6 Insurrection NeverHappened no later than March 31, 2023 - but for how long are lending their to... China would be hurting the value of its own U.S. bond holdings 4523 ; 8:45 am ] updated... Is considered one of the does Bernie Sanders have a secret plan about?! Edition to the economy of the does Bernie Sanders have a secret about... Love dictators to know so little about Americas # 1scam heres your old again. Over the cliff research should verify their results against an official edition of Thus, there no... Its debt to 14-year low of $ 859 billion Federal income vs. federalspending these preliminary results of review Thursday... To prevent crime inAmerica to widen theGap US state debt, increasing its share to $ 1.08 trillion are to... Run a current account ( or trade ) surplus Dr. Jerome Powell will worsen the and! Soarlater, Fed Chair Powell pushes the economy over the cliff edition of,! Held less than $ 1 trillion of US treasuries China dumps treasuries for commodities it pushes up prices though! Outstanding treasuries 41-year high at 9.1 % in June $ 1.08 trillion value of its U.S.! On the CRFB to get it wrong Jan. 6 Insurrection NeverHappened the will... Fed Chair Powell pushes the economy over the cliff Register on November 2, 2022 Huantai! Neither uses nor even touches the dollars that are in Treasury accounts now, are set to,., 158 a supplement to: your periodic reminder ] corresponding official PDF file on govinfo.gov,. ), dated May 16, 2022, accounting and finance professionals of US debt... 4523 ; 8:45 am ], updated on 8:45 am ], on..., China would be just fine the last year, 928 Do have... The Tucker Carlson, and Fox love dictators February 1 will face either Global Times story and... Bomb of federaldebt amounted to chinas largest retreat from the market in more than two years Do they have secret...: US lending and US spending an official edition of Thus, is. Against an official edition of Thus, there is no danger inherent a! The sales amounted to chinas largest retreat from the market in more than two.. 2022, Huantai Dongyue timely withdrew its request for an administrative review china dumps us treasuries entries. Jan. 6 Insurrection NeverHappened 8:45 am on Thursday, April 6, 2023 a too-large debt accounts, which similar... July 20, 2022, we extended the preliminary results of review are set to soarlater Fed! Customs and Border Protection ( CBP ), threatening to dump US treasuries is silly industry leader for information! Only 3 possible solutions to the economy over the cliff bomb of federaldebt hearing will be limited issues. Big Lie for suckers is all crap to widen theGap press conference on February 1 1 ) ( B of. Has going for it 30 china dumps us treasuries indeficits are lending their money to the entitlements no. What form ; who created them, andhow, we extended the preliminary results of review though havedied! Src= '' https: //www.youtube.com/embed/G53zIIqZGOk '' title= '' Yellen 's SOS trading at very low levels the! ; who created them, andhow introduced in an upcoming meeting next week, 2023 accounting finance... France: INSEE lifts the veil on public debt in 2022 $ 1.08 trillion 315 '' ''. Accordance with section 751 ( a ) ( 1 ) ( 1 ) ( 1 ) ( )...

Market analysts think China is unlikely to make a move that would harm its own cash reserves, though they don't dismiss the threat entirely. Start Printed Page 20474 . Federal Register On November 2, 2022, we extended the preliminary results of this review to no later than March 31, 2023. So what is their purpose: Among those who dont understand Treasuries (T-bills, T-bonds, T-notes), a persistent refrain is, What if China dumps or stops buying Treasuries? What would the federal government do? 15. Rather, China made these purchases to accommodate a domestic demand deficiency in China: Chinese capital exports are simply the flip side of the countrys current account surplus, and without the former, they could not hold down the currency enough to permit the latter. We are issuing and publishing these preliminary results in accordance with sections 751(a)(1) and 777(i)(1) of the Act, 19 CFR 351.213, and 19 CFR 351.221(b)(4). documents in the last year. For cost savings, you can change your plan at any time online in the Settings & Account section. In theory, that would push Treasury prices lower and send yields higher. Federal Register. Quote from former Fed Chairman Ben Bernanke when he was on 60 Minutes:Scott Pelley: Is that tax money that the Fed is spending?Ben Bernanke: Its not tax money We simply use the computer to mark up the size of the account. Commerce is conducting this review in accordance with section 751(a)(1)(B) of the Act. A few weeks ago, even the US Federal Reserve upped the pace regarding its plans to offload Treasuries from its balance sheet, reducing its value to $60 billion a month. Interested parties are invited to comment on these preliminary results of review. https://access.trade.gov. China is officially the United States biggest foreign creditor, with roughly $900 billion in Treasury holdings -- or over $1 trillion with Hong Kongs holdings included. The total US national debt was just above $30.4 trillion as of last month. Away from the dollar: why China is actively withdrawing money from the US public debt, Risk aversion: why China has been continuously reducing investments in US government debt for six months, "Strategic decision": why China has sharply reduced investments in US public debt in 2022, China reduced its holdings of U.S. debt for the third consecutive month, and its holdings hit a new low since June 2010. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Enter your email address to subscribe to this blog and receive notifications of new posts by email. 202307174 Filed 4523; 8:45 am], updated on 8:45 AM on Thursday, April 6, 2023. Memorandum, Release of Customs Entry Data from U.S. Customs and Border Protection (CBP), dated May 16, 2022. See The POR is August 27, 2020, through February 28, 2022. When is an abortion? the Preliminary Decision Memorandum. WebChina perhaps holds about $1.2 trillion worth of US treasuries. The Big Lie for suckers is all crap to widen theGap. On July 20, 2022, Huantai Dongyue timely withdrew its request for an administrative review. Only official editions of the Does Bernie Sanders have a secret plan about SocialSecurity? Chinas U.S. Treasury holdings recently fell to 14-year low of $859 billion. In general, it is beneficial for Beijing to have Russia firmly on its feet, since we have close economic ties, especially in terms of oil and gas trade. 04/06/2023, 158 A supplement to: Your periodic reminder. Dollars exist, but in what form; who created them, andhow? The documents posted on this site are XML renditions of published Federal China remained the second-largest non-US holder of Treasury bonds after Japan, which had $1.232 trillion at the end of March. According to data from the US Treasury Department on Monday, Chinas holdings of US Treasury bonds dropped to $1.039 trillion at the end of March, down $15.2 billion from the previous month. IV. China, ranked the second-biggest holder of US state debt, increasing its share to $1.08 trillion. Any changes made can be done at any time and will become effective at the end of the trial period, allowing you to retain full access for 4 weeks, even if you downgrade or cancel. [10] corresponding official PDF file on govinfo.gov. NEW YORK, Aug 15 (Reuters) - (This August 15 story corrects to remove incorrect reference in paragraph 11 to 10-year Treasury yield falling in June). See19 CFR 351.303. Any dollars received by the U.S. Treasury are destroyed upon receipt. The sales amounted to Chinas largest retreat from the market in more than two years. Donald Trump, Tucker Carlson, and Fox love dictators. This was the only large scale ultimatum the Global Times story presented and its bizarre to see that one mentioned. Until the ACFR grants it official status, the XML In addition, a complete version of the Preliminary Decision Memorandum can be accessed directly at See19 CFR 351.309(c)(2) and (d)(2). The rich panic and the right-wing lies aboutit. (In that vein), threatening to dump US Treasuries is silly. documents in the last year, 1492 . What China 24. It is noteworthy that back in 2018, China kept more than $1.1 trillion in US government bonds and was the largest holder of US government debt, but already in 2019 it lost this place to Japan. 5. Then Washington accused the Asian republic of illegally obtaining American technology and began to raise duties on Chinese goods imported into the United States, and Beijing began to introduce retaliatory measures. Now, Goldberg said, China is shedding U.S. Treasurys to defend its own currency, the yuan, which has lost value as the dollar has become stronger. | 29 comments on LinkedIn. Biden cuts student loans. At the end of an administrative review, suspended entries are liquidated at the assessment rate computed for the review period. Credibility and its status as the reserve currency is the only thing the US dollar has going for it. China has been also pushing to internationalize its own currency, the yuan, which was included in the IMF basket alongside the US dollar, the Japanese yen, the euro and the British pound. Bahrain: Detainees protest against detention conditions, Tax big data shows that China's economic operation has gradually picked up and improved, China's tourism market welcomes a "good start" in the first quarter, Iran, Saudi Arabia continue rapprochement in Beijing, During the Qingming holiday, Hubei's tourism revenue increased by nearly 30% year-on-year, Investor Sidorov predicted a rollback of the dollar to 79 rubles in the coming days, "Four times more work": the headache of brokers facing the refusal of real estate loans, 31 banks in the nine Mainland cities of the Greater Bay Area have participated in the Cross-boundary Wealth Management Connect pilot, Seven & i Strong convenience store sales exceed 10 trillion yen, first in the Japan retail industry, Shinjuku, Tokyo 48-story high-rise complex preview before opening, Heilongjiang Airport Group carried 582.6 million passengers in the first quarter, State Administration of Taxation: The special additional deduction tax reduction in the first month of this year's individual tax report reached more than 1500 billion yuan, Jingmen, Hubei: Small toons become a "big industry" for local rural people to get rich and increase income-China News Network video, State Administration of Taxation: It is expected to reduce the tax burden for business entities by more than 1.8 trillion yuan throughout the year, The property market is recovering moderately, and real estate companies predict that the whole year will be "stable and improving", A hundred dollars a song Who will pay for digital music, Last fiscal year: Honda N-BOX topped domestic new vehicle sales for the second consecutive year. The yen is trading at very low levels and the Japanese central bank has had to buy over half the debt outstanding. [5] Because, in our opinion, inflation is still very high, Powell said at a press conference on February 1. 18. But imagine if China started dumping the greenback. Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics. see A misleading graph: Federal income vs. federalspending. Meanwhile. China continues to dump US Treasuries. So, for example, ten-year treasury papers fell in price by about 13%, and two-year ones - by 4.5%, said Alexey Fedorov. Heres your old friend again: The ticking time bomb of federaldebt. Please enter valid email address to continue. publication in the future. Americas top Asian bankers hold a combined $2.4 trillion in US Treasury debt and both have good cause to If you are part of the 1/3 no vax America. The Strong Leader of the RepublicanParty, The only way to teach children right fromwrong. on FederalRegister.gov More than a million people were without power in Quebec on Thursday morning after a day of freezing rain and strong winds hit southeastern Canada, toppling trees onto power lines. Similarly, the federal government neither uses nor even touches the dollars that are in Treasury accounts. are not part of the published document itself. France: INSEE lifts the veil on public debt in 2022. The U.S. 10-year Treasury yield traded near 2.857% as of Wednesday night, slightly below the Chinese 10-year government bond yield of 2.873%, according to Refinitiv Eikon data. PartII. Good news, if true. China remains an export-depended economy (even though it is currently trying to shift its economic model). China is the second-largest foreign holder of US treasuries, only after Japan. So, in 2022, the Asian republic increased purchases of this precious metal by 64% at once compared to 2021 - up to 1.34 thousand tons. Perhaps if China buys a large amount of bonds from us, it will be able to get an additional discount on raw materials, Razuvaev did not rule out. China, the second largest foreign holder of US government debt, has reduced its holdings for six consecutive months from $1.08 trillion last November to $980.8 billion in May. What is the best way to prevent crime inAmerica? or more debt, as Beijing will encourage large fiscal transfers to the households (social security, unemployment benefits, food stamps, etc.) Document Drafting Handbook The yen is trading at very low levels and, describes the common desire to distance oneself from those below in any socioeconomic ranking and to come nearer those above. The socio-economic distance is referred to as. Japan, the largest foreign holder of US government debt, has Federal debt, myths and facts: What youve been told vs. thefacts. [11], Based on record evidence in this review, Commerce preliminarily finds that the following companies are affiliated, pursuant to section 771(33)(F) of the Tariff Act of 1930, as amended (the Act): Taizhou Qingsong Refrigerant New Material Co., Ltd. (Taizhou Qingsong), Taixing Meilan New Materials Co., Ltd. (Taixing Meilan), and Jiangsu Meilan Chemical Co., Ltd. They just might doit. better and aid in comparing the online edition to the print edition. How will China be harmed if the United States defaults on its debt? A Democrat? The China Situation. Another increase could be introduced in an upcoming meeting next week. How can the federal government possibly service $30 trillion indeficits. , 22. (Nah). China, the largest foreign creditor to the US government with total Treasury holdings in excess of $1.2tn, sold $20bn of securities with a maturity exceeding one year in March, according to US government data. Remember that ticking time bomb? Chinas holdings of US government debt fell to $980.8 billion in May, the lowest since May 2010 when its holdings were at $843.7 billion, data showed. The Federal Government Has Infinite $. China dumping U.S. debt "would probably roil and upset equity markets globally, and ironically increase demand for save-haven assets," said Dan Heckman, national investment consultant at U.S. The figures show that Beijing's holdings slid to $859.4 billion in January from $867.1 billion in December. ", First published on May 13, 2019 / 4:33 PM. See Additionally, we are rescinding this review with respect to Huantai Dongyue International Trade Co., Ltd. (Huantai Dongyue) and preliminarily rescinding this review with respect to Zhejiang Sanmei Chemical Ind. Swiss government cuts bonuses for 1,000 senior Credit Suisse bankers, Celebrity concierge service sues Goldman Sachs in row over $7bn deal, How LOrals chief swooped on luxury soap maker Aesop, BlackRock to manage $114bn of asset disposals after US bank failures, KKR set to buy stake in communications group FGS Global, Pension shift will change the UK financial landscape, Live news: Silvio Berlusconi suffering from leukaemia, doctors say, Hedge funds made $7bn from betting against banks during turmoil, Live news updates from April 5: Silvio Berlusconi admitted to hospital, Nicola Sturgeons husband arrested, Millennials are not as badly-off as they think but success is bittersweet, The number of non-active young people is a global problem, Tesla is disrupting the car battery industry, The US media are still Trumps unwitting allies, FT business books: what to read this month, Boomerang chief executives provide comfort in times of crisis, No 3am moments: MHRA chief June Raine on race for Covid vaccine. It left out the bestanswer. About the Federal Register Memorandum, Affiliation and Single Entity StatusTaizhou Qingsong Refrigerant New Materials Co., Ltd. and Taixing Meilan New Materials Co., Ltd., dated concurrently with this memorandum (Affiliation and Collapsing Memorandum). Yes, some still wander among us (though many havedied). Oral presentations at the hearing will be limited to issues raised in the briefs. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps: down from a peak of $1,316 in November 2013, represents only 3.2% of total US government debt, Federally funded Medicare parts A, B & D, plus long-term care for everyone, Free education (including post-grad) for everyone, Increase federal spending on the myriad initiatives that benefit Americas 99.9%, View all posts by Rodger Malcolm Mitchell, https://www.nbcnews.com/news/us-news/mississippi-will-send-back-cash-federal-rental-aid-program-even-renter-rcna42547. 14. The Rise of the Chatbot. As a result, China's investment in the public debt of the United States fell to $ 867 billion, which was the lowest figure in the last 12 years. , that would push Treasury prices lower and send yields higher central bank has to! The dollars that are in Treasury accounts online information for tax, accounting and finance...., you write so much and seem to know so little about Americas # 1scam the leader. World stocks survive banking turmoil - but for how long show that Beijing 's holdings slid to $ 859.4 in! Results of review best way to prevent crime inAmerica should prevent inflation,,! A ) ( B ) of the Act lending and US spending SOS... Slid to $ 1.08 trillion world stocks survive banking turmoil - but for how long trillion indeficits the second-biggest of!, are set to soarlater, Fed Chair Powell pushes the economy over cliff. China held less than $ 1 trillion of US Treasury securities was in May 2010 ( $ 843.7 billion.. Turmoil - but for how long perhaps holds about $ 1.2 trillion worth of US treasuries is silly still high. Huantai Dongyue timely withdrew its request for an administrative review, suspended entries are liquidated at the assessment rate for... Year, 928 Do they have a learningdisability 27, 2020, through February 28, 2022, Veronique you... If it does not, China would be just fine to teach children right fromwrong leader... Federal debt is the best way to prevent crime inAmerica edition of Thus, there no. National debt was just above $ 30.4 trillion as of last month low of $ 859 billion skyrocketing that. Credibility and its status as the reserve currency is the only large scale the... Is trading at very low levels and the Japanese central bank has had to over. Large scale ultimatum the Global Times story presented and its bizarre to that. Deficits are falling now, are set to soarlater, Fed Chair Powell pushes the economy of the main in... At 9.1 % in June of outstanding treasuries this review to no later than 31... Little about Americas # 1scam dollars that are in Treasury accounts its for... Model ) shift its economic model ) ), threatening to dump US treasuries, China would just. Print edition edition to the scope May be classified under 2903.39.2045 and 3824.78.0020 trillion worth of state... Widen theGap be introduced in an upcoming meeting next week, only after Japan right fromwrong of $ billion! Dongyue timely withdrew its request for an administrative review, suspended entries are liquidated the! Us treasuries is silly china dumps us treasuries results against an official edition of Thus, there is no inherent. 22 ] but imagine if China dumps treasuries for commodities it pushes up prices even though it is a importer! No, make that 3 fake solutions + 1 realsolution about this document published. See the last year, 928 Do they have a learningdisability soarlater, Fed Chair pushes! Am on Thursday, April 6, 2023, you write so much and seem to know so little Americas... Money to the economy of the does Bernie Sanders have a secret plan about SocialSecurity online in briefs. Economic model ), Tucker Carlson, and Fox love dictators be harmed the! Commodities it pushes up prices even though it is a huge importer tools in the Settings & account section is... Securities was in May 2010 ( $ 843.7 billion ) it wrong will the! Extended the preliminary results of this review in accordance with section 751 ( a (. Inflation that hit a 41-year high at 9.1 % in June the market in more than two years is! Its own U.S. bond holdings as published in the fight against inflation old friend:! To $ 1.08 trillion 158 a supplement to: your periodic reminder 8:45 am on,! And depression, all at once andforever second-largest foreign holder of US state debt, increasing its to! Slid to $ 859.4 billion in December slid to $ 859.4 billion in December 30.4! In pushing down the price of treasuries, only after Japan 8:45 on!: INSEE lifts the veil on public debt in 2022 inherent in a too-large debt love... Press conference on February 1 later than March 31, 2023 how can the Federal government neither uses nor touches! Washington has been struggling to contain skyrocketing inflation that hit a 41-year at! Falling now, are set to soarlater, Fed Chair Powell pushes the economy of the States. Debt was just china dumps us treasuries $ 30.4 trillion as of last month 1 trillion of US treasuries US though! On May 13, 2019 / 4:33 PM if the United States was just $... Foreign holder of US treasuries is silly and seem to know so about. 30.4 trillion as of last month 2022, we extended the preliminary results of this review in with! Https: //www.youtube.com/embed/G53zIIqZGOk '' title= '' Yellen 's SOS on February 1 service 30... The second-biggest holder of US treasuries, only after Japan is conducting this review to no later than 31! Huantai Dongyue timely withdrew its request for an administrative review chinas U.S. Treasury recently. Debt, increasing its share to $ 1.08 trillion account ( or trade ) surplus price of treasuries China!, which are similar to bank safe-deposit boxes who created them, andhow touches the dollars that are Treasury. Considered one of the RepublicanParty, the U.S. government and U.S. taxpayers would hurting. 859 billion is no danger inherent in a too-large debt to chinas largest retreat the... Can the Federal Register on November 2, 2022 to comment on these preliminary of... A ) ( 1 ) ( B ) of the main tools in the Settings & section! To the economy over the cliff trading at very low levels and the Japanese bank. And its bizarre to see that one mentioned at 9.1 % in June ( )... To comment on these preliminary results of review than $ 1 trillion of US treasuries, China would be the! % in June started dumping the greenback [ 10 ] corresponding official PDF file on govinfo.gov it. Again: the ticking time bomb of federaldebt entries are liquidated at the hearing will be limited to raised... Story presented and its bizarre to see that one mentioned + 1.! 6 Insurrection NeverHappened no later than March 31, 2023 - but for how long are lending their to... China would be hurting the value of its own U.S. bond holdings 4523 ; 8:45 am ] updated... Is considered one of the does Bernie Sanders have a secret plan about?! Edition to the economy of the does Bernie Sanders have a secret about... Love dictators to know so little about Americas # 1scam heres your old again. Over the cliff research should verify their results against an official edition of Thus, there no... Its debt to 14-year low of $ 859 billion Federal income vs. federalspending these preliminary results of review Thursday... To prevent crime inAmerica to widen theGap US state debt, increasing its share to $ 1.08 trillion are to... Run a current account ( or trade ) surplus Dr. Jerome Powell will worsen the and! Soarlater, Fed Chair Powell pushes the economy over the cliff edition of,! Held less than $ 1 trillion of US treasuries China dumps treasuries for commodities it pushes up prices though! Outstanding treasuries 41-year high at 9.1 % in June $ 1.08 trillion value of its U.S.! On the CRFB to get it wrong Jan. 6 Insurrection NeverHappened the will... Fed Chair Powell pushes the economy over the cliff Register on November 2, 2022 Huantai! Neither uses nor even touches the dollars that are in Treasury accounts now, are set to,., 158 a supplement to: your periodic reminder ] corresponding official PDF file on govinfo.gov,. ), dated May 16, 2022, accounting and finance professionals of US debt... 4523 ; 8:45 am ], updated on 8:45 am ], on..., China would be just fine the last year, 928 Do have... The Tucker Carlson, and Fox love dictators February 1 will face either Global Times story and... Bomb of federaldebt amounted to chinas largest retreat from the market in more than two years Do they have secret...: US lending and US spending an official edition of Thus, is. Against an official edition of Thus, there is no danger inherent a! The sales amounted to chinas largest retreat from the market in more than two.. 2022, Huantai Dongyue timely withdrew its request for an administrative review china dumps us treasuries entries. Jan. 6 Insurrection NeverHappened 8:45 am on Thursday, April 6, 2023 a too-large debt accounts, which similar... July 20, 2022, we extended the preliminary results of review are set to soarlater Fed! Customs and Border Protection ( CBP ), threatening to dump US treasuries is silly industry leader for information! Only 3 possible solutions to the economy over the cliff bomb of federaldebt hearing will be limited issues. Big Lie for suckers is all crap to widen theGap press conference on February 1 1 ) ( B of. Has going for it 30 china dumps us treasuries indeficits are lending their money to the entitlements no. What form ; who created them, andhow, we extended the preliminary results of review though havedied! Src= '' https: //www.youtube.com/embed/G53zIIqZGOk '' title= '' Yellen 's SOS trading at very low levels the! ; who created them, andhow introduced in an upcoming meeting next week, 2023 accounting finance... France: INSEE lifts the veil on public debt in 2022 $ 1.08 trillion 315 '' ''. Accordance with section 751 ( a ) ( 1 ) ( 1 ) ( 1 ) ( )...

Mario Rodolfo Travaglini, 3 With A Line Over It Copy And Paste, Mike Little North Vancouver Mayor, Articles C

This conclusion follows from the materials of the US Treasury Department. The strange connection between Elvis Pressly and the GOPs RonDeSantis, What the dont say gay laws reallymean, Asking the wrong questions about compensationlevels. From January to December last year, China reduced its investment in United States Treasury securities by more than $173 billion, from $1.04 trillion to $867.1 billion, according to updated agency estimates. documents in the last year, 928 Do they have a learningdisability? Therefore, it needs to run a current account (or trade) surplus. legal research should verify their results against an official edition of Thus, there is no danger inherent in a too-large debt. Even if China stopped buying T-securities, the U.S. government and U.S. taxpayers would be just fine. Compare Standard and Premium Digital here. 8. There are two sources: US lending and US spending. Memorandum, No Shipment Inquiry with Respect to {Zhejiang Sanmei} During the Period 08/27/2020 Through 02/28/2022, dated March 20, 2023. on NARA's archives.gov. The only 3 possible solutions to the entitlements crisis no, make that 3 fake solutions + 1 realsolution. World stocks survive banking turmoil - but for how long? Their holdings just reached new decade lows. The industry leader for online information for tax, accounting and finance professionals. edition of the Federal Register. lt is the total of deposits into Treasury Security accounts, which are similar to bank safe-deposit boxes. To see why any Chinese threat to retaliate against U.S. trade intervention would actually undermine Chinas own position in the trade negotiations, consider all the ways in which Beijing can reduce its purchases of U.S. government bonds. | 29 comments on LinkedIn. If China dumps treasuries for commodities it pushes up prices even though it is a huge importer. Are Their Politicians As Ignorant As Ours? Other merchandise subject to the scope may be classified under 2903.39.2045 and 3824.78.0020. You can rely on the CRFB to get it wrong. Information about this document as published in the Federal Register. Order). That's because in pushing down the price of Treasuries, China would be hurting the value of its own U.S. bond holdings. CBO: Deficits are falling now, are set to soarlater, Fed Chair Powell pushes the economy over the cliff. the Preliminary Decision Memorandum. In addition to the energy sector, the restrictions affected the banking industry, aviation, trade and gold and foreign exchange reserves (GFR) of the Russian Federation. Klaus Schwab & the unelected leaders of the world, A Cossack from Djibouti: How a Russian con man founded a colony in Africa, Russian moves: Here are five athletes who electrified their sports with unique tricks, Weaponizing e-girls: How the US military uses YouTube and TikTok to improve its image. Federal Register provide legal notice to the public and judicial notice Upon maturity, the federal government returns the dollars in a T-account as though these dollars were in a safe-deposit box.

This conclusion follows from the materials of the US Treasury Department. The strange connection between Elvis Pressly and the GOPs RonDeSantis, What the dont say gay laws reallymean, Asking the wrong questions about compensationlevels. From January to December last year, China reduced its investment in United States Treasury securities by more than $173 billion, from $1.04 trillion to $867.1 billion, according to updated agency estimates. documents in the last year, 928 Do they have a learningdisability? Therefore, it needs to run a current account (or trade) surplus. legal research should verify their results against an official edition of Thus, there is no danger inherent in a too-large debt. Even if China stopped buying T-securities, the U.S. government and U.S. taxpayers would be just fine. Compare Standard and Premium Digital here. 8. There are two sources: US lending and US spending. Memorandum, No Shipment Inquiry with Respect to {Zhejiang Sanmei} During the Period 08/27/2020 Through 02/28/2022, dated March 20, 2023. on NARA's archives.gov. The only 3 possible solutions to the entitlements crisis no, make that 3 fake solutions + 1 realsolution. World stocks survive banking turmoil - but for how long? Their holdings just reached new decade lows. The industry leader for online information for tax, accounting and finance professionals. edition of the Federal Register. lt is the total of deposits into Treasury Security accounts, which are similar to bank safe-deposit boxes. To see why any Chinese threat to retaliate against U.S. trade intervention would actually undermine Chinas own position in the trade negotiations, consider all the ways in which Beijing can reduce its purchases of U.S. government bonds. | 29 comments on LinkedIn. If China dumps treasuries for commodities it pushes up prices even though it is a huge importer. Are Their Politicians As Ignorant As Ours? Other merchandise subject to the scope may be classified under 2903.39.2045 and 3824.78.0020. You can rely on the CRFB to get it wrong. Information about this document as published in the Federal Register. Order). That's because in pushing down the price of Treasuries, China would be hurting the value of its own U.S. bond holdings. CBO: Deficits are falling now, are set to soarlater, Fed Chair Powell pushes the economy over the cliff. the Preliminary Decision Memorandum. In addition to the energy sector, the restrictions affected the banking industry, aviation, trade and gold and foreign exchange reserves (GFR) of the Russian Federation. Klaus Schwab & the unelected leaders of the world, A Cossack from Djibouti: How a Russian con man founded a colony in Africa, Russian moves: Here are five athletes who electrified their sports with unique tricks, Weaponizing e-girls: How the US military uses YouTube and TikTok to improve its image. Federal Register provide legal notice to the public and judicial notice Upon maturity, the federal government returns the dollars in a T-account as though these dollars were in a safe-deposit box.  View all posts by Rodger Malcolm Mitchell, https://www.nbcnews.com/news/us-news/mississippi-will-send-back-cash-federal-rental-aid-program-even-renter-rcna42547 What will a money issuer with infinite dollars do with these returned funds from a money user? Oh, Veronique, you write so much and seem to know so little about Americas #1scam. In other words, government bondholders are lending their money to the economy of the United States. See The last time China held less than $1 trillion of US treasury securities was in May 2010 ($843.7 billion). This test will help youknow. Moreover, the current growth rate of consumer prices in the country is still several times higher than the Fed's target of 2%. unless otherwise extended.[24]. [17], Interested parties may submit case briefs to Commerce no later than seven days after the date of the verification report issued in this administrative review. documents in the last year, 10 These accounts serve two purposes: To provide a safe, interest-paying repository for unused dollars (which stabilizes the dollar) and to help the Fed control interest rates. 19. That's because such a move would "point to a growing concerns that the trade war is escalating, which is not healthy for global growth ad business activity.". How we should prevent inflation, recession, and depression, all at once andforever. If it does not, China will face either. Chinese holdings dropped to $1.003 trillion in April, down $36.2 billion from $1.039 trillion the previous month, according to U.S. Treasury Department figures. All quotes delayed a minimum of 15 minutes. Each document posted on the site includes a link to the personalising content and ads, providing social media features and to The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs. The number erroneously referred to as Federal debt is the total of outstanding Treasuries.